Nutrien Announces TSX Approval for Its Renewed Share Repurchase Program

February 25 2021 - 8:00AM

Business Wire

Nutrien Ltd. (TSX and NYSE: NTR) (Nutrien) today announced that

the Toronto Stock Exchange (TSX) has accepted Nutrien's notice to

commence a normal course issuer bid (NCIB) to purchase up to five

percent of its outstanding common shares.

Under the NCIB, purchases of common shares may be made through

the facilities of the TSX, the New York Stock Exchange or

alternative Canadian trading systems, or as otherwise permitted by

the Canadian Securities Administrators. The actual number of common

shares that may be purchased under the NCIB and the timing of any

such purchases will be determined by Nutrien. Nutrien believes that

purchasing its own common shares represents an attractive

investment opportunity, is in the best interests of the company and

is consistent with Nutrien's objective of delivering a strong

return of capital to its shareholders over time. As of February 16,

2021, Nutrien had 569,368,963 common shares outstanding and,

therefore, is permitted to repurchase up to 28,468,448 of its

outstanding common shares pursuant to the NCIB. Common shares

purchased under the NCIB will be cancelled.

The NCIB will be effected in accordance with the TSX normal

course issuer bid rules and/or Rule 10b-18 under the U.S.

Securities Exchange Act of 1934, as amended, which contain

restrictions on the number of common shares that may be purchased

on a single day, subject to certain exceptions for block purchases,

based on the average daily trading volumes of Nutrien's common

shares on the applicable exchange. Subject to exceptions for block

purchases, Nutrien will limit daily purchases of common shares on

the TSX in connection with the NCIB to no more than 25 percent

(357,658 common shares) of the average daily trading volume of the

common shares on the TSX (1,430,634 common shares) during any

trading day. Purchases under the NCIB will be made through open

market purchases at market price, as well as by other means as may

be permitted by applicable securities regulatory authorities,

including private agreements. Any purchases made by private

agreement under an issuer bid exemption order issued by a

securities regulatory authority will be at a discount to the

prevailing market price as provided in any exemption order.

Purchases of common shares may commence on March 1, 2021 and will

expire on the earlier of February 28, 2022, the date on which the

company has acquired the maximum number of common shares allowable

or otherwise decides not to make any further repurchases. Nutrien

has entered into an automatic purchase plan with a broker which

will enable Nutrien to provide standard instructions and purchase

common shares on the open market during self-imposed blackout

periods. Outside of these black-out periods, common shares may be

purchased in accordance with management's discretion.

Nutrien's prior NCIB for the purchase of up to 28,572,458 common

shares will expire on February 26, 2021. As of February 16, 2021,

Nutrien has repurchased an aggregate of 710,100 common shares at a

weighted-average price of US$39.31 per share, excluding brokerage

fees, under the prior NCIB. Purchases were made on the open

market.

Forward-Looking Statements

Certain statements and other information included in this press

release constitute "forward-looking information" or

"forward-looking statements" (collectively, "forward-looking

statements") under applicable securities laws (such statements are

usually accompanied by words such as "anticipate", "expect",

"believe", "may", "will", "should", "estimate", "intend" or other

similar words). All statements in this press release, other than

those relating to historical information or current conditions, are

forward-looking statements, including, but not limited to the

timing, methods and quantity of any purchases by Nutrien of its

common shares under the NCIB.

Forward-looking statements in this press release are based on

certain key expectations and assumptions made by Nutrien, including

expectations and assumptions concerning: Nutrien's views with

respect to its financial condition and prospects, the stability of

general economic and market conditions, currency exchange rates and

interest rates, the availability of cash for repurchases of common

shares under the NCIB, the existence of alternative uses for

Nutrien's cash resources and compliance with applicable laws and

regulations pertaining to the NCIB. Although Nutrien believes that

the expectations and assumptions on which such forward-looking

statements are based are reasonable, undue reliance should not be

placed on the forward-looking statements because Nutrien can give

no assurance that they will prove to be correct.

Forward-looking statements are subject to various risks and

uncertainties which could cause actual results and experience to

differ materially from the anticipated results or expectations

expressed in this press release. The key risks and uncertainties

include, but are not limited to: Nutrien's future capital

requirements; market and general economic conditions; demand for

Nutrien's products; and unforeseen legal or regulatory developments

and other risk factors detailed from time to time in Nutrien

reports filed with the Canadian securities regulatory authorities

and the United States Securities and Exchange Commission.

The forward-looking statements in this document are made as of

the date hereof and Nutrien disclaims any intention or obligation

to update or revise any forward-looking statements in this press

release as a result of new information or future events, except as

may be required under applicable laws.

About Nutrien

Nutrien is the world's largest provider of crop inputs and

services, playing a critical role in helping growers increase food

production in a sustainable manner. We produce and distribute 27

million tonnes of potash, nitrogen and phosphate products

world-wide. With this capability and our leading agriculture retail

network, we are well positioned to supply the needs of our

customers. We operate with a long-term view and are committed to

working with our stakeholders as we address our economic,

environmental and social priorities. The scale and diversity of our

integrated portfolio provides a stable earnings base, multiple

avenues for growth and the opportunity to return capital to

shareholders.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210225005265/en/

Investor Relations Richard Downey Vice President,

Investor Relations (403) 225-7357

Tim Mizuno Director, Investor Relations (306) 933-8548

Media Relations Megan Fielding Vice President, Brand

& Culture Communications (403) 797-3015

Contact us at: www.nutrien.com

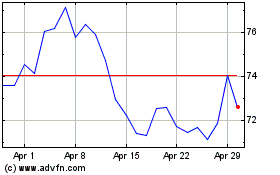

Nutrien (TSX:NTR)

Historical Stock Chart

From Feb 2025 to Mar 2025

Nutrien (TSX:NTR)

Historical Stock Chart

From Mar 2024 to Mar 2025