Minco Silver Expects to Receive the Repayment of All Investments Made to Sterling As a Result of Its Unsuccessful Bid to Acquire

April 23 2010 - 11:24AM

Marketwired

Minco Silver Corporation (the "Company" or "Minco Silver") (TSX:

MSV) announces that the Company was unsuccessful in its bid to

acquire 100% of the shares of Sterling Mining Company ("Sterling")

during a bankruptcy auction held on April 21, 2010. As a result,

the Company expects to receive the repayment of all amounts

advanced and incurred on the Sterling matter, with interest, in the

aggregate amount of approximately US$11.76 million, secured by all

assets of Sterling. Minco Silver will also seek to obtain the

termination fee, or "break fee", in the amount of US$2.75 million

pursuant to the "Amended and Restated Letter Agreement" entered

into between Sterling and Minco Silver on July 30, 2008. The

receipts of the funds are expected to take place on May 14, 2010,

the closing date for the acquisition by the winning bidder.

"We are pleased to see that the proceeding is coming to a

conclusion. With the funding by the Company pre and post bankruptcy

of Sterling over the past two years, we ensured the well-being and

upkeep of the historical and legendary Sunshine Mine and protected

the assets of Sterling for all the creditors. We are pleased to see

that the Sunshine Mine will be opening a new chapter going forward

and wish them the best in their future endeavors," commented Dr.

Ken Cai, Chairman & CEO of Minco Silver. "With over C$21

million working capital after the repayment from Sterling, Minco

Silver will continue to focus on bringing its flagship Fuwan Silver

Project into production while continuing to seek valuable global

mining opportunities."

The Company is also pleased to announce that it has closed the

second tranche of its non-brokered private placement (the

"Offering") totaling 327,500 units at a price of C$1.71 per unit

for gross proceeds of C$560,025. Each unit consists of one (1)

common share in the capital of the Company and one-half of one

common share purchase warrant ("Warrant"). Each Warrant will

entitle the holder to purchase one common share in the capital of

Minco Silver at an exercise price of C$2.15 for a period of twelve

(12) months from the closing of the Offering.

The Company will pay a 5% finders' fee in connection with the

Offering subject to the Toronto Stock Exchange approval. The

proceeds of the Offering will be used for general corporate

purposes.

About Minco Silver

Minco Silver Corporation (TSX: MSV) is a TSX listed company

focusing on the acquisition and development of silver dominant

projects. The Company owns 90% interest in the world class Fuwan

Silver Deposit, situated along the northeast margin of the highly

prospective Fuwan Silver Belt.

ON BEHALF OF THE BOARD

Dr. Ken Z. Cai, Chairman & CEO

Certain terms or statements made that are not historical facts,

such as anticipated advancement of mineral properties or programs,

productions, sales of assets, exploration plans or results, costs,

prices, performance are "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995,

and involve a number of risks and uncertainties that could cause

actual results to differ materially from those projected,

anticipated, expected or implied. These risks and uncertainties

include, but are not limited to; metals price volatility,

volatility of metals production, project development risks and

ability to raise financing. The Company undertakes no obligation

and has no intention of updating forward-looking statements.

The Toronto Stock Exchange does not accept responsibility for

the accuracy of this news release.

Contacts: Minco Silver Corporation Ute Koessler 1-888-288-8288

or (604) 688-8002 ir@mincosilver.ca www.mincosilver.ca

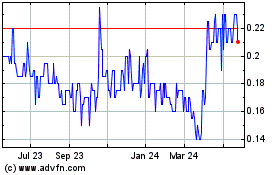

Minco Silver (TSX:MSV)

Historical Stock Chart

From Dec 2024 to Jan 2025

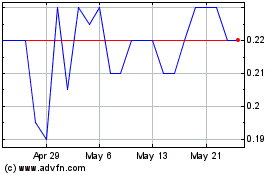

Minco Silver (TSX:MSV)

Historical Stock Chart

From Jan 2024 to Jan 2025