McEwen Copper Inc., 47.7% owned by

McEwen Mining Inc. (NYSE: MUX) (TSX:

MUX), is pleased to announce results from the recently

completed Phase 1 copper heap leaching metallurgical tests

undertaken at SGS Chile Limitada in Santiago, Chile. The test

results were produced utilizing conventional bio-heap leaching

technology and generated an average copper recovery of 76.0%. This

represents an increase of 3.2% over the recovery rate used in the

June 2023 Preliminary Economic Assessment (PEA) for Los Azules.

These test results were reviewed by Jim Sorensen and

Michael McGlynn at Samuel Engineering Inc., who are

responsible for the development and oversight of the metallurgical

programs.

Phase 1 Results

Based on the Phase 1 test results available at

the time and prior historical column test work, the PEA used an

average copper recovery of 72.8% by employing

conventional bio-heap leaching technology (see results published

June 20th, 2023). Final results of Phase 1 show an increase in the

average recovery to 76.0% in approximately 230

days of leaching over the planned 27-year life of the project.

Average net acid consumption was also reduced by 8.3% relative to

the PEA.

The potential impact of the 3.2% increase in

average recovery and 8.3% reduction in net acid consumption can be

illustrated by selectively adjusting the PEA Base Case financial

model, which results in a life of mine copper cathode production

increase of 172,000 tonnes and an after-tax

NPV(8%) increase of approximately $262 million.

This disclosure should not be taken to modify or update the

conclusions of the PEA.

Deposit Mineralogy

Located in San Juan, Argentina, the Los Azules

deposit consists primarily of secondary copper mineralization

(supergene zone of predominantly chalcocite), with minimal oxide

copper content. Additionally, there is a deeper primary copper

(hypogene zone of predominantly chalcopyrite with some zones of

significant bornite).

Metallurgical Testing

Phases

Preliminary results from the Phase 1 program

along with historical metallurgical testing at Los Azules were used

to support the 2023 Preliminary Economic Assessment (PEA), which

proposed an environmentally friendly heap leach alternative to a

conventional copper concentrator. The testing program is now

advancing with two additional phases (2 & 3) currently underway

to support the Feasibility Study (FS). Drilling activities related

to the current study work started in 2021 and are continuing into

2024. The leach testing protocols are based on conventional

bio-leaching methods used extensively in commercial applications

for supergene copper mineralization. The current phases, 2 & 3,

are being conducted at SGS Chile and Alfred H. Knight (ASMIN

Industrial Limitada) laboratories, both located in Santiago,

Chile.

The Phase 1 program was

initiated using drill core from drilling programs completed prior

to 2021, but not older than 2015, for a total of 21 column tests.

Started in 2022, Phase 1 has now been completed and final results

received. Preliminary results of this work and prior historical

leach testing information were used for the PEA metallurgical

assumptions.

The Phase 2 program utilizes

drill core from the 2022-2023 drilling campaign and focuses on

deposit-wide variability testing, leaching protocol optimization

and scalability. A total of 34 column tests are in progress, with

results expected in Q2 2024.

The Phase 3 program is also

started, utilizing additional drill core material from the ongoing

2023-2024 drilling program. Phase 3 testing is focusing on the

material of the initial 5-year mine plan, as delineated in the PEA.

A total of 33 additional column tests are planned as part of this

final confirmatory testing program, with results anticipated in Q4

2024.

The combined metallurgical programs comprise a

total of 88 column tests to be used for the FS metallurgical design

basis and geo-metallurgical model.

Copper assaying is conducted using a sequential

method to determine the relative amounts of acid soluble (CuAS) and

cyanide soluble (CuCN) copper mineralization (oxides and secondary

sulfides). When combined, these two partial assay methods are

generally considered readily soluble copper (CuSOL), extractable

with conventional heap leaching technologies. Copper assayed that

does not report to these two partial assay methods is classified as

residual copper (CuRES) and is considered copper that requires

additional time or is potentially not recoverable with conventional

heap leaching technologies.

The finalized results from the Phase 1

metallurgy program for tests completed at minus ½" and ¾" crush

sizes confirmed that soluble copper (CuSOL) component recovery is

100% for all leachable resources. The information in Figure 1 below

shows the minus ¾" (19 mm) test results. The PEA envisions a minus

¾" crush size for the heap leaching feed in the commercial

application.

Figure 1 – Soluble Copper Recovery

Kinetics

The recovery results for the residual copper

(CuRES) component shown in Figure 2 indicated an average recovery

of 25%, an increase of 10% from the 15% preliminary recovery

assumption used in the PEA. The additional residual copper recovery

when applied to the entire resource increases the overall average

recovery from 72.8% to 76.0%.

Figure 2 – Residual Copper Recovery

Kinetics

Figure 3 below illustrates the increase in

potential copper production throughout the mine life, attributable

to the improved recovery, in comparison with the PEA assumptions.

The initial two production years do not show additional recovered

copper, as the design capacity of the electrowinning plant

considered in the PEA is fully utilized.

Figure 3 – Copper Cathode Production (PEA

& Revised Model)

The sulfuric acid consumption has also been

updated with the Phase 1 final results. The averaged net sulfuric

acid consumption reported in the PEA was 18 kilograms per ton of

ore processed. The finalized Phase 1 testing now indicates a

reduction of 8.3% to 16.5 kilograms per ton. The primary reason for

the reduction of acid consumption is minimizing excess acid in the

leaching solutions and operating the columns at a pH closer to 2.0

pH than the historic column work at 1.2 pH, which minimizes acid

consumption by excess unmineralized gangue material dissolution.

This lowered acid requirement may also improve the project

economics, both NPV and IRR, by reducing the operating costs for

copper produced and increasing revenue from the same tonnes

mined.

Bioleaching Summary

Copper bioleaching has been a commercially

applied technology at altitudes similar to the Los Azules site and

as much as 1,000 meters higher for several decades, in multiple

locations around the world. Testing is conducted in conventional

leach test columns by inoculation of the columns with naturally

occurring bacterial ferrooxidans and thiooxidans prior to

introduction of the leach solution. Bacterial cultures for the

inoculum were sourced from the testing laboratories and adapted to

the Los Azules leach material. Ferrooxidans convert the ferrous

iron in solution to ferric iron, while thiooxidans convert the

sulfur produced in the copper sulfide leaching activity to sulfuric

acid/sulfate. Ferric iron is the key chemical component necessary

for leaching of copper sulfide material. Bioactivity in the tests

is monitored by measurement of the ferrous/ferric ratios and

electrochemical oxidation potential in the leaching solutions.

ABOUT MCEWEN COPPER

McEwen Copper is a well-funded, private company

which owns 100% of the large, advanced-stage Los Azules copper

project, located in the San Juan province, Argentina. McEwen Copper

is a 47.7% owned private subsidiary of McEwen Mining, which is

listed on NYSE and TSX under the ticker MUX.

Los Azules is being designed to be distinctly

different from conventional copper mines, consuming significantly

less water, emitting much lower carbon levels and progressing to be

carbon neutral by 2038, being powered by 100% renewable energy once

in operation. The project’s recently updated Preliminary Economic

Assessment (PEA) projects a long life of mine, low production costs

per pound, a short payback period, high annual copper production,

and an after-tax IRR of 21.1%.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with

operations in Nevada, Canada, Mexico and Argentina. In addition, it

owns approximately 47.7% of McEwen Copper, which owns the large,

advanced stage Los Azules copper project in Argentina. The

Company’s goal is to improve the productivity and life of its

assets with the objective of increasing the share price and

providing a yield. Rob McEwen, Chairman and Chief Owner, has a

personal investment in the company of US$220 million. His annual

salary is US$1.

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTS

This news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.'s (the "Company") estimates, forecasts,

projections, expectations or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward-looking statements and information include, but are not

limited to, fluctuations in the market price of precious and base

metals, mining industry risks, political, economic, social and

security risks associated with foreign operations, the ability of

the corporation to receive or receive in a timely manner permits or

other approvals required in connection with operations, risks

associated with the construction of mining operations and

commencement of production and the projected costs thereof, risks

related to litigation, the state of the capital markets,

environmental risks and hazards, uncertainty as to calculation of

mineral resources and reserves, and other risks. Readers should not

place undue reliance on forward-looking statements or information

included herein, which speak only as of the date hereof. The

Company undertakes no obligation to reissue or update

forward-looking statements or information as a result of new

information or events after the date hereof except as may be

required by law. See McEwen Mining's Annual Report on Form 10-K for

the fiscal year ended December 31, 2022, and other filings with the

Securities and Exchange Commission, under the caption "Risk

Factors", for additional information on risks, uncertainties and

other factors relating to the forward-looking statements and

information regarding the Company. All forward-looking statements

and information made in this news release are qualified by this

cautionary statement.

The NYSE and TSX have not reviewed and do not

accept responsibility for the adequacy or accuracy of the contents

of this news release, which has been prepared by the management of

McEwen Mining Inc.

Want News Fast?Subscribe to our

email list by clicking

here:https://www.mcewenmining.com/contact-us/#section=followUs and

receive news as it happens!!

|

|

|

|

|

|

WEB SITE |

SOCIAL MEDIA |

|

|

|

www.mcewenmining.com |

McEwen Mining |

Facebook: |

facebook.com/mcewenmining |

|

|

LinkedIn: |

linkedin.com/company/mcewen-mining-inc- |

|

CONTACT INFORMATION |

Twitter: |

twitter.com/mcewenmining |

|

150 King Street West |

Instagram: |

instagram.com/mcewenmining |

|

Suite 2800, PO Box 24 |

|

|

|

|

Toronto, ON, Canada |

McEwen Copper |

Facebook: |

facebook.com/ mcewencopper |

|

M5H 1J9 |

LinkedIn: |

linkedin.com/company/mcewencopper |

|

|

Twitter: |

twitter.com/mcewencopper |

|

Relationship with Investors: |

Instagram: |

instagram.com/mcewencopper |

|

(866)-441-0690 - Toll free line |

|

|

|

|

(647)-258-0395 |

Rob McEwen |

Facebook: |

facebook.com/mcewenrob |

|

Mihaela Iancu ext. 320 |

LinkedIn: |

linkedin.com/in/robert-mcewen-646ab24 |

|

info@mcewenmining.com |

Twitter: |

twitter.com/robmcewenmux |

|

|

|

|

|

|

|

|

|

|

Figures accompanying this announcement are

available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/a00f17e3-f10b-4352-a03b-0d5f24cad26d

https://www.globenewswire.com/NewsRoom/AttachmentNg/dc6f3341-d17c-4a66-b6ad-060ef3149d8e

https://www.globenewswire.com/NewsRoom/AttachmentNg/1f5e3e19-5a50-4e5e-941e-758057522548

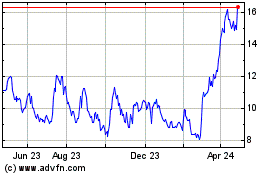

McEwen Mining (TSX:MUX)

Historical Stock Chart

From Nov 2024 to Dec 2024

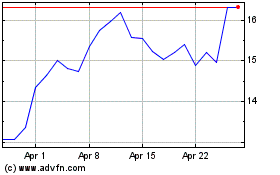

McEwen Mining (TSX:MUX)

Historical Stock Chart

From Dec 2023 to Dec 2024