Helix BioPharma Corp. to divest remaining ownership of Polish subsidiary

June 26 2020 - 6:30AM

Helix BioPharma Corp. (TSX: HBP) (“

Helix” or the

“

Company”), a clinical-stage biopharmaceutical

company developing unique therapies in the field of immuno-oncology

based on its proprietary technological platform DOS47, today

announced that it has entered into a non-binding term sheet to

divest the remaining shares it holds in its Polish subsidiary (the

“

Divestment”), Helix Immuno-Oncology S.A.

(“

HIO”), representing approximately 51% of the

issued and outstanding shares of HIO prior to the HIO Private

Placement described below.

Under the term sheet, the Company has accepted a

non-binding offer from CAIAC Fund Management AG, in its capacity as

designated trustee of an Alternative Investment Fund (the

“Fund”), that is currently in the process of being

established and authorized by the Financial Market Authority in

Liechtenstein (“FMA”). The terms of the offer

provide for Helix to sell its remaining holdings in HIO for gross

proceeds of up to PLN6,700,000 (~CAD2,300,000). The

transaction is scheduled to close on August 31, 2020, and is

subject to a number of conditions, including the approval of the

Fund by the FMA; the raising of a minimum PLN7,300,000 by the Fund

as well as regulatory approval of the transaction, if required. As

a result, there can be no assurance that the closing of the

Divestment will occur on the terms set out herein or at all.

The Company has also approved an increase in

share capital of HIO and the issuance of up to 2,200,000 Series B

ordinary shares in the capital of HIO to enable it to issue up to

2,200,000 series B ordinary shares by way of a private placement

financing for aggregate gross proceeds of approximately PLN

2,970,000 (the “HIO Private Placement”). Assuming

the successful completion of the HIO Private Placement, the

Company’s shareholding in HIO is expected to decrease to

approximately 42.5 % of the outstanding shares of HIO.

In addition, the Company has entered into

agreements with HIO (the “Debt Cancellation

Agreements”), pursuant to which it has cancelled an

aggregate amount of ~CAD$2,700,000 of intercompany debt owed to the

Company by HIO. Since HIO is a subsidiary of the Company, the

Consolidated Statements of Financial Position of the Company have

not presented intercompany transactions as advances by the Company

to HIO since liabilities of the subsidiary were offset and

eliminated against each other on the Consolidated Statements of

Financial Position. As part of the Debt Cancellation Agreements,

the Company and HIO have agreed to terminate both the BiphasixTM

asset transfer agreement and the V-DOS47 license agreement. As a

result, all transferred assets related to BiphasixTM and V-DOS47

have been automatically re-assigned and transferred from HIO back

to Helix without any formality. The Company has also ceased funding

HIO with immediate effect.

The debt forgiveness and the transfer of assets

pursuant to the Debt Cancellation Agreement are considered related

party transactions within the meaning of Multilateral Instrument

61-101 Protection of Minority Security Holders in Special

Transactions (“MI 61-101”). The Company relied on

exemptions from the formal valuation and minority approval

requirements in sections 5.5(a) and 5.7(1)(a) of MI 61-101 in

respect of the transactions based on a determination that the fair

market value of the transactions does not exceed 25% of the

Company’s market capitalization, as determined in accordance with

MI 61-101.

About Helix BioPharma Corp.

Helix BioPharma Corp. is an immuno-oncology

company specializing in the field of cancer therapy. Helix is a

biopharmaceutical company developing unique therapies in the field

of immuno-oncology, for the prevention and treatment of cancer,

based on its proprietary technology platform DOS47. Helix is

currently listed on the TSX under the symbol “HBP”. For more

information: https://www.helixbiopharma.com

Forward-Looking Statements and Risks and

Uncertainties

This news release may contain forward-looking

statements with respect to Helix, its operations, strategy,

financial performance and condition, including its activities

relating to its drug development program, any anticipated timelines

for the commencement or completion of certain activities such as

the closing of the transactions described herein, raising

sufficient capital, merger and acquisition activity, listing on a

U.S. exchange and other information in future periods. These

statements generally can be identified by use of forward-looking

words such as “aims”, “transform”, “should”, “may”, “will”,

“expect”, “estimate”, “anticipate”, “intends”, “believe” or

“continue” or the negative thereof or similar variations. The

actual results and performance of discussed herein could differ

materially from those expressed or implied by such statements. Such

statements are qualified in their entirety by the inherent risks

and uncertainties surrounding future expectations, including: (i)

Helix’s ability to operate as a going concern being dependent

mainly on securing sufficient additional financing in order to fund

its ongoing research and development and other operating

activities; (ii) the generally inherent uncertainty involved in

scientific research and drug development and those specific to

Helix’s pre-clinical and clinical development programs (DOS47,

L-DOS47 and V-DOS47); (iii) that any transactions contemplated

herein are completed; and (iv) those risks and uncertainties

affecting Helix as more fully described in Helix’s most recent

Annual Information Form, which is available at www.sedar.com

(together, the “Helix Risk Factors”). Certain material factors and

assumptions are applied in making the forward-looking statements,

including, without limitation, that the conditions to closing of

the transactions described herein will be satisfied or waived, that

sufficient financing will be obtained in a timely manner to allow

Helix to continue operations and implement its clinical trials in

the manner and on the timelines anticipated and that the Helix Risk

Factors will not cause Helix’s actual results or events to differ

materially from the forward-looking statements. These cautionary

statements qualify all such forward-looking statements.

Forward-looking statements and information are

based on the beliefs, assumptions, opinions, plans and expectations

of Helix’s management on the date of this news release, and the

Company does not assume any obligation to update any

forward-looking statement or information should those beliefs,

assumptions, opinions, plans or expectations, or other

circumstances change, except as required by law.

Investor Relations

Helix BioPharma Corp.9120 Leslie Street, Suite 205Richmond Hill,

Ontario, L4B 3J9Tel: 905-841-2300ir@helixbiopharma.com

Alpha Bronze, LLCMr. Pascal NigenPhone: + 1 (917)

385-2160helix@alphabronze.net

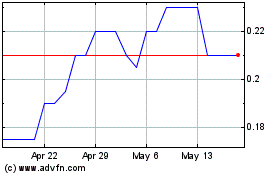

Helix BioPharma (TSX:HBP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Helix BioPharma (TSX:HBP)

Historical Stock Chart

From Dec 2023 to Dec 2024