Guardian Smart Infrastructure Management Announces First Direct Infrastructure Investment

September 26 2023 - 4:45PM

Guardian Capital Group Limited (Guardian) (TSX:GCG) (TSX:GCG.A)

announced today that Guardian Smart Infrastructure Management

(GSIM), its direct private infrastructure investment management

subsidiary, has made its initial infrastructure investment. GSIM is

focused on investing in the growing number of opportunities and

projects designed to enhance the productivity of new and existing

global infrastructure assets by integrating technological

innovations.

As announced separately today, Juniper Holdco AS

(Juniper), a company 70% owned by a subsidiary of Guardian, and 30%

owned by Rieber & Son, a Bergen-based privately held investment

firm (Rieber), has entered into a conditional agreement to acquire

Rieber’s 62.8% shareholding in Q-Free ASA (Q-Free) at a price of

Norwegian Krone 12.00 per share (the “Transaction”). Q-Free ASA

(OSE: QFR) is a global innovator in intelligent transportation

systems, which improve traffic flow, road safety, and air

quality.

Subject to completion of the Transaction, which

is itself subject to customary closing conditions, Juniper will

make an offer at 12.00 NOK per share to the remaining shareholders

of Q-Free as specified in Chapter 6 of the Norwegian Securities

Act.

Funding for the initial investment and proposed

follow-on investments was provided by Guardian and the GSIM

management team for a total initial commitment of US$100

million.

Guardian CEO George Mavroudis said, “We formed

our infrastructure strategy to invest in the growing number of

opportunities where digital and traditional infrastructure are

converging. Guardian’s infrastructure strategy is managed by

seasoned infrastructure investor Rob Mah and his GSIM team, who,

together, bring decades-long experience in the investment industry

and, specifically, in the infrastructure space.”

Mr. Mavroudis added, “This latest development in

the launch of Guardian’s infrastructure strategy is an exciting

milestone for Guardian and a testament to the experience and skill

of our very talented team, whose leaders are steeped in the

knowledge and experience of investing in private infrastructure

assets. We continue to leverage this significant experience to

build the next frontier of infrastructure investing with our

partners.”

“We believe this transaction is a perfect start

to launch our investment strategy of infrastructure value add,

utilizing demonstrated and commercial technologies to enhance the

operation of infrastructure assets,” said Mr. Mah. “The Q-Free

investment is an important first step in our strategy of investment

in the Intelligent Transportation Systems market. We look forward

to working with Rieber & Son and management to grow this

business.”

For further information, please contact:

George Mavroudis(416) 364-8341

About Guardian Capital Group

Limited

Guardian Capital Group Limited (“Guardian”) is a

global financial services company, which provides extensive

investment management services to institutional, retail and private

high- and ultra-high-net worth clients through its subsidiaries. As

at June 30, 2023, Guardian had C$56.5 billion of total client

assets, while managing a proprietary investment portfolio with a

fair market value of C$1.27 billion. Founded in 1962, Guardian’s

reputation for steady growth, long-term relationships and its core

values of trustworthiness, integrity and stability have been key to

its success over six decades. Its Common and Class A shares are

listed on the Toronto Stock Exchange as GCG and GCG.A,

respectively. To learn more about Guardian, visit

www.guardiancapital.com.

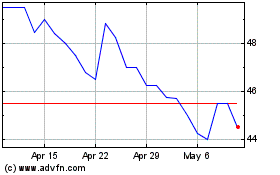

Guardian Capital (TSX:GCG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Guardian Capital (TSX:GCG)

Historical Stock Chart

From Feb 2024 to Feb 2025