Peak assays of 41.4 g/t Au, 24.4

g/t Au and 18.1 g/t Au defined within new gold trend

LONDON, April 26,

2022 /CNW/ - Meridian Mining UK S (TSX: MNO)

(Frankfurt/Tradegate: 2MM) (OTCQB:

MRRDF), ("Meridian" or the "Company") is pleased to announce that

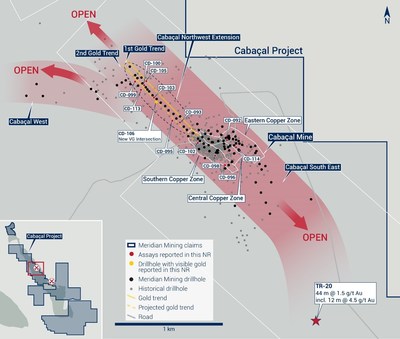

multiple holes have confirmed a 2nd structure hosting

high grade gold overprinting the copper-gold VMS layers, drilled on

the southwestern side of Cabaçal's Northwest Extension ("CNWE").

This 2nd parallel gold trend is ~70m to the southwest of

the first structure defined by Meridian1 ("Figure 1").

To date this 2nd structure is open, initially defined

over 100m, and is interpreted as

being one of the structures extending out from the Cabaçal mine

750m to the southeast. As the CNWE's

infill drill program is ongoing, there is a potential for further

overprinting high-grade gold structures extending out from the mine

to be intersected. These first two high-grade gold structures (and

any future ones delineated) were never identified within the CNWE's

historical vertical drilling nor included in Cabaçal's historical

resource2 ("Figure 2"). Meridian is also reporting,

equally high-grade results from the ongoing drill program at the

Cabaçal Mine. A further 10,000m

remain to be drilled and further assay results are pending.

Highlights of today's announcement:

- Meridian confirms 2nd parallel high-grade gold trend

within Cabaçal's Northwest Extension;

-

- This 2nd high-grade gold structure multiplies the

CNWE's upside potential;

- CNWE's 2nd gold trend is hosted within strong and

shallow copper-gold VMS mineralization;

-

- CD-099 assays: 32.4m @ 1.3% CuEq (0.4% Cu, 1.5g/t Au, 1.0g/t

Ag & 0.1% Zn) from 22.6m;

-

- Including: 15.0m @ 2.3% CuEq (0.5%

Cu, 3.0g/t Au & 0.9g/t Ag) from 30.0m;

- Peak gold assay of 41.4 g/t Au over 0.45m from 30.55m

(sample: CBDS12538);

- CD-113 assays: 64.1m @

0.8% CuEq (0.2% Cu, 1.0g/t Au & 1.0g/t Ag) from

11.1m;

-

- Including: 20.5m @ 2.6g/t Au &

0.2g/t Ag from 14.0m;

- Peak gold assay of 24.4 g/t Au over 1.0m from 14.0m

(sample: CBDS14110);

- CD-106 has intersected visible gold with final assays

pending;

- CNWEinfill drilling confirms high-grade copper-gold

mineralisation and gold overprint;

-

- CD-100 assays: 50.8m @ 1.0

CuEq (0.5% Cu, 0.8g/t Au & 1.3g/t Ag,) from

41.9m;

-

- Including: 15m @

1.8% CuEq (1.0% Cu, 1.3g/t Au & 2.5g/t Ag) from

75.2m;

- Peak gold assay of 18.4 g/t Au over 0.94m from 60.6m

(sample: CBDS12682);

- Southern Copper Zone intercepts broad zone of strong

copper-gold mineralisation & visible gold;

-

- CD-096 assays: 34.7m @

1.1% CuEq (0.6% Cu, 0.7g/t Au, 1.9g/t Ag & 0.2% Zn) from

116.0m;

-

- Including: 11.6m

@ 2.8% CuEq (1.4% Cu, 1.9g/t Au, 4.7g/t Ag & 0.6% Zn) from

139.2m;

- CD-098 assays: 32.9m @ 0.9%

CuEq (0.6% Cu, 0.5g/t Au & 2.4g/t Ag) from

66.0m;

-

- Including: 17.7m

@ 1.3% CuEq (1.0% Cu, 0.5g/t Au, 4.1g/t Ag & 0.1% Zn) from

80.4m; and

- Eastern Copper Zone intercepts broad zone of strong copper-gold

mineralisation & visible gold;

-

- CD-114 assays: 15.5m @ 0.9% CuEq (0.1% Cu, 1.4g/t Au &

0.6g/t Ag) from 53.0m;

-

- Peak gold assay of 56.8g/t Au over 0.36m from 63.85m

(sample: CBDS14431).

|

Note: Copper

Equivalents ("CuEq") have been calculated using the formula CuEq =

((Cu%*Cu price 1% per tonne) + (Au ppm*Au price per g/t) + (Ag

ppm*Ag price per g/t) + (Zn%*Zn price 1% per tonne)) / (Cu price 1

% per tonne). Commodity Prices: Copper and Zinc ("Zn") prices from

LME Official Settlement Price dated April 23, 2021 USD per Tonne:

Cu = USD 9,545.50 and Zn = USD 2,802.50. Gold & Silver prices

from LBMA Precious Metal Prices USD per Troy ounce: Au = USD

1781.80 (PM) and Ag = USD 26.125 (Daily). The CuEq values are for

exploration purposes only and include no assumptions for

metallurgical recovery.

|

|

Dr Adrian McArthur, CEO

and President of Meridian, comments: "The high-grade gold endowment

of Cabaçal's Northwest Extension is being pushed higher with

another gold trend clearly defined. Multiple structures hosting

high grade gold were mapped and mined at Cabaçal and as we start to

infill the Northwest Extension, we are hoping to intersect more of

them. We have now confirmed that Northwest Extension hosts multiple

high-grade overprinting structures, and presents a strong

opportunity for definition of further near surface copper-gold

mineralization. While we continue to go from strength to strength

in the Northwest, we are also returning equally high-grade results

across the Cabaçal Mine environment. These results are all

combining to support the very strong metrics and near surface

geometry of Cabaçal, to be optimal for future development as an

open pit operation. Always remembering that Cabaçal is the most

advanced of many targets that have been predefined within the

belt."

|

Cabaçal Northwest Extension

Update

The Cabaçal Northwest Extension angled drill program, initially

followed a structural corridor projecting outwards from the Cabaçal

Mine along a NW-trending strike ridge. It is confirming that

significant mineralization extended into areas not previously

detected in the wide-spaced, up to 100m, vertical drilling of BP Minerals. This

program is now focussed on building the cross-strike drill coverage

to test the lateral extent of the VMS host package and distribution

of gold expressed in the later stage overprinting structures.

Highlights on this ongoing program include significant

intersections reported to the west of the main trend. The Company

previously reported the presence of visible gold in

CD-0993, collared 70m

west-northwest of CD-072. Results now received for this hole

confirm a strong package of mineralization reported from shallow

depths. Results reported for CD-113, drilled 97m southeast along strike from CD-099, returned

a similar strong package of mineralization:

- CD-099: 32.4m @ 1.3% CuEq

(0.4% Cu, 1.5g/t Au, 1.0g/t Ag, 0.1% Zn) from 22.6m4; including:

-

- 15.0m @ 2.3% CuEq (0.5%

Cu, 3.0g/t Au, 0.9g/t Ag, 0.0% Zn) from 30.0m;

The high-grade gold overprint was present with a peak gold grade

of:

- 0.94m @ 41.4 g/t Au from

30.55m (sample: CBDS12538).

- CD-113: 64.1m @ 0.8% CuEq

(0.2% Cu, 1.0g/t Au, 1.0g/t Ag, 0.0% Zn) from 11.1m; including:

- 20.5m @ 1.6% CuEq (0.0%

Cu, 2.6g/t Au, 0.2g/t Ag, 0.0% Zn) from 14.0m.

The high-grade gold overprint was present with a peak gold grade

of:

- 1.0m @ 24.4 g/t Au from

14.0m (sample: CBDS14110).

CD-099 and CD-113 results indicate that the mineral system

remains open and strong at the current limit of the CNWE, with

ongoing and planned drilling in progress to test its western

projection, and to trace it back towards the Cabaçal Mine

environment; further results pending. The CD-113 result confirms

that the later-staged structural overprint can mobilize gold

mineralization outside of the VMS mineralization, with the

intersection cutting above the copper envelope (20.5m @ 2.6g/t Au & 0.2g/t Ag from

14.0m).

Results from CD-106 collared 184m,

to the southeast of CD-113 extend the 2nd high-grade

gold trend, with visible gold observed at depths of 85m with assays pending. The multiple

intersections of copper-gold VMS mineralisation reported by

Meridian in the northern limits of the CNWE and its open western

trend, present a large envelope of mineralisation that is outside

of the historical resource. While the entirety of the contained

gold hosted in the high angled structures drilled by Meridian along

the CNWE were never included in the historical resource calculation

that partially covered the CNWE.

The Company's fixed-loop EM programs5 show enhanced

conductivity responses splaying westwards from the Cabaçal trend

towards Cabaçal West, with the converging structural trends

appearing to be creating favourable environment from strong

mineralization. The angled drilling continues to be an important

factor in delineating the combination of shallow-dipping

copper-gold VMS stratigraphy with the steeper dipping structural

overprint that host high-grade gold mineralization.

CD-100 is a resource infill hole along the central trend and

returned broad high-grade mineralisation from shallow depths while

continuing to define the gold overprinting structure:

- CD-100 assays: 50.8m @ 1.0

CuEq (0.5% Cu, 0.8g/t Au & 1.3g/t Ag) from 41.9m; Including:

- 15.0m @ 1.8% CuEq (1.0%

Cu, 1.3g/t Au & 2.5g/t Ag) from 75.2m.

The high-grade gold overprint was present with a peak gold grade

of:

- 0.94m @ 18.4 g/t Au from

60.6m (sample: CBDS12682)

Cabaçal Mine Environment

Additional results have been received from Southern Copper Zone

("SCZ") metallurgical drilling program, holes CD-096 and CD-098

being reported. These holes drilled deeper in the mine sequence,

and passed through multiple mineralized layers:

- 7.9m @ 0.3% CuEq (0.3% Cu &

0.8g/t Ag) from 49.5m;

- 22.5m @ 0.4% CuEq (0.2% Cu,

0.2g/t Au & 0.4g/t Ag) from 67.0m;

- 34.7m @ 1.1% CuEq (0.6%

Cu, 0.7g/t Au, 1.9g/t Ag &, 0.2% Zn) from 116.0m, Including:

-

- 11.6m @ 2.8% CuEq (1.4%

Cu, 1.9g/t Au, 4.7g/t Ag & 0.6% Zn) from 139.2m;

- 15.1m @ 0.2% CuEq (0.2% Cu &

0.5g/t Ag) from 39.0m;

- 32.9m @ 0.9% CuEq (0.6% Cu,

0.5g/t Au & 2.4g/t Ag) from 66.0m, Including:

-

- 17.7m @ 1.3% CuEq (1.0%

Cu, 0.5g/t Au, 4.1g/t Ag & 0.1% Zn) from 80.4m;

- 5m @ 0.4% CuEq (0.3% Cu, 0.1g/t

Au & 0.9g/t Ag) from 104m;

and

- 17.7m @ 0.9% CuEq (0.7% Cu,

0.3g/t Au, 1.9g/t Ag & 0.1% Zn) from 118.6m.

CD-096 acts as a resource infill hole, drilled immediately

southeast of the lower limit of the selective underground mine

developed and showing again that the Cabaçal Mine's high-grade

copper-gold basal layer was only selectively mined in localised

areas grading above the +3.0g/t Au cut-off limit. CD-098 was also

drilled in the historical mine's workings. Meridian's angled drill

program within the mine's limits, confirms that the mine's

historical vertical delineation program (1983-86) insufficiently

defined the high-grade & sub-vertical gold mineralization.

These results do further confirm that the mine's limited

exploitation phase has left behind extensive layers of high-grade

copper-gold mineralization and multiple zones of overprinting

high-grade gold structures within the mines limits.

Two results are reported from the Eastern Copper Zone ("ECZ").

Assays were received for CD-092 – a hole planned as a metallurgical

platform but abandoned in a mining void without reaching the basal

high-grade zone. Assays were also received from resource infill

hole CD-114:

- 32.7m @ 0.3% CuEq (0.2% Cu,

0.1g/t Au & 0.8g/t Ag) from 13.0m;

- 15.5m @ 0.9% CuEq (0.1% Cu,

1.4g/t Au & 0.6g/t Ag) from 53.0m;

-

- 0.36m @ 56.8g/t Au, 0.4%

Cu & 4.1g/t Ag ) from 63.85m;

and

- 14.4m @ 0.6% CuEq (0.3% Cu,

0.1g/t Au, 1.5g/t Ag & 0.5% Zn) from 84.0m.

The CD-114 supports again the presence of late-stage high-grade

gold mineralization in the ECZ, traditionally less of a focus of

the historical underground mine development as the entire zone was

perceived as being not prospective for gold mineralization that

graded above the set +3g/t Au cut-off.

Some ongoing resource definition requirements in the mine area

will test the shallow up-dip portion of the ECZ, to finalize

definition of its boundaries Northeast and Southwest beneath the

gabbro.

Table 1: Cabaçal Assays reported today.

|

Hole Id

|

Zone*

|

Intercept

|

Grade

|

From

|

|

CuEq

|

Cu

|

Au

|

Ag

|

Zn

|

Pb

|

|

|

(m)

|

(%)

|

(%)

|

(g/t)

|

(g/t)

|

(%)

|

(%)

|

(m)

|

|

|

|

|

|

|

|

|

|

|

|

CD-092

|

ECZ

|

11

|

0.4

|

0.3

|

0.0

|

0.8

|

0.0

|

0.0

|

9.0

|

|

|

15.9

|

0.5

|

0.3

|

0.3

|

0.7

|

0.0

|

0.0

|

32.0

|

|

|

|

|

|

|

|

|

|

|

|

CD-093

|

CNWE

|

7.0

|

0.2

|

0.2

|

0.1

|

0.5

|

0.0

|

0.0

|

8.2

|

|

|

2.8

|

1.5

|

0.4

|

1.7

|

2.5

|

0.0

|

0.0

|

58.7

|

|

|

4.2

|

0.2

|

0.1

|

0.0

|

0.5

|

0.0

|

0.0

|

65.9

|

|

|

19.5

|

0.4

|

0.2

|

0.4

|

0.4

|

0.0

|

0.0

|

73.5

|

|

|

12.0

|

0.4

|

0.3

|

0.1

|

1.2

|

0.1

|

0.0

|

102.0

|

|

|

CD-095

|

CNWE

|

5.6

|

0.3

|

0.2

|

0.0

|

0.6

|

0.0

|

0.0

|

14.4

|

|

|

22.8

|

0.6

|

0.4

|

0.3

|

3.2

|

0.0

|

0.0

|

33.0

|

|

Including

|

6.3

|

1.6

|

1.2

|

0.6

|

9.1

|

0.1

|

0.0

|

48.3

|

|

|

7.5

|

0.2

|

0.1

|

0.0

|

0.8

|

0.0

|

0.0

|

59.0

|

|

|

CD-096

|

SCZ

|

7.9

|

0.3

|

0.3

|

0.0

|

0.8

|

0.0

|

0.0

|

49.5

|

|

|

22.5

|

0.4

|

0.2

|

0.2

|

0.4

|

0.0

|

0.0

|

67.0

|

|

|

34.7

|

1.1

|

0.6

|

0.7

|

1.9

|

0.2

|

0.0

|

116.0

|

|

Including

|

11.6

|

2.8

|

1.4

|

1.9

|

4.7

|

0.6

|

0.0

|

139.2

|

|

|

CD-098

|

SCZ

|

15.1

|

0.2

|

0.2

|

0.0

|

0.5

|

0.0

|

0.0

|

39.0

|

|

|

32.9

|

0.9

|

0.6

|

0.5

|

2.4

|

0.0

|

0.0

|

66.0

|

|

Including

|

17.7

|

1.3

|

1.0

|

0.5

|

4.1

|

0.1

|

0.0

|

80.4

|

|

|

5.0

|

0.4

|

0.3

|

0.1

|

0.9

|

0.2

|

0.0

|

104.0

|

|

|

17.7

|

0.9

|

0.7

|

0.3

|

1.9

|

0.1

|

0.0

|

118.6

|

|

|

CD-099

|

CNWE

|

32.4

|

1.3

|

0.4

|

1.5

|

1.0

|

0.1

|

0.0

|

22.6

|

|

Including

|

15.0

|

2.3

|

0.5

|

3.0

|

0.9

|

0.0

|

0.0

|

30.0

|

|

|

CD-100

|

CNWE

|

9.9

|

0.2

|

0.1

|

0.1

|

0.2

|

0.0

|

0.0

|

2.2

|

|

|

50.8

|

1.0

|

0.5

|

0.8

|

1.3

|

0.0

|

0.0

|

41.9

|

|

Including

|

15.0

|

1.8

|

1.0

|

1.3

|

2.5

|

0.0

|

0.0

|

75.2

|

|

|

2.7

|

0.2

|

0.1

|

0.0

|

1.9

|

0.3

|

0.0

|

94.8

|

|

|

CD-102

|

SCZ

|

23.2

|

0.2

|

0.2

|

0.0

|

0.4

|

0.0

|

0.0

|

19.8

|

|

|

34.6

|

0.9

|

0.2

|

1.1

|

0.7

|

0.0

|

0.0

|

52.9

|

|

Including

|

11.5

|

1.9

|

0.2

|

2.8

|

0.6

|

0.0

|

0.0

|

53.9

|

|

|

CD-103

|

CNWE

|

25.0

|

0.2

|

0.2

|

0.1

|

0.3

|

0.0

|

0.0

|

28.8

|

|

|

11.4

|

0.6

|

0.3

|

0.1

|

2.5

|

0.6

|

0.0

|

89.6

|

|

|

CD-105

|

CNWE

|

27.0

|

0.2

|

0.2

|

0.1

|

0.3

|

0.1

|

0.0

|

44.0

|

|

|

CD-113

|

CNWE

|

64.1

|

0.8

|

0.2

|

1.0

|

1.0

|

0.0

|

0.0

|

11.1

|

|

Including

|

20.5

|

1.6

|

0.0

|

2.6

|

0.2

|

0.0

|

0.0

|

14.0

|

|

Including

|

3.0

|

5.7

|

0.1

|

9.4

|

0.1

|

0.0

|

0.0

|

14.0

|

|

and

|

7.5

|

1.8

|

0.0

|

3.0

|

0.5

|

0.0

|

0.0

|

27.0

|

|

|

CD-114

|

ECZ

|

32.7

|

0.3

|

0.2

|

0.1

|

0.8

|

0.0

|

0.0

|

13.0

|

|

|

15.5

|

0.9

|

0.1

|

1.4

|

0.6

|

0.0

|

0.0

|

53.0

|

|

Including

|

0.36

|

|

0.4

|

56.8

|

4.1

|

0.0

|

0.0

|

63.85

|

|

|

14.4

|

0.6

|

0.3

|

0.1

|

1.5

|

0.5

|

0.0

|

84.0

|

|

Drill

Details

|

|

|

|

Hole

Id

|

Dip

|

Azimuth

|

EOH

|

|

|

|

|

|

|

|

CD-092

|

-90

|

0

|

60.1

|

|

|

|

|

|

|

|

CD-093

|

-50

|

60

|

133.1

|

|

|

|

|

|

|

|

CD-095

|

-49

|

57

|

198.5

|

|

|

|

|

|

|

|

CD-096

|

-65

|

45

|

178.1

|

|

|

|

|

|

|

|

CD-098

|

-65

|

45

|

160.1

|

|

|

|

|

|

|

|

CD-099

|

-50

|

60

|

94.2

|

|

|

|

|

|

|

|

CD-100

|

-50

|

60

|

115.4

|

|

|

|

|

|

|

|

CD-102

|

-60

|

45

|

110.8

|

|

|

|

|

|

|

|

CD-103

|

-50

|

60

|

136.3

|

|

|

|

|

|

|

|

CD-105

|

-47

|

60

|

101.6

|

|

|

|

|

|

|

|

CD-113

|

-50

|

60

|

166.6

|

|

|

|

|

|

|

|

CD-114

|

-60

|

45

|

118.8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

ECZ: Eastern Copper

Zone, SCZ: Southern Copper Zone

|

|

1

|

Meridian news releases

of September 2nd 7th & 13th,

November 9th & 29th

|

|

2

|

Meridian news release

of August 26th 2020

|

|

3

|

Meridian news release

of March 22nd 2022

|

|

4

|

Base metal results

remain pending for sample CBDS12538; 30.55- 31.0, returning a peak

gold value of

41.4 g/t over 0.45m

|

|

5

|

Meridian news release

of July 8, 2021

|

Notes

True widths are approximately 80-90% of downhole lengths and

assay figures and intervals rounded to 1 decimal place.

General exploratory holes have been drilled HQ through the

saprolite and upper bedrock and then reduced to NQ – mineralized

intervals represent half HQ or NQ drill core. Metallurgical holes

are drilled HQ from surface, and reduced only if voids are

intersected (Hole CD-098 was reduced to NQ from 127.9m). Samples represent quarter HQ core, and

half NQ core). Samples have been analysed at the accredited ALS

laboratory in Lima. Gold analyses

have been conducted by Au-AA23 (fire assay of a 30g charge with AAS

finish). High-grade samples are repeated with a gravimetric finish

(Au-GRA21). Base metal analysis is by methods four-acid digestion

and ICP-AES finish (ME-ICP61a; Cu-OG62 for over-range samples).

Samples are held in the Company's secure facilities until

dispatched and delivered by staff and commercial couriers to the

laboratory. CD114 was analysed at the accredited SGS laboratory in

Belo Horizonte. Gold analyses have

been conducted by FAA505 (fire assay of a 50g charge), and base

metal analysis by methods ICP40B and ICP40B_S (four acid digest

with ICP-OES finish). Visible gold intervals are sampled by

metallic screen fire assay method MET150-FAASCR.Pulps are retained

for umpire testwork, and ultimately returned to the Company for

storage. The Company submits a range of quality control samples,

including blanks and gold and polymetallic standards supplied by

ITAK and OREAS, supplementing laboratory quality control

procedures. True widths are approximately 90% of downhole lengths

and assay figures and intervals rounded to 1 decimal place.

Qualified Person

Dr Adrian McArthur, B.Sc. Hons,

PhD. FAusIMM., CEO and President of Meridian as well as a Qualified

Person as defined by National Instrument 43-101, has supervised the

preparation of the technical information in this news release.

On behalf of the Board of Directors of Meridian Mining UK S

Dr. Adrian McArthur

CEO, President and Director

Executive Chairman

Meridian Mining UK S

Email: info@meridianmining.net.br

Ph: +1 (778) 715-6410 (PST)

Stay up to date by subscribing for news alerts here:

https://meridianmining.co/subscribe/

Follow Meridian on Twitter:

https://twitter.com/MeridianMining

Further information can be found at www.meridianmining.co

ABOUT MERIDIAN

Meridian Mining UK S is focused on the acquisition, exploration,

and development activities in Brazil. The Company is currently focused on

resource development of the Cabaçal VMS Copper-Gold project,

exploration in the Jaurú & Araputanga Greenstone belts located

in the state of Mato Grosso;

exploring the Espigão polymetallic project and the Mirante da Serra

manganese project in the State of Rondônia Brazil.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking

information or forward-looking statements for the purposes of

applicable securities laws. These statements address future events

and conditions and so involve inherent risks and uncertainties, as

disclosed under the heading "Risk Factors" in under the heading

"Risk Factors" in Meridian's most recent Annual Information Form

filed on www.sedar.com. While these factors and assumptions are

considered reasonable by Meridian, in light of management's

experience and perception of current conditions and expected

developments, Meridian can give no assurance that such expectations

will prove to be correct. Any forward-looking statement

speaks only as of the date on which it is made and, except as may

be required by applicable securities laws, Meridian disclaims any

intent or obligation to update any forward-looking statement,

whether as a result of new information, future events or results or

otherwise.

SOURCE Meridian Mining UK Societas