OBSIDIAN ENERGY LTD. (TSX – OBE, OTCQX – OBELF)

(“

Obsidian Energy”, the

“

Company”, “

we”,

“

us” or “

our”) is pleased to

announce that it has filed an amended and restated preliminary

short form prospectus (the “

Amended and Restated

Prospectus”) in connection with its previously announced

marketed offering (the “

Offering”) of subscription

receipts of the Company (“

Subscription Receipts”).

The Amended and Restated Prospectus provides that the price of the

Subscription Receipts to be issued and sold pursuant to the

Offering will be $4.40 per Subscription Receipt for gross proceeds

of up to $22.5 million.

The Offering is being conducted on a “best

efforts” agency basis by lead agents and joint bookrunners, Raymond

James Ltd. and Stifel Nicolaus Canada Inc. (the

“Agents”). The Agents have advised Obsidian Energy

that they expect the maximum Offering size will be reached.

The Company has granted the Agents an option

(the “Over-Allotment Option”) to offer and sell

that number of additional Subscription Receipts as is equal to 15

percent of the aggregate number of Subscription Receipts sold under

the Offering on the same terms and conditions as the Offering. The

Over-Allotment Option is exercisable at any time for a period of 30

days after the closing of the Offering.

The Subscription Receipts will be offered in all

Canadian provinces, excluding Québec, by way of a short form

prospectus, and in the United States on a private placement basis

to a limited number of “accredited investors” pursuant to the

registration exemption provided by Rule 506(b) of Regulation D

under the United States Securities Act of 1933, as amended (the

“U.S. Securities Act”). In connection with the

forgoing, the Company has filed the Amended and Restated Prospectus

in each of the provinces of Canada, other than Québec, amending and

restating the preliminary short form prospectus filed on November

2, 2021. There will not be any sale of Subscription Receipts until

a receipt for the final short form prospectus has been issued.

The net proceeds from the Offering will used by

the Company to facilitate the funding of a portion of the purchase

price of the acquisition of the remaining 45% non-operated working

interest in the Company’s Peace River Oil Partnership from its

existing partner (the “Acquisition”) pursuant to

the terms of a definitive agreement entered into between the

parties (the “Acquisition Agreement”). The

Acquisition is expected to close the week of November 15, 2021.

Based on the expectation that the maximum Offering size will be

reached, no common shares of the Company (“Common

Shares") will be issued under the Acquisition

Agreement.

The gross proceeds from the sale of Subscription

Receipts pursuant to the Offering will be held in escrow pending

the completion of the Acquisition. If all conditions to the

completion of the Acquisition are satisfied or waived (other than

funding the portion of the purchase price therefor to be financed

with the net proceeds of the Offering) and Obsidian Energy has

confirmed the same to the Agents before 5:00 p.m. (Calgary time) on

December 31, 2021, the net proceeds from the sale of the

Subscription Receipts will be released from escrow to Obsidian

Energy, and each Subscription Receipt will automatically be

exchanged for one Common Share for no additional consideration and

without any action on the part of the holder. If: (i) the

Acquisition is not completed at or before 5:00 p.m. (Calgary time)

on December 31, 2021; (ii) the Acquisition Agreement is terminated

in accordance with its terms; or (iii) the Company advises the

Agents or formally announces to the public by way of a news release

or otherwise that it does not intend to proceed with the

Acquisition then the purchase price for the Subscription Receipts

will be returned pro rata to subscribers, together with a pro rata

portion of interest earned on the escrowed funds.

The Offering is expected to close during the

week of November 15, 2021.

No securities regulatory authority has either

approved or disapproved of the contents of this news release. The

Subscription Receipts and underlying Common Shares, have not been

and will not be registered under the U.S. Securities Act or any

state securities laws. Accordingly, the securities described herein

may not be offered or sold within the “United States” unless

registered under the U.S. Securities Act and applicable state

securities laws or pursuant to exemptions from such registration

requirements. This news release does not constitute an offer to

sell or a solicitation of an offer to buy any securities of

Obsidian Energy in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this news

release constitute forward-looking statements. These statements

relate to future events or future performance. All statements other

than statements of historical fact may be forward-looking

statements. Forward-looking statements are often, but not always,

identified by the use of words such as “seek”, “anticipate”,

“plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”,

“predict”, “potential”, “targeting”, “intend”, “could”, “might”,

“should”, “believe” and similar expressions. These statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements. Obsidian

Energy believes the expectations reflected in those forward-looking

statements are reasonable, but no assurance can be given that these

expectations will prove to be correct and such forward-looking

statements included in this news release should not be unduly

relied upon. These statements speak only as of the date of this

news release.

This news release contains, without limitation,

forward-looking statements pertaining to the following: the

anticipated closing date of the Acquisition; the expectation that

the maximum Offering size will be reached; the anticipated closing

date of the Offering; and the anticipated jurisdictions in which

Subscription Receipts will be offered.

With respect to forward-looking statements

contained in this news release, Obsidian Energy has made

assumptions regarding, among other things: the Company’s ability to

close the Offering and the Acquisition, including the transactions

and financings contemplated thereby, on a timely basis and on the

terms expected; the fulfillment by the Agents in respect of the of

their obligations pursuant to the agency agreement and the entering

into thereof; the satisfaction of all conditions to the completion

of the Acquisition or the waiver thereof; the receipt of all

required regulatory approvals in respect of the Offering; the

timing of the Acquisition and the Offering; commodity prices;

availability of skilled labour; timing and amount of future capital

expenditures; future exchange and interest rates; future oil and

natural gas production rates; the ability of Obsidian Energy to use

its current tax pools and attributes in the future and that the use

of such tax pools and attributes will not be successfully

challenged by any taxing authority; the impact of increasing

competition; conditions in general economic and financial markets;

access to capital; availability of drilling and related equipment;

effects of regulation by governmental agencies; royalty rates and

future operating costs.

There is no certainty that the maximum Offering

size will be reached or that the Offering will be completed at all.

Some of the risks that could affect the Company’s future results or

the Offering and could cause actual results to differ materially

from those expressed in the forward-looking statements include: the

continuing impact of COVID-19 and developments related to the

variants thereof on economic activity and demand for oil and

natural gas; volatility in market prices for oil and natural gas;

incorrect assumptions associated with the location and pace of

development on assets; liabilities inherent in oil and natural gas

operations; uncertainties associated with estimating oil and

natural gas reserves; competition for, among other things, capital,

acquisitions of royalty reserves, undeveloped lands and skilled

personnel; incorrect assessments of the value of acquisitions,

including the Acquisition; risks related to the environment and

changing environmental laws, such as, carbon tax and methane

emissions regulations; geological, technical, drilling, and

processing problems; currency exchange rate, fluctuations; changes

in income tax laws or changes in tax laws and incentive programs

relating to the oil and gas industry; and the inability of the

Company to complete some or all of the financings required to fund

the purchase price for the Acquisition (on acceptable terms or at

all) or to satisfy all of the conditions to closing the

Acquisition.

Readers are cautioned that the foregoing lists

of factors are not exhaustive. Readers are cautioned that the

assumptions used in the preparation of such information, although

considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on

forward-looking information. Obsidian Energy gives no assurance

that any of the events anticipated will transpire or occur, or if

any of them do, what benefits Obsidian Energy will derive from

them. The forward-looking statements contained in this news release

are expressly qualified by this cautionary statement. Except as

required by law, the Company does not undertake any obligation to

publicly update or revise any forward-looking statements. Readers

should also carefully consider the matters discussed under the

heading “Risk Factors” in Obsidian Energy’s annual information form

for the year ended December 31, 2020, which is available under

Obsidian Energy’s profile on SEDAR at www.sedar.com.

Obsidian Energy shares are listed on both the

Toronto Stock Exchange in Canada and the OTCQX Market in the United

States under the symbol “OBE” and “OBELF” respectively.

All figures are in Canadian dollars unless

otherwise stated.

Contact

OBSIDIAN ENERGYSuite 200, 207 -

9th Avenue SW, Calgary, Alberta T2P 1K3Phone: 403-777-2500Toll

Free: 1-866-693-2707Website: www.obsidianenergy.com;

Investor Relations: Toll Free:

1-888-770-2633E-mail: investor.relations@obsidianenergy.com

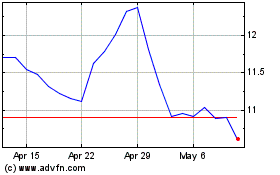

Obsidian Energy (TSX:OBE)

Historical Stock Chart

From Dec 2024 to Jan 2025

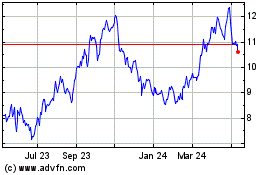

Obsidian Energy (TSX:OBE)

Historical Stock Chart

From Jan 2024 to Jan 2025