Major Drilling Group International Inc. (TSX: MDI), a leading

provider of specialized drilling services to the mining sector

(“Major Drilling” or the “Company”), today reported results for the

year and fourth quarter of fiscal 2022, ended April 30,

2022.

Highlights

- Annual revenue of $650 million, highest since 2013, with annual

EBITDA(1) of $114 million.

- Quarterly revenue of $190.0 million, an increase of 48% over

the same period last year.

- EBITDA(1) for the quarter was $40.7 million, an increase of

240% compared to same period last year.

- Net earnings of $22.4 million, or $0.27 per share for the

quarter, up from net earnings of $2.3 million, or $0.03 per share,

for the same period last year.

“As the upcycle progresses, demand for our

specialized drilling services continues to grow with customers

turning to us to execute their increasingly challenging drill

programs. Despite the COVID-19 Omicron variant causing some

minor delays to operations, the momentum we saw in January

continued throughout this quarter,” said Denis Larocque, President

and CEO of Major Drilling.

“I am particularly pleased to see the efforts

deployed by our teams over the last few years, both in terms of

recruiting and preparation, finally bearing fruit.

Furthermore, at a time when the industry faces a shortage of

qualified crews, we saw greater recognition from our customers for

our superior value-added services, which has allowed us to gain new

contracts, and renew contracts at improved terms and pricing.

Finally, our strategy of holding rigs and inventory ready for

immediate deployment to customers also continues to deliver

results, mitigating any potential supply chain disruptions

experienced in the industry.”

“The fourth quarter of 2022 closed a fiscal year

of exceptional EBITDA growth, as the operating leverage inherent in

our business model delivered positive results. We generated $40.7

million in EBITDA in the quarter, the highest Major Drilling has

seen since the previous upcycle. Despite an expected ramp-up

in working capital, caused by the Company's rapid growth in the

quarter, our financial position remains strong and our balance

sheet flexible, with net debt(1) of only $1.6 million at the end of

the quarter,” said Ian Ross, CFO of Major Drilling. “Our ability to

invest in our equipment and respond to growth opportunities has

been well received by our customers. We continued this effort

by spending $14.9 million on capital expenditures this quarter,

adding seven drill rigs and support equipment for existing rigs

going out in the field. At the same time, we continue to keep our

fleet modern by disposing of four older, less efficient rigs,

bringing the total rig count to 603. In line with our plans, we

invested $49.9 million in capital expenditures during the fiscal

year, adding 29 new drills and support equipment.”

“Looking ahead to fiscal 2023, we continue to

see an increase in inquiries from all categories of

customers. Most senior companies expect to at least replicate

the drilling efforts deployed in fiscal 2022, with many increasing

their efforts, some significantly. Additionally, last month’s

announcement by the Canadian government, doubling the Mineral

Exploration Tax Credit (METC) for critical minerals, should help

spark even more funding of exploration efforts going forward,

driving more discoveries towards development in the future,” said

Denis Larocque.

“Gold projects accounted for 52% of our drilling

revenue this year. This is key for Major Drilling’s success, as

gold has led the mineral exploration recovery with the average gold

mine life falling to a low of nearly 10 years due to the lack of

exploration over the last 6 years. Because of this growing

supply shortfall, several of our senior gold customers have

committed to prioritizing value-adding grassroots exploration and

development. Many of the new mineral deposits in question are

located in areas challenging to access, requiring complex drilling

solutions, and increasing demand for Major Drilling’s specialized

services.”

“Turning to the base metals, we saw an increase

in copper exploration in fiscal 2022, representing 19% of our

revenue. Most industry experts believe that there is an

urgent need to replenish copper reserves given the anticipated

supply deficit. The global demand for electric vehicles

continues to grow, which will only increase the need for metals

like copper, nickel and lithium. Against this backdrop, we

have also seen governments across the world unleashing significant

stimulus programs, targeting renewable energy and upgrading their

electric grids. This will require an enormous volume of copper and

uranium, increasing pressure on the existing supply/demand dynamic.

We expect all of this to lead to substantial additional investments

in copper and other base metal exploration projects as we help our

customers discover the metals that will allow the world to

accelerate its efforts toward decarbonization.”

“With these fundamentals still firmly in place,

the outlook for our Company remains extremely positive. With

the need to add more specialized and underground drills in some of

our busy markets, the Company expects to spend approximately $65

million in capital expenditures in fiscal 2023, to continue to meet

and exceed the rigorous standards of our customers,” stated Mr.

Larocque.

“Major Drilling continues to be in a unique

position to react to, and benefit from these market dynamics.

Although availability of skilled labour continues to be challenging

for everyone in the most operationally intense markets, putting

pressure on costs, we continue to aggressively and successfully

invest in the recruitment and training of new drillers. I’m proud

to say that, backed by our strong financial position, our foresight

to prepare ahead of this upcycle by focusing investment on safety,

equipment, inventory and innovation, has secured our position as

both the operator and employer of choice in our industry,” said

Denis Larocque.

|

In millions of Canadian dollars (except earnings per share) |

|

Q4 2022 |

|

|

Q4 2021 |

|

|

YTD 2022 |

|

|

YTD 2021 |

|

|

Revenue |

|

$ |

190.0 |

|

|

$ |

128.1 |

|

|

$ |

650.4 |

|

|

$ |

432.1 |

|

|

Gross margin |

|

|

25.5 |

% |

|

|

11.7 |

% |

|

|

21.5 |

% |

|

|

14.8 |

% |

|

Adjusted gross margin (1) |

|

|

31.0 |

% |

|

|

18.4 |

% |

|

|

27.7 |

% |

|

|

23.4 |

% |

|

EBITDA (1) |

|

|

40.7 |

|

|

|

12.0 |

|

|

|

114.1 |

|

|

|

53.9 |

|

|

As percentage of revenue |

|

|

21.4 |

% |

|

|

9.3 |

% |

|

|

17.5 |

% |

|

|

12.5 |

% |

|

Net earnings |

|

|

22.4 |

|

|

|

2.3 |

|

|

|

53.5 |

|

|

|

10.0 |

|

|

Earnings per share |

|

|

0.27 |

|

|

|

0.03 |

|

|

|

0.65 |

|

|

|

0.12 |

|

(1) See “Non-IFRS Financial Measures”

Fourth Quarter Ended April 30,

2022

Total revenue for the quarter was $190.0

million, up 48.3% from revenue of $128.1 million recorded in the

same quarter last year. The foreign exchange translation impact on

revenue and net earnings for the quarter, when comparing to the

effective rates for the same period last year, was negligible. All

regions saw tremendous growth driven by the Company’s positioning

in an industry upturn.

Revenue for the quarter from Canada - U.S.

drilling operations increased by 47.0% to $109.1 million, compared

to the same period last year. Growth continued in the

Company’s busiest market as customers recognized the Company’s

superior value-added services and ability to supply crews, rigs and

inventory to jobs.

South and Central American revenue increased by

46.3% to $47.7 million for the quarter, compared to the same

quarter last year. This growth was driven by improved market

conditions in Argentina and Chile, which had been negatively

impacted by COVID-19 in the prior year.

Australasian and African revenue increased by

56.6% to $33.2 million, compared to the same period last year. The

McKay acquisition was the main driver of this increase.

Gross margin percentage for the quarter was

25.5%, compared to 11.7% for the same period last year.

Depreciation expense totaling $10.4 million is included in direct

costs for the current quarter, versus $8.6 million in the same

quarter last year. Adjusted gross margin, which excludes

depreciation expense, was 31.0% for the quarter, compared to 18.4%

for the same period last year. Margins improved from the

prior year due to improved productivity from the Company’s training

schools and favourable pricing arrangements that helped offset

inflation headwinds.

General and administrative costs were $15.2

million, an increase of $2.7 million compared to the same quarter

last year. The McKay acquisition accounted for $0.8 million

of this increase, while the balance is made up of an increase in

employee compensation and increased travel costs as COVID-19

restrictions ease.

Other expenses were $3.4 million, up from $0.8

million in the prior year quarter, due primarily to higher

incentive compensation expenses throughout the Company given the

increased profitability.

The income tax provision for the quarter was an

expense of $6.5 million, compared to an expense of $0.3 million for

the prior year period. The increase from the prior year was

due to an overall increase in profitability.

Net earnings were $22.4 million or $0.27 per

share ($0.27 per share diluted) for the quarter, compared to net

earnings of $2.3 million or $0.03 per share ($0.03 per share

diluted) for the prior year quarter.

Fiscal Year Ended April 30, 2022

Total revenue for the year ended April 30, 2022

was $650.4 million, up from revenue of $432.1 million recorded last

year. The unfavourable foreign exchange translation impact on

revenue for the year, when comparing to the effective rates for the

same period last year, was approximately $17 million. The impact on

net earnings was minimal as expenditures in foreign jurisdictions

tend to be in the same currency as revenue.

Revenue for the year from Canada - U.S. drilling

operations increased by 48% to $366.7 million, compared to the same

period last year. The growth is attributed to the Company’s

positioning in a busy market, accompanied by a favourable pricing

environment.

South and Central American revenue increased by

59% to $151.6 million for the year, compared to the previous year.

This region was heavily impacted by COVID-19 in the prior year and

has shown signs of recovery throughout the fiscal year.

Australasian and African revenue increased by

49% to $132.1 million, compared to the same period last year. The

McKay acquisition is the main driver of the growth in the

region.

Gross margin percentage for the year was 21.5%,

compared to 14.8% for the previous year. Depreciation expense

totaling $40.6 million is included in direct costs for the current

year, versus $37.1 million in the previous year. Adjusted gross

margin, which excludes depreciation expense, was 27.7% for the

year, compared to 23.4% for the previous year. Contract

renewals that covered inflation, and productivity improvements due

to enhanced training programs, enabled margins to improve. Prior

year margins were impacted by ramp-up costs due to rapid

growth.

General and administrative costs were $57.0

million, up $9.9 million compared to the previous year. The

McKay acquisition represented the majority of the increase, while

increased travel and inflationary wage adjustments represented the

remainder.

Other expenses were $11.8 million, up from $4.1

million in the prior year, due primarily to higher incentive

compensation expenses throughout the Company given the increased

profitability.

The income tax provision for the year was an

expense of $15.0 million compared to an expense of $3.6 million for

the prior year. The increase from the prior year was due to

an overall increase in profitability.

Net earnings were $53.5 million or $0.65 per

share ($0.65 per share diluted) for the year, compared to $10.0

million or $0.12 per share ($0.12 per share diluted) for the prior

year.

Non-IFRS Financial Measures

The Company’s financial data has been prepared

in accordance with IFRS, with the exception of certain financial

measures detailed below. The measures below have been used

consistently by the Company’s management team in assessing

operational performance on both segmented and consolidated levels,

and in assessing the Company’s financial strength. The Company

believes these non-IFRS financial measures are key, for both

management and investors, in evaluating performance at a

consolidated level and are commonly reported and widely used by

investors and lending institutions as indicators of a company’s

operating performance and ability to incur and service debt, and as

a valuation metric. These measures do not have a standardized

meaning prescribed by IFRS and therefore may not be comparable to

similarly titled measures presented by other publicly traded

companies and should not be construed as an alternative to other

financial measures determined in accordance with IFRS.

Adjusted gross profit/margin - excludes

depreciation expense:

| (in $000s CAD) |

Q4 2022 |

|

|

Q4 2021 |

|

|

YTD 2022 |

|

|

YTD 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

revenue |

$ |

189,975 |

|

|

$ |

128,117 |

|

|

$ |

650,415 |

|

|

$ |

432,076 |

|

| Less:

direct costs |

|

141,527 |

|

|

|

113,064 |

|

|

|

510,642 |

|

|

|

367,988 |

|

| Gross

profit |

|

48,448 |

|

|

|

15,053 |

|

|

|

139,773 |

|

|

|

64,088 |

|

| Add:

depreciation |

|

10,416 |

|

|

|

8,570 |

|

|

|

40,579 |

|

|

|

37,051 |

|

| Adjusted

gross profit |

|

58,864 |

|

|

|

23,623 |

|

|

|

180,352 |

|

|

|

101,139 |

|

| Adjusted

gross margin |

|

31.0 |

% |

|

|

18.4 |

% |

|

|

27.7 |

% |

|

|

23.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA - earnings before interest, taxes, depreciation,

and amortization:

| (in $000s CAD) |

Q4 2022 |

|

|

Q4 2021 |

|

|

YTD 2022 |

|

|

YTD 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

earnings |

$ |

22,433 |

|

|

$ |

2,344 |

|

|

$ |

53,459 |

|

|

$ |

10,034 |

|

| Finance

costs |

|

385 |

|

|

|

207 |

|

|

|

1,629 |

|

|

|

1,168 |

|

| Income

tax provision |

|

6,471 |

|

|

|

289 |

|

|

|

15,025 |

|

|

|

3,552 |

|

|

Depreciation and amortization |

|

11,440 |

|

|

|

9,112 |

|

|

|

43,981 |

|

|

|

39,160 |

|

|

EBITDA |

$ |

40,729 |

|

|

$ |

11,952 |

|

|

$ |

114,094 |

|

|

$ |

53,914 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash (debt) – cash

net of debt, excluding lease liabilities reported under IFRS 16

Leases:

| |

Current quarterended |

|

|

Previous quarterended |

|

|

|

|

|

| (in $000s CAD) |

April 30, 2022 |

|

|

January 31, 2022 |

|

|

April 30, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash |

$ |

71,260 |

|

|

$ |

78,306 |

|

|

$ |

22,359 |

|

| Contingent consideration |

|

(22,907 |

) |

|

|

(22,176 |

) |

|

|

(1,907 |

) |

| Long-term debt |

|

(50,000 |

) |

|

|

(50,016 |

) |

|

|

(15,462 |

) |

| Net cash (debt) |

$ |

(1,647 |

) |

|

$ |

6,114 |

|

|

$ |

4,990 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Forward-Looking Statements

This news release includes certain information

that may constitute “forward-looking information” under applicable

Canadian securities legislation. All statements, other than

statements of historical facts, included in this news release that

address future events, developments, or performance that the

Company expects to occur (including management’s expectations

regarding the Company’s objectives, strategies, financial

condition, results of operations, cash flows and businesses) are

forward-looking statements. Forward-looking statements are

typically identified by future or conditional verbs such as

“outlook”, “believe”, “anticipate”, “estimate”, “project”,

“expect”, “intend”, “plan”, and terms and expressions of similar

import. All forward-looking information in this news release

is qualified by this cautionary note.

Forward-looking information is necessarily based

upon various estimates and assumptions including, without

limitation, the expectations and beliefs of management related to

the factors set forth below. While these factors and assumptions

are considered reasonable by the Company as at the date of this

document in light of management’s experience and perception of

current conditions and expected developments, these statements are

inherently subject to significant business, economic and

competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements and undue reliance

should not be placed on such statements and information.

Such forward-looking statements are subject to a

number of risks and uncertainties that include, but are not limited

to: the level of activity in the mining industry and the demand for

the Company’s services; the level of funding for the Company’s

clients (particularly for junior mining companies); competitive

pressures; global political and economic environments; the

integration of business acquisitions and the realization of the

intended benefits of such acquisitions; implications of the

COVID-19 pandemic; the Company’s dependence on key customers;

exposure to currency movements (which can affect the Company’s

revenue in Canadian dollars); currency restrictions; the geographic

distribution of the Company’s operations; the impact of operational

changes; changes in jurisdictions in which the Company operates

(including changes in regulation); failure by counterparties to

fulfill contractual obligations; as well as other risk factors

described under the “General Risks and Uncertainties” section of

the fiscal 2022 Management’s Discussion and Analysis. Should one or

more risk, uncertainty, contingency, or other factor materialize or

should any factor or assumption prove incorrect, actual results

could vary materially from those expressed or implied in the

forward-looking information.

Forward-looking statements made in this document

are made as of the date of this document and the Company disclaims

any intention and assumes no obligation to update any

forward-looking statement, even if new information becomes

available, as a result of future events, or for any other reasons,

except as required by applicable securities laws.

About Major Drilling

Major Drilling Group International Inc. is one

of the world’s largest drilling services companies primarily

serving the mining industry. Established in 1980, Major Drilling

has over 1,000 years of combined experience and expertise within

its management team alone. The Company maintains field

operations and offices in Canada, the United States, Mexico, South

America, Asia, Africa, and Australia. Major Drilling provides a

complete suite of drilling services including surface and

underground coring, directional, reverse circulation, sonic,

geotechnical, environmental, water-well, coal-bed methane, shallow

gas, underground percussive/longhole drilling, surface drill and

blast, and a variety of mine services.

Webcast/Conference Call Information

Major Drilling Group International Inc. will

provide a simultaneous webcast and conference call to discuss its

quarterly results on Wednesday, June 8, 2022 at 8:00 AM

(EDT). To access the webcast, which includes a slide

presentation, please go to the investors/webcast section of Major

Drilling’s website at www.majordrilling.com and click on the link.

Please note that this is listen-only mode.

To participate in the conference call, please

dial 416-340-2217, participant passcode 5953589# and ask for Major

Drilling’s Fourth Quarter Results Conference Call. To ensure

your participation, please call in approximately five minutes prior

to the scheduled start of the call.

For those unable to participate, a taped

rebroadcast will be available approximately one hour after the

completion of the call until Saturday, July 9, 2022. To

access the rebroadcast, dial 905-694-9451 and enter the passcode

9460056#. The webcast will also be archived for one year and

can be accessed on the Major Drilling website at

www.majordrilling.com.

For further information:Ian Ross, Chief

Financial OfficerTel: (506) 857-8636Fax: (506)

857-9211ir@majordrilling.com

|

Major Drilling Group International Inc. |

|

|

Condensed Consolidated Statements of

Operations |

|

|

(in thousands of Canadian dollars, except per share

information) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended |

|

|

Twelve months ended |

|

| |

April 30 |

|

|

April 30 |

|

| |

(unaudited) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL

REVENUE |

$ |

189,975 |

|

|

$ |

128,117 |

|

|

$ |

650,415 |

|

|

$ |

432,076 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DIRECT

COSTS |

|

141,527 |

|

|

|

113,064 |

|

|

|

510,642 |

|

|

|

367,988 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS

PROFIT |

|

48,448 |

|

|

|

15,053 |

|

|

|

139,773 |

|

|

|

64,088 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

15,219 |

|

|

|

12,547 |

|

|

|

57,043 |

|

|

|

47,083 |

|

|

Other expenses |

|

3,419 |

|

|

|

769 |

|

|

|

11,767 |

|

|

|

4,110 |

|

|

(Gain) loss on disposal of property, plant and equipment |

|

(135 |

) |

|

|

57 |

|

|

|

(546 |

) |

|

|

(394 |

) |

|

Foreign exchange (gain) loss |

|

656 |

|

|

|

(1,160 |

) |

|

|

1,396 |

|

|

|

(1,465 |

) |

|

Finance costs |

|

385 |

|

|

|

207 |

|

|

|

1,629 |

|

|

|

1,168 |

|

| |

|

19,544 |

|

|

|

12,420 |

|

|

|

71,289 |

|

|

|

50,502 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS BEFORE INCOME

TAX |

|

28,904 |

|

|

|

2,633 |

|

|

|

68,484 |

|

|

|

13,586 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME TAX EXPENSE

(RECOVERY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current |

|

5,833 |

|

|

|

(938 |

) |

|

|

13,285 |

|

|

|

3,822 |

|

|

Deferred |

|

638 |

|

|

|

1,227 |

|

|

|

1,740 |

|

|

|

(270 |

) |

| |

|

6,471 |

|

|

|

289 |

|

|

|

15,025 |

|

|

|

3,552 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET

EARNINGS |

$ |

22,433 |

|

|

$ |

2,344 |

|

|

$ |

53,459 |

|

|

$ |

10,034 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS PER

SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.27 |

|

|

$ |

0.03 |

|

|

$ |

0.65 |

|

|

$ |

0.12 |

|

| Diluted |

$ |

0.27 |

|

|

$ |

0.03 |

|

|

$ |

0.65 |

|

|

$ |

0.12 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Major Drilling Group International Inc. |

|

|

Condensed Consolidated Statements of Comprehensive Earnings

(Loss) |

|

|

(in thousands of Canadian dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

Twelve months ended |

|

|

|

April 30 |

|

|

April 30 |

|

| |

(unaudited) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET

EARNINGS |

$ |

22,433 |

|

|

$ |

2,344 |

|

|

$ |

53,459 |

|

|

$ |

10,034 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE

EARNINGS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Items that may be reclassified

subsequently to profit or loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on foreign currency translations |

|

3,523 |

|

|

|

(8,816 |

) |

|

|

7,407 |

|

|

|

(29,026 |

) |

|

Unrealized gain (loss) on derivatives (net of tax) |

|

854 |

|

|

|

(157 |

) |

|

|

469 |

|

|

|

1,678 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE EARNINGS

(LOSS) |

$ |

26,810 |

|

|

$ |

(6,629 |

) |

|

$ |

61,335 |

|

|

$ |

(17,314 |

) |

|

|

|

|

Major Drilling Group International Inc. |

|

|

Condensed Consolidated Statements of Changes in

Equity |

|

|

For the twelve months ended April 30, 2022 and

2021 |

|

|

(in thousands of Canadian dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retained |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

earnings |

|

|

Other |

|

|

Share-based |

|

|

Foreign currency |

|

|

|

|

|

|

|

Share capital |

|

|

(deficit) |

|

|

reserves |

|

|

payments reserve |

|

|

translation reserve |

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BALANCE AS AT MAY 1,

2020 |

$ |

243,189 |

|

|

$ |

(35,691 |

) |

|

$ |

(611 |

) |

|

$ |

8,519 |

|

|

$ |

81,640 |

|

|

$ |

297,046 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exercise of stock options |

|

190 |

|

|

|

- |

|

|

|

- |

|

|

|

(55 |

) |

|

|

- |

|

|

|

135 |

|

| Share-based compensation |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

296 |

|

|

|

- |

|

|

|

296 |

|

| Stock options

expired/forfeited |

|

- |

|

|

|

3,201 |

|

|

|

- |

|

|

|

(3,201 |

) |

|

|

- |

|

|

|

- |

|

| |

|

243,379 |

|

|

|

(32,490 |

) |

|

|

(611 |

) |

|

|

5,559 |

|

|

|

81,640 |

|

|

|

297,477 |

|

| Comprehensive

earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings |

|

- |

|

|

|

10,034 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

10,034 |

|

|

Unrealized gain (loss) on foreign |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

currency translations |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(29,026 |

) |

|

|

(29,026 |

) |

|

Unrealized gain (loss) on derivatives |

|

- |

|

|

|

- |

|

|

|

1,678 |

|

|

|

- |

|

|

|

- |

|

|

|

1,678 |

|

| Total comprehensive loss |

|

- |

|

|

|

10,034 |

|

|

|

1,678 |

|

|

|

- |

|

|

|

(29,026 |

) |

|

|

(17,314 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BALANCE AS AT APRIL

30, 2021 |

|

243,379 |

|

|

|

(22,456 |

) |

|

|

1,067 |

|

|

|

5,559 |

|

|

|

52,614 |

|

|

|

280,163 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share issue |

|

12,911 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

12,911 |

|

| Exercise of stock options |

|

6,893 |

|

|

|

- |

|

|

|

- |

|

|

|

(1,913 |

) |

|

|

- |

|

|

|

4,980 |

|

| Share-based compensation |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

369 |

|

|

|

- |

|

|

|

369 |

|

| Stock options

expired/forfeited |

|

- |

|

|

|

19 |

|

|

|

- |

|

|

|

(19 |

) |

|

|

- |

|

|

|

- |

|

| |

|

263,183 |

|

|

|

(22,437 |

) |

|

|

1,067 |

|

|

|

3,996 |

|

|

|

52,614 |

|

|

|

298,423 |

|

| Comprehensive

earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings |

|

- |

|

|

|

53,459 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

53,459 |

|

|

Unrealized gain (loss) on foreign |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

currency translations |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

7,407 |

|

|

|

7,407 |

|

|

Unrealized gain (loss) on derivatives |

|

- |

|

|

|

- |

|

|

|

469 |

|

|

|

- |

|

|

|

- |

|

|

|

469 |

|

| Total comprehensive

earnings |

|

- |

|

|

|

53,459 |

|

|

|

469 |

|

|

|

- |

|

|

|

7,407 |

|

|

|

61,335 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BALANCE AS AT APRIL

30, 2022 |

$ |

263,183 |

|

|

$ |

31,022 |

|

|

$ |

1,536 |

|

|

$ |

3,996 |

|

|

$ |

60,021 |

|

|

$ |

359,758 |

|

|

|

|

|

Major Drilling Group International Inc. |

|

|

Condensed Consolidated Statements of Cash

Flows |

|

|

(in thousands of Canadian dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

Twelve months ended |

|

|

|

April 30 |

|

|

April 30 |

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING

ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before income

tax |

$ |

28,904 |

|

|

$ |

2,633 |

|

|

$ |

68,484 |

|

|

$ |

13,586 |

|

| Operating items not involving

cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

11,440 |

|

|

|

9,112 |

|

|

|

43,981 |

|

|

|

39,160 |

|

|

(Gain) loss on disposal of property, plant and equipment |

|

(135 |

) |

|

|

57 |

|

|

|

(546 |

) |

|

|

(394 |

) |

|

Share-based compensation |

|

96 |

|

|

|

74 |

|

|

|

369 |

|

|

|

296 |

|

| Finance costs recognized in

earnings before income tax |

|

385 |

|

|

|

207 |

|

|

|

1,629 |

|

|

|

1,168 |

|

| |

|

40,690 |

|

|

|

12,083 |

|

|

|

113,917 |

|

|

|

53,816 |

|

| Changes in non-cash operating

working capital items |

|

(33,210 |

) |

|

|

(6,335 |

) |

|

|

(11,601 |

) |

|

|

(13,138 |

) |

| Finance costs paid |

|

(385 |

) |

|

|

(207 |

) |

|

|

(1,629 |

) |

|

|

(1,168 |

) |

| Income taxes paid |

|

(2,146 |

) |

|

|

(1,364 |

) |

|

|

(5,814 |

) |

|

|

(5,062 |

) |

| Cash flow from (used in)

operating activities |

|

4,949 |

|

|

|

4,177 |

|

|

|

94,873 |

|

|

|

34,448 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCING

ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Repayment of lease

liabilities |

|

(363 |

) |

|

|

(395 |

) |

|

|

(1,371 |

) |

|

|

(1,362 |

) |

| Repayment of long-term

debt |

|

- |

|

|

|

(252 |

) |

|

|

(355 |

) |

|

|

(36,004 |

) |

| Issuance of common shares due

to exercise of stock options |

|

2,079 |

|

|

|

94 |

|

|

|

4,980 |

|

|

|

135 |

|

| Proceeds from draw on

long-term debt |

|

- |

|

|

|

- |

|

|

|

35,000 |

|

|

|

- |

|

| Cash flow from (used in)

financing activities |

|

1,716 |

|

|

|

(553 |

) |

|

|

38,254 |

|

|

|

(37,231 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INVESTING

ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Business acquisitions (net of

cash acquired) |

|

- |

|

|

|

- |

|

|

|

(38,050 |

) |

|

|

- |

|

| Acquisition of property, plant

and equipment |

|

(14,958 |

) |

|

|

(10,690 |

) |

|

|

(49,939 |

) |

|

|

(31,303 |

) |

| Proceeds from disposal of

property, plant and equipment |

|

242 |

|

|

|

892 |

|

|

|

2,144 |

|

|

|

1,925 |

|

| Cash flow from (used in)

investing activities |

|

(14,716 |

) |

|

|

(9,798 |

) |

|

|

(85,845 |

) |

|

|

(29,378 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of exchange rate

changes |

|

1,005 |

|

|

|

(1,418 |

) |

|

|

1,619 |

|

|

|

(3,913 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCREASE (DECREASE) IN

CASH |

|

(7,046 |

) |

|

|

(7,592 |

) |

|

|

48,901 |

|

|

|

(36,074 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH AND CASH

EQUIVALENTS, BEGINNING OF THE PERIOD |

|

78,306 |

|

|

|

29,951 |

|

|

|

22,359 |

|

|

|

58,433 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH AND CASH

EQUIVALENTS, END OF THE PERIOD |

$ |

71,260 |

|

|

$ |

22,359 |

|

|

$ |

71,260 |

|

|

$ |

22,359 |

|

|

|

|

|

Major Drilling Group International Inc. |

|

|

Condensed Consolidated Balance Sheets |

|

|

As at April 30, 2022 and April 30, 2021 |

|

|

(in thousands of Canadian dollars) |

|

|

|

|

|

|

|

|

|

|

| |

April 30, 2022 |

|

|

April 30, 2021 |

|

| |

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| CURRENT

ASSETS |

|

|

|

|

|

|

|

|

Cash |

$ |

71,260 |

|

|

$ |

22,359 |

|

|

Trade and other receivables |

|

142,621 |

|

|

|

102,571 |

|

|

Income tax receivable |

|

2,037 |

|

|

|

5,973 |

|

|

Inventories |

|

96,782 |

|

|

|

85,585 |

|

|

Prepaid expenses |

|

8,960 |

|

|

|

6,710 |

|

| |

|

321,660 |

|

|

|

223,198 |

|

| |

|

|

|

|

|

|

|

| PROPERTY, PLANT AND

EQUIPMENT |

|

198,196 |

|

|

|

144,382 |

|

| |

|

|

|

|

|

|

|

| RIGHT-OF-USE

ASSETS |

|

5,479 |

|

|

|

3,773 |

|

| |

|

|

|

|

|

|

|

| DEFERRED INCOME TAX

ASSETS |

|

4,351 |

|

|

|

8,903 |

|

| |

|

|

|

|

|

|

|

| GOODWILL |

|

22,798 |

|

|

|

7,708 |

|

| |

|

|

|

|

|

|

|

| INTANGIBLE

ASSETS |

|

4,596 |

|

|

|

568 |

|

| |

|

|

|

|

|

|

|

| |

$ |

557,080 |

|

|

$ |

388,532 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| CURRENT

LIABILITIES |

|

|

|

|

|

|

|

|

Trade and other payables |

$ |

102,596 |

|

|

$ |

73,083 |

|

|

Income tax payable |

|

5,022 |

|

|

|

1,639 |

|

|

Current portion of lease liabilities |

|

1,502 |

|

|

|

803 |

|

|

Current portion of contingent consideration |

|

8,619 |

|

|

|

- |

|

|

Current portion of long-term debt |

|

- |

|

|

|

356 |

|

| |

|

117,739 |

|

|

|

75,881 |

|

| |

|

|

|

|

|

|

|

| LEASE

LIABILITIES |

|

3,885 |

|

|

|

2,943 |

|

| |

|

|

|

|

|

|

|

| CONTINGENT

CONSIDERATION |

|

14,288 |

|

|

|

1,907 |

|

| |

|

|

|

|

|

|

|

| LONG-TERM

DEBT |

|

50,000 |

|

|

|

15,106 |

|

| |

|

|

|

|

|

|

|

| DEFERRED INCOME TAX

LIABILITIES |

|

11,410 |

|

|

|

12,532 |

|

| |

|

197,322 |

|

|

|

108,369 |

|

| |

|

|

|

|

|

|

|

| SHAREHOLDERS'

EQUITY |

|

|

|

|

|

|

|

|

Share capital |

|

263,183 |

|

|

|

243,379 |

|

|

Retained earnings (deficit) |

|

31,022 |

|

|

|

(22,456 |

) |

|

Other reserves |

|

1,536 |

|

|

|

1,067 |

|

|

Share-based payments reserve |

|

3,996 |

|

|

|

5,559 |

|

|

Foreign currency translation reserve |

|

60,021 |

|

|

|

52,614 |

|

| |

|

359,758 |

|

|

|

280,163 |

|

| |

|

|

|

|

|

|

|

| |

$ |

557,080 |

|

|

$ |

388,532 |

|

MAJOR DRILLING GROUP INTERNATIONAL

INC.SELECTED FINANCIAL

INFORMATIONFOR THE THREE AND TWELVE MONTHS ENDED

APRIL 30, 2022 AND 2021(in thousands of Canadian

dollars)

SEGMENTED INFORMATION

The Company’s operations are divided into three

geographic segments corresponding to its management structure:

Canada - U.S.; South and Central America; and Australasia and

Africa. The services provided in each of the reportable segments

are essentially the same. The accounting policies of the segments

are the same as those described in note 3 presented in the Notes to

Consolidated Financial Statements for the year ended April 30,

2022. Management evaluates performance based on earnings from

operations in these three geographic segments before finance costs,

general and corporate expenses, and income tax. Data relating

to each of the Company’s reportable segments is presented as

follows:

| |

Q4 2022 |

|

|

Q4 2021 |

|

|

YTD 2022 |

|

|

YTD 2021 |

|

| |

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada - U.S.* |

$ |

109,115 |

|

|

$ |

74,239 |

|

|

$ |

366,662 |

|

|

$ |

247,703 |

|

|

South and Central America |

|

47,663 |

|

|

|

32,639 |

|

|

|

151,613 |

|

|

|

95,567 |

|

|

Australasia and Africa |

|

33,197 |

|

|

|

21,239 |

|

|

|

132,140 |

|

|

|

88,806 |

|

| |

$ |

189,975 |

|

|

$ |

128,117 |

|

|

$ |

650,415 |

|

|

$ |

432,076 |

|

*Canada - U.S. includes revenue of $51,097 and

$44,397 for Canadian operations for the three months ended April

30, 2022 and 2021 respectively, and $185,919 and $129,488 for the

twelve months ended April 30, 2022 and 2021 respectively.

| |

| |

Q4 2022 |

|

|

Q4 2021 |

|

|

YTD 2022 |

|

|

YTD 2021 |

|

| |

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

Earnings (loss) from operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada - U.S. |

$ |

24,183 |

|

|

$ |

1,108 |

|

|

$ |

59,098 |

|

|

$ |

10,654 |

|

|

South and Central America |

|

7,383 |

|

|

|

1,151 |

|

|

|

6,353 |

|

|

|

(1,623 |

) |

|

Australasia and Africa |

|

2,198 |

|

|

|

2,141 |

|

|

|

18,205 |

|

|

|

11,996 |

|

| |

|

33,764 |

|

|

|

4,400 |

|

|

|

83,656 |

|

|

|

21,027 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Finance

costs |

|

385 |

|

|

|

207 |

|

|

|

1,629 |

|

|

|

1,168 |

|

| General corporate

expenses** |

|

4,475 |

|

|

|

1,560 |

|

|

|

13,543 |

|

|

|

6,273 |

|

| Income

tax |

|

6,471 |

|

|

|

289 |

|

|

|

15,025 |

|

|

|

3,552 |

|

| |

|

11,331 |

|

|

|

2,056 |

|

|

|

30,197 |

|

|

|

10,993 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

earnings |

$ |

22,433 |

|

|

$ |

2,344 |

|

|

$ |

53,459 |

|

|

$ |

10,034 |

|

**General and corporate expenses include

expenses for corporate offices, stock options and certain

unallocated costs.

| |

| |

Q4 2022 |

|

|

Q4 2021 |

|

|

YTD 2022 |

|

|

YTD 2021 |

|

| |

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada - U.S. |

$ |

5,568 |

|

|

$ |

4,511 |

|

|

$ |

20,579 |

|

|

$ |

19,824 |

|

|

South and Central America |

|

2,450 |

|

|

|

2,724 |

|

|

|

9,896 |

|

|

|

12,089 |

|

|

Australasia and Africa |

|

3,803 |

|

|

|

1,780 |

|

|

|

12,953 |

|

|

|

6,935 |

|

|

Unallocated and corporate assets |

|

(381 |

) |

|

|

97 |

|

|

|

553 |

|

|

|

312 |

|

| Total depreciation and

amortization |

$ |

11,440 |

|

|

$ |

9,112 |

|

|

$ |

43,981 |

|

|

$ |

39,160 |

|

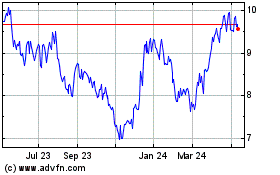

Major Drilling (TSX:MDI)

Historical Stock Chart

From Oct 2024 to Nov 2024

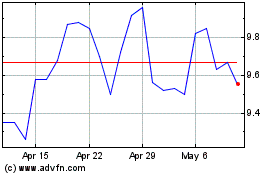

Major Drilling (TSX:MDI)

Historical Stock Chart

From Nov 2023 to Nov 2024