International Petroleum Corporation (IPC or the

Corporation) (TSX, Nasdaq Stockholm: IPCO) is pleased to announce

that IPC repurchased a total of 245,200 IPC common

shares (ISIN: CA46016U1084) during the period of May 1 to 10, 2024

under IPC’s normal course issuer bid / share repurchase program

(NCIB).

IPC’s NCIB, announced on December 1, 2023, is

being implemented in accordance with the Market Abuse Regulation

(EU) No 596/2014 (MAR) and Commission Delegated Regulation (EU) No

2016/1052 (Safe Harbour Regulation) and the applicable rules and

policies of the Toronto Stock Exchange (TSX) and Nasdaq Stockholm

and applicable Canadian and Swedish securities laws.

During the period of May 1 to 10, 2024, IPC

repurchased a total of 173,000 IPC common shares on Nasdaq

Stockholm. All of these share repurchases were carried out by

Pareto Securities AB on behalf of IPC.

For more information regarding transactions

under the NCIB in Sweden, including aggregated volume, weighted

average price per share and total transaction value for each

trading day during the period of May 1 to 10, 2024, see the

following link to Nasdaq Stockholm’s website:

www.nasdaqomx.com/transactions/markets/nordic/corporate-actions/stockholm/repurchases-of-own-shares

A detailed breakdown of the transactions

conducted on Nasdaq Stockholm during the period of May 1 to 10,

2024 according to article 5.3 of MAR and article 2.3 of the Safe

Harbour Regulation is available with this press release on IPC’s

website: www.international-petroleum.com/investors/#press.

During the same period, IPC purchased a total of

72,200 IPC common shares on the TSX. All of these share repurchases

were carried out by ATB Capital Markets Inc. on behalf of IPC.

All common shares repurchased by IPC under the

NCIB will be cancelled. As at May 10, 2024, the total number of

issued and outstanding IPC common shares is 125,151,742 with voting

rights, of which IPC holds 245,200 common shares in treasury.

Since December 5, 2023 up to and including May

10, 2024, a total of 3,318,278 IPC common shares have been

repurchased under the NCIB through the facilities of the TSX and

Nasdaq Stockholm. A maximum of 8,342,119 IPC common shares may be

repurchased over the period of twelve months commencing December 5,

2023 and ending December 4, 2024, or until such earlier date as the

NCIB is completed or terminated by IPC.

International Petroleum Corp. (IPC) is an

international oil and gas exploration and production company with a

high quality portfolio of assets located in Canada, Malaysia and

France, providing a solid foundation for organic and inorganic

growth. IPC is a member of the Lundin Group of Companies. IPC is

incorporated in Canada and IPC’s shares are listed on the Toronto

Stock Exchange (TSX) and the Nasdaq Stockholm exchange under the

symbol "IPCO".

For further information, please contact:

|

Rebecca GordonSVP Corporate Planning and Investor

Relationsrebecca.gordon@international-petroleum.comTel: +41 22 595

10 50 |

or |

Robert ErikssonMedia Managerreriksson@rive6.chTel: +46 701 11 26

15 |

The information was submitted for publication, through the

contact persons set out above, at 12:00 CEST on May 13, 2024.

Forward-Looking Statements This press release

contains statements and information which constitute

"forward-looking statements" or "forward-looking information"

(within the meaning of applicable securities legislation). Such

statements and information (together, "forward-looking statements")

relate to future events, including the Corporation's future

performance, business prospects or opportunities. Actual results

may differ materially from those expressed or implied by

forward-looking statements. The forward-looking statements

contained in this press release are expressly qualified by this

cautionary statement. Forward-looking statements speak only as of

the date of this press release, unless otherwise indicated. IPC

does not intend, and does not assume any obligation, to update

these forward-looking statements, except as required by applicable

laws.

All statements other than statements of

historical fact may be forward-looking statements. Any statements

that express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, forecasts, guidance,

budgets, objectives, assumptions or future events or performance

(often, but not always, using words or phrases such as "seek",

"anticipate", "plan", "continue", "estimate", "expect", "may",

"will", "project", “forecast”, "predict", "potential", "targeting",

"intend", "could", "might", "should", "believe", "budget" and

similar expressions) are not statements of historical fact and may

be "forward-looking statements". Forward-looking statements

include, but are not limited to, statements with respect to: the

ability and willingness of IPC to continue the NCIB, including the

number of common shares to be acquired and cancelled and the timing

of such purchases and cancellations; and the return of value to

IPC’s shareholders as a result of any common share repurchases.

The forward-looking statements are based on

certain key expectations and assumptions made by IPC, including

expectations and assumptions concerning: prevailing commodity

prices and currency exchange rates; applicable royalty rates and

tax laws; interest rates; future well production rates and reserve

and contingent resource volumes; operating costs; our ability to

maintain our existing credit ratings; our ability to achieve our

performance targets; the timing of receipt of regulatory approvals;

the performance of existing wells; the success obtained in drilling

new wells; anticipated timing and results of capital expenditures;

the sufficiency of budgeted capital expenditures in carrying out

planned activities; the timing, location and extent of future

drilling operations; the successful completion of acquisitions and

dispositions and that we will be able to implement our standards,

controls, procedures and policies in respect of any acquisitions

and realize the expected synergies on the anticipated timeline or

at all; the benefits of acquisitions; the state of the economy and

the exploration and production business in the jurisdictions in

which IPC operates and globally; the availability and cost of

financing, labour and services; our intention to complete share

repurchases under our normal course issuer bid program, including

the funding of such share repurchases, existing and future market

conditions, including with respect to the price of our common

shares, and compliance with respect to applicable limitations under

securities laws and regulations and stock exchange policies; and

the ability to market crude oil, natural gas and natural gas

liquids successfully.

Although IPC believes that the expectations and

assumptions on which such forward-looking statements are based are

reasonable, undue reliance should not be placed on the

forward-looking statements because IPC can give no assurances that

they will prove to be correct. Since forward-looking statements

address future events and conditions, by their very nature they

involve inherent risks and uncertainties. Actual results could

differ materially from those currently anticipated due to a number

of factors and risks. These include, but are not limited to:

general global economic, market and business conditions; the risks

associated with the oil and gas industry in general such as

operational risks in development, exploration and production;

delays or changes in plans with respect to exploration or

development projects or capital expenditures; the uncertainty of

estimates and projections relating to reserves, resources,

production, revenues, costs and expenses; health, safety and

environmental risks; commodity price fluctuations; interest rate

and exchange rate fluctuations; marketing and transportation; loss

of markets; environmental and climate-related risks; competition;

innovation and cybersecurity risks related to our systems,

including our costs of addressing or mitigating such risks; the

ability to attract, engage and retain skilled employees; incorrect

assessment of the value of acquisitions; failure to complete or

realize the anticipated benefits of acquisitions or dispositions;

the ability to access sufficient capital from internal and external

sources; failure to obtain required regulatory and other approvals;

geopolitical conflicts, including the war between Ukraine and

Russia and the conflict in the Middle East, and their potential

impact on, among other things, global market conditions; and

changes in legislation, including but not limited to tax laws,

royalties and environmental regulations. Readers are cautioned that

the foregoing list of factors is not exhaustive.

Additional information on these and other

factors that could affect IPC, or its operations or financial

results, are included in IPC’s annual information form for the year

ended December 31, 2023 (See “Cautionary Statement Regarding

Forward-Looking Information", “Risks Factors” and "Reserves and

Resources Advisory” therein), in the management's discussion and

analysis (MD&A) for the three months ended March 31, 2024 (See

"Cautionary Statement Regarding Forward-Looking Information",

“Risks Factors” and "Reserves and Resources Advisory" therein) and

other reports on file with applicable securities regulatory

authorities, including previous financial reports, management’s

discussion and analysis and material change reports, which may be

accessed through the SEDAR+ website (www.sedarplus.ca) or IPC's

website (www.international-petroleum.com).

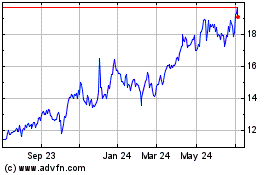

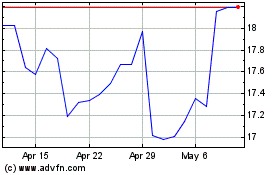

International Petroleum (TSX:IPCO)

Historical Stock Chart

From Oct 2024 to Oct 2024

International Petroleum (TSX:IPCO)

Historical Stock Chart

From Oct 2023 to Oct 2024