North American Construction Group Ltd. Announces Share Purchase Program in Canada and the United States

April 06 2022 - 4:05PM

North American Construction Group Ltd. (“NACG” or “the Company”)

(TSX:NOA/NYSE:NOA) today announced that it intends to commence a

normal course issuer bid (the “NCIB”) to purchase, for

cancellation, up to 2,113,054 common shares in the capital of the

Company (“Common Shares”), which represents approximately 10% of

the public float (as defined in the TSX Company Manual) and

approximately 7.05% of the issued and outstanding Common Shares as

of March 31, 2022. As at March 31, 2022, the Company had 29,974,336

Common Shares issued and outstanding. In connection with the shares

purchasable under the NCIB, the Company has entered into an

automatic share purchase plan (“ASPP”) with its designated broker.

Purchases of Common Shares under the NCIB may be

made through the facilities of the Toronto Stock Exchange (“TSX”),

the New York Stock Exchange (“NYSE”) and alternative trading

systems by means of open market transactions or by such other means

as may be permitted by the TSX and under applicable securities

laws. Under the NCIB, and in order to comply with applicable

securities laws, the Company will purchase a maximum of 1,498,716

Common Shares (or approximately 5% of the issued and outstanding

voting common shares) on the NYSE and alternative trading

systems.

The Company believes that the current market

price of its Common Shares does not fully reflect their underlying

value and that current market conditions provide opportunities for

the Company to acquire Common Shares at attractive prices. In the

Company’s view, a repurchase of Common Shares would be an effective

use of its cash resources and would be in the best interests of the

Company and its shareholders. The Company believes that it would

both enhance liquidity for shareholders seeking to sell and provide

an increase in the proportionate interests of shareholders wishing

to maintain their positions.

The NCIB is expected to commence on or about

April 11, 2022 and will terminate no later than April 10, 2023,

provided that purchases may not be made on the NYSE until April 14,

2022. All purchases of Common Shares will be made in compliance

with applicable TSX and NYSE rules. The average daily trading

volume of the Common Shares on the TSX for the six calendar months

preceding March 31, 2022 is 76,402 Common Shares. In accordance

with the TSX rules and subject to the exemption for block

purchases, a maximum daily repurchase of 25% of this average may be

made, representing 19,100 Common Shares. The price per Common Share

will be based on the market price of such shares at the time of

purchase in accordance with regulatory requirements.

Pursuant to the ASPP, the designated broker may

purchase up to 2,113,054 Common Shares until the expiry of the NCIB

on April 10, 2023. Such purchases will be determined by the broker

at its sole discretion, based on the purchasing parameters set out

by the Company in accordance with the rules of the TSX, applicable

securities laws and the terms of the ASPP. Purchases of Common

Shares under the ASPP may be made through the facilities of the

TSX, the NYSE and alternative trading systems. The ASPP has been

pre-cleared by the TSX and will be effective as of April 11, 2022.

The ASPP will terminate on the earliest of the date on which: (i)

the NCIB expires; (ii) the maximum number of Common Shares have

been purchased under the NCIB; and (iii) the Company terminates the

ASPP in accordance with its terms. Concurrent with the

establishment of the ASPP, the Company has confirmed to the broker

that it was then not aware of any material undisclosed or

non-public information with respect to the Company or any

securities of the Company. During the term of the ASPP, the Company

will not communicate any material undisclosed or non-public

information to the trading staff of the broker; accordingly, the

broker may make purchases regardless of whether a trading blackout

period is in effect or whether there is material undisclosed or

non-public information about the Company at the time that purchases

are made under the ASPP. In the event that the ASPP is materially

varied, suspended or terminated, the Company will issue a news

release advising of such variation, suspension or termination, as

applicable.

The Company was permitted to repurchase a total

of up to 2,000,000 Common Shares under the NCIB it previously

announced on April 6, 2021, of which 85,592 Common Shares were

purchased at a weighted average purchase price of $16.10 CDN per

Common Share.

About the Company

North American Construction Group Ltd.

(www.nacg.ca) is one of Canada’s largest providers of heavy civil

construction and mining contractors. For more than 65 years, NACG

has provided services to large oil, natural gas and resource

companies.

For further information contact:Jason Veenstra,

CPA, CAChief Financial OfficerNorth American Construction Group

Ltd.(780) 960-7171ir@nacg.ca

www.nacg.ca

Forward-Looking Information

The information provided in this news release

contains forward-looking statements. Forward-looking statements

include statements preceded by, followed by or that include the

words “will”, “intends”, “expect”, “may”, “could”, “believe”,

“anticipate”, “should” or similar expressions. In particular, this

news release contains forward-looking statements and information

relating to the Company’s belief that the NCIB is in the best

interests of the Company and its shareholders and that underlying

value of the Company may not be reflected in the market price of

the Common Shares, the Company’s intentions regarding the NCIB and

whether the Company will receive the requisite approval of the TSX

in respect of the NCIB. Forward-looking statements in this news

release are being made by NACG based on certain assumptions that

NACG has made in respect thereof as at the date of this news

release. These forward-looking statements are not guarantees of

future performance and are subject to a number of known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Company to differ

materially from anticipated future results, performance or

achievement expressed or implied by such forward-looking statements

and information. The material factors or assumptions used to

develop such forward-looking statements include, and the risks and

uncertainties to which such forward-looking statements are subject,

are highlighted in the MD&A for the quarter and year ended

December 31, 2021. Actual results could differ materially from

those contemplated by such forward-looking statements because of

any number of factors and uncertainties, many of which are beyond

NACG’s control. Undue reliance should not be placed upon

forward-looking statements and NACG undertakes no obligation, other

than those required by applicable law, to update or revise those

statements. For more complete information about NACG, please read

our disclosure documents filed with the SEC and the CSA. These free

documents can be obtained by visiting EDGAR on the SEC website at

www.sec.gov or on the CSA website at www.sedar.com.

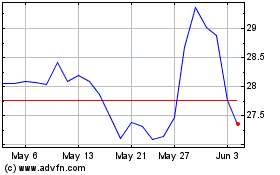

North American Construct... (TSX:NOA)

Historical Stock Chart

From Nov 2024 to Dec 2024

North American Construct... (TSX:NOA)

Historical Stock Chart

From Dec 2023 to Dec 2024