All per share figures disclosed below are stated

on a diluted basis.

|

For the periods ended June 30, |

Threemonths |

|

Six months |

|

|

($ in thousands, except per share amounts) |

2022 |

2021 |

2022 |

2021 |

|

|

|

|

|

|

| Net revenue |

$ 74,109 |

$ 69,960 |

$ 149,174 |

$ 134,654 |

| Operating earnings |

17,157 |

21,199 |

36,523 |

38,703 |

| Net gains (losses) |

(90,128) |

56,467 |

(98,110) |

98,438 |

| Net earnings (loss) |

(68,224) |

66,831 |

(62,409) |

117,692 |

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA(1) |

$ 25,592 |

$ 27,495 |

$ 51,962 |

$ 50,984 |

| Adjusted cash flow from

operations(1) |

18,485 |

21,829 |

38,434 |

42,352 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Attributable to

shareholders: |

|

|

|

|

| Net earnings (loss) |

$ (69,698) |

$ 65,138 |

$ (65,436) |

$ 114,763 |

| EBITDA(1) |

23,042 |

24,708 |

46,888 |

45,919 |

| Adjusted cash flow from

operations(1) |

16,218 |

19,201 |

33,973 |

37,693 |

| Per share: |

|

|

|

|

| Net earnings (loss) |

$ (2.85) |

$ 2.42 |

$ (2.68) |

$ 4.24 |

| EBITDA(1) |

0.94 |

0.92 |

1.80 |

1.70 |

| Adjusted cash flow from

operations(1) |

0.63 |

0.72 |

1.31 |

1.39 |

|

|

|

|

|

|

|

As at |

2022 |

2021 |

|

| ($ in

millions, except per share amounts) |

June 30 |

December 31 |

June 30 |

|

|

|

|

|

| Assets under management |

$ 46,931 |

$ 56,341 |

$ 51,641 |

| Assets

under administration |

27,626 |

31,508 |

29,902 |

|

Total client assets |

74,557 |

87,849 |

81,543 |

| Shareholders' equity |

$ 743 |

$ 839 |

$ 780 |

| Securities |

651 |

752 |

698 |

| |

|

|

|

|

|

|

|

|

| Per share (diluted): |

|

|

|

| Shareholders' equity(1) |

$ 28.74 |

$ 31.53 |

$ 29.09 |

| Securities(1) |

25.17 |

28.27 |

26.03 |

|

|

|

|

|

The Company is reporting $74.6 billion in total

client assets as at June 30, 2022, which include assets under

management (“AUM”) and assets under administration (“AUA”). This is

a 9% decrease from $81.5 billion as at June 30, 2021, and a 15%

decrease from $87.8 billion reported as at December 31, 2021. The

Company is reporting AUM of $46.9 billion as at June 30, 2022, a 9%

decrease from $51.6 billion as at June 30, 2021, and a 17% decrease

from $56.3 billion as at December 31, 2021. The decrease in AUM was

driven largely by the negative global financial market performance

and, to a lesser extent, net redemption of approximately $1.6

billion in institutional client assets in the current quarter. The

Company’s AUA was $27.6 billion as at June 30, 2022, an 8% decrease

from $29.9 billion as at June 30, 2021, and a 12% decrease from

$31.5 billion as at December 31, 2021.

The Company is reporting Operating earnings of

$17.2 million for the quarter ended June 30, 2022, a decrease of

19% or $4.0 million from the $21.2 million reported in the second

quarter of 2021. The decrease in AUM and AUA since their peaks at

the end of 2021 has negatively impacted the Company’s Net revenue

for the quarter. The expenses remained consistent over that same

period, other than the one-time costs discussed below, as the

Company continued to invest in the strategically important

initiatives of building both our retail distribution capabilities

and the recently launched Guardian Smart Infrastructure Management

Inc., our private infrastructure business, while integrating and

enhancing our other recently acquired businesses. These investments

incurred a combined Operating loss of $2.8 million in the current

quarter, $0.5 million higher than in the second quarter of 2021. In

addition, $1.2 million in other one-time costs, including

approximately $0.7 million in restructuring costs associated with

the Company’s decision to no longer pursue the build out of our

Emerging Markets Debt investment team, were incurred in the current

quarter.

Net revenue for the current quarter grew to

$74.1 million, 6% or $4.1 million higher than the $70.0 million

reported in the same quarter in the prior year. The increase is due

to average AUM and AUA for the current period being higher than in

the comparative period. The large redemptions referred to above

occurred in the latter part of the current quarter. As a result,

the full quarter’s impact of the loss of those assets are not

reflected in the current quarter’s Net revenue.

Expenses in the current quarter were $57.0

million, an $8.2 million increase from $48.8 million in the same

quarter in the prior year. The higher expenses reflect the

continued strategic investments in future growth sources, as well

as the non-recurring costs mentioned above.

Net losses in the current quarter were $90.1

million, compared to Net gains of $56.5 million in the same quarter

in the prior year. The largest portion of the Net losses in the

current quarter was attributable to the declines in fair values of

our securities holdings resulting from the negative performance in

the global financial markets to which those securities are

exposed.

The Company's Net loss attributable to

shareholders in the current quarter was $69.7 million, compared to

Net earnings attributable to shareholders of $65.1 million in the

same quarter in 2021. The significant Net losses associated with

our securities holdings, as described above, compared to the large

Net gains in the prior year, had the most significant impact on the

change in Net (loss) earnings attributable to shareholders.

EBITDA attributable to shareholders(1) for the

current quarter was $23.0 million, compared to $24.7 million in the

same period in the prior year. Adjusted cash flow from operations

attributable to shareholders(1) for the current quarter was $16.2

million, compared to $19.2 million in the same quarter in the prior

year.

The Company’s Shareholders’ equity as at June

30, 2022 was $743 million, or $28.74 per share(1), compared to $839

million, or $31.53 per share(1) as at December 31, 2021, and $780

million, or $29.09 per share(1) as at June 30, 2021. During the

current quarter, the Company returned to shareholders $6.3 million

in dividends and $17.9 million in share buybacks. The fair value of

the Company’s Securities as at June 30, 2022 was $651 million, or

$25.17 per share(1), compared to $752 million, or $28.27 per

share(1) as at December 31, 2021 and $698 million, or $26.03 per

share(1) as at June 30, 2021.

The Board of Directors has declared a quarterly

eligible dividend of $0.24 per share, payable on October 18, 2022,

to shareholders of record on October 11, 2022.

The Company's financial results for the past eight quarters are

summarized in the following table.

|

|

Jun 30,2022 |

Mar 31,2022 |

Dec 31,2021 |

Sep 30,2021 |

Jun 30,2021 |

Mar 31,2021 |

Dec 31,2020 |

Sep 30,2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As at ($

in millions) |

|

|

|

|

|

|

|

|

| Assets

under management |

$ 46,931 |

$ 53,123 |

$ 56,341 |

$ 53,113 |

$ 51,641 |

$ 47,945 |

$ 45,984 |

$ 32,733 |

|

Assets under administration |

27,626 |

30,526 |

31,508 |

30,015 |

29,902 |

28,376 |

22,289 |

20,755 |

| Total

client assets |

74,557 |

83,649 |

87,849 |

83,128 |

81,543 |

76,321 |

68,273 |

53,488 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the three

months ended ($ in thousands) |

|

|

|

|

|

|

| Net

revenue |

$ 74,109 |

$ 75,065 |

$ 78,049 |

$ 72,384 |

$ 69,960 |

$ 64,694 |

$ 63,724 |

$ 52,042 |

|

Operating earnings |

17,157 |

19,366 |

22,314 |

20,771 |

21,199 |

17,504 |

18,493 |

12,108 |

| Net

gains (losses) |

(90,128) |

(7,982) |

52,331 |

(8,146) |

56,467 |

41,971 |

80,983 |

35,739 |

| Net

earnings (losses) |

(68,224) |

5,815 |

64,451 |

8,597 |

66,831 |

50,861 |

87,083 |

42,652 |

| Net

earnings (loss) attributable to shareholders |

(69,698) |

4,262 |

62,421 |

7,054 |

65,138 |

49,625 |

86,039 |

42,201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in

$) |

|

|

|

|

|

|

|

|

| Net earnings

(loss) attributable to shareholders: |

|

|

|

|

|

|

| Per Class A and

Common share |

|

|

|

|

|

|

|

|

Basic |

$ (2.85) |

$ 0.17 |

$ 2.52 |

$ 0.28 |

$ 2.59 |

$ 1.95 |

$ 3.38 |

$ 1.66 |

|

Diluted |

(2.85) |

0.16 |

2.35 |

0.27 |

2.42 |

1.83 |

3.17 |

1.56 |

|

Dividends paid on Class A and Common shares |

$ 0.18 |

$ 0.18 |

$ 0.18 |

$ 0.18 |

$ 0.18 |

$ 0.16 |

$ 0.16 |

$ 0.16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As

at |

|

|

|

|

|

|

|

|

|

Shareholders' equity($ in thousands) |

$ 742,917 |

$ 828,404 |

$ 838,520 |

$ 781,334 |

$ 780,323 |

$ 737,363 |

$ 699,610 |

$ 631,863 |

|

|

|

|

|

|

|

|

|

|

| Per Class A and

Common share(in $) |

|

|

|

|

|

|

|

|

Basic |

$ 30.68 |

$ 33.67 |

$ 33.89 |

$ 31.56 |

$ 31.15 |

$ 29.02 |

$ 27.43 |

$ 24.80 |

|

Diluted |

28.74 |

31.27 |

31.53 |

29.40 |

29.09 |

27.14 |

25.69 |

23.25 |

|

|

|

|

|

|

|

|

|

|

|

Total Class A and Common shares outstanding(shares in

thousands) |

26,342 |

26,892 |

26,954 |

26,968 |

27,263 |

27,691 |

27,740 |

27,758 |

Guardian Capital Group Limited (Guardian) is a

diversified, global financial services company operating in two

main business segments: Investment Management and Wealth

Management. Guardian provides extensive investment management

solutions to institutional and private wealth clients through its

subsidiaries, while offering comprehensive wealth management

services to financial advisors in its national mutual fund dealer,

securities dealer and insurance distribution network. Founded in

1962, Guardian’s reputation for steady growth, long-term

relationships and its core values of trustworthiness, integrity and

stability have been key to its success over six decades. Its Common

and Class A shares are listed on the Toronto Stock Exchange as GCG

and GCG.A, respectively. To learn more about Guardian, visit

www.guardiancapital.com.

For further information, contact:

|

Donald Yi |

George Mavroudis |

| Chief Financial Officer |

President and Chief Executive

Officer |

| (416) 350-3136 |

(416) 364-8341 |

Investor Relations:

investorrelations@guardiancapital.com.

Caution Concerning Forward-Looking

Information

Certain information included in this press

release constitutes forward-looking information within the meaning

of applicable Canadian securities laws. All information other than

statements of historical fact may be forward-looking information.

Forward-looking information is often, but not always, identified by

the use of forward-looking terminology such as “outlook”,

“objective”, “may”, “will”, “would”, “expect”, “intend”,

“estimate”, “anticipate”, “believe”, “should”, “plan”, “continue”,

or similar expressions suggesting future outcomes or events or the

negative thereof. Forward-looking information in this press release

includes, but is not limited to, statements with respect to

management’s beliefs, plans, estimates, and intentions, and similar

statements concerning anticipated future events, results,

circumstances, performance or expectations. Such forward-looking

information reflects management’s beliefs and is based on

information currently available. All forward-looking information in

this press release is qualified by the following cautionary

statements.

Although Guardian believes that the expectations

reflected in such forward-looking information are reasonable, such

information involves known and unknown risks and uncertainties

which may cause Guardian’s actual performance and results in future

periods to differ materially from any estimates or projections of

future performance or results expressed or implied by such

forward-looking information. Important factors that could cause

actual results to differ materially include but are not limited to:

general economic and market conditions, including interest rates,

business competition, changes in government regulations or in tax

laws, the duration and severity of the current COVID pandemic, the

ongoing conflict in the Ukraine, as well as those risk factors

discussed or referred to in the disclosure documents filed by

Guardian with the securities regulatory authorities in certain

provinces of Canada and available at www.sedar.com. The reader is

cautioned to consider these factors, uncertainties and potential

events carefully and not to put undue reliance on forward-looking

information, as there can be no assurance that actual results will

be consistent with such forward-looking information.

The forward-looking information included in this

press release is made as of the date of this press release and

should not be relied upon as representing Guardian’s views as of

any date subsequent to the date of this press release.

(1)The Company's management uses EBITDA, EBITDA

attributable to shareholders, including the per share amount,

Adjusted cash flows from operations, Adjusted cash flow from

operations attributable to shareholders, including the per share

amount, Shareholders' equity per share and Securities per share to

evaluate and assess the performance of its business. These measures

do not have standardized measures under International Financial

Reporting Standards ("IFRS"), and are therefore unlikely to be

comparable to similar measures presented by other companies.

However, management believes that most shareholders, creditors,

other stakeholders and investment analysts prefer to include the

use of these measures in analyzing the Company's results. The

Company defines EBITDA as net earnings before interest, income

taxes, amortization, stock-based compensation, net gains or losses

and EBITDA attributable shareholders as EBITDA less the amounts

attributable to non-controlling interests. The Company defines

Adjusted cash flow from operations as net cash from operating

activities, net of changes in non-cash working capital items and

Adjusted cash flow from operations attributable to shareholders as

Adjusted cash flow from operations less the amounts attributable to

non-controlling interests. The most comparable IFRS measures are

Net earnings (loss), which was ($68.2) million in 2022 (2021 –

$66.8 million) and Net cash from operating activities, which was

$27.7 million in 2022 (2021 – $26.4 million). The per share

amounts for EBITDA attributable to shareholders, Adjusted cash flow

from operations attributable to shareholders, Shareholders' equity

and Securities are calculated by dividing the amounts by diluted

shares, which Is calculated in a manner similar to net earnings

attributable to shareholders per share. More detailed descriptions

of these non-IFRS measures are provided in the Company's

Management's Discussion and Analysis, including a reconciliation of

these measures to their most comparable IFRS measures.

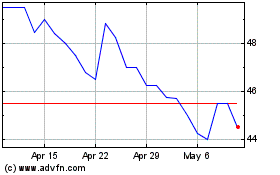

Guardian Capital (TSX:GCG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Guardian Capital (TSX:GCG)

Historical Stock Chart

From Dec 2023 to Dec 2024