Kelt Exploration Ltd. (TSX:KEL) (“Kelt” or the “Company”) has

released its financial and operating results for the three and six

months ended June 30, 2019. The Company’s financial results are

summarized as follows:

|

FINANCIAL HIGHLIGHTS |

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

(CA$ thousands, except as otherwise indicated) |

|

2019 |

|

2018 |

|

% |

|

2019 |

|

2018 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Petroleum

and natural gas revenue, before royalties |

|

100,734 |

|

98,715 |

|

2 |

|

203,319 |

|

188,708 |

|

8 |

|

| Cash

provided by operating activities |

|

58,639 |

|

39,183 |

|

50 |

|

112,452 |

|

92,846 |

|

21 |

|

| Adjusted

funds from operations (1) |

|

45,455 |

|

47,099 |

|

-3 |

|

96,896 |

|

92,823 |

|

4 |

|

|

Basic ($/ common share) (1) |

|

0.25 |

|

0.26 |

|

-4 |

|

0.53 |

|

0.51 |

|

4 |

|

|

Diluted ($/ common share) (1) |

|

0.25 |

|

0.25 |

|

- |

|

0.53 |

|

0.51 |

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit

(loss) and comprehensive income (loss) |

|

2,740 |

|

1,702 |

|

61 |

|

12,109 |

|

1,679 |

|

621 |

|

|

Basic ($/ common share) |

|

0.01 |

|

0.01 |

|

- |

|

0.07 |

|

0.01 |

|

600 |

|

|

Diluted ($/ common share) |

|

0.01 |

|

0.01 |

|

- |

|

0.07 |

|

0.01 |

|

600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

capital expenditures, net of dispositions |

|

91,022 |

|

54,702 |

|

66 |

|

198,984 |

|

146,739 |

|

36 |

|

| Total

assets |

|

1,577,824 |

|

1,346,701 |

|

17 |

|

1,577,824 |

|

1,346,701 |

|

17 |

|

| Net bank

debt (1) |

|

308,636 |

|

157,058 |

|

97 |

|

308,636 |

|

157,058 |

|

97 |

|

|

Convertible debentures |

|

80,512 |

|

76,348 |

|

5 |

|

80,512 |

|

76,348 |

|

5 |

|

|

Shareholders' equity |

|

909,373 |

|

882,916 |

|

3 |

|

909,373 |

|

882,916 |

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average shares outstanding (000s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

184,151 |

|

182,708 |

|

1 |

|

184,085 |

|

181,423 |

|

1 |

|

|

Diluted |

|

184,532 |

|

184,825 |

|

- |

|

184,513 |

|

183,210 |

|

1 |

|

|

|

|

(1) Refer to advisories regarding non-GAAP financial measures and

other key performance indicators. |

|

|

FINANCIAL STATEMENTS

Kelt’s unaudited consolidated interim financial

statements and related notes for the quarter ended June 30, 2019

will be available to the public on SEDAR at www.sedar.com and will

also be posted on the Company’s website at www.keltexploration.com

on August 8, 2019.

Kelt’s operating results for the second quarter

ended June 30, 2019 are summarized as follows:

|

OPERATIONAL HIGHLIGHTS |

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

(CA$ thousands, except as otherwise indicated) |

|

2019 |

|

2018 |

|

% |

|

2019 |

|

2018 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

| Average

daily production |

|

|

|

|

|

|

|

|

|

Oil (bbls/d) |

|

9,727 |

|

8,300 |

|

17 |

|

8,772 |

|

8,396 |

|

4 |

|

|

NGLs (bbls/d) |

|

4,679 |

|

2,700 |

|

73 |

|

4,293 |

|

3,067 |

|

40 |

|

|

Gas (mcf/d) |

|

95,450 |

|

90,723 |

|

5 |

|

93,779 |

|

90,498 |

|

4 |

|

|

Combined (BOE/d) |

|

30,314 |

|

26,120 |

|

16 |

|

28,695 |

|

26,546 |

|

8 |

|

|

Production per million common shares (BOE/d) (1) |

|

165 |

|

143 |

|

15 |

|

156 |

|

146 |

|

7 |

|

|

|

|

|

|

|

|

|

|

|

| Average

realized prices, before financial instruments(1) |

|

|

|

|

|

|

|

|

|

Oil ($/bbl) |

|

72.17 |

|

80.56 |

|

-10 |

|

69.95 |

|

74.33 |

|

-6 |

|

|

NGLs ($/bbl) |

|

20.28 |

|

38.67 |

|

-48 |

|

22.51 |

|

34.15 |

|

-34 |

|

|

Gas ($/mcf) |

|

2.75 |

|

2.56 |

|

7 |

|

3.95 |

|

2.87 |

|

38 |

|

|

|

|

|

|

|

|

|

|

|

| Operating

netbacks ($/BOE) (1) |

|

|

|

|

|

|

|

|

|

Petroleum and natural gas revenue |

|

36.52 |

|

41.54 |

|

-12 |

|

39.14 |

|

39.28 |

|

- |

|

|

Cost of purchases |

|

(1.56 |

) |

(3.03 |

) |

-49 |

|

(1.52 |

) |

(2.00 |

) |

-24 |

|

|

Average realized price, before financial instruments(1) |

|

34.96 |

|

38.51 |

|

-9 |

|

37.62 |

|

37.28 |

|

1 |

|

|

Realized gain (loss) on financial instruments |

|

0.05 |

|

- |

|

- |

|

(0.13 |

) |

- |

|

- |

|

|

Average realized price, after financial instruments(1) |

|

35.01 |

|

38.51 |

|

-9 |

|

37.49 |

|

37.28 |

|

1 |

|

|

Royalties |

|

(2.25 |

) |

(3.97 |

) |

-43 |

|

(2.14 |

) |

(3.35 |

) |

-36 |

|

|

Production expense |

|

(8.73 |

) |

(9.14 |

) |

-4 |

|

(9.39 |

) |

(9.30 |

) |

1 |

|

|

Transportation expense |

|

(5.53 |

) |

(3.83 |

) |

44 |

|

(5.17 |

) |

(3.61 |

) |

43 |

|

|

Operating netback (1) |

|

18.50 |

|

21.57 |

|

-14 |

|

20.79 |

|

21.02 |

|

-1 |

|

|

|

|

|

|

|

|

|

|

|

|

Undeveloped land |

|

|

|

|

|

|

|

|

|

Gross acres |

|

679,904 |

|

761,429 |

|

-11 |

|

679,904 |

|

761,429 |

|

-11 |

|

|

Net acres |

|

585,075 |

|

644,986 |

|

-9 |

|

585,075 |

|

644,986 |

|

-9 |

|

|

|

|

(1) Refer to advisories regarding non-GAAP financial measures and

other key performance indicators. |

|

|

MESSAGE TO SHAREHOLDERS

Average production for the three months ended

June 30, 2019 was 30,314 BOE per day, up 16% compared to average

production of 26,120 BOE per day during the second quarter of 2018.

Quarter-over-quarter, daily average production in the second

quarter of 2019 was 12% higher than average production of 27,057

BOE per day in the first quarter of 2019. Higher

quarter-over-quarter production reflects on-going new production

additions from the Company’s successful development pad drilling

operations at Inga/Fireweed. Production for the three months ended

June 30, 2019 was weighted 48% oil and NGLs and 52% gas. However,

operating income was weighted 90% oil and NGLs and 10% gas.

Kelt’s realized average oil price during the

second quarter of 2019 was $72.17 per barrel, down 10% from $80.56

per barrel in the second quarter of 2018. The realized average NGLs

price during the second quarter of 2019 was $20.28 per barrel, down

48% from $38.67 per barrel in the same quarter of 2018. The

significant decrease in NGL prices were due to much weaker propane

and butane prices at Edmonton. In British Columbia, where the

Company has oil blending operations that result in premium liquids

pricing, Kelt’s direct oil sales were impacted during the Husky

Prince George Refinery turnaround operations that occurred from

April 8, 2019 to June 16, 2019, resulting in lower liquids pricing

and higher oil transportation expenses.

Kelt’s realized average gas price for the second

quarter of 2019 was $2.75 per Mcf, up 7% from $2.56 per Mcf in the

corresponding quarter of the previous year. Kelt benefits with

premium natural gas price realizations compared to AECO as a result

of its gas market diversification portfolio and high heat content

gas. During the second quarter of 2019, the Company’s realized

average gas price per Mcf was 167% higher than the average AECO 5A

price of $1.03 per MMBtu.

For the three months ended June 30, 2019,

revenue was $100.7 million and adjusted funds from operations was

$45.5 million ($0.25 per share, diluted), compared to $98.7 million

and $47.1 million ($0.25 per share, diluted) respectively, in the

second quarter of 2018.

Net capital expenditures incurred during the

three months ended June 30, 2019 were $91.0 million. During the

second quarter of 2019, the Company spent $57.1 million on drill

and complete operations, $36.2 million on equipment, facilities and

pipelines and $1.4 million on land and seismic. Property

dispositions, net of property acquisitions were $3.7 million during

the quarter.

During the second quarter of 2019, Kelt’s

production was negatively impacted by firm gas transportation

service restrictions on TC Energy’s NGTL system, temporary shut-ins

from producing Inga wells during completion operations on the Inga

24-well pad and intermittent downtime at the Encana Sexsmith Gas

Plant where the Company processes gas from its La Glace field. In

order to mitigate the impact of production disruptions resulting

from these events, Kelt elected to advance its 2019 capital

expenditure program. In doing so, the Company was also able to take

advantage of significant cost savings on its continuing drilling

and completion operations. Approximately $30.0 million in capital

expenditures relating to capital projects that were originally

budgeted for the third quarter of 2019 were completed during the

second quarter of 2019, including the following:

- completion operations for six wells

from the Inga 24-well pad (wells #7 to #12);

- drilling operations for six wells

from the Inga 24-well pad (wells #13 to #18); and

- drilling operations for one well at

Oak.

At June 30, 2019, bank debt, net of working

capital was $308.6 million. During the second half of 2019, Kelt is

forecasting higher funds from operations compared to estimated

capital expenditures, resulting in bank debt, net of working

capital of approximately $258.0 million at December 31, 2019.

OPERATIONS UPDATE

Inga/Fireweed Core Area

At Inga, Kelt completed six wells (wells #7 to

#12) on its 24-well pad Montney cube development program. Four of

the six wells have been put on production and the remaining two

wells are expected to be put on production this week. Initial

production rates from these wells have exceeded the Company’s

expectations. The average drill and complete cost per well was $4.8

million, a 4% reduction from the average drill and complete cost of

$5.0 million per well for the first six wells and 11% lower than

the original budgeted average drill and complete cost of $5.4

million per well. The Company is pleased with the higher capital

efficiencies on the second batch of six wells considering that the

total amount of proppant pumped into the wells averaged 3,528

tonnes per well, a 15% increase from an average 3,074 tonnes per

well of proppant pumped into the first six wells drilled from the

pad. Kelt has been able to improve costs through drilling

efficiencies resulting in lower drill times and completion

efficiencies resulting from the use of the Company’s newly

installed water handling facilities. Additional savings are being

realized by using bi-fuel (natural gas capable) frac pumpers and

on-site fuel gas further reducing costs and at the same time,

improving the Company’s carbon footprint. A summary of the drill

and complete operations for these wells is shown in the table

below:

|

Well |

MontneyZone |

CompletionTechnology |

Drill &Complete(MM) |

TotalProppant(tonnes) |

Proppantper Metre(tonnes) |

Total FracFluid(m3) |

Avg. FracIntensity(m3/min) |

|

00/16-17 (H4-9) |

Upper |

Open Hole Ball-Drop |

$ 4.6 |

3,398 |

1.25 |

23,657 |

11.0 |

|

02/15-17 (J4-9) |

Upper |

Open Hole Ball Drop |

$ 4.7 |

3,406 |

1.21 |

22,153 |

11.0 |

|

03/16-17 (F4-9) |

IBZ |

Plug and Perf |

$ 4.4 |

3,288 |

1.33 |

26,730 |

11.2 |

|

03/15-17 (I4-9) |

IBZ |

Plug and Perf |

$ 5.0 |

3,516 |

1.33 |

27,891 |

10.7 |

|

02/16-17 (G4-9) |

Middle |

Open Hole Ball-Drop |

$ 4.3 |

3,440 |

1.27 |

22,158 |

11.2 |

|

00/15-17 (K4-9) |

Middle |

Plug and Perf |

$ 5.9 |

4,120 |

1.56 |

27,268 |

11.2 |

| |

|

|

|

|

|

|

|

The next six wells (wells #13 to #18) on the

24-well pad were also drilled in the second quarter and are

expected to be completed during the third quarter of 2019. Included

in these six wells is one well targeting the Lower Middle Montney

horizon. This will be the Company’s first Lower Middle Montney test

on its Inga/Fireweed land acreage. The first six wells (wells #1 to

#6) were put on production during the second quarter and were

temporarily shut-in for a short period while the Company was

completing the second batch of six wells. Production volumes from

each of these first six wells for the respective initial 30 days

(approximately 720 operating hours) in aggregate were 6,569 BOE per

day (77% oil and NGLs), exceeding the Company’s expected range of

5,800 to 6,200 BOE per day (60% to 65% oil and NGLs).

At Fireweed, the Company was ahead of schedule

putting five Upper and Middle Montney single pad wells on

production during the second quarter. These wells that were

previously drilled in 2018 and which were expected to be put on

production in the third quarter of 2019, were tied-in ahead of

schedule with production commencing in the second quarter of 2019.

Production volumes from each of these five wells for the respective

initial 30 days (approximately 720 operating hours) in aggregate

were 5,281 BOE per day (72% oil and NGLs), within the Company’s

expected range of 5,200 to 5,500 BOE per day (60% to 65% oil and

NGLs).

Kelt has entered into an agreement with AltaGas

Ltd. (“AltaGas”) whereby the Company will construct a 16-inch gas

pipeline from its Inga 2-10 facility to the AltaGas Townsend

Deep-Cut Gas Plant. The total cost to build the pipeline is

estimated to be approximately $39.0 million and ownership of the

pipeline will be two-thirds Kelt and one-third AltaGas. The

pipeline will have a capacity to transport up to approximately 300

MMcf per day of natural gas. AltaGas will reimburse Kelt the full

amount of $39.0 million ($13 million during construction and $26

million after construction) and in return Kelt has agreed to make

annual payments over 10 years as repayment for its share of the

cost of the pipeline (approximately $26.0 million). The annual

payments to AltaGas over ten years are representative of payments

that would have been required if Kelt did not take an ownership

interest in the pipeline but instead entered into a take-or-pay

arrangement to deliver gas through the pipeline as a third party.

Under such an arrangement, Kelt would not have an ownership

interest in the pipeline after 10 years and would have to

re-negotiate transportation terms thereafter. Under the current

agreement, Kelt retains its two-thirds ownership in the pipeline

after the ten year term is complete, with no further financial

obligation to AltaGas.

The Government of British Columbia offers an

Infrastructure Royalty Credit Program that encourages new capital

investment in oil and natural gas infrastructure. The program is

designed to create and sustain good paying jobs for British

Columbians and stimulate new royalty revenue for the Province.

Through the Infrastructure Royalty Credit Program, oil and gas

companies such as Kelt can apply for a reduction to the royalties

they would otherwise pay to the Province under a competitive

Request for Applications process. This reduction can be applied to

future royalties that would otherwise be payable and is determined

based on an approved percentage of the costs to build roads,

pipelines and gas facilities that are approved under the

program.

In 2017, Kelt made an application to the

Infrastructure Royalty Credit Program and was approved for its

planned infrastructure build in certain parts of its Inga/Fireweed

property relating to expenditures totaling approximately $38.6

million. This infrastructure build includes the following:

- construction of a pipeline route

comprised of a sour gas line, a sweet gas line, a sour emulsion

line, a disposal water line, a frac water line and a fuel gas

line;

- building and upgrading of roads and

installation of a bridge; and

- installation of centralized

dehydration and compression facilities.

The Government of British Columbia approved a

recovery of approximately 39% of Kelt’s infrastructure expenditures

or $15.0 million through the program. The amount is expected to be

recovered from reduced future royalties payable relating to 20

horizontal Montney wells associated with this project. To date,

Kelt has incurred over 80% of the infrastructure capital committed

to under the program and has drilled 10 of the 20 horizontal

Montney wells. The Company has commenced sales from these wells and

expects to apply for royalty credits imminently, however, the

future benefit of credits from the program are not currently

reflected in the Company’s 2019 financial guidance.

Wembley/Pipestone Core Area

At Wembley/Pipestone, the Company has now

drilled and completed three Upper Middle Montney (D3/D4) wells from

the 1-14 pad offsetting the original discovery well located at

00/04-01-072-08W6 which had an IP30 production rate of 1,337 BOE

per day (83% oil and NGLs). The average drill & complete cost

per well was $5.4 million per well, 8% lower than the budgeted

average cost of $5.9 million per well. Kelt has also drilled three

additional Upper Middle Montney (D3/D4) wells from the 12-3 pad

offsetting the 2018 well drilled from the same pad located at

00/12-05-073-08W6 which when tested, over the last three days of

the test, produced average sales volumes of approximately 1,497 BOE

per day (74% oil and NGLs). In August 2019, the Company expects to

commence completion operations on these three wells that were

drilled from the 12-3 pad. During the second quarter, the Company

also drilled a single well on its main Wembley/Pipestone land block

located at (03/16-08) 02/16-10-72-7W6.

At Wembley/Pipestone, Kelt is currently building

a battery that will be capable of processing all of the gas, oil

and water associated with the Company’s firm service commitment at

the Pipestone Sour Deep-Cut Gas Processing Plant which is also

currently under construction by Tidewater Midstream and

Infrastructure Ltd. (“Tidewater”). The Kelt battery, consisting of

dehydration, separation, treating, storage and water injection

facilities, is expected to be commissioned in September coinciding

with the expected start-up of the Tidewater facility. Kelt’s water

injection well, which was completed earlier this year, has already

been tested and used for water disposal.

OUTLOOK/GUIDANCE

As the Company prepares to ramp up production in

the second half of 2019 with significant production additions from

its Inga/Fireweed and Wembley/Pipestone core areas, Kelt has not

changed its 2019 average production estimate that was forecasted to

be in a range of 33,500 to 34,500 BOE per day. However, in light of

recent third party gas plant interruptions, the Company expects its

2019 average production to be at the low end of its forecasted

range. Subsequent to the end of the second quarter, the Enbridge

McMahon Gas Plant, which accounts for approximately one-third of

Kelt’s B.C. production, was shut down on July 30, 2019 and has

indicated that it will resume operations on August 13, 2019. At La

Glace, where the Company produces approximately 2,800 BOE per day

through the Encana Sexsmith Gas Plant, Kelt has been experiencing

interruptions in its production resulting from restrictions to the

plant due to heat caused by high ambient temperatures and increased

NGTL pipeline pressures.

With the recent volatility in oil and gas

prices, Kelt is reducing its forecasted commodity price assumptions

for 2019.

Kelt’s 2019 capital expenditure program,

excluding the Company’s share of costs relating to the proposed

16-inch gas pipeline from its Inga 2-10 facility to the Townsend

Deep-Cut Gas Plant, remains unchanged at $270.0 million. The cost

of the pipeline of approximately $26.0 million will be incurred by

Kelt during the year, however, Kelt will be reimbursed by AltaGas

and in return Kelt will re-pay AltaGas based on a pre-determined

fee basis over 10 years.

In addition, Kelt’s 2019 capital expenditures

includes approximately $18.0 million of drilling expenditures for

wells (DUCs) that are not expected to be completed until 2020:

- 6 wells at Inga/Fireweed – wells

#19 to #24 from the Inga 24-well pad; and

- 2 wells at Wembley/Pipestone –

02/16-10 (sfc 03/16-08) and 00/04-24 (sfc 16-26).

Production from these eight wells (DUCs) plus an

additional two wells at Oak (to be drilled and completed in 2019)

is not included in the Company’s 2019 production forecast and will

provide the Company with momentum for continued production growth

in early 2020.

The table below summarizes Kelt’s revised

financial guidance for 2019:

|

Commodity Prices: |

2019 Forecast |

Previous Forecast |

Change |

|

WTI Crude Oil (USD/bbl) |

58.00 |

60.00 |

− 3% |

|

MSW Edmonton Oil (CAD/bbl) |

69.32 |

73.17 |

− 5% |

|

NYMEX Natural Gas (USD/MMBtu) |

2.80 |

2.85 |

− 2% |

|

DAWN Gas Daily Index (USD/MMBtu) |

2.70 |

2.75 |

− 2% |

|

CHICAGO City Gate Gas Daily Index (USD/MMBtu) |

2.70 |

2.70 |

N/C |

|

MALIN Gas Monthly Index (USD/MMBtu) |

2.75 |

2.80 |

− 2% |

|

SUMAS Gas Monthly Index (USD/MMBtu) |

3.50 |

3.50 |

N/C |

|

AECO 5A Gas Daily Index (USD/MMBtu) |

1.25 |

1.30 |

− 4% |

|

Station 2 Gas NGX Daily Index (USD/MMBtu) |

0.85 |

0.90 |

− 6% |

|

Exchange Rate (USD/CAD) |

1.320 |

1.340 |

− 1% |

|

|

|

|

|

|

Capital expenditures, net of dispositions [1] ($ MM) |

296.0 |

270.0 |

+ 10% |

|

Adjusted funds from operations (“AFFO”) ($ MM) |

220.0 |

240.0 |

− 8% |

|

Per common share, diluted ($) |

1.19 |

1.24 |

− 4% |

|

Bank debt, net of working capital, at year-end [2] ($ MM) |

258.0 |

235.0 |

+ 10% |

|

Net bank debt to trailing AFFO ratio |

1.2 x |

0.9 x |

|

|

|

|

[1] Capital expenditures include $26.0 million for the 16-inch gas

pipeline from Kelt’s Inga 2-10 facility to AltaGas’s Townsend Gas

Plant. |

|

[2] In addition to forecasted net bank debt at December 31, 2019,

Kelt estimates 2019 year-end financial liabilities of approximately

$26.0 million primarily relating to the Inga 16-inch gas pipeline

(AltaGas). |

|

|

During this period of volatile commodity price

swings responding to headlines regarding political uncertainty and

global trade wars, Kelt continues to remain disciplined

financially. Management looks forward to updating shareholders with

2019 third quarter results on or about November 8, 2019.

Changes in forecasted commodity prices and

variances in production estimates can have a significant impact on

estimated funds from operations and profit. Please refer to the

advisories regarding forward-looking statements and to the

cautionary statement below.

The information set out herein is “financial

outlook” within the meaning of applicable securities laws. The

purpose of this financial outlook is to provide readers with

disclosure regarding Kelt’s reasonable expectations as to the

anticipated results of its proposed business activities for the

calendar year 2019. Readers are cautioned that this financial

outlook may not be appropriate for other purposes.

ADVISORY REGARDING FORWARD-LOOKING

STATEMENTS

This press release contains forward-looking

statements and forward-looking information within the meaning of

applicable securities laws. The use of any of the words “expect”,

“anticipate”, “continue”, “estimate”, “execute”, “ongoing”, “may”,

“will”, “project”, “should”, “believe”, “plans”, “intends”,

“forecasted” and similar expressions are intended to identify

forward-looking information or statements. In particular, this

press release contains forward-looking statements pertaining to the

following: Kelt’s expected price realizations and future commodity

prices; expectations for operating costs, transportation expenses

and royalties, the cost and timing of future capital expenditures

and expected well results; anticipated production volumes; the

expected timing of well completions in 2019 and 2020; the expected

timing of wells commencing production, the expected timing of

facility expenditures, the expected timing of facility start-up

dates, and the Company's expected future financial position and

operating results.

Although Kelt believes that the expectations and

assumptions on which the forward-looking statements are based are

reasonable, undue reliance should not be placed on the

forward-looking statements because Kelt cannot give any assurance

that they will prove to be correct. Since forward-looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. These include, but are not

limited to, the risks associated with the oil and gas industry in

general, operational risks in development, exploration and

production; delays or changes in plans with respect to exploration

or development projects or capital expenditures; the uncertainty of

reserve estimates; the uncertainty of estimates and projections

relating to production, costs and expenses; failure to obtain

necessary regulatory approvals for planned operations; health,

safety and environmental risks; uncertainties resulting from

potential delays or changes in plans with respect to exploration or

development projects or capital expenditures; volatility of

commodity prices, currency exchange rate fluctuations; imprecision

of reserve estimates; as well as general economic conditions, stock

market volatility; and the ability to access sufficient capital. We

caution that the foregoing list of risks and uncertainties is not

exhaustive.

In addition, the reader is cautioned that

historical results are not necessarily indicative of future

performance. The forward-looking statements contained herein are

made as of the date hereof and the Company does not intend, and

does not assume any obligation, to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise unless expressly required by applicable

securities laws.

Certain information set out herein may be

considered as “financial outlook” within the meaning of applicable

securities laws. The purpose of this financial outlook is to

provide readers with disclosure regarding Kelt’s reasonable

expectations as to the anticipated results of its proposed business

activities for the periods indicated. Readers are cautioned that

the financial outlook may not be appropriate for other

purposes.

Any reference in this press release to IP rates

is useful in confirming the presence of hydrocarbons. IP rates are

not determinative of the rates at which wells will continue

production and decline thereafter and are not necessarily

indicative of long term performance. While encouraging, readers are

cautioned not to place reliance on such rates in calculating

aggregate production for the Company.

NON-GAAP FINANCIAL MEASURES AND OTHER

KEY PERFORMANCE INDICATORS

This press release contains certain financial

measures, as described below, which do not have standardized

meanings prescribed by GAAP. In addition, this press release

contains other key performance indicators (“KPI”), financial and

non-financial, that do not have standardized meanings under the

applicable securities legislation. As these non-GAAP financial

measures and KPI are commonly used in the oil and gas industry, the

Company believes that their inclusion is useful to investors. The

reader is cautioned that these amounts may not be directly

comparable to measures for other companies where similar

terminology is used.

Non-GAAP financial measures

“Operating income” is calculated by deducting

royalties, production expenses and transportation expenses from

petroleum and natural gas revenue, net of the cost of purchases and

after realized gains or losses on associated financial instruments.

The Company refers to operating income expressed per unit of

production as an “operating netback”.

“Adjusted funds from operations” is calculated

as cash provided by operating activities before changes in non-cash

operating working capital, and adding back (if applicable):

transaction costs associated with acquisitions and dispositions,

provisions for potential credit losses, and settlement of

decommissioning obligations. Adjusted funds from operations per

common share is calculated on a consistent basis with profit (loss)

per common share, using basic and diluted weighted average common

shares as determined in accordance with GAAP. Adjusted funds from

operations and operating income or netbacks are used by Kelt as key

measures of performance and are not intended to represent operating

profits nor should they be viewed as an alternative to cash

provided by operating activities, profit or other measures of

financial performance calculated in accordance with GAAP.

The following table reconciles cash provided by

operating activities to adjusted funds from operations:

|

|

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

(CA$ thousands, except as otherwise indicated) |

|

2019 |

|

2018 |

|

% |

|

2019 |

|

2018 |

|

% |

|

| Cash provided by

operating activities |

|

58,639 |

|

39,183 |

|

50 |

|

112,452 |

|

92,846 |

|

21 |

|

| Change

in non-cash working capital |

|

(14,033 |

) |

7,740 |

|

-281 |

|

(17,483 |

) |

(786 |

) |

2,124 |

|

| Funds from

operations |

|

44,606 |

|

46,923 |

|

-5 |

|

94,969 |

|

92,060 |

|

3 |

|

| Provision for potential credit

losses |

|

221 |

|

- |

|

- |

|

203 |

|

- |

|

- |

|

|

Settlement of decommissioning obligations |

|

628 |

|

176 |

|

257 |

|

1,724 |

|

763 |

|

126 |

|

|

Adjusted funds from operations |

|

45,455 |

|

47,099 |

|

-3 |

|

96,896 |

|

92,823 |

|

4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Throughout this press release, reference is made

to “total revenue”, “Kelt Revenue” and “average realized prices”.

“Total revenue” refers to petroleum and natural gas revenue (before

royalties) as reported in the consolidated financial statements in

accordance with GAAP, and is before realized gains or losses on

financial instruments. "Kelt Revenue" is a non-GAAP measure and is

calculated by deducting the cost of purchases from petroleum and

natural gas revenue (before royalties). “Average realized prices”

are calculated based on “Kelt Revenue” divided by production and

reflect the Company's realized selling prices plus the net benefit

of oil blending/marketing activities, which commenced during the

fourth quarter of 2017. In addition to using its own production,

the Company may purchase butane and crude oil from third parties

for use in its blending operations, with the objective of selling

the blended oil product at a premium. Marketing revenue from the

sale of third party volumes is included in total petroleum and

natural gas revenue as reported in the Consolidated Statement of

Profit (Loss) and Comprehensive Income (Loss) in accordance with

GAAP. Given the Company’s per unit operating statistics disclosed

throughout this press release are calculated based on Kelt’s

production volumes, management believes that disclosing its average

realized prices based on Kelt Revenue is more appropriate and

useful, because the cost of third party volumes purchased to

generate the incremental marketing revenue has been deducted.

“Average realized prices” referenced throughout

this press release are before financial instruments, except as

otherwise indicated as being after financial instruments.

“Average realized prices” referenced throughout

this MD&A are before financial instruments, except as otherwise

indicated as being after financial instruments.

The term “net bank debt” is used synonymously

with, and is equal to, “bank debt, net of working capital”. “Net

bank debt” is calculated by adding the working capital deficiency

to bank debt. The working capital deficiency is equal to total

current assets net of total current liabilities. The Company uses a

“net bank debt to annualized adjusted funds from operations ratio”

as a benchmark on which management monitors the Company’s capital

structure and short-term financing requirements. Management

believes that this ratio, which is a non-GAAP financial measure,

provides investors with information to understand the Company’s

liquidity risk. The “net bank debt to annualized quarterly adjusted

funds from operations ratio” is also indicative of the “debt to

EBITDA” calculation used to determine the applicable margin for a

quarter under the Company’s Credit Facility agreement (though the

calculation may not always be a precise match, it is

representative).

MEASUREMENTS

All dollar amounts are referenced in thousands

of Canadian dollars, except when noted otherwise. This press

release contains various references to the abbreviation BOE which

means barrels of oil equivalent. Where amounts are expressed on a

BOE basis, natural gas volumes have been converted to oil

equivalence at six thousand cubic feet per barrel and sulphur

volumes have been converted to oil equivalence at 0.6 long tons per

barrel. The term BOE may be misleading, particularly if used in

isolation. A BOE conversion ratio of six thousand cubic feet per

barrel is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead and is significantly different

than the value ratio based on the current price of crude oil and

natural gas. This conversion factor is an industry accepted norm

and is not based on either energy content or current prices. Such

abbreviation may be misleading, particularly if used in isolation.

References to “oil” in this press release include crude oil and

field condensate. References to “natural gas liquids” or “NGLs”

include pentane, butane, propane, and ethane. References to

“liquids” include field condensate and NGLs. References to “gas” in

this discussion include natural gas and sulphur.

ABBREVIATIONS

|

bbls |

barrels |

| bbls/d |

barrels per day |

| mcf |

thousand cubic feet |

| mcf/d |

thousand cubic feet per day |

| mmcf |

million cubic feet |

| mmcf/d |

million cubic feet per day |

| tcf |

trillion cubic feet |

| MMBTU |

million British Thermal

Units |

| GJ |

gigajoule |

| BOE |

barrel of oil equivalent |

| BOE/d |

barrel of oil equivalent per

day |

| NGLs |

natural gas liquids |

| LNG |

liquefied natural gas |

| AECO |

Alberta Energy Company “C” Meter

Station of the NOVA Pipeline System |

| NIT |

NOVA Inventory Transfer

(“AB-NIT”), being the reference price at the AECO Hub |

| WTI |

West Texas Intermediate |

| NYMEX |

New York Mercantile Exchange |

| Station 2 |

Spectra Energy receipt

location |

| US$ |

United States dollars |

| CA$ |

Canadian dollars |

| TSX |

the Toronto Stock Exchange |

| KEL |

trading symbol for Kelt

Exploration Ltd. common shares on the TSX |

| KEL.DB |

trading symbol for Kelt

Exploration Ltd. 5% convertible debentures on the TSX |

| CDE |

Canadian Development Expenses, as

defined by the Income Tax Act (Canada) |

| CEE |

Canadian Exploration Expenses, as

defined by the Income Tax Act (Canada) |

| GAAP |

Generally Accepted Accounting

Principles |

| |

|

For further information, please contact:

KELT EXPLORATION LTD., Suite

300, 311 – 6th Avenue SW, Calgary, Alberta, Canada T2P 3H2

DAVID J. WILSON, President and

Chief Executive Officer (403) 201-5340, or SADIQ H.

LALANI, Vice President and Chief Financial Officer (403)

215-5310. Or visit our website at www.keltexploration.com.

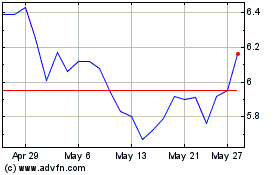

Kelt Exploration (TSX:KEL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kelt Exploration (TSX:KEL)

Historical Stock Chart

From Nov 2023 to Nov 2024