Methanex Reports Higher Adjusted EBITDA in the First Quarter of

2014

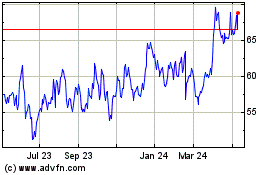

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Apr 29, 2014) - For

the first quarter of 2014, Methanex (TSX:MX)(NASDAQ:MEOH) reported

Adjusted EBITDA1 of $255 million and Adjusted net income1 of $160

million ($1.65 per share on a diluted basis1). These figures

compare with Adjusted EBITDA1 of $245 million and Adjusted net

income1 of $167 million ($1.72 per share on a diluted basis1) for

the fourth quarter of 2013.

John Floren, President and CEO of Methanex commented, "This was

another excellent quarter. Increased production resulting from our

2013 capacity growth initiatives in New Zealand and Medicine Hat,

together with higher methanol pricing, contributed to robust EBITDA

and earnings results this quarter." Mr. Floren added, "The methanol

industry environment remains favorable. In Q4 2013, we saw methanol

prices rise rapidly as a result of industry supply constraints.

Late in Q1 2014, several idle plants resumed operation which

resulted in methanol pricing moderating to levels seen prior to the

supply disruptions. Industry demand remains steady, particularly

for methanol into energy, and limited new supply additions are

expected in the near to medium term."

Mr. Floren added, "We continue to target methanol production

from our Geismar 1 facility in late 2014 and Geismar 2 in early

2016. These two facilities are expected to provide a two million

tonne increase in our operating capacity to eight million tonnes by

2016, at a time when new market supply is expected to be

limited."

Mr. Floren concluded, "With approximately $700 million of cash

on hand, an undrawn credit facility, robust balance sheet, and

strong cash flow generation, we are well positioned to deliver on

our growth projects, continue to grow our business and deliver on

our commitment to return excess cash to shareholders. Our

announcement today of a new 5% normal course issuer bid share

repurchase program, along with a 25% increase in our quarterly

dividend, reflects that commitment."

A conference call is scheduled for April 30, 2014 at 12:00 noon

ET (9:00 am PT) to review these first quarter results. To access

the call, dial the conferencing operator ten minutes prior to the

start of the call at (416) 340-2218, or

toll free at (866) 226-1793. A

playback version of the conference call will be available until May

21, 2014 at (905) 694-9451, or

toll free at (800) 408-3053. The

passcode for the playback version is 3924003. Presentation slides

summarizing Q1-14 results and a simultaneous audio-only webcast of

the conference call can be accessed from our website at

www.methanex.com. The webcast will be available on the website for

three weeks following the call.

Methanex is a Vancouver-based, publicly traded company and is

the world's largest producer and supplier of methanol to major

international markets. Methanex shares are listed for trading on

the Toronto Stock Exchange in Canada under the trading symbol "MX"

and on the NASDAQ Global Market in the United States under the

trading symbol "MEOH".

FORWARD-LOOKING INFORMATION WARNING

This First Quarter 2014 press release contains forward-looking

statements with respect to us and the chemical industry. Refer to

Forward-Looking Information Warning in the attached First Quarter

2014 Management's Discussion and Analysis for more information.

|

1 |

Adjusted EBITDA, Adjusted net income and Adjusted net income

per common share are non-GAAP measures which do not have any

standardized meaning prescribed by GAAP. These measures represent

the amounts that are attributable to Methanex Corporation

shareholders and are calculated by excluding the mark-to-market

impact of share-based compensation as a result of changes in our

share price and items considered by management to be

non-operational. Refer to Additional Information - Supplemental

Non-GAAP Measures section of the attached Interim Report for the

three months ended March 31, 2014 for reconciliations to the most

comparable GAAP measures. |

Interim Report for the Three Months Ended March 31, 2014

At April 29, 2014 the Company had 96,523,956 common shares

issued and outstanding and stock options exercisable for 1,665,436

additional common shares.

Share Information

Methanex Corporation's common shares are listed for trading on

the Toronto Stock Exchange under the symbol MX and on the Nasdaq

Global Market under the symbol MEOH.

Transfer Agents & Registrars

| CIBC

Mellon Trust Company |

| 320

Bay Street |

|

Toronto, Ontario Canada M5H 4A6 |

| Toll

free in North America: 1-800-387-0825 |

Investor Information

All financial reports, news releases and corporate information

can be accessed on our website at www.methanex.com.

Contact Information

|

Methanex Investor Relations |

| 1800

- 200 Burrard Street |

|

Vancouver, BC Canada V6C 3M1 |

|

E-mail: invest@methanex.com |

|

Methanex Toll-Free: 1-800-661-8851 |

FIRST QUARTER MANAGEMENT'S DISCUSSION AND ANALYSIS

Except where otherwise noted, all currency amounts are stated in

United States dollars.

FINANCIAL AND OPERATIONAL HIGHLIGHTS

- A reconciliation from net income attributable to Methanex

shareholders to Adjusted net income1 and the calculation of

Adjusted net income per common share1 is as follows:

|

Three Months Ended |

| ($ millions except number of shares and per share

amounts) |

Mar 31 2014 |

Dec 31 2013 |

Mar 31 2013 |

|

|

|

|

|

|

|

| Net income attributable to Methanex shareholders |

$ |

145 |

$ |

128 |

$ |

60 |

|

Mark-to-market impact of share-based compensation, net of tax |

|

15 |

|

34 |

|

28 |

|

Write-off of oil and gas rights, net of tax |

|

- |

|

5 |

|

- |

| Adjusted net income 1 |

$ |

160 |

$ |

167 |

$ |

88 |

| Diluted weighted average shares outstanding

(millions) |

|

97 |

|

97 |

|

96 |

| Adjusted net income per common share 1 |

$ |

1.65 |

$ |

1.72 |

$ |

0.92 |

- We recorded Adjusted EBITDA1 of $255 million for the first

quarter of 2014 compared with $245 million for the fourth quarter

of 2013. The increase in Adjusted EBITDA1 was primarily due to an

increase in our average realized price to $524 per tonne for the

first quarter of 2014 from $493 per tonne for the fourth quarter of

2013 and an increase in sales of Methanex-produced methanol.

- Production for the first quarter of 2014 was 1,226,000 tonnes

compared with 1,194,000 tonnes for the fourth quarter of 2013.

Refer to the Production Summary section.

- Sales of Methanex-produced methanol were 1,228,000 tonnes in

the first quarter of 2014 compared with 1,190,000 in the fourth

quarter of 2013.

- We continue to progress our Geismar relocation projects. We are

targeting to be producing methanol from Geismar 1 in late 2014 and

from Geismar 2 in early 2016.

- During the first quarter of 2014, we paid a $0.20 per share

dividend to shareholders for a total of $19 million.

- We announced today that the Board of Directors has approved a

25% increase to our quarterly dividend to shareholders, from $0.20

per share per quarter to $0.25 per share per quarter, effective

with the dividend payable June 30, 2014.

- We also announced today that the Board of Directors has

approved a 5% normal course issuer bid under which the Company may

repurchase up to 4.8 million common shares.

| 1 |

These

items are non-GAAP measures that do not have any standardized

meaning prescribed by GAAP and therefore are unlikely to be

comparable to similar measures presented by other companies. Refer

to Additional Information - Supplemental Non-GAAP Measures section

for a description of each non-GAAP measure and reconciliations to

the most comparable GAAP measures. |

This First Quarter 2014 Management's Discussion and Analysis

("MD&A") dated April 29, 2014 for Methanex Corporation ("the

Company") should be read in conjunction with the Company's

condensed consolidated interim financial statements for the period

ended March 31, 2014 as well as the 2013 Annual Consolidated

Financial Statements and MD&A included in the Methanex 2013

Annual Report. Unless otherwise indicated, the financial

information presented in this interim report is prepared in

accordance with International Financial Reporting Standards (IFRS)

as issued by the International Accounting Standards Board (IASB).

The Methanex 2013 Annual Report and additional information relating

to Methanex is available on SEDAR at www.sedar.com and on EDGAR at

www.sec.gov.

FINANCIAL AND OPERATIONAL DATA

|

Three Months Ended |

| ($ millions, except per share amounts and where

noted) |

Mar 31 2014 |

Dec 31 2013 |

Mar 31 2013 |

|

|

|

|

| Production (thousands of tonnes) (attributable to

Methanex shareholders) |

1,226 |

1,194 |

1,063 |

|

|

|

|

| Sales volumes (thousands of tonnes): |

|

|

|

|

Methanex-produced methanol (attributable to Methanex

shareholders) |

1,228 |

1,190 |

1,030 |

|

Purchased methanol |

654 |

663 |

588 |

|

Commission sales |

296 |

274 |

219 |

|

Total sales volumes 1 |

2,178 |

2,127 |

1,837 |

|

|

|

|

| Methanex average non-discounted posted price ($ per

tonne) 2 |

613 |

557 |

474 |

| Average realized price ($ per tonne) 3 |

524 |

493 |

412 |

|

|

|

|

| Adjusted EBITDA (attributable to Methanex shareholders)

4 |

255 |

245 |

149 |

| Cash flows from operating activities |

179 |

162 |

118 |

| Adjusted net income (attributable to Methanex

shareholders) 4 |

160 |

167 |

88 |

| Net income attributable to Methanex shareholders |

145 |

128 |

60 |

|

|

|

|

| Adjusted net income per common share (attributable to

Methanex shareholders) 4 |

1.65 |

1.72 |

0.92 |

| Basic net income per common share (attributable to

Methanex shareholders) |

1.51 |

1.33 |

0.64 |

| Diluted net income per common share (attributable to

Methanex shareholders) |

1.50 |

1.32 |

0.63 |

|

|

|

|

| Common share information (millions of shares): |

|

|

|

|

Weighted average number of common shares |

96 |

96 |

95 |

|

Diluted weighted average number of common shares |

97 |

97 |

96 |

|

Number of common shares outstanding, end of period |

97 |

96 |

95 |

| 1 |

Methanex-produced methanol includes volumes produced by Chile using

natural gas supplied from Argentina under a tolling arrangement.

Commission sales represent volumes marketed on a commission basis

related to 36.9% of the Atlas methanol facility and the portion of

the Egypt methanol facility that we do not own. |

| 2 |

Methanex average non-discounted posted price represents the average

of our non-discounted posted prices in North America, Europe and

Asia Pacific weighted by sales volume. Current and historical

pricing information is available at www.methanex.com. |

| 3 |

Average realized price is calculated as revenue, excluding

commissions earned and the Egypt non-controlling interest share of

revenue but including an amount representing our share of Atlas

revenue, divided by the total sales volumes of Methanex-produced

(attributable to Methanex shareholders) and purchased

methanol. |

|

4 |

These items are non-GAAP measures that do not have any standardized

meaning prescribed by GAAP and therefore are unlikely to be

comparable to similar measures presented by other companies. Refer

to Additional Information - Supplemental Non-GAAP Measures section

for a description of each non-GAAP measure and reconciliations to

the most comparable GAAP measures. |

|

|

PRODUCTION SUMMARY

|

|

Q1 2014 |

Q4 2013 |

Q1 2013 |

|

(thousands of tonnes) |

Capacity1 |

Production |

Production |

Production |

|

|

|

|

|

|

|

New Zealand 2 |

608 |

500 |

400 |

309 |

|

|

|

|

|

|

Atlas (Trinidad) (63.1% interest) |

281 |

249 |

268 |

248 |

|

|

|

|

|

|

Titan (Trinidad) |

218 |

149 |

173 |

181 |

|

|

|

|

|

|

Egypt (50% interest)3 |

158 |

139 |

159 |

133 |

|

|

|

|

|

|

Medicine Hat (Canada) |

140 |

122 |

86 |

131 |

|

|

|

|

|

|

Chile I and IV |

430 |

67 |

108 |

61 |

|

|

|

|

|

|

Geismar 1 and 2 (Louisiana, USA)4 |

- |

- |

- |

- |

|

|

1,835 |

1,226 |

1,194 |

1,063 |

| 1 |

The

production capacity of our facilities may be higher than original

nameplate capacity as, over time, these figures have been adjusted

to reflect ongoing operating efficiencies. Actual production for a

facility in any given year may be higher or lower than annual

production capacity due to a number of factors, including natural

gas composition or the age of the facility's catalyst. |

| 2 |

The

annual production capacity of New Zealand represents the two

Motunui facilities and the Waitara Valley facility (refer to New

Zealand section below). |

| 3 |

On

December 9, 2013, we completed a sale of 10% equity interest in the

Egypt facility. Production figures prior to December 9, 2013

reflect a 60% interest. |

| 4 |

We

are relocating two 1.0 million tonne idle Chile facilities to

Geismar, Louisiana and are targeting to be producing methanol from

Geismar 1 in late 2014 and Geismar 2 by early 2016. |

|

|

New Zealand

Our New Zealand methanol facilities produced 500,000 tonnes of

methanol in the first quarter of 2014 compared with 400,000 tonnes

in the fourth quarter of 2013. With all three facilities now

operating, we are able to produce up to 2.4 million tonnes

annually, depending on natural gas composition. During the first

quarter 2014, production was primarily impacted by an upstream

supplier who performed major maintenance on an offshore gas

platform resulting in losses of 50,000 tonnes. We continue to work

with suppliers in New Zealand to secure gas that will allow our New

Zealand facilities to operate at full capacity.

Trinidad

In Trinidad, we own 100% of the Titan facility with an annual

production capacity of 875,000 tonnes and have a 63.1% interest in

the Atlas facility with an annual production capacity of 1,125,000

tonnes (63.1% interest). Production in Trinidad during the quarter

was impacted by a combination of minor unplanned outages and gas

curtailments. The Titan facility produced 149,000 tonnes in the

first quarter of 2014 compared with 173,000 tonnes in the fourth

quarter of 2013. The Atlas facility produced 249,000 tonnes in the

first quarter of 2014 compared with 268,000 tonnes in the fourth

quarter of 2013.

We continue to experience some natural gas curtailments to our

Trinidad facilities due to a mismatch between upstream commitments

to supply the Natural Gas Company of Trinidad and Tobago (NGC) and

downstream demand from NGC's customers, which becomes apparent when

an upstream supplier has a technical issue or planned maintenance

that reduces gas delivery. We are engaged with key stakeholders to

find a solution to this issue, but in the meantime expect to

continue to experience gas curtailments to the Trinidad site.

Egypt

On a 100% basis, the Egypt methanol facility produced 278,000

tonnes in the first quarter of 2014 (Methanex share of 139,000

tonnes) compared with 273,000 tonnes (Methanex share of 159,000

tonnes) in the fourth quarter of 2013. Production during the first

quarter of 2014 and the fourth quarter of 2013 continued to be

impacted by natural gas supply restrictions.

The Egypt facility has experienced periodic natural gas supply

restrictions since mid-2012 which have resulted in production below

full capacity. This situation may persist in the future and become

more acute during the summer months when electricity demand is at

its peak. Refer to page 23 of the Risk Factors and Risk Management

section of our 2013 Annual Report for further details.

Medicine Hat, Canada

During the first quarter of 2014, we produced 122,000 tonnes at

our Medicine Hat facility compared with 86,000 tonnes during the

fourth quarter of 2013. The Medicine Hat facility experienced an

unplanned outage in the fourth quarter of 2013 and restarted on

January 10, 2014.

Chile

During the first quarter of 2014, we produced 67,000 tonnes in

Chile operating one plant at approximately 30% of production

capacity, supported by natural gas supplies from Chile and from

Argentina through a tolling arrangement.

As a result of the short-term outlook for gas supply in Chile

and Argentina, we anticipate idling our Chile operations in early

May due to insufficient natural gas feedstock to keep our plant

operating through the southern hemisphere winter. We are continuing

to work with Empresa Nacional del Petroleo (ENAP) and others to

secure sufficient natural gas to sustain our operations and while a

restart of a Chile plant is possible later in 2014, the restart is

dependent on securing a sustainable natural gas supply to our

facilities on economic terms from Chile and Argentina to operate

over the medium term.

The future of our Chile operations is primarily dependent on the

level of natural gas exploration and development in southern Chile

and our ability to secure a sustainable natural gas supply to our

facilities on economic terms from Chile and Argentina.

Geismar, Louisiana

We continue to progress our two Geismar relocation projects. We

are targeting to be producing methanol from the 1.0 million tonne

Geismar 1 facility in late 2014 and from the 1.0 million tonne

Geismar 2 facility in early 2016. During the first quarter of 2014,

we incurred $130 million of capital expenditures related to these

projects, excluding capitalized interest.

FINANCIAL RESULTS

For the first quarter of 2014 we recorded Adjusted EBITDA of

$255 million and Adjusted net income of $160 million ($1.65 per

share on a diluted basis). This compares with Adjusted EBITDA of

$245 million and Adjusted net income of $167 million ($1.72 per

share on a diluted basis) for the fourth quarter of 2013.

For the first quarter of 2014, we reported net income

attributable to Methanex shareholders of $145 million ($1.50 per

share on a diluted basis) compared with net income attributable to

Methanex shareholders for the fourth quarter of 2013 of $128

million ($1.32 income per share on a diluted basis).

We calculate Adjusted EBITDA and Adjusted net income by

including amounts related to our equity share of the Atlas (63.1%

interest) and Egypt (50% interest) facilities and by excluding the

mark-to-market impact of share-based compensation as a result of

changes in our share price and items which are considered by

management to be non-operational. Refer to Additional Information -

Supplemental Non-GAAP Measures section for a further discussion on

how we calculate these measures. Our analysis of depreciation and

amortization, finance costs, finance income and other expenses and

income taxes is consistent with the presentation of our

consolidated statements of income and excludes amounts related to

Atlas.

A reconciliation from net income attributable to Methanex

shareholders to Adjusted net income and the calculation of Adjusted

net income per common share is as follows:

|

Three Months Ended |

| ($ millions except number of shares and per share

amounts) |

Mar 31 2014 |

Dec 31 2013 |

Mar 31 2013 |

|

|

|

|

|

|

|

| Net income attributable to Methanex shareholders |

$ |

145 |

$ |

128 |

$ |

60 |

|

Mark-to-market impact of share-based compensation, net of tax |

|

15 |

|

34 |

|

28 |

|

Write-off of oil and gas rights, net of tax |

|

- |

|

5 |

|

- |

| Adjusted net income 1 |

$ |

160 |

$ |

167 |

$ |

88 |

| Diluted weighted average shares outstanding

(millions) |

|

97 |

|

97 |

|

96 |

| Adjusted net income per common share 1 |

$ |

1.65 |

$ |

1.72 |

$ |

0.92 |

|

|

|

|

|

|

|

|

| 1 |

These

items are non-GAAP measures that do not have any standardized

meaning prescribed by GAAP and therefore are unlikely to be

comparable to similar measures presented by other companies. Refer

to Additional Information - Supplemental Non-GAAP Measures section

for a description of each non-GAAP measure and reconciliations to

the most comparable GAAP measures. |

|

|

We review our financial results by analyzing changes in Adjusted

EBITDA, mark-to-market impact of share-based compensation,

depreciation and amortization, write-off of oil and gas rights,

finance costs, finance income and other expenses and income taxes.

A summary of our consolidated statements of income is as

follows:

|

Three Months Ended |

|

| ($ millions) |

Mar 31 2014 |

|

Dec 31 2013 |

|

Mar 31 2013 |

|

|

|

|

|

|

|

|

|

|

|

| Consolidated statements of income: |

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

968 |

|

$ |

881 |

|

$ |

652 |

|

|

Cost of sales and operating expenses, excluding mark-to-market

impact of share-based compensation |

|

(692 |

) |

|

(634 |

) |

|

(497 |

) |

|

Adjusted EBITDA of associate (Atlas) 1 |

|

17 |

|

|

26 |

|

|

9 |

|

|

|

293 |

|

|

273 |

|

|

164 |

|

| Comprised of: |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (attributable to Methanex shareholders) 2 |

|

255 |

|

|

245 |

|

|

149 |

|

|

Attributable to non-controlling interests |

|

38 |

|

|

28 |

|

|

15 |

|

|

|

293 |

|

|

273 |

|

|

164 |

|

| Mark-to-market impact of share-based compensation |

|

(18 |

) |

|

(37 |

) |

|

(31 |

) |

| Depreciation and amortization |

|

(35 |

) |

|

(35 |

) |

|

(30 |

) |

| Write-off of oil and gas rights |

|

- |

|

|

(8 |

) |

|

- |

|

| Earnings of associate, excluding amount included in

Adjusted EBITDA 1 |

|

(9 |

) |

|

(9 |

) |

|

(8 |

) |

| Finance costs |

|

(11 |

) |

|

(13 |

) |

|

(15 |

) |

| Finance income and other expenses |

|

- |

|

|

2 |

|

|

(2 |

) |

| Income tax expense |

|

(52 |

) |

|

(29 |

) |

|

(12 |

) |

| Net income |

$ |

168 |

|

$ |

144 |

|

$ |

66 |

|

| Net income attributable to Methanex shareholders |

$ |

145 |

|

$ |

128 |

|

$ |

60 |

|

|

|

|

|

|

|

|

|

|

|

| 1 |

Earnings of associate has been divided into an amount included in

Adjusted EBITDA and an amount excluded from Adjusted EBITDA. The

amount excluded from Adjusted EBITDA represents depreciation and

amortization, finance costs, finance income and other expenses and

income tax expense relating to earnings of associate. |

| 2 |

This

item is a non-GAAP measure that does not have any standardized

meaning prescribed by GAAP and therefore is unlikely to be

comparable to similar measures presented by other companies. Refer

to Additional Information - Supplemental Non-GAAP Measures section

for a description of the non-GAAP measure and reconciliation to the

most comparable GAAP measure. |

|

|

Adjusted EBITDA (Attributable to Methanex Shareholders)

Our operations consist of a single operating segment - the

production and sale of methanol. We review the results of

operations by analyzing changes in the components of Adjusted

EBITDA. For a discussion of the definitions used in our Adjusted

EBITDA analysis, refer to How We Analyze Our Business section.

The changes in Adjusted EBITDA resulted from changes in the

following:

|

($ millions) |

Q1 2014 compared with Q4 2013 |

|

Q1 2014 compared with Q1 2013 |

|

|

|

|

|

|

|

|

|

|

Average realized price |

$ |

58 |

|

$ |

209 |

|

|

Sales volume |

|

7 |

|

|

27 |

|

|

Total cash costs |

|

(55 |

) |

|

(130 |

) |

|

Increase in Adjusted EBITDA |

$ |

10 |

|

$ |

106 |

|

|

|

|

|

|

|

|

Average realized price

|

|

Three Months Ended |

|

($ per tonne) |

Mar 31 2014 |

Dec 31 2013 |

Mar 31 2013 |

|

|

|

|

|

|

Methanex average non-discounted posted price |

613 |

557 |

474 |

|

Methanex average realized price |

524 |

493 |

412 |

Entering the first quarter of 2014, methanol prices were higher

as a result of strong demand and industry supply issues, primarily

in Asia Pacific. Late in the first quarter, several plants returned

to operation and pricing began to moderate (refer to Supply/Demand

Fundamentals section). Our average non-discounted posted price for

the first quarter of 2014 was $613 per tonne compared with $557 per

tonne for the fourth quarter of 2013 and $474 per tonne for the

first quarter of 2013. Our average realized price for the first

quarter of 2014 was $524 per tonne compared with $493 per tonne for

the fourth quarter of 2013 and $412 per tonne for the first quarter

of 2013. The change in average realized price for the first quarter

of 2014 increased Adjusted EBITDA by $58 million compared with the

fourth quarter of 2013 and increased Adjusted EBITDA by $209

million compared with the first quarter of 2013.

Sales volume

Methanol sales volumes excluding commission sales volumes were

higher for all periods presented and this increased Adjusted EBITDA

by the amounts noted in the table above.

Total cash costs

The primary drivers of changes in our total cash costs are

changes in the cost of methanol we produce at our facilities

(Methanex-produced methanol) and changes in the cost of methanol we

purchase from others (purchased methanol). All of our production

facilities except Medicine Hat and Chile are underpinned by natural

gas purchase agreements with pricing terms that include base and

variable price components. We supplement our production with

methanol produced by others through methanol offtake contracts and

purchases on the spot market to meet customer needs and support our

marketing efforts within the major global markets.

We have adopted the first-in, first-out method of accounting for

inventories and it generally takes between 30 and 60 days to sell

the methanol we produce or purchase. Accordingly, the changes in

Adjusted EBITDA as a result of changes in Methanex-produced and

purchased methanol costs primarily depend on changes in methanol

pricing and the timing of inventory flows.

The impact on Adjusted EBITDA from changes in our cash costs are

explained below:

|

($ millions) |

Q1 2014 compared with Q4 2013 |

|

Q1 2014 compared with Q1 2013 |

|

|

|

|

|

|

|

|

|

|

Methanex-produced methanol costs |

$ |

(25 |

) |

$ |

(50 |

) |

|

Proportion of Methanex-produced methanol sales |

|

6 |

|

|

3 |

|

|

Purchased methanol costs |

|

(27 |

) |

|

(78 |

) |

|

Other, net |

|

(9 |

) |

|

(5 |

) |

|

|

$ |

(55 |

) |

$ |

(130 |

) |

Methanex-produced methanol costs

We purchase natural gas for the New Zealand, Trinidad and Egypt

methanol facilities under natural gas purchase agreements where the

unique terms of each contract include a base price and a variable

price component linked to the price of methanol to reduce our

commodity price risk exposure. The variable price component of each

gas contract is adjusted by a formula related to methanol prices

above a certain level. For the first quarter of 2014 compared with

the fourth quarter of 2013 and the first quarter of 2013,

Methanex-produced methanol costs were higher by $25 million and $50

million, respectively, primarily due to the impact of higher

realized methanol prices on the variable portion of our natural gas

costs and changes in the mix of production sold from inventory.

Proportion of Methanex-produced methanol sales

The cost of purchased methanol is directly linked to the selling

price for methanol at the time of purchase and the cost of

purchased methanol is generally higher than the cost of

Methanex-produced methanol. Accordingly, an increase in the

proportion of Methanex-produced methanol sales results in a

decrease in our overall cost structure for a given period. For the

first quarter of 2014 compared with the fourth quarter of 2013 and

the first quarter of 2013, a higher proportion of Methanex-produced

methanol sales increased Adjusted EBITDA by $6 million and $3

million, respectively. Sales of Methanex-produced methanol

increased in the first quarter of 2014 primarily as a result of

higher production from New Zealand.

Purchased methanol costs

Changes in purchased methanol costs for all periods presented

are primarily as a result of changes in methanol pricing.

Other, net

We have commenced the process of building a manufacturing

organization in Geismar, Louisiana. Under IFRS, costs incurred

related to organizational build-up are not eligible for

capitalization and are charged directly to earnings as incurred.

During the first quarter of 2014, we incurred approximately $3

million of Geismar organizational build-up costs compared to $2

million in the fourth quarter of 2013 and nil in the first quarter

of 2013. The remaining organizational build-up costs are estimated

to be approximately $25 million. The remaining change in other, net

compared to the fourth quarter of 2013 primarily relates to an

insurance settlement recorded in the fourth quarter of 2013.

Mark-to-Market Impact of Share-based Compensation

We grant share-based awards as an element of compensation.

Share-based awards granted include stock options, share

appreciation rights, tandem share appreciation rights, deferred

share units, restricted share units and performance share units.

For all the share-based awards, share-based compensation is

recognized over the related vesting period for the proportion of

the service that has been rendered at each reporting date.

Share-based compensation includes an amount related to the

grant-date value and a mark-to-market impact as a result of

subsequent changes in the Company's share price. The grant-date

value amount is included in Adjusted EBITDA and Adjusted net

income. The mark-to-market impact of share-based compensation as a

result of changes in our share price is excluded from Adjusted

EBITDA and Adjusted net income and analyzed separately.

|

|

Three Months Ended |

|

($ millions except share price) |

Mar 31 2014 |

Dec 31 2013 |

Mar 31 2013 |

|

|

|

|

|

|

|

|

|

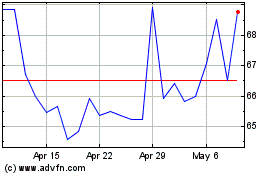

Methanex Corporation share price 1 |

$ |

63.94 |

$ |

59.24 |

$ |

40.63 |

|

|

|

|

|

|

|

|

|

Grant-date fair value expense included in Adjusted EBITDA and

Adjusted net income |

|

7 |

|

4 |

|

6 |

|

Mark-to-market impact due to change in share price |

|

18 |

|

37 |

|

31 |

|

Total share-based compensation expense |

$ |

25 |

$ |

41 |

$ |

37 |

|

|

|

|

|

|

|

|

| 1 |

US

dollar share price of Methanex Corporation as quoted on NASDAQ

Global Market on the last trading day of the respective

period. |

|

|

The Methanex Corporation share price increased from US $59.24

per share at December 31, 2013 to US $63.94 per share at March 31,

2014. As a result of the increase in the share price and the

resulting impact on the fair value of the outstanding units, we

recorded an $18 million mark-to-market expense on share-based

compensation in the first quarter of 2014 compared with a $37

million mark-to-market share-based compensation expense in the

fourth quarter of 2013 and a $31 million expense in the first

quarter of 2013.

Depreciation and Amortization

Depreciation and amortization was $35 million for the first

quarter of 2014 compared with $35 million for the fourth quarter of

2013 and $30 million for the first quarter of 2013. Depreciation

and amortization was higher in the first quarter of 2014 compared

with the first quarter of 2013 primarily due to higher sales

volumes of Methanex-produced methanol.

Finance Costs

|

|

Three Months Ended |

|

|

($ millions) |

Mar 31 2014 |

|

Dec 31 2013 |

|

Mar 31 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance costs before capitalized interest |

$ |

16 |

|

$ |

16 |

|

$ |

16 |

|

|

Less capitalized interest |

|

(5 |

) |

|

(3 |

) |

|

(1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Finance costs |

$ |

11 |

|

$ |

13 |

|

$ |

15 |

|

|

|

|

|

|

|

|

|

|

|

Finance costs before capitalized interest primarily relate to

interest expense on the unsecured notes and limited recourse debt

facilities. Capitalized interest relates to interest costs

capitalized for the Geismar projects.

Finance Income and Other Expenses

|

|

Three Months Ended |

|

|

($ millions) |

Mar 31 2014 |

Dec 31 2013 |

Mar 31 2013 |

|

|

|

|

|

|

|

|

|

|

|

Finance income and other expenses |

$ |

- |

$ |

2 |

$ |

(2 |

) |

|

|

|

|

|

|

|

|

The change in finance income and other expenses for all periods

presented was primarily due to the impact of changes in foreign

exchange rates.

Income Taxes

A summary of our income taxes for the first quarter of 2014

compared with the fourth quarter of 2013 is as follows:

|

|

Three Months Ended March 31, 2014 |

|

|

Three Months Ended December 31, 2013 |

|

|

($ millions, except where noted) |

Net Income |

|

Adjusted Net Income1 |

|

|

Net Income |

|

Adjusted Net Income1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount before income tax |

$ |

220 |

|

$ |

210 |

|

|

$ |

173 |

|

$ |

203 |

|

|

Income tax expense |

|

(52 |

) |

|

(50 |

) |

|

|

(29 |

) |

|

(36 |

) |

|

Amount after income tax |

$ |

168 |

|

$ |

160 |

|

|

$ |

144 |

|

$ |

167 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effective tax rate |

|

24 |

% |

|

24 |

% |

|

|

17 |

% |

|

18 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1 |

This

item is a non-GAAP measure that does not have any standardized

meaning prescribed by GAAP and therefore is unlikely to be

comparable to similar measures presented by other companies. Refer

to Additional Information - Supplemental Non-GAAP Measures section

for a description of the non-GAAP measure and reconciliation to the

most comparable GAAP measure. |

|

|

For the first quarter of 2014, the effective tax rate was 24%

compared with 17% for the fourth quarter of 2013. Adjusted net

income represents the amount that is attributable to Methanex

shareholders and excludes the mark-to-market impact of share-based

compensation and items that are considered by management to be

non-operational. The effective tax rate related to Adjusted net

income was 24% for the first quarter of 2014 compared with 18% for

the fourth quarter of 2013. Entering the first quarter of 2014, all

previously unrecognized tax benefits in Canada and New Zealand were

fully utilized, which contributed to an increase in the effective

tax rate.

We earn the majority of our earnings in Trinidad, Egypt, Chile,

Canada and New Zealand. In Trinidad and Chile, the statutory tax

rate is 35% and in Egypt, the statutory tax rate is 25%. The

statutory rates in Canada and New Zealand are 25% and 28%,

respectively. As the Atlas entity is accounted for using the equity

method, any income taxes related to Atlas are included in earnings

of associate and therefore excluded from total income taxes.

SUPPLY/DEMAND FUNDAMENTALS

| Methanex Non-Discounted Regional Posted Prices 1 |

|

(US$ per tonne) |

Apr 2014 |

Mar 2014 |

Feb 2014 |

Jan 2014 |

|

|

|

|

|

|

|

United States |

599 |

632 |

632 |

632 |

|

Europe 2 |

565 |

610 |

610 |

610 |

|

Asia Pacific |

480 |

590 |

590 |

590 |

| 1 |

Discounts from our posted prices are offered to customers based on

various factors. |

|

2 |

EUR412 for Q2 2014 (Q1 2014 - EUR450) converted to United States

dollars. |

We estimate that methanol demand, excluding methanol demand from

integrated methanol to olefins facilities, is currently

approximately 57 million tonnes on an annualized basis.

Entering the first quarter of 2014, we experienced rising

methanol prices due to continued supply constraints, primarily in

Asia Pacific. During the quarter, several plants returned to

operation and pricing began to moderate. Our average non-discounted

price in the first quarter of 2014 was $613 per tonne compared with

$557 per tonne in the fourth quarter of 2013. We recently announced

our North American non-discounted price for May at $565 per tonne

and our Asia Pacific price at $460 per tonne.

The outlook for methanol demand growth continues to be strong.

Traditional chemical derivatives consume about 60% of global

methanol demand and growth is correlated to industrial

production.

Energy-related applications consume the remaining 40% of global

methanol demand, and the wide disparity between the price of crude

oil and that of natural gas and coal has resulted in an increased

use of methanol in energy-related applications, such as direct

methanol blending into gasoline, DME and biodiesel production.

Growth of direct methanol blending into gasoline in China has been

particularly strong and we believe that future growth in this

application is supported by numerous provincial fuel-blending

standards, such as M15 or M85 (15% methanol and 85% methanol,

respectively).

China is also leading the commercialization of methanol's use as

a feedstock to manufacture olefins. The use of methanol to produce

olefins, at current energy prices, is proving to be cost

competitive relative to the traditional production of olefins from

naphtha. There are now three methanol-to-olefins (MTO) plants

operating in China which are dependent on merchant methanol supply

and which have the capacity to consume over 3 million tonnes of

methanol annually. There are other MTO plants which are integrated

and purchase methanol to supplement their production when required.

We believe demand potential into energy-related applications and

olefins production will continue to grow.

The methanol price will ultimately depend on the strength of the

global economy, industry operating rates, global energy prices, new

supply additions and the strength of global demand. Over the next

few years, there is a modest level of new capacity expected to come

on-stream relative to demand growth expectations. We are relocating

two idle Chile facilities to Geismar, Louisiana and are targeting

to be producing methanol from the first 1.0 million tonne facility

by late 2014 and the second 1.0 million tonne facility in early

2016. A 1.3 million tonne Celanese plant is currently under

construction in Bishop, Texas. We expect that production from new

capacity in China will be consumed in that country and that higher

cost production capacity in China will need to operate in order to

satisfy demand growth.

LIQUIDITY AND CAPITAL RESOURCES

Cash flows from operating activities in the first quarter of

2014 increased by $17 million to $179 million compared with $162

million for the fourth quarter of 2013 and increased by $61 million

compared to $118 million for the first quarter of 2013. The changes

in cash flows from operating activities resulted from changes in

the following:

|

($ millions) |

Q1 2014 compared with Q4 2013 |

|

Q1 2014 compared with Q1 2013 |

|

|

|

|

|

|

|

|

|

|

Change in Adjusted EBITDA (attributable to Methanex

shareholders) |

$ |

10 |

|

$ |

106 |

|

|

Exclude change in Adjusted EBITDA of associate (Atlas) |

|

9 |

|

|

(8 |

) |

|

Cash flows attributable to non-controlling interests |

|

10 |

|

|

23 |

|

|

Non-cash working capital |

|

(9 |

) |

|

(44 |

) |

|

Income taxes paid |

|

4 |

|

|

(2 |

) |

|

Share-based payments |

|

(16 |

) |

|

(19 |

) |

|

Other |

|

9 |

|

|

5 |

|

|

Increase in cash flows from operating activities |

$ |

17 |

|

$ |

61 |

|

During the first quarter of 2014, we paid a quarterly dividend

of $0.20 per share, or $19 million. Additionally, on April 29,

2014, the Board of Directors approved a 25% increase to our

quarterly dividend to shareholders, from $0.20 to $0.25 per share

per quarter. The increased dividend will apply commencing with the

dividend payable June 30, 2014 to holders of common shares of

record on June 16, 2014.

On April 29, 2014, the Board of Directors approved a 5% normal

course issuer bid, which allows us to repurchase for cancellation

up to 4.8 million shares.

We operate in a highly competitive commodity industry and

believe it is appropriate to maintain a conservative balance sheet

and retain financial flexibility. At March 31, 2014, our cash

balance was $709 million, including $52 million related to the

non-controlling interest in Egypt. We invest our cash only in

highly rated instruments that have maturities of three months or

less to ensure preservation of capital and appropriate liquidity.

We have a strong balance sheet and an undrawn $400 million credit

facility provided by highly rated financial institutions that

expires in mid-2016.

Our planned capital maintenance expenditure program directed

towards maintenance, turnarounds and catalyst changes for existing

operations is currently estimated to total approximately $140

million to the end of 2015. Capital expenditures during the first

quarter, excluding the Geismar projects, were $15 million. We are

relocating two methanol plants from our Chile site to Geismar,

Louisiana. During the first quarter of 2014, capital expenditures

related to the Geismar projects were $130 million, excluding

capitalized interest. The remaining budgeted capital expenditures

related to the Geismar projects are $505 million, excluding

capitalized interest.

We believe we are well positioned to meet our financial

commitments, invest to grow the Company and continue to deliver on

our commitment to return excess cash to shareholders.

SHORT-TERM OUTLOOK

Entering the second quarter, methanol prices have moderated with

additional supply re-entering the market, primarily in Asia

Pacific. The methanol price will ultimately depend on the strength

of the global economy, industry operating rates, global energy

prices, new supply additions and the strength of global demand. We

believe that our financial position and financial flexibility,

outstanding global supply network and competitive-cost position

will provide a sound basis for Methanex to continue to be the

leader in the methanol industry and to invest to grow the

Company.

CONTROLS AND PROCEDURES

For the three months ended March 31, 2014, no changes were made

in our internal control over financial reporting that have

materially affected, or are reasonably likely to materially affect,

our internal control over financial reporting.

ADDITIONAL INFORMATION - SUPPLEMENTAL NON-GAAP MEASURES

In addition to providing measures prepared in accordance with

International Financial Reporting Standards (IFRS), we present

certain supplemental non-GAAP measures. These are Adjusted EBITDA,

Adjusted net income, Adjusted net income per common share and

operating income. These measures do not have any standardized

meaning prescribed by generally accepted accounting principles

(GAAP) and therefore are unlikely to be comparable to similar

measures presented by other companies. These supplemental non-GAAP

measures are provided to assist readers in determining our ability

to generate cash from operations and improve the comparability of

our results from one period to another. We believe these measures

are useful in assessing operating performance and liquidity of the

Company's ongoing business on an overall basis. We also believe

Adjusted EBITDA is frequently used by securities analysts and

investors when comparing our results with those of other

companies.

Adjusted EBITDA (attributable to Methanex shareholders)

Adjusted EBITDA differs from the most comparable GAAP measure,

net income attributable to Methanex shareholders, because it

excludes depreciation and amortization, finance costs, finance

income and other expenses, income tax expense, mark-to-market

impact of share-based compensation, Geismar project relocation

expenses and charges and write-off of oil and gas rights. Adjusted

EBITDA includes an amount representing our 63.1% interest in the

Atlas facility and our 50% interest in the methanol facility in

Egypt.

Adjusted EBITDA and Adjusted net income exclude the

mark-to-market impact of share-based compensation related to the

impact of changes in our share price on share appreciation rights,

tandem share appreciation rights, deferred share units, restricted

share units and performance share units. The mark-to-market impact

related to performance share units that is excluded from Adjusted

EBITDA and Adjusted net income is calculated as the difference

between the grant date value determined using a Methanex total

shareholder return factor of 100% and the fair value recorded at

each period end. As share-based awards will be settled in future

periods, the ultimate value of the units is unknown at the date of

grant and therefore the grant date value recognized in Adjusted

EBITDA and Adjusted net income may differ from the total settlement

cost.

The following table shows a reconciliation from net income

attributable to Methanex shareholders to Adjusted EBITDA:

|

Three Months Ended |

|

| ($ millions) |

Mar 31 2014 |

|

Dec 31 2013 |

|

Mar 31 2013 |

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Methanex shareholders |

$ |

145 |

|

$ |

128 |

|

$ |

60 |

|

|

Mark-to-market impact of share-based compensation |

|

18 |

|

|

37 |

|

|

31 |

|

|

Depreciation and amortization |

|

35 |

|

|

35 |

|

|

30 |

|

|

Write-off of oil and gas rights |

|

- |

|

|

8 |

|

|

- |

|

|

Finance costs |

|

11 |

|

|

13 |

|

|

15 |

|

|

Finance income and other expenses |

|

- |

|

|

(2 |

) |

|

2 |

|

|

Income tax expense |

|

52 |

|

|

29 |

|

|

12 |

|

|

Earnings of associate, excluding amount included in Adjusted EBITDA

1 |

|

9 |

|

|

9 |

|

|

8 |

|

|

Non-controlling interests adjustment 1 |

|

(15 |

) |

|

(12 |

) |

|

(9 |

) |

| Adjusted EBITDA (attributable to Methanex

shareholders) |

$ |

255 |

|

$ |

245 |

|

$ |

149 |

|

|

|

|

|

|

|

|

|

|

|

| 1 |

These

adjustments represent depreciation and amortization, finance costs,

finance income and other expenses and income tax expense associated

with the non-controlling interest in the methanol facility in Egypt

and our 63.1% interest in the Atlas methanol facility. |

Adjusted Net Income and Adjusted Net Income per Common Share

Adjusted net income and Adjusted net income per common share are

non-GAAP measures because they exclude the mark-to-market impact of

share-based compensation and items that are considered by

management to be non-operational, including Geismar project

relocation expenses and charges and write-off of oil and gas

rights. The following table shows a reconciliation of net income

attributable to Methanex shareholders to Adjusted net income and

the calculation of Adjusted net income per common share:

|

Three Months Ended |

|

| ($ millions except number of shares and per share

amounts) |

Mar 31 2014 |

|

Dec 31 2013 |

|

Mar 31 2013 |

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Methanex shareholders |

$ |

145 |

|

$ |

128 |

|

$ |

60 |

|

|

Mark-to-market impact of share-based compensation |

|

18 |

|

|

37 |

|

|

31 |

|

|

Write-off of oil and gas rights |

|

- |

|

|

8 |

|

|

- |

|

|

Income tax recovery related to above items |

|

(3 |

) |

|

(6 |

) |

|

(3 |

) |

| Adjusted net income |

$ |

160 |

|

$ |

167 |

|

$ |

88 |

|

| Diluted weighted average shares outstanding

(millions) |

|

97 |

|

|

97 |

|

|

96 |

|

| Adjusted net income per common share |

$ |

1.65 |

|

$ |

1.72 |

|

$ |

0.92 |

|

|

|

|

|

|

|

|

|

|

|

Operating Income

Operating income is reconciled directly to a GAAP measure in our

consolidated statements of income.

QUARTERLY FINANCIAL DATA (UNAUDITED)

A summary of selected financial information for the prior eight

quarters is as follows:

|

|

Three Months Ended |

|

($ millions, except per share amounts) |

Mar 31 2014 |

Dec 31 2013 |

Sep 30 2013 |

Jun 30 2013 |

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

968 |

$ |

881 |

$ |

758 |

$ |

733 |

|

Adjusted EBITDA 1,2 |

|

255 |

|

245 |

|

184 |

|

157 |

|

Net income 1 |

|

145 |

|

128 |

|

87 |

|

54 |

|

Adjusted net income 1,2 |

|

160 |

|

167 |

|

117 |

|

99 |

|

Basic net income per common share 1 |

|

1.51 |

|

1.33 |

|

0.91 |

|

0.57 |

|

Diluted net income per common share 1 |

|

1.50 |

|

1.32 |

|

0.90 |

|

0.56 |

|

Adjusted net income per share 1,2 |

|

1.65 |

|

1.72 |

|

1.22 |

|

1.02 |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

($ millions, except per share amounts) |

Mar 31 2013 |

Dec 31 2012 |

|

Sep 30 2012 |

|

Jun 30 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

652 |

$ |

668 |

|

$ |

608 |

|

$ |

613 |

|

Adjusted EBITDA 1,2 |

|

149 |

|

119 |

|

|

104 |

|

|

113 |

|

Net income (loss) 1 |

|

60 |

|

(140 |

) |

|

(3 |

) |

|

52 |

|

Adjusted net income 1,2 |

|

88 |

|

61 |

|

|

36 |

|

|

44 |

|

Basic net income (loss) per common share 1 |

|

0.64 |

|

(1.49 |

) |

|

(0.03 |

) |

|

0.56 |

|

Diluted net income (loss) per common share 1 |

|

0.63 |

|

(1.49 |

) |

|

(0.03 |

) |

|

0.50 |

|

Adjusted net income per share 1,2 |

|

0.92 |

|

0.64 |

|

|

0.38 |

|

|

0.47 |

|

|

|

|

|

|

|

|

|

|

|

| 1 |

Attributable to Methanex Corporation shareholders. |

| 2 |

These

items are non-GAAP measures that do not have any standardized

meaning prescribed by GAAP and therefore are unlikely to be

comparable to similar measures presented by other companies. Refer

to Additional Information - Supplemental Non-GAAP Measures section

for a description of each non-GAAP measure and reconciliations to

the most comparable GAAP measures. |

|

|

FORWARD-LOOKING INFORMATION WARNING

This First Quarter 2014 Management's Discussion and Analysis

("MD&A") as well as comments made during the First Quarter 2014

investor conference call contain forward-looking statements with

respect to us and our industry. These statements relate to future

events or our future performance. All statements other than

statements of historical fact are forward-looking statements.

Statements that include the words "believes", "expects", "may",

"will", "should", "potential", "estimates", "anticipates", "aim",

"goal" or other comparable terminology and similar statements of a

future or forward-looking nature identify forward-looking

statements.

More particularly and without limitation, any statements

regarding the following are forward-looking statements:

- expected demand for methanol and its derivatives,

- expected new methanol supply or restart of idled capacity and

timing for start-up of the same,

- expected shutdowns (either temporary or permanent) or restarts

of existing methanol supply (including our own facilities),

including, without limitation, the timing and length of planned

maintenance outages,

- expected methanol and energy prices,

- expected levels of methanol purchases from traders or other

third parties,

- expected levels, timing and availability of economically priced

natural gas supply to each of our plants,

- capital committed by third parties towards future natural gas

exploration and development in the vicinity of our plants,

- our expected capital expenditures,

- anticipated operating rates of our plants,

- expected operating costs, including natural gas feedstock costs

and logistics costs,

- expected tax rates or resolutions to tax disputes,

- expected cash flows, earnings capability and share price,

- availability of committed credit facilities and other

financing,

- ability to meet covenants or obtain or continue to obtain

waivers associated with our long-term debt obligations, including,

without limitation, the Egypt limited recourse debt facilities that

have conditions associated with the payment of cash or other

distributions and the finalization of certain land title

registration and related mortgages that require action by Egyptian

governmental entities,

- our shareholder distribution strategy and anticipated

distributions to shareholders,

- commercial viability and timing of, or our ability to execute,

future projects, plant restarts, capacity expansions, plant

relocations, or other business initiatives or opportunities,

including the planned relocation of idle Chile methanol plants to

Geismar, Louisiana ("Geismar"),

- our financial strength and ability to meet future financial

commitments,

- expected global or regional economic activity (including

industrial production levels),

- expected outcomes of litigation or other disputes, claims and

assessments,

- expected actions of governments, government agencies, gas

suppliers, courts, tribunals or other third parties, and

- expected impact on our operations in Egypt or our financial

condition as a consequence of civil unrest or actions taken or

inaction by the Government of Egypt and its agencies.

We believe that we have a reasonable basis for making such

forward-looking statements. The forward-looking statements in this

document are based on our experience, our perception of trends,

current conditions and expected future developments as well as

other factors. Certain material factors or assumptions were applied

in drawing the conclusions or making the forecasts or projections

that are included in these forward-looking statements, including,

without limitation, future expectations and assumptions concerning

the following:

- the supply of, demand for and price of methanol, methanol

derivatives, natural gas, coal, oil and oil derivatives,

- our ability to procure natural gas feedstock on commercially

acceptable terms,

- operating rates of our facilities,

- receipt of remaining required permits in connection with our

Geismar project,

- receipt or issuance of third-party consents or approvals,

including, without limitation, governmental registrations of land

title and related mortgages in Egypt, governmental approvals

related to rights to purchase natural gas,

- the establishment of new fuel standards,

- operating costs including natural gas feedstock and logistics

costs, capital costs, tax rates, cash flows, foreign exchange rates

and interest rates,

- the availability of committed credit facilities and other

financing,

- timing of completion and cost of our Geismar project,

- global and regional economic activity (including industrial

production levels),

- absence of a material negative impact from major natural

disasters,

- absence of a material negative impact from changes in laws or

regulations,

- absence of a material negative impact from political

instability in the countries in which we operate, and

- enforcement of contractual arrangements and ability to perform

contractual obligations by customers, natural gas and other

suppliers and other third parties.

However, forward-looking statements, by their nature, involve

risks and uncertainties that could cause actual results to differ

materially from those contemplated by the forward-looking

statements. The risks and uncertainties primarily include those

attendant with producing and marketing methanol and successfully

carrying out major capital expenditure projects in various

jurisdictions, including, without limitation:

- conditions in the methanol and other industries including

fluctuations in the supply, demand for and price of methanol and

its derivatives, including demand for methanol for energy

uses,

- the price of natural gas, coal, oil and oil derivatives,

- the success of natural gas exploration and development

activities in southern Chile,

- our ability to obtain natural gas feedstock on commercially

acceptable terms to underpin current operations and future

production growth opportunities,

- the ability to successfully carry out corporate initiatives and

strategies,

- actions of competitors, suppliers and financial

institutions,

- conditions within the natural gas delivery systems that may

prevent delivery of our natural gas supply requirements,

- our ability to meet timeline and budget targets for our Geismar

project, including cost pressures arising from labour costs,

- competing demand for natural gas, especially with respect to

domestic needs for gas and electricity in Chile and Egypt,

- actions of governments and governmental authorities, including,

without limitation, the implementation of policies or other

measures that could impact the supply of or demand for methanol or

its derivatives,

- changes in laws or regulations,

- import or export restrictions, anti-dumping measures, increases

in duties, taxes and government royalties, and other actions by

governments that may adversely affect our operations or existing

contractual arrangements,

- world-wide economic conditions,

- satisfaction of conditions precedent contained in the Geismar 1

natural gas supply agreement, and

- other risks described in our 2013 Management's Discussion and

Analysis and this First Quarter 2014 Management's Discussion and

Analysis.

Having in mind these and other factors, investors and other

readers are cautioned not to place undue reliance on

forward-looking statements. They are not a substitute for the

exercise of one's own due diligence and judgment. The outcomes

anticipated in forward-looking statements may not occur and we do

not undertake to update forward-looking statements except as

required by applicable securities laws.

HOW WE ANALYZE OUR BUSINESS

Our operations consist of a single operating segment - the

production and sale of methanol. We review our results of

operations by analyzing changes in the components of Adjusted

EBITDA (refer to the Additional Information - Supplemental Non-GAAP

Measures section for a description of each non-GAAP measure and

reconciliations to the most comparable GAAP measures).

In addition to the methanol that we produce at our facilities

("Methanex-produced methanol"), we also purchase and re-sell

methanol produced by others ("purchased methanol") and we sell

methanol on a commission basis. We analyze the results of all

methanol sales together, excluding commission sales volumes. The

key drivers of changes in Adjusted EBITDA are average realized

price, cash costs and sales volume which are defined and calculated

as follows:

|

PRICE |

The

change in Adjusted EBITDA as a result of changes in average

realized price is calculated as the difference from period to

period in the selling price of methanol multiplied by the current

period total methanol sales volume excluding commission sales

volume plus the difference from period to period in commission

revenue. |

|

|

| CASH

COST |

The

change in Adjusted EBITDA as a result of changes in cash costs is

calculated as the difference from period to period in cash costs

per tonne multiplied by the current period total methanol sales

volume excluding commission sales volume in the current period. The

cash costs per tonne is the weighted average of the cash cost per

tonne of Methanex-produced methanol and the cash cost per tonne of

purchased methanol. The cash cost per tonne of Methanex-produced

methanol includes absorbed fixed cash costs per tonne and variable

cash costs per tonne. The cash cost per tonne of purchased methanol

consists principally of the cost of methanol itself. In addition,

the change in Adjusted EBITDA as a result of changes in cash costs

includes the changes from period to period in unabsorbed fixed

production costs, consolidated selling, general and administrative

expenses and fixed storage and handling costs. |

|

|

|

VOLUME |

The

change in Adjusted EBITDA as a result of changes in sales volume is

calculated as the difference from period to period in total

methanol sales volume excluding commission sales volumes multiplied

by the margin per tonne for the prior period. The margin per tonne

for the prior period is the weighted average margin per tonne of

Methanex-produced methanol and margin per tonne of purchased

methanol. The margin per tonne for Methanex-produced methanol is

calculated as the selling price per tonne of methanol less absorbed

fixed cash costs per tonne and variable cash costs per tonne. The

margin per tonne for purchased methanol is calculated as the

selling price per tonne of methanol less the cost of purchased

methanol per tonne. |

We own 63.1% of the Atlas methanol facility and market the

remaining 36.9% of its production through a commission offtake

agreement. A contractual agreement between us and our partners

establishes joint control over Atlas. As a result, we account for

this investment using the equity method of accounting, which

results in 63.1% of the net assets and net earnings of Atlas being

presented separately in the consolidated statements of financial

position and consolidated statements of income, respectively. For

purposes of analyzing our business, Adjusted EBITDA, Adjusted net

income and Adjusted net income per common share include an amount

representing our 63.1% equity share in Atlas.

On December 9, 2013, we completed the sale of a 10% equity

interest in the Egypt methanol facility. At March 31, 2014, we own

50% of the 1.26 million tonne per year Egypt methanol facility and

market the remaining 50% of its production through a commission

offtake agreement. We account for this investment using

consolidation accounting, which results in 100% of the revenues and

expenses being included in our financial statements with the other

investors' interests in the methanol facility being presented as

"non-controlling interests". For purposes of analyzing our

business, Adjusted EBITDA, Adjusted net income and Adjusted net

income per common share exclude the amount associated with the

other investors' non-controlling interests.

| Methanex Corporation Consolidated Statements of

Income (unaudited) (thousands of U.S. dollars, except

number of common shares and per share amounts) |

|

|

|

Three Months Ended |

|

|

Mar 31 |

|

Mar 31 |

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

| Revenue |

$ |

968,478 |

|

$ |

651,899 |

|

| Cost of sales and operating expenses |

|

(709,872 |

) |

|

(527,995 |

) |

| Depreciation and amortization |

|

(34,811 |

) |

|

(29,817 |

) |

| Operating income |

|

223,795 |

|

|

94,087 |

|

| Earnings of associate (note 4) |

|

7,411 |

|

|

1,286 |

|

| Finance costs (note 6) |

|

(10,838 |

) |

|

(15,451 |

) |

| Finance income and other expenses |

|

(363 |

) |

|

(1,627 |

) |

| Income before income taxes |

|

220,005 |

|

|

78,295 |

|

| Income tax expense: |

|

|

|

|

|

|

|

Current |

|

(26,378 |

) |

|

(4,391 |

) |

|

Deferred |

|

(25,288 |

) |

|

(7,671 |

) |

|

|

(51,666 |

) |

|

(12,062 |

) |

| Net income |

$ |

168,339 |

|

$ |

66,233 |

|

| Attributable to: |

|

|

|

|

|

|

|

Methanex Corporation shareholders |

|

145,102 |

|

|

60,267 |

|

|

Non-controlling interests |

|

23,237 |

|

|

5,966 |

|

|

$ |

168,339 |

|

$ |

66,233 |

|

|

|

|

|

|

|

|

| Income per share for the period attributable to

Methanex Corporation shareholders |

|

|

|

|

|

|

|

Basic net income per common share |

$ |

1.51 |

|

$ |

0.64 |

|

|

Diluted net income per common share |

$ |

1.50 |

|

$ |

0.63 |

|

|

|

|

|

|

|

|

| Weighted average number of common shares outstanding

(note 7) |

|

96,298,231 |

|

|

94,514,188 |

|

| Diluted weighted average number of common shares

outstanding (note 7) |

|

96,997,489 |

|

|

95,717,869 |

|

|

|

|

|

|

|

|

| See accompanying notes to condensed consolidated

interim financial statements. |

|

|

|

|

|

|

|

|

|

| Methanex Corporation Consolidated Statements of

Comprehensive Income (unaudited) (thousands of U.S.

dollars) |

|

|

Three Months Ended |

|

|

Mar 31 |

|

Mar 31 |

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

| Net income |

$ |

168,339 |

|

$ |

66,233 |

|

|

Other comprehensive income, net of taxes: |

|

|

|

|

|

|

|

|

Items that may be reclassified to income: |

|

|

|

|

|

|

|

|

|

Change in fair value of forward exchange contracts |

|

148 |

|

|

(184 |

) |

|

|

|

Change in fair value of interest rate swap contracts |

|

(266 |