Guardian Capital LP (“

Guardian Capital”) is

pleased to announce the launch of exchange traded fund

(“

ETF”) series of each of Guardian i3

International Quality Growth Fund and Guardian Strategic Income

Fund, and the launch of Series A, F and I mutual fund series of

Guardian i3 US Quality Growth Fund (together with Guardian i3

International Quality Growth Fund and Guardian Strategic Income

Fund, the “

Guardian Funds”).

Each of Guardian i3 International Quality Growth

Fund and Guardian Strategic Income Fund has closed its initial

offering of ETF Units, and the units are expected to commence

trading on Cboe Canada Inc. (“Cboe”) when the

market opens this morning. The mutual fund series of Guardian i3 US

Quality Growth Fund are also available for purchase effective

immediately.

These new series launches represent a

continuation of Guardian Capital’s ongoing effort to provide

investors and their advisors with convenient access to our

professional-managed investment mandates in various vehicle types

that best suit their needs and preferences.

In launching these new series, Guardian Capital

aims to provide investors with exposure to actively managed

products with attractive performance profiles*.

Additional details about the new series launches

are set out in the table below:

|

Guardian Fund |

New Series |

Overview |

Management Fee1 |

Administration Fee1 |

Distribution Frequency |

|

Guardian i3 International Quality Growth Fund |

ETF Series (Cboe: GIQI) |

The primary objective of the Guardian Fund is the achievement of

long-term growth of capital primarily through investment in equity

and equity-related securities of issuers outside of North America.

The Guardian Fund maintains a mid-large capitalization bias and is

broadly diversified by issuer, sector and geographic region,

seeking to isolate stock selection as the primary source of

alpha. |

0.65% |

0.19% |

Income and Capital Gains - Annually |

|

Guardian i3 US Quality Growth Fund(prior to September 19, 2024,

Guardian i3 US Quality Growth ETF) |

Series A |

The primary objective of the Guardian Fund is the achievement of

long-term capital appreciation by investing in a portfolio of

equity or equity-related securities of issuers based in the U.S.

with business operations potentially located throughout the world.

The Guardian Fund maintains a mid-large capitalization bias and is

broadly diversified by issuer, sector and geographic region,

seeking to isolate stock selection as the primary source of

alpha. |

1.55% |

0.18% |

Quarterly, if any |

|

Series F |

0.55% |

0.18% |

|

Series I |

N/A2 |

0.18% |

|

Guardian Strategic Income Fund4 |

ETF Series (Cboe: GSIF) |

The Guardian Fund is an Alternative Mutual Fund3 with its primary

objectives being to generate capital gains, preserve capital and

make monthly distributions by investing primarily in securities

that can benefit from changes to interest rates and credit spreads.

The Guardian Fund aims to maintain low volatility and low

correlation with traditional equity and fixed income markets. |

0.85% |

0.20% |

Income, Capital Gains or Capital – MonthlyCapital Gains -

Annually |

|

1 Plus applicable taxes.2 No management fee is payable by the

investor or the Guardian Fund in respect of the Series I Mutual

Fund Units. Instead, an investment advisory fee is negotiated and

paid directly by each Series I Mutual Fund Unit investor.3 This

Guardian Fund is an alternative mutual fund. It is permitted to

invest in asset classes or use investment strategies that are not

permitted for other types of mutual funds. The specific strategies

that differentiate this Guardian Fund from other types of mutual

funds include borrowing cash, engaging in short selling and

investing in specified derivatives. While these strategies will be

used in accordance with the Guardian Fund's objectives and

strategies, during certain market conditions they may accelerate

the pace at which your investment decreases in value.4 The Guardian

Fund also pays a performance fee to the manager based on the

investment performance of the Guardian Fund. Please refer to

the Guardian Fund’s prospectus for additional details. |

i3

Investments

Guardian i3 International Quality Growth Fund

and Guardian i3 US Quality Growth Fund are managed by Guardian

Capital’s i3 Investments team, which uses an investment process

that combines innovative A.I.-driven investment analysis with

traditional human portfolio management in an effort to deliver

superior risk-adjusted returns.

“Guardian Capital’s i3 Investments team has been

at the forefront in using new technology, which includes the

increasing use of artificial intelligence, to improve security

selection,” said Barry Gordon, Managing Director, Head of Retail

Asset Management, Guardian Capital LP. “Many Canadian advisors and

investors are probably well aware of how successful this team has

been in managing global equity portfolios, but we have seen similar

performance profiles in both International and U.S. equity

selection. We are excited to offer increased access to these

strategies in mutual fund and ETF formats.”

Guardian Strategic Income

Fund

Guardian Strategic Income Fund is a liquid

alternative mutual fund with a track record of positive returns.

With a track record longer than 11 years, it stands as one of

Canada’s oldest fixed-income focused liquid alternative mandates

and has been available via prospectus since 2019.

“Our fixed income team continues to deliver

strong results for clients, particularly with increasing complexity

in the market, and we believe our Strategic Income Fund may provide

investors with an uncorrelated source of returns within their

portfolios,” said Mr. Gordon. “This mandate underscores the

importance of having access to alternative solutions in Fixed

Income. The team generally uses the alternative investment fund

structure to reduce volatility and risk, which helped them deliver

strong relative returns during the recent periods of fixed income

volatility.”

In addition to ETF Units, each of Guardian i3

International Quality Growth Fund and Guardian Strategic Income

Fund already offers Series A Mutual Fund Units, Series F Mutual

Fund Units and Series I Mutual Fund Units. Guardian i3 US Quality

Growth Fund already offers Hedged and Unhedged ETF Units (TSX:

GIQU, GIQU.B). Units of the Guardian Funds are denominated in

Canadian dollars.

For further information regarding the Guardian

Funds, please visit www.guardiancapital.com (for Series I mutual

fund units) or www.guardiancapital.com/investmentsolutions (for all

other series of units).

*Annual Compound Returns (%) as of

August 31, 20241

|

Guardian Fund, Series |

1 Year |

3 Year |

5 Year |

10 Year |

Since Inception |

Inception Date |

|

Guardian i3 International Quality Growth Fund2 |

|

|

|

|

|

|

|

Series A Mutual Fund Units |

22.79 |

3.58 |

n/a |

n/a |

5.31 |

2021-07-05 |

|

Series I Mutual Fund Units |

25.09 |

5.54 |

9.20 |

8.09 |

6.45 |

2003-12-31 |

|

Guardian Strategic Income Fund3 |

|

|

|

|

|

|

|

Series A Mutual Fund Units |

9.43 |

2.59 |

2.69 |

3.28 |

4.35 |

2013-05-31 |

|

Series F Mutual Fund Units |

10.66 |

3.72 |

3.80 |

4.38 |

5.40 |

2013-05-31 |

|

Series I Mutual Fund Units |

11.63 |

4.63 |

4.65 |

n/a |

5.66 |

2015-11-06 |

|

Guardian i3 US Quality Growth Fund |

|

|

|

|

|

|

|

Hedged ETF Units |

30.94 |

3.57 |

n/a |

n/a |

9.91 |

2020-08-11 |

|

Unhedged ETF Units |

31.49 |

7.47 |

n/a |

n/a |

11.37 |

2020-08-11 |

1 The indicated rates of return are the

historical annual compounded total returns including changes in

unit value and reinvestment of all distributions and do not take

into account sales, redemption, distribution or optional charges or

income taxes payable by any unitholder that would have reduced

returns. Past performance is not indicative of future results.

2 In accordance with regulatory requirements,

investment performance for the Series F Mutual Fund Units of

Guardian i3 International Quality Growth Fund cannot be shown as

they have less than 12 months of performance history. The

performance data provided for the Series I Mutual Fund Units of

Guardian i3 International Quality Growth Fund includes performance

during a period when the fund was not a reporting issuer (the

period prior to March 30, 2011). The expenses of Guardian i3

International Quality Growth Fund could have been higher during the

applicable period had the fund been subject to the additional

regulatory requirements applicable to a reporting issuer. Guardian

Capital filed for and obtained exemptive relief on behalf of the

fund to permit the disclosure of performance data since inception

of the private fund. The Series I Mutual Fund Units do not charge a

management fee, commission or trailer fee. Series I Mutual Fund

Units are also subject to the minimum investment requirements set

forth in the prospectus for the Guardian Fund and are only eligible

to be purchased in certain circumstances. Series A and F Mutual

Fund Units have different management fees, commissions and trailer

fees, as applicable, and performance will be lower on that series

as a result.

3 The performance data provided for the Series A

Mutual Fund Units, Series F Mutual Fund Units and Series I Mutual

Fund Units of Guardian Strategic Income Fund includes performance

during a period when the fund was not a reporting issuer (the

period prior to December 13, 2019). The expenses of Guardian

Strategic Income Fund could have been higher during the applicable

period had the fund been subject to the additional regulatory

requirements applicable to a reporting issuer. Guardian Capital

filed for and obtained exemptive relief on behalf of the fund to

permit the disclosure of performance data since inception of the

private fund. The Series I Mutual Fund Units do not charge a

management fee, commission or trailer fee. Series I Mutual Fund

Units are also subject to the minimum investment requirements set

forth in the prospectus for the Guardian Fund and are only eligible

to be purchased in certain circumstances. Series A and F Mutual

Fund Units have different management fees, commissions and trailer

fees, as applicable, and performance will be lower on those series

as a result.

About Guardian Capital LP

Guardian Capital LP is the manager and portfolio

manager of the Guardian Capital Funds and Guardian Capital ETFs,

with capabilities that span a range of asset classes, geographic

regions and specialty mandates. Additionally, Guardian Capital LP

manages portfolios for institutional clients such as defined

benefit and defined contribution pension plans, insurance

companies, foundations, endowments and investment funds. Guardian

Capital LP is a wholly owned subsidiary of Guardian Capital Group

Limited and the successor to its original investment management

business, which was founded in 1962. For further information on

Guardian Capital LP, please call 416-350-8899 or visit

www.guardiancapital.com.

About Guardian Capital Group

Limited

Guardian Capital Group Limited

(“Guardian”) is a global investment management

company servicing institutional, retail and private clients through

its subsidiaries. As at June 30, 2024, Guardian had C$58.6 billion

of total client assets while managing a proprietary investment

portfolio with a fair market value of C$1.1 billion. On July 2,

2024, Guardian completed its acquisition of Sterling Capital

Management, LLC, a Charlotte, North Carolina-based investment

management firm, adding approximately C$104.0 billion (US$76.0

billion) in client assets. Founded in 1962, Guardian’s reputation

for steady growth, long-term relationships and its core values of

authenticity, integrity, stability and trustworthiness have been

key to its success over six decades. Its Common and Class A shares

are listed on the Toronto Stock Exchange as GCG and GCG.A,

respectively. To learn more about Guardian, visit

www.guardiancapital.com.

CONTACT INFORMATION

Guardian Capital LP Richard BritnellTelephone:

+1-416-350-3117 Email: rbritnell@guardiancapital.com

Guardian Capital LP Commerce Court West Suite

2700, 199 Bay Street PO Box 201 Toronto, Ontario M5L 1E8

Caution Concerning Forward-Looking

Statements

Certain information included in this press

release constitutes forward-looking information within the meaning

of applicable Canadian securities laws. All information other than

statements of historical fact may be forward-looking information.

Forward-looking information is often, but not always, identified by

the use of forward-looking terminology such as “outlook”,

“objective”, “may”, “will”, “would”, “expect”, “intend”,

“estimate”, “anticipate”, “believe”, “should”, “plan”, “continue”,

or similar expressions suggesting future outcomes or events or the

negative thereof. Forward-looking information in this press release

includes, but is not limited to, statements with respect to

management’s beliefs, plans, estimates, and intentions, and similar

statements concerning anticipated future events, results,

circumstances, performance or expectations. Such forward-looking

information reflects management’s beliefs and is based on

information currently available. Certain material factors and

assumptions were applied in providing this forward-looking

information. All forward-looking information in this press release

is qualified by the following cautionary statements.

Although Guardian Capital believes that the

expectations reflected in such forward-looking information are

reasonable, such information involves known and unknown risks and

uncertainties which may cause actual performance and results in

future periods to differ materially from any estimates or

projections of future performance or results expressed or implied

by such forward-looking information. Important factors that could

cause actual results to differ materially include but are not

limited to: general economic and market conditions, including

interest rates, business competition, changes in government

regulations or in tax laws, the outbreak and severity of pandemics,

such as COVID 19, military conflicts in various parts of the world,

the failure to satisfy any applicable stock exchange requirements,

as well as those risk factors discussed or referred to in the

Guardian Funds’ prospectus and the disclosure documents filed by

Guardian Capital with the securities regulatory authorities in the

provinces and territories of Canada and available at

www.sedarplus.com. The reader is cautioned to consider these

factors, uncertainties and potential events carefully and not to

put undue reliance on forward-looking information, as there can be

no assurance that actual results will be consistent with such

forward-looking information.

The forward-looking information contained in

this press release is presented as of the preparation date of this

press release and should not be relied upon as representing

Guardian Capital’s views as of any date subsequent to the date of

this press release. Guardian Capital undertakes no obligation,

except as required by applicable law, to publicly update or revise

any forward-looking information, whether as a result of new

information, future events or otherwise.

This communication is intended for informational

purposes only and does not constitute an offer to sell or the

solicitation of an offer to purchase Guardian Funds and is not, and

should not be construed as, investment, tax, legal or accounting

advice, and should not be relied upon in that regard. Commissions,

management fees and expenses all may be associated with investments

in Guardian Funds. Please read the prospectus before investing.

ETFs and mutual funds are not guaranteed, their values change

frequently and past performance may not be repeated. You will

usually pay brokerage fees to your dealer if you purchase or sell

units of an ETF on the Toronto Stock Exchange or Cboe. If the units

are purchased or sold on the Toronto Stock Exchange or Cboe,

investors may pay more than the current net asset value when buying

units of the ETF and may receive less than the current net asset

value when selling them.

All trademarks, registered and unregistered, are

owned by Guardian Capital Group Limited and are used under

licence.

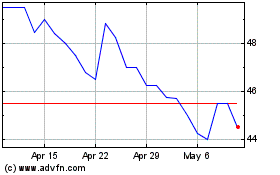

Guardian Capital (TSX:GCG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Guardian Capital (TSX:GCG)

Historical Stock Chart

From Nov 2023 to Nov 2024