Primaris Retail REIT (TSX: PMZ.UN) is reporting stable operating

results and continued strong liquidity.

President and CEO, Michael Latimer, commented "Primaris'

financial position remains strong in these uncertain times. While

it is encouraging to see some capital markets activity during the

first quarter, market conditions are by no means normal. We have a

cautious outlook for future operating results because we see less

depth to tenant demand for vacant space. However, to date,

occupancy rates remain solid and rents continue to grow on renewal

of leases."

Highlights

Liquidity

- Primaris continues to remain extremely liquid. It has $80

million cash and a $120 million unutilized credit facility. There

is one loan maturity in 2009 of $3.7 million that needs to be

re-financed and there are no loan maturities in 2010. There are no

commitments to fund mezzanine loans.

Funds From Operations

- Funds from operations for the first quarter ended March 31,

2009 were $21.8 million or $0.347 per unit diluted, down 4.4% on a

per unit basis from the $22.7 million, or $0.363 per unit diluted

reported for the first quarter of 2008.

Net Operating Income

- Net operating income for the first quarter ended March 31,

2009, was $37.5 million, virtually the same as the $37.6 million

recorded in the first quarter of 2008.

Same Property - Net Operating Income

- Net operating income for the first quarter ended March 31,

2009, on a same property basis, decreased 0.4% over the comparative

three-month period. Primaris is currently externally managed and as

previously announced, the rate of the property management fee

increased during the third quarter of 2008. After adjusting for the

$842 increase in the property management fees during 2009, same

property net operating income would have increased 1.9%.

Operations

- The REIT renewed or leased 392,426 square feet of space during

the first quarter, which includes the renewal of one anchor store.

The weighted average new rent in these leases, on a cash basis,

represented a 6.2% increase over the previous rent paid (5.8%

excluding the anchor store).

- The portfolio occupancy rate decreased during the first

quarter and was 97.3% at March 31, 2009, compared to 98.2% at

December 31, 2008, and the same as the 97.3% at March 31, 2008.

- Same-tenant sales, for the 13 reporting properties owned

during all of the 24 months ended February 28, 2009 decreased 1.8%

to $470 per square foot as compared to the previous 12 months.

- The first quarter results included seasonal revenues of $2.6

million as compared to $2.3 million recorded in the first quarter

of 2008.

Liquidity

Primaris continues to remain extremely liquid. It has $80

million cash invested in Treasury Bills and a variety of high

quality Bankers Acceptances and bearer deposit notes, and has a

$120 million unutilized credit facility not maturing until mid

2010. There is one loan maturity in 2009 of $3.7 million and there

are no loan maturities in 2010. The annual requirement to fund loan

principal payments amounts to approximately $20 million. There are

no commitments to fund mezzanine loans.

Financial Results

Funds from operations for the three months ended March 31, 2009

was $21.8 million or $0.350 per unit basic ($0.347 diluted). This

compares to funds from operations of $22.7 million or $0.366 per

unit basic ($0.363 diluted) earned during the three months ended

March 31, 2008.

Net income for the three months ended March 31, 2009 was $0.5

million or $0.008 per unit (basic and diluted). This compares to

net income of $2.4 million or $0.038 per unit (basic and diluted)

earned during the three months ended March 31, 2008.

Funds from Operations and Net Income for the three months ended

March 31, 2009 include a gain of $467 resulting from the repurchase

of $3,051 (cost $2,288) of the 5.85% convertible debentures. This

repurchase occurred in the late March 2009.

The REIT made one small acquisition in the first quarter of 2008

and two small acquisitions in the fourth quarter of 2008, which

contributed to operations for the three months ended March 31,

2009. The total purchase price for the acquisitions was $14.6

million.

The distribution payout ratio for the first quarter of 2009,

expressed on a per unit basis as distributions paid divided by

diluted funds from operations was 87.8% as compared to a 84.0%

payout ratio for the first quarter of 2008. The payout ratios are

sensitive to both seasonal operating results and financial

leverage.

At March 31, 2009, the REIT's total enterprise value was

approximately $1.5 billion (based on the market closing price of

Primaris' units on March 31, 2009, plus total debt outstanding). At

March 31, 2009 the REIT had $978.7 million of outstanding debt

equating to a debt to total enterprise value ratio of 63.4% . On a

net of cash basis, this ratio would be 58.3% . The REIT's debt

consisted of $885.6 million of fixed-rate senior debt with a

weighted average interest rate of 5.7% and a weighted average term

to maturity of 7.5 years, $5.9 million of 6.75% fixed-rate

convertible debentures and $87.2 million of 5.85% fixed-rate

convertible debentures. The REIT had a debt to gross book value

ratio, as defined under the Declaration of Trust, of 49.1% . During

the three months ended March 31, 2009, the REIT had an interest

coverage ratio of 2.5 times as expressed by EBITDA divided by net

interest expensed. The REIT defines EBITDA as net income increased

by depreciation, amortization, interest expense and income tax

expense. EBITDA is a non-GAAP measure and may not be comparable to

similar measures used by other Trusts.

Operating Results

Net Operating Income - Same Properties

Three Months Three Months Variance to

Ended Ended Comparative Period

Favourable/

March 31, 2009 March 31, 2008 (Unfavourable)

Operating revenue $ 68,010 $ 65,650 $ 2,360

Operating expenses 30,644 28,152 (2,492)

------------------------------------------------------

Net operating income $ 37,366 $ 37,498 $ (132)

------------------------------------------------------

The same property comparison includes only 26 properties that

were owned throughout both the current and comparative three-month

periods. Net operating income, on a same property basis, decreased

$132, or 0.4%, over the comparative three-month period. Net

operating income, on a same-property basis, would have increased

1.9% excluding the net change in the property management fees of

$842.

Tenant sales

Tenant sales per square foot, on a same-tenant basis, have

decreased to $470 for the 12 months ended February 28, 2009. Total

tenant volume has increased by 0.9% when comparing sales for the

same properties.

Same-Tenant

Sales per Square Foot Variance

2009 2008 $ %

---------------------------------------------

Aberdeen Mall $ 429 $ 444 $ (14) (3.2%)

Cornwall Centre 551 524 28 5.3%

Dufferin Mall 558 563 (5) (1.0%)

Eglinton Square 343 343 (1) (0.2%)

Grant Park Shopping Centre 492 495 (3) (0.5%)

Lambton Mall 370 382 (12) (3.2%)

Midtown Plaza 565 548 17 3.1%

Northland Village 461 461 0 0.1%

Orchard Park Shopping Centre 528 557 (29) (5.1%)

Park Place Shopping Centre 523 527 (4) (0.8%)

Place Fleur de Lys 309 311 (2) (0.6%)

Place du Royaume 389 392 (3) (0.8%)

Stone Road Mall 568 568 (1) (0.1%)

---------------------------------------------

$ 470 $ 473 $ (3) (1.8%)

---------------------------------------------

All-Tenant

Total Sales Volume Variance

2009 2008 $ %

---------------------------------------------

Aberdeen Mall $ 52,015 $ 53,496 $ (1,481) (2.8%)

Cornwall Centre 77,699 73,427 4,272 5.8%

Dufferin Mall 89,583 89,398 185 0.2%

Eglinton Square 34,103 39,505 (5,402) (13.7%)

Grant Park Shopping Centre 29,805 29,686 119 0.4%

Lambton Mall 51,849 54,057 (2,208) (4.1%)

Midtown Plaza 135,812 126,737 9,075 7.2%

Northland Village 47,684 46,826 858 1.8%

Orchard Park Shopping Centre 147,081 149,839 (2,758) (1.8%)

Park Place Shopping Centre 81,571 80,590 981 1.2%

Place Fleur de Lys 73,660 73,285 375 0.5%

Place du Royaume 104,796 101,692 3,104 3.1%

Stone Road Mall 117,900 115,657 2,243 1.9%

---------------------------------------------

$ 1,043,558 $ 1,034,196 $ 9,363 0.9%

---------------------------------------------

The REIT's sales decreased 1.8% per square foot, while the

national average tenant sales as reported by the International

Council of Shopping Centers ("ICSC") for the 12-month period ended

February 28, 2009 increased 2.2%. The REIT's sales productivity of

$470 is lower than the ICSC average of $561, largely because the

ICSC includes sales from super regional malls that have the highest

sales per square foot in the country. However the ICSC data point

is for all tenant sales. The REIT's all tenant sales per square

foot increase was 0.2% for same period, lower than the ICSC figure

of 2.2%.

Leasing activity

Primaris Retail REIT's property portfolio remains well

leased.

The portfolio occupancy rate decreased during the first quarter

and was 97.3% at March 31, 2009, down from 98.2% at December 31,

2009, and the same as the 97.3% at March 31, 2008. These

percentages include space for which signed leases are in place but

where the tenant may not yet be in occupancy.

The REIT leased 392,426 square feet of space during the first

quarter of 2009. This represented 89 leases of generally smaller

stores and the renewal of one anchor store. Approximately 83% of

the leased spaces during the first quarter of 2009 consisted of the

renewal of existing tenants, or 73% if the anchor store is

excluded. The weighted average new rent for renewals of existing

tenants in the first quarter, on a cash basis, represented a 6.2%

increase over the previous cash rent (5.8% excluding the anchor

store).

Development Activity

Canadian Tire leased a 139,000 square foot store, previously

occupied by Wal-Mart at Lambton Mall in Sarnia, Ontario. Canadian

Tire began work on the premises in October 2008, and opened on

April 15, 2009. Their existing 106,331 square foot store, also at

Lambton Mall, remained in operation until the new store opened. The

REIT's budget for this first phase of the project was approximately

$3.5 million, and Canadian Tire spent additional amounts in

completing their store and executing their move. The scope of work

included a small expansion as well as constructing a connection

between the new store and the interior of the mall, something that

did not exist with the previous tenant. Once the existing Canadian

Tire store is vacated, a second phase of the project will be

initiated, with Lambton Mall modifying and releasing the vacated

space. Plans for this second phase are not yet finalized; however,

discussions are underway with a number of retailers to participate

in this second phase.

In mid-April 2007, the REIT agreed to terminate the lease of an

86,500 square foot Bay department store at Place du Royaume located

in Saguenay, Quebec. The store closed in June 2007. The first phase

of the project was to reconstruct the existing space for use by

other retailers. Tenants are in place for 100% of the leasable area

of the first phase of the project. The second phase included a new

common area of the mall, including the floor, demising walls and

ceilings and the demolition of the exterior entrance. Both phases

were completed on time and under budget. As at March 31, 2009,

$9,539 has been incurred and capitalized. As part of this new

circulation plan, a small part of existing common area has been

backfilled by retail use. The total budgeted cost of this project

is approximately $14,000. There are still some further costs to be

incurred, but the REIT is anticipating the cost of this project to

be substantially under budget. The REIT experienced 12 months of

downtime in the former department store space and six months of

downtime for the backfill of existing common area. During the

second quarter of 2008 almost all of the tenants in the former

department store space opened, with the last tenant having opened

in the first quarter of 2009. The project generated a positive

return for the property.

Comparison to Prior Period Financial Results

Variance to

Comparative

Three Months Three Months Period

Ended Ended Favourable/

March 31, 2009 March 31, 2008 (Unfavourable)

Revenue

Minimum rent $ 40,568 $ 39,571 $ 997

Recoveries from tenants 25,311 23,789 1,522

Percentage rent 724 712 12

Parking 1,528 1,564 (36)

Interest and other income 887 1,086 (199)

--------------- --------------- --------------

$ 69,018 $ 66,722 $ 2,296

Expenses

Operating 30,401 27,827 (2,574)

Interest 14,625 14,182 (443)

Depreciation and

amortization 18,550 19,946 1,396

Ground rent 300 353 53

--------------- --------------- --------------

$ 63,876 $ 62,308 $ (1,568)

--------------- --------------- --------------

Income from operations 5,142 4,414 728

General and administrative (2,118) (1,908) (210)

Future income taxes (2,500) (150) (2,350)

--------------- --------------- --------------

Net income $ 524 $ 2,356 $ (1,832)

Depreciation of

income-producing properties 16,999 18,821 (1,822)

Amortization of leasing

costs 1,503 1,125 378

Accretion of convertible

debentures 269 249 20

Future income taxes 2,500 150 2,350

--------------- --------------- --------------

Funds from operations $ 21,795 $ 22,701 $ (906)

--------------- --------------- --------------

Funds from operations per

unit - basic $ 0.350 $ 0.366 $ (0.016)

Funds from operations per

unit - diluted $ 0.347 $ 0.363 $ (0.016)

Funds from operations -

payout ratio 87.8% 84.0% 3.8%

Distributions per unit $ 0.305 $ 0.305 $ -

Weighted average units

outstanding - basic 62,306,961 61,965,060 341,901

Weighted average units

outstanding - diluted 67,230,327 66,950,493 279,834

Units outstanding, end of

period 62,348,408 62,039,190 309,218

Notes:

Funds from Operations, which is not a defined term within Canadian generally

accepted accounting principles, has been calculated by management in

accordance with REALPac's White Paper on Funds from Operations. The White

Paper defines Funds from Operations as net income adjusted for depreciation

and amortization of assets purchased, including the net impact of above and

below market leases, amortization of leasing costs and accretion of

convertible debentures. Funds from Operations may not be comparable to

similar measures used by other entities.

Funds from operations for the quarter ended March 31, 2009 was

$0.9 million ($0.016 less per unit, diluted) less than the

comparative period.

Transition Update

As previously announced, the REIT is planning to fully

internalize its management on January 1, 2010. There is a fuller

discussion of this in the Management's Discussion and Analysis.

During the quarter ended March 31, 2009 the REIT incurred $384 of

transition costs (2008 $nil), of which $353 was expensed and $31

was capitalized.

Reclassification Prior Years Amounts

The REIT has reclassified prior periods' results to reflect the

reclassification of recoverable improvements (previously called

recoverable operating costs) to a component of income-producing

properties. This is discussed more fully in Management's Discussion

and Analysis and the reclassification of the previous seven

quarters is contained therein.

Supplemental Information

The REIT's unaudited interim consolidated financial statements

for the three-months ended March 31, 2009 and 2008 and Management's

Discussion and Analysis for the three-month period ended March 31,

2009 are available on the REIT's website at

www.primarisreit.com.

Forward-Looking Information

The MD&A contains forward-looking information based on

management's best estimates and the current operating environment.

These forward-looking statements are related to, but not limited

to, the REIT's operations, anticipated financial performance,

business prospects and strategies. Forward-looking information

typically contains statements with words such as "anticipate",

"believe", "expect", "plan", or similar words suggesting future

outcomes. Such forward-looking statements are subject to risks,

uncertainties and other factors which could cause actual results to

differ materially from future results expressed, projected or

implied by such forward-looking statements.

Examples of such information include, but are not limited to,

factors relating to the business, financial position of the REIT,

operations and redevelopments including volatility of capital

markets, legislative changes, consumer spending, retail leasing

demand, strength of the retail sector, price volatility of

construction costs, availability of construction labour and timing

of regulatory and contractual approvals for developments.

Although the forward-looking statements contained in this

document are based on what management of the REIT believes are

reasonable assumptions, forward-looking statements involve

significant risks and uncertainties. They should not be read as

guarantees of future performance or results and will not

necessarily be an accurate indicator of whether or not such results

will be achieved. Readers are cautioned not to place undue reliance

on forward-looking statements as a number of factors could cause

actual future results to differ from targets, expectations or

estimates expressed in the forward-looking statements. Factors that

could cause actual results to differ materially include, but are

not limited to, economic, competitive and commercial real estate

conditions, unplanned compliance-related expenses, uninsured

property losses and tenant-related risks.

Non-GAAP Measures

Funds from operations ("FFO"), net operating income ("NOI") and

earnings before interest, taxes, depreciation and amortization

("EBITDA") are widely used supplemental measures of a Canadian real

estate investment trust's performance and are not defined under

Canadian generally accepted accounting principles ("GAAP").

Management uses these measures when comparing itself to industry

data or others in the marketplace. The MD&A describes FFO, NOI

and EBITDA and provides a reconciliation to net income as defined

under GAAP. FFO and EBITDA should not be considered alternatives to

net income or other measures that have been calculated in

accordance with GAAP and may not be comparable to measures

presented by other issuers.

Conference Call

Primaris invites you to participate in the conference call that

will be held on Friday, May 8, 2009 at 9am EST to discuss these

results. Senior management will speak to the results and provide a

brief corporate update. The telephone numbers for the conference

are: 416-340-2216 (within Toronto), and 1-866-226-1792 (within

North America).

Audio replays of the conference call will be available

immediately following the completion of the conference call, and

will remain active until Friday, May 15, 2009. The replay will be

accessible by dialing 416-695-5800 or 1-800-408-3053 and using the

pass code 7230077#.

The REIT is a TSX listed real estate investment trust (TSX:

PMZ.UN). The REIT owns 26 income-producing properties comprising

approximately 9.3 million square feet located in Canada. As of

April 30, 2009, the REIT had 62,376,548 units issued and

outstanding.

PRIMARIS RETAIL REAL ESTATE INVESTMENT TRUST

Interim Consolidated Balance Sheets

(In thousands of dollars)

-----------------------------------------------------------------------

-----------------------------------------------------------------------

March 31, December 31,

2009 2008

-----------------------------------------------------------------------

(Unaudited)

Assets

Income-producing properties $ 1,428,848 $ 1,443,958

Leasing costs 38,427 38,200

Rents receivable 5,245 4,812

Other assets and receivables 28,004 24,438

Cash and cash equivalents 80,196 97,424

-----------------------------------------------------------------------

$ 1,580,720 $ 1,608,832

-----------------------------------------------------------------------

-----------------------------------------------------------------------

Liabilities and Unitholders' Equity

Liabilities:

Mortgages payable $ 885,591 $ 890,258

Convertible debentures 93,106 95,438

Accounts payable and other liabilities 39,815 45,782

Distribution payable 6,341 6,334

Future income taxes 43,300 40,800

----------------------------------------------------------------------

1,068,153 1,078,612

Unitholders' equity 512,567 530,220

-----------------------------------------------------------------------

$ 1,580,720 $ 1,608,832

-----------------------------------------------------------------------

-----------------------------------------------------------------------

PRIMARIS RETAIL REAL ESTATE INVESTMENT TRUST

Interim Consolidated Statements of Income

(In thousands of dollars, except per unit amounts)

Three months ended March 31, 2009 and 2008

(Unaudited)

-----------------------------------------------------------------------

-----------------------------------------------------------------------

2009 2008

-----------------------------------------------------------------------

Revenue:

Minimum rent $ 40,568 $ 39,571

Recoveries from tenants 25,311 23,789

Percentage rent 724 712

Parking 1,528 1,564

Interest and other 887 1,086

----------------------------------------------------------------------

69,018 66,722

Expenses:

Property operating 17,839 15,616

Property taxes 12,562 12,211

Depreciation 17,047 18,821

Amortization 1,503 1,125

Interest 14,625 14,182

Ground rent 300 353

General and administrative 2,118 1,908

----------------------------------------------------------------------

65,994 64,216

-----------------------------------------------------------------------

Income before income taxes 3,024 2,506

Future income taxes (2,500) (150)

-----------------------------------------------------------------------

Net income $ 524 $ 2,356

-----------------------------------------------------------------------

-----------------------------------------------------------------------

Basic and diluted net income per unit $ 0.008 $ 0.038

-----------------------------------------------------------------------

-----------------------------------------------------------------------

PRIMARIS RETAIL REAL ESTATE INVESTMENT TRUST

Interim Consolidated Statements of Cash Flows

(In thousands of dollars)

Three months ended March 31, 2009 and 2008

(Unaudited)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

2009 2008

---------------------------------------------------------------------------

Cash provided by (used in):

Operations:

Net income $ 524 $ 2,356

Items not involving cash:

Depreciation of income-producing properties 16,172 18,005

Depreciation of recoverable improvements 827 816

Amortization of leasing commissions and tenant

improvements 1,503 1,125

Accretion of convertible debt 269 249

Future income taxes 2,500 150

---------------------------------------------------------------------------

21,795 22,701

Change in non-cash operating items:

Depreciation of fixtures and equipment 48 -

Gain on purchase of convertible debentures under

normal course issuer bid (467) -

Amortization of above- and below-market leases (621) (474)

Amortization of tenant inducements 36 27

Amortization of financing costs 403 322

Other (9,632) (6,797)

Leasing commissions (220) (199)

Tenant inducements (53) -

---------------------------------------------------------------------------

11,289 15,580

Financing:

Mortgage principal repayments (4,555) (4,085)

Financing costs - (35)

Distributions to Unitholders (19,009) (18,902)

Issuance of units, net of costs 717 642

Purchase of convertible debentures under normal

course issuer bid (2,288) -

---------------------------------------------------------------------------

(25,135) (22,380)

Investments:

Acquisition of income-producing properties - (7,024)

Additions to buildings and building improvements (1,821) (2,847)

Additions to tenant improvements (1,493) (2,020)

Additions to recoverable improvements (68) (1,378)

--------------------------------------------------------------------------

(3,382) (13,269)

---------------------------------------------------------------------------

Increase (decrease) in cash and cash equivalents (17,228) (20,069)

Cash and cash equivalents, beginning of period 97,424 94,202

---------------------------------------------------------------------------

Cash and cash equivalents, end of period $ 80,196 $ 74,133

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Supplemental cash flow information:

Interest paid $ 14,598 $ 14,122

Supplemental disclosure of non-cash operating and

financing activities:

Value of units issued under asset management

agreement 57 757

Value of units issued under equity incentive plan 14 -

Value of units issued from conversion of convertible

debentures - 217

Financing costs transferred to equity upon

conversion of convertible debentures - 8

Financing accumulated amortization transferred to

equity upon conversion of convertible debentures - (3)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

PRIMARIS RETAIL REAL ESTATE INVESTMENT TRUST

Reconciliation of Net Income to Funds from Operations

(In thousands of dollars)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Three Months Three Months

Ended Ended

March 31, 2009 March 31, 2008

-------------------------------------------------------------------------

Net income $ 524 $ 2,356

Depreciation of income producing

properties 16,999 18,821

Amortization of leasing costs 1,503 1,125

Accretion of convertible debentures 269 249

Future income taxes 2,500 150

-------------- --------------

Funds from operations $ 21,795 $ 22,701

-------------- --------------

Funds from Operations, which is not a defined term within Canadian generally

accepted accounting principles, has been calculated by management in

accordance with REALPac's White Paper on Funds from Operations. The White

Paper defines Funds from Operations as net income adjusted for depreciation

and amortization of assets purchased, including the net impact of above and

below market leases, amortization of leasing costs and accretion of

convertible debentures. Funds from Operations may not be comparable to

similar measures used by other entities.

Calculation of Net Operating Income

(In thousands of dollars)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Three Months Three Months

Ended Ended

March 31, 2009 March 31, 2008

-------------------------------------------------------------------------

Revenue $69,018 $66,722

Less: Corporate interest and other income (825) (975)

Property operating expenses (17,839) (15,616)

Property tax expense (12,562) (12,211)

Ground rent (300) (353)

--------------- ---------------

Net operating income $ 37,492 $ 37,567

--------------- ---------------

Contacts: Primaris Retail REIT R. Michael Latimer Chief

Executive Officer (416) 865-5353 Primaris Retail REIT Louis M.

Forbes Senior Vice President, Chief Financial Officer (416)

865-5360 www.primarisreit.com

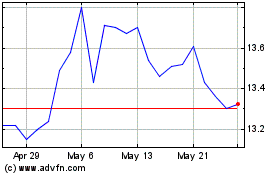

Primaris Real Estate Inv... (TSX:PMZ.UN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Primaris Real Estate Inv... (TSX:PMZ.UN)

Historical Stock Chart

From Jul 2023 to Jul 2024