North American Construction Group Ltd. Announces C$65 Million Bought Deal Offering of 5.50% Convertible Unsecured Subordinate...

May 10 2021 - 2:31PM

North American Construction Group Ltd. (“NACG” or the “Company”)

(TSX/NYSE: NOA) is pleased to announce that it has entered into an

agreement with a syndicate of underwriters (the “Underwriters”) led

by National Bank Financial Inc. under which the underwriters have

agreed to purchase $65,000,000 aggregate principal amount of

convertible unsecured subordinated debentures due June 30, 2028

(the “Debentures”) at a price of $1,000 per Debenture (the

“Offering”). In addition, the Company has granted the Underwriters

an over-allotment option to purchase up to an additional $9,750,000

aggregate principal amount of Debentures at the same price,

exercisable in whole or in part at any time for a period of up to

30 days following closing of the Offering, to cover

over-allotments.

The Debentures will be subordinated, unsecured

obligations of NACG and will bear interest at a rate of 5.50% per

annum, payable semi-annually in arrears on June 30 and December 31

of each year, commencing December 31, 2021. The Debentures will be

convertible at any time at the option of the holders into common

shares of the Company (“Common Shares”) at a conversion price (the

“Conversion Price”) of $24.75 per share. The Debentures will

mature on June 30, 2028 (the “Maturity”).

The Debentures will not be redeemable at the

option of the Company before June 30, 2024. On or after June 30,

2024 and prior to June 30, 2026, the Debentures may be redeemed in

whole or in part at the option of the Company on not more than 60

days and not less than 30 days prior notice at a price equal to

their principal amount thereof plus accrued and unpaid interest,

provided that the volume weighted average trading price of the

Common Shares on the Toronto Stock Exchange for the 20 consecutive

trading days ending five trading days preceding the date on which

the notice of redemption is given is not less than 125% of the

Conversion Price. On or after June 30, 2026 and prior to Maturity,

the Debentures may be redeemed in whole or in part at the option of

the Company on not more than 60 days and not less than 30 days

prior notice at a price equal to their principal amount plus

accrued and unpaid interest.

NACG will use net proceeds of the Offering for

future growth opportunities, to repay outstanding indebtedness and

for general corporate purposes.

A preliminary short-form prospectus qualifying

the distribution of the Debentures will be filed with securities

regulatory authorities in all of the provinces of Canada, excluding

Quebec. The Offering is subject to customary regulatory and stock

exchange approvals, with closing expected to occur on or about June

1 , 2021.

The securities to be offered have not been and

will not be registered under the U.S. Securities Act of 1933 and

may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements of

such Act. This news release shall not constitute an offer to sell

or the solicitation of an offer to buy securities in any

jurisdiction.

About the Company

North American Construction Group Ltd.

(www.nacg.ca) is one of Canada’s largest providers of heavy

construction and mining services. For more than 65 years, NACG has

provided services to large resource-based companies.

For further information, please contact:

Jason Veenstra, CPA, CA Chief Financial Officer

North American Construction Group Ltd. Phone: (780) 948-2009 Email:

jveenstra@nacg.ca

Forward-Looking Information

The information provided in this release

contains forward-looking information and forward-looking statements

(together, “forward-looking statements”). Forward-looking

statements include statements preceded by, followed by or that

include the words “expect”, “may”, “could”, “believe”,

“anticipate”, “continue”, “should”, “estimate”, “potential”,

“likely”, “target” or similar expressions. The material factors or

assumptions used to develop the above forward-looking statements

include, and the risks and uncertainties to which such

forward-looking statements are subject, are highlighted in the

Company’s Management’s Discussion and Analysis for the year ended

December 31, 2020 and the Company’s annual information form dated

February 17, 2021. Actual results could differ materially from

those contemplated by such forward-looking statements as a result

of any number of factors and uncertainties, many of which are

beyond NACG’s control. Undue reliance should not be placed upon

forward-looking statements and NACG undertakes no obligation, other

than those required by applicable law, to update or revise those

statements. For more complete information about NACG, you should

read the Company’s disclosure documents filed with the SEC and the

CSA. You may obtain these documents for free by visiting EDGAR on

the SEC website at www.sec.gov or SEDAR on the CSA website at

www.sedar.com.

Since 1953 - Heavy Construction & Mining

Suite 300, 18817 Stony Plain Road Edmonton, Alberta T5S 0C2

Canada Phone 780.960.7171 Fax 780.969.5599www.nacg.ca

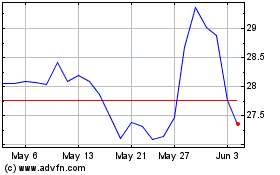

North American Construct... (TSX:NOA)

Historical Stock Chart

From Dec 2024 to Jan 2025

North American Construct... (TSX:NOA)

Historical Stock Chart

From Jan 2024 to Jan 2025