Ninepoint Partners and Third Eye Capital Announce Pieridae Energy’s Successful Refinancing and Early Repayment of Term Loan

June 15 2023 - 11:51AM

Ninepoint Partners LP (“Ninepoint”), one of Canada’s leading

alternative investment managers, and Third Eye Capital Corporation

(“TEC” or “Third Eye Capital”), whose affiliate, Third Eye Capital

Management Inc., is sub-advisor of the Ninepoint-TEC Private Credit

Fund and the Ninepoint-TEC Private Credit Fund II (“the Funds”),

today announced that Pieridae Energy Limited (“Pieridae”) (TSX:PEA)

has successfully refinanced a senior secured non-revolving term

loan facility. In conjunction with the refinancing, Pieridae will

enter a new loan with Prudential Private Capital, the private

capital arm of PGIM, the US$1.3 trillion global investment

management business of Prudential Financial, Inc. (NYSE: PRU), and

Voya Investment Management which manages approximately US$323

billion as of March 31, 2023.

Proceeds from the refinancing will be used to

fully repay the current outstanding debt of $185 million to funds

managed, sub-advised, or operated by affiliates of Third Eye

Capital. The term loan was originally provided to Pieridae in

October 2019 and has produced a double-digit internal rate of

return for the Funds.

Through this repayment, the Ninepoint-TEC

Private Credit Fund and Ninepoint-TEC Private Credit Fund II will

receive their respective pro-rata share of collectively $123

million. The repayment to both funds will be made upon closing of

the refinancing transaction and will provide significant liquidity

to service their cash requirements and will position the

Ninepoint-TEC Private Credit Fund II to continue to invest and

grow. Since inception in 2010, the Ninepoint-TEC Private Credit

strategy has produced an annualized net return of 10.33%.

“The transaction is a prime example of the

pivotal role private credit plays in the Canadian economy by

helping to support and grow successful businesses that typically

don’t have access to traditional lenders, like the Canadian banks,”

said Ramesh Kashyap, Managing Director and Head of Ninepoint’s

Alternative Income Group. “By focusing on senior secured loans

positioned at the top of the capital structure, the Ninepoint-TEC

Private Credit strategy has been able to deliver healthy,

risk-adjusted returns to our investors all the while helping

companies like Pieridae strategically support and scale their

businesses.”

Third Eye Capital provided the senior secured

term loan to Pieridae to help finance its purchase of Shell Canada

Energy’s (“Shell”) midstream and upstream assets in the Southern

Alberta Foothills in 2019. The transaction and term loan allowed

Pieridae to retain more than 200 jobs for former Shell Canada

employees. With the addition of these new employees, Pieridae has

become a significant employer in the region with roughly 300

employees and has contributed millions of dollars to the local and

Canadian economy. The integration of the Shell assets has enabled

Pieridae to become the largest Foothills producer in North America,

growing net operating income from $25 million in 2019 to $201

million in 2022.

“The refinancing of Pieridae’s debt today is

further evidence of the high quality investments that Third Eye

Capital makes, which may be overlooked or underappreciated by

others. It not only demonstrates our ability to identify hidden

gems and capitalize on market inefficiencies, but also shows how

our private credit strategy empowers our borrowers and their own

employees, stakeholders, and local economies,” said Arif Bhalwani,

Chief Executive Officer at Third Eye Capital.

Third Eye Capital made the $200-million (net)

loan to Pieridae in 2019 through Erikson National Energy Inc.

(“Erikson”), a special purpose entity partially financially backed

by Ninepoint-TEC Private Credit Fund and the Ninepoint-TEC Private

Credit Fund II. Through to today, Erikson has received $370 million

in cash payments, comprising principal, interest and fees from the

loan. Erikson will retain a $20 million short-term, senior secured

loan at Pieridae Energy’s parent company, and it currently owns

about 15% of Pieridae Energy’s common stock.

About Ninepoint Partners

Based in Toronto, Ninepoint Partners LP is one

of Canada’s leading alternative investment management firms

overseeing approximately $8 billion in assets under management and

institutional contracts. Committed to helping investors explore

innovative investment solutions that have the potential to enhance

returns and manage portfolio risk, Ninepoint offers a diverse set

of alternative strategies spanning Equities, Fixed Income,

Alternative Income, Real Assets, F/X and Digital Assets. Ninepoint

Digital Asset Group is a division of Ninepoint.

For more information on Ninepoint, please visit

www.ninepoint.com or contact us at 416-362-7172 or 1-888-362-7172

or institutional@ninepoint.com.

About Third Eye Capital

Founded in 2005, Third Eye Capital is Canada’s

leading provider of asset-based financing solutions to companies

that are underserved or overlooked by traditional sources of

capital. With a proven track record of nearly $5 billion in lending

commitments across more than 125 portfolio investments, Third Eye

Capital is one of the most experienced private debt firms in

Canada. From navigating through periods of extreme distress to

embracing moments of extraordinary change, Third Eye Capital excels

at executing opportunities that other lenders simply cannot or will

not pursue. Third Eye Capital actively engages with a company’s key

assets to bridge the gap between their perceived value and actual

worth, and provides access to capital and expertise that enables

portfolio companies to flourish.

Media Inquiries

Scott Deveau/Kate Sylvester Longacre Square

Partners ninepoint@longacresquare.com

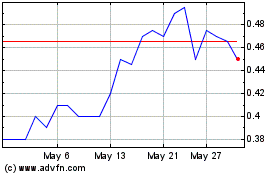

Pieridae Energy (TSX:PEA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Pieridae Energy (TSX:PEA)

Historical Stock Chart

From Dec 2023 to Dec 2024