mdf commerce inc. (“mdf commerce” or the

“Corporation”) (TSX:MDF), a SaaS leader in digital commerce

technologies, today announced that it has entered into a share

purchase agreement (the “Share Purchase Agreement”) with SPS

Commerce, Inc. (“SPS”) and concurrently closed the transaction for

the sale of its wholly owned subsidiary InterTrade Systems Inc.

(“InterTrade”). Financial references are expressed in Canadian

dollars unless otherwise indicated.

“We are thankful for the hard work and

dedication on the part of InterTrade employees, who built this

business and its envious reputation over the years. As a

world-leading retail network connecting trading partners around the

globe, SPS commerce represents a perfect fit to bring this business

to the next level and to provide even more value to customers,”

stated Luc Filiatreault, Chief Executive Officer of mdf commerce.

“This sale also fits well with our strategic goal of adding focus

and investing in our two core platforms, eprocurement and

ecommerce. The received consideration will allow the Corporation to

improve its balance sheet and create near-term shareholder value

within mdf commerce.”

Pursuant to the Share Purchase Agreement, SPS

acquired all the issued and outstanding shares of InterTrade for a

total, all-cash consideration of $65.8 million1 (US$48.5 million),

subject to certain customary post-closing adjustments. The total

consideration consists of an upfront payment of $62.7 million1

(US$46.2 million), which is net of amounts in escrow for customary

indemnification purposes and the completion of certain transition

services within prescribed timing, the whole subject to customary

purchase price adjustments.

The proceeds from the sale will be used to repay

the Corporation’s Term Facility of $21.7 million1 (US$16 million)

in full at Closing. The balance of net proceeds will go towards

repaying the Corporation’s Revolving Facility drawn in US and

Canadian dollars.

Upon repayment of the Term

Facility, it will no longer be available. The

Corporation’s Revolving Facility which has a

limit of up to $50 million, with an accordion amount

of up to $20 million (which is subject to lender’s

approval), will remain available to mdf commerce

until its maturity on August 31, 2024. In addition, as a

consequence of the closing of the transaction, a third amendment to

the Credit Agreement was executed on October 4, 2022, which

provides for a waiver of the fixed charge coverage

ratio, which is replaced with a minimum EBITDA (as

defined in the Credit Agreement) for the next three

fiscal quarters ending on December 31, 2022, March 31, 2023, and

June 30, 2023, and that, until June 30, 2023, requires

the approval of the use of the funds as it relates

to borrowings in excess of $30 million.

The InterTrade solution provides

business-to-business (B2B) integration solutions to better manage

the Supply Chain Collaboration between trading partners and was

part of mdf commerce’s Unified Commerce platform. Further to the

sale of InterTrade, mdf commerce’s Unified Commerce platform will

be renamed ecommerce and will be comprised of mdf commerce’s two

ecommerce solutions: Orckestra and k-ecommerce.

1 Translated at USD/CAD of 1.3574

About mdf commerce inc.

mdf commerce inc. (TSX: MDF) enables the flow of

commerce by providing a broad set of SaaS solutions that optimize

and accelerate commercial interactions between buyers and sellers.

Our platforms and services empower businesses around the world,

allowing them to generate billions of dollars in transactions on an

annual basis. Our eprocurement, ecommerce and emarketplace

platforms are supported by a strong and dedicated team of over

700 employees based in Canada, the United States,

Denmark, Ukraine, and China. For more information, please visit us

at mdfcommerce.com, follow us on LinkedIn or call at

1-877-677-9088.

Forward-Looking Statements

Certain statements in this press release herein

constitute forward-looking statements. These statements relate to

future events or our future financial performance and involve known

and unknown risks, uncertainties and other factors that may cause

mdf commerce’s, or the Corporation’s industry’s actual results,

levels of activity, performance, or achievements to be materially

different from those expressed or implied by any of the

Corporation’s statements. Such factors may include, but are not

limited to, risks and uncertainties that are discussed in greater

detail in the “Risk Factors and Uncertainties” section of the

Corporation’s Annual Information Form as at March 31, 2022, as well

as in the “Risk Factors and Uncertainties” section of the

Management’s Discussion and Analysis for the first quarter ended

June 30, 2022 and elsewhere in the Corporation’s filings

with the Canadian securities regulators, as applicable.

Forward-looking statements generally can be identified by the use

of forward-looking terminology such as “may,” “will,” “should,”

“could,” “expects,” “plans,” “anticipates,” “intends,” “believes,”

“estimates,” “predicts,” “potential” or “continue” or the negatives

of these terms or other comparable terminology. These statements

are only predictions. Examples of such statements include

statements with respect to post-closing adjustments, timing of

completion of certain transition services and borrowings under the

Revolving Facility. Forward-looking statements are based on

management’s current estimates, expectations, and assumptions,

which management believes are reasonable as of the date hereof, and

are inherently subject to significant business, economic,

competitive, and other uncertainties and contingencies regarding

future events and are accordingly subject to changes after such

date. Undue importance should not be placed on forward-looking

statements, and the information contained in such forward-looking

statements should not be relied upon as of any other date. Actual

events or results may differ materially. We cannot guarantee future

results, levels of activity, performance, or achievement. The

forward-looking statements included in this press release are made

as of the date of this press release and we disclaim any intention,

and assume no obligation, to update these forward-looking

statements, except as required by applicable securities laws.

Additional information about mdf commerce,

including the Corporation’s interim condensed consolidated

financial statements as at June 30, 2022 and 2021 and for the

three-month periods then ended, Management’s Discussion and

Analysis for the first quarter ended June 30, 2022 and its latest

Annual Information Form as at March 31, 2022 are available on the

Corporation’s website www.mdfcommerce.com and have been filed with

SEDAR at www.sedar.com

For further information:

mdf commerce inc.

Luc Filiatreault, President & CEOToll free: 1-877-677-9088,

ext. 2004Email: luc.filiatreault@mdfcommerce.com

Deborah Dumoulin, Chief Financial OfficerToll free:

1-877-677-9088, ext. 2134Email:

deborah.dumoulin@mdfcommerce.com

André Leblanc, Vice President, Marketing and Public AffairsToll

Free: 1-877-677-9088, ext. 8220Email:

andre.leblanc@mdfcommerce.com

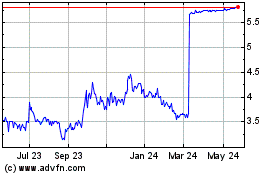

MDF Commerce (TSX:MDF)

Historical Stock Chart

From Jan 2025 to Feb 2025

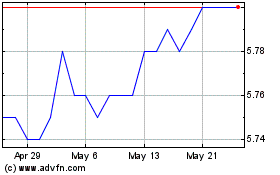

MDF Commerce (TSX:MDF)

Historical Stock Chart

From Feb 2024 to Feb 2025