Pieridae Energy Limited (“Pieridae” or the “Company”) (TSX:

PEA) is pleased to provide 2024 guidance including

scope of the 2024 capital program along with production and net

operating income projections.

|

2024 Guidance Estimates |

Initial Guidance (Dec-23) |

|

Low |

High |

|

Production (boe/d) |

33,000 |

34,500 |

|

Net Operating Income ($M) (1)(2)(3) |

$80,000 |

$100,000 |

|

Operating Netback ($/boe) (2)(3) |

$6.50 |

$8.00 |

|

Capital Expenditures ($M) |

$28,000 |

$33,000 |

(1) Refer to the “non-GAAP measures” section of the

Company’s latest MD&A(2) Assumes average 2024 AECO price

of $2.25/GJ and average 2024 WTI price of

USD$70/bbl(3) Accounts for impact of hedging contracts in

place as at December 7, 2023

Pieridae’s specific priorities for 2024 are:

-

Maximize processing facility reliability to meet production

targets;

-

Reduce operating and G&A expenses to improve corporate netback;

and

-

Reduce long term debt to further de-risk the balance sheet.

Pieridae has hedged approximately 65% of its

expected 2024 natural gas production at approximately $3.50/Mcf,

and approximately 59% of its expected 2024 condensate production

using swaps and an $80.00 x $90.75 CAD WTI collar. The unrealized

gain on the Company’s hedge portfolio is approximately $62 million,

using the forward strip as of December 6, 2023.

Pieridae’s 2024 production guidance of 33,000 to

34,500 boe/d reflects the Company’s low 8% base decline rate

mitigated by low-cost optimization initiatives and an expectation

of less facility downtime than was experienced in 2023. The

Company’s current onstream production capability and 2023 exit rate

is approximately 37,500 boe/d.

Pieridae’s $28-$33 million 2024 capital budget

is highlighted by the second and final phase of the maintenance

turnaround at the Company’s Waterton deep-cut, sour gas processing

facility, which is scheduled for the third quarter. Pieridae owns

and operates three major gas processing facilities which each

require periodic maintenance turnarounds on a five-to-six-year

cycle. The Company successfully completed phase 1 of the Waterton

turnaround from August to October of 2023.

Due to the current outlook for North American

natural gas prices, Pieridae is not currently planning to resume

drilling operations during 2024. The Company is instead directing

its available capital towards certain low-risk, short-payout

production and facility optimization projects to mitigate

production decline. Pieridae plans to continue to exploit its

portfolio of high impact conventional Foothills drilling

opportunities once the Company has achieved its deleveraging

target, natural gas prices recover, and risked project economics

improve.

ABOUT PIERIDAE

Pieridae is a Canadian energy company

headquartered in Calgary, Alberta. The Company is a significant

upstream producer of conventional natural gas, NGLs, condensate and

sulphur from the Canadian Foothills of Alberta and northeast

British Columbia. Pieridae’s vision is to provide responsible,

affordable natural gas and derived products to meet society’s

energy security needs. Pieridae’s common shares trade on the TSX

under the symbol “PEA”.

For further information, visit

www.pieridaeenergy.com, or please contact:

| Darcy

Reding, President & Chief Executive Officer |

Adam

Gray, Chief Financial Officer |

| Telephone: (403) 261-5900 |

Telephone: (403) 261-5900 |

| |

|

| Investor Relations |

|

| investors@pieridaeenergy.com |

|

| |

|

Forward-Looking

StatementsCertain statements contained herein may

constitute "forward-looking statements" or "forward-looking

information" within the meaning of applicable securities laws

(collectively "forward-looking statements"). Words such as "may",

"will", "should", "could", "anticipate", "believe", "expect",

"intend", "plan", "potential", "continue", "shall", "estimate",

"expect", "propose", "might", "project", "predict", "forecast" and

similar expressions may be used to identify these forward-looking

statements.

Forward-looking statements involve significant

risk and uncertainties. A number of factors could cause actual

results to differ materially from the results discussed in the

forward-looking statements including, but not limited to, risks

associated with oil and gas exploration, development, exploitation,

production, marketing and transportation, loss of markets,

volatility of commodity prices, currency fluctuations, imprecision

of resources estimates, environmental risks, competition from other

producers, incorrect assessment of the value of acquisitions,

failure to realize the anticipated benefits or synergies from

acquisitions, delays resulting from or inability to obtain required

regulatory approvals and ability to access sufficient capital from

internal and external sources and the risk factors outlined under

"Risk Factors" and elsewhere herein. The recovery and resources

estimate of Pieridae's reserves provided herein are estimates only

and there is no guarantee that the estimated resources will be

recovered. As a consequence, actual results may differ materially

from those anticipated in the forward-looking statements.

Forward-looking statements are based on a number

of factors and assumptions which have been used to develop such

forward-looking statements, but which may prove to be incorrect.

Although Pieridae believes that the expectations reflected in such

forward-looking statements are reasonable, undue reliance should

not be placed on forward-looking statements because Pieridae can

give no assurance that such expectations will prove to be correct.

In addition to other factors and assumptions which may be

identified in this document, assumptions have been made regarding,

among other things: the impact of increasing competition; the

general stability of the economic and political environment in

which Pieridae operates; the timely receipt of any required

regulatory approvals; the ability of Pieridae to obtain qualified

staff, equipment and services in a timely and cost efficient

manner; the ability of the operator of the projects which Pieridae

has an interest in, to operate the field in a safe, efficient and

effective manner; the ability of Pieridae to obtain financing on

acceptable terms; the ability to replace and expand oil and natural

gas resources through acquisition, development and exploration; the

timing and costs of pipeline, storage and facility construction and

expansion and the ability of Pieridae to secure adequate product

transportation; future commodity prices; currency, exchange and

interest rates; the regulatory framework regarding royalties, taxes

and environmental matters in the jurisdictions in which Pieridae

operates; timing and amount of capital expenditures, future sources

of funding, production levels, weather conditions, success of

exploration and development activities, access to gathering,

processing and pipeline systems, advancing technologies, and the

ability of Pieridae to successfully market its oil and natural gas

products.

Readers are cautioned that the foregoing list of

factors is not exhaustive. Additional information on these and

other factors that could affect Pieridae's operations and financial

results are included in reports on file with Canadian securities

regulatory authorities and may be accessed through the SEDAR

website (www.sedar.com), and at Pieridae's website

(www.pieridaeenergy.com). Although the forward-looking statements

contained herein are based upon what management believes to be

reasonable assumptions, management cannot assure that actual

results will be consistent with these forward-looking statements.

Investors should not place undue reliance on forward-looking

statements. These forward-looking statements are made as of the

date hereof and Pieridae assumes no obligation to update or review

them to reflect new events or circumstances except as required by

Applicable Securities Laws.

Forward-looking statements contained herein

concerning the oil and gas industry and Pieridae's general

expectations concerning this industry are based on estimates

prepared by management using data from publicly available industry

sources as well as from reserve reports, market research and

industry analysis and on assumptions based on data and knowledge of

this industry which Pieridae believes to be reasonable. However,

this data is inherently imprecise, although generally indicative of

relative market positions, market shares and performance

characteristics. While Pieridae is not aware of any misstatements

regarding any industry data presented herein, the industry involves

risks and uncertainties and is subject to change based on various

factors.

Additional Reader

AdvisoriesBarrels of oil equivalent (“boe”) may be

misleading, particularly if used in isolation. A boe conversion

ratio of 6 Mcf: 1 boe is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead.

Abbreviations

|

Natural Gas |

Oil |

|

mcf |

thousand cubic feet |

bbl/d |

barrels per day |

|

mcf/d |

thousand cubic feet per day |

boe/d |

barrels of oil equivalent per

day |

|

mmcf/d |

million cubic feet per day |

WCS |

Western Canadian Select |

|

AECO |

Alberta benchmark price for natural gas |

WTI |

West Texas Intermediate |

|

|

|

|

|

Neither TSX nor its Regulation Services

Provider (as that term is defined in policies of the TSX) accepts

responsibility for the adequacy or accuracy of this

release.

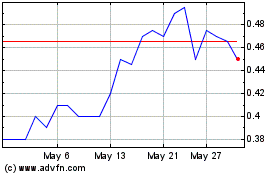

Pieridae Energy (TSX:PEA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Pieridae Energy (TSX:PEA)

Historical Stock Chart

From Dec 2023 to Dec 2024