Primaris Retail REIT (TSX: PMZ.UN) is reporting stable operating

results and continued strong liquidity.

President and CEO, John Morrison, commented "Primaris' financial

position remains strong in these uncertain times. The decrease in

occupancy rate during the quarter was expected, as a result of the

redevelopment work at Lambton Mall in Sarnia. We have a cautious

outlook for future operating results because we continue to see

less depth in tenant demand for vacant space. On the other hand,

credit markets appear to have a better tone than early in the

year."

Highlights

Liquidity

- Primaris continues to remain extremely liquid. It has $58

million cash and a $120 million unutilized credit facility. There

is one loan maturity in 2009 of $3.7 million and there are no loan

maturities in 2010. There are no commitments to fund mezzanine

loans.

Funds From Operations

- Funds from operations for the second quarter ended June 30,

2009 were $21.1 million or $0.337 per unit diluted, down 4.0% on a

per unit basis from the $22.0 million, or $0.351 per unit diluted

reported for the second quarter of 2008.

Net Operating Income

- Net operating income for the second quarter ended June 30,

2009, was $37.7 million, up from the $37.2 million recorded in the

second quarter of 2008.

Same Property - Net Operating Income

- Net operating income for the second quarter ended June 30,

2009, on a same property basis, increased 1.1% over the comparative

three-month period. Primaris is currently externally managed and as

previously announced, the rate of the property management fee

increased during the third quarter of 2008. After adjusting for the

$842 increase in the property management fees during 2009, same

property net operating income would have increased 3.4%.

Operations

- The REIT renewed or leased 332,729 square feet of space during

the second quarter, which includes the renewal of one anchor store.

The weighted average new rent in these leases, on a cash basis,

represented a 3.3% increase over the previous rent paid (3.5%

excluding the anchor store).

- The portfolio occupancy rate decreased during the second

quarter and was 96.4% at June 30, 2009, compared to 97.3% at March

31, 2009, and down from 97.7% at June 30, 2008.

- Same-tenant sales, for the 13 reporting properties owned

during all of the 24 months ended May 31, 2009, decreased 1.9% to

$466 per square foot as compared to the previous 12 months.

- The second quarter results included seasonal revenues of $2.5

million as compared to $2.5 million recorded in the second quarter

of 2008.

- During the second quarter the REIT incurred and expensed $0.8

million of transition costs, included in general and administrative

expenses.

Liquidity

Primaris continues to remain extremely liquid. It has $58

million cash invested in Treasury Bills and a variety of high

quality Bankers Acceptances and bearer deposit notes, and has a

$120 million unutilized credit facility not maturing until mid

2010. There is one loan maturity in 2009 of $3.7 million and there

are no loan maturities in 2010. The annual requirement to fund loan

principal payments amounts to approximately $20 million. There are

no commitments to fund mezzanine loans.

Financial Results

Funds from operations for the three months ended June 30, 2009

was $21.1 million or $0.339 per unit basic ($0.337 diluted). This

compares to funds from operations of $22.0 million or $0.354 per

unit basic ($0.351 diluted) earned during the three months ended

June 30, 2008.

Net income for the three months ended June 30, 2009 was $0.7

million or $0.011 per unit (basic and diluted). This compares to

net income of $1.0 million or $0.017 per unit (basic and diluted)

earned during the three months ended June 30, 2008.

Funds from Operations and Net Income for the three months ended

June 30, 2009 include a gain of $260 resulting from the repurchase

of $3,427 (cost $2,839) of the 5.85% convertible debentures.

The REIT made one small acquisition in the second quarter of

2009. The REIT made one small acquisition in the first quarter of

2008 and two small acquisitions in the fourth quarter of 2008,

which contributed to operations for the three months ended June 30,

2009. The total purchase price for the acquisition completed to

date in 2009 was $7.4 million and those acquisitions completed in

2008 was $14.6 million.

General and administrative expenses in the second quarter

include $0.8 million of transition costs, compared to virtually no

such costs incurred in the comparative quarter. This increase is

partially offset by a reduction in consulting and other

professional fees.

The distribution payout ratio for the second quarter of 2009,

expressed on a per unit basis as distributions paid divided by

diluted funds from operations was 90.3% as compared to an 86.8%

payout ratio for the second quarter of 2008. The payout ratios are

sensitive to both seasonal operating results and financial

leverage.

At June 30, 2009, the REIT's total enterprise value was

approximately $1.7 billion (based on the market closing price of

Primaris' units on June 30, 2009, plus total debt outstanding). At

June 30, 2009 the REIT had $975.0 million of outstanding debt

equating to a debt to total enterprise value ratio of 56.9% . On a

net of cash basis, this ratio would be 53.5% . The REIT's debt

consisted of $884.6 million of fixed-rate senior debt with a

weighted average interest rate of 5.7% and a weighted average term

to maturity of 7.2 years, $5.9 million of 6.75% fixed-rate

convertible debentures and $84.5 million of 5.85% fixed-rate

convertible debentures. The REIT had a debt to gross book value

ratio, as defined under the Declaration of Trust, of 49.1% . During

the three months ended June 30, 2009, the REIT had an interest

coverage ratio of 2.4 times as expressed by EBITDA divided by net

interest expensed. The REIT defines EBITDA as net income increased

by depreciation, amortization, interest expense and income tax

expense. EBITDA is a non-GAAP measure and may not be comparable to

similar measures used by other Trusts.

Operating Results

Net Operating Income - Same Properties

Three Months Three Months Variance to

Ended Ended Comparative Period

Favourable/

June 30, 2009 June 30, 2008 (Unfavourable)

Operating revenue $ 66,131 $ 63,991 $ 2,140

Operating expenses 28,617 26,882 (1,735)

-----------------------------------------------------

Net operating income $ 37,514 $ 37,109 $ 405

-----------------------------------------------------

The same property comparison includes only 26 properties that

were owned throughout both the current and comparative three-month

periods. Net operating income, on a same property basis, increased

$405, or 1.1%, over the comparative three-month period. Net

operating income, on a same-property basis, would have increased

3.4% excluding the net change in the property management fees of

$842.

Tenant sales

Tenant sales per square foot, on a same-tenant basis, have

decreased to $466 for the 12 months ended May 31, 2009. Total

tenant volume has decreased by 1.1% when comparing sales for the

same properties.

Same-Tenant

Sales per Square Foot Variance

2009 2008 $ %

-----------------------------------------

Aberdeen Mall $ 408 $ 437 $ (29) (6.6%)

Cornwall Centre 585 560 25 4.5%

Dufferin Mall 531 548 (17) (3.1%)

Eglinton Square 385 390 (5) (1.3%)

Grant Park Shopping Centre 491 489 2 0.4%

Lambton Mall 351 370 (19) (5.1%)

Midtown Plaza 567 564 3 0.5%

Northland Village 449 446 3 0.7%

Orchard Park Shopping Centre 518 551 (33) (6.0%)

Park Place Shopping Centre 514 531 (17) (3.2%)

Place Fleur de Lys 305 309 (4) (1.3%)

Place du Royaume 385 393 (8) (2.0%)

Stone Road Mall 550 561 (11) (2.0%)

-----------------------------------------

$ 466 $ 475 $ (9) (1.9%)

-----------------------------------------

All-Tenant

Total Sales Volume Variance

2009 2008 $ %

-----------------------------------------------

Aberdeen Mall $ 50,741 $ 53,059 $ (2,318) (4.4%)

Cornwall Centre 78,321 74,655 3,666 4.9%

Dufferin Mall 88,040 89,660 (1,620) (1.8%)

Eglinton Square 31,365 39,437 (8,072) (20.5%)

Grant Park Shopping Centre 29,596 29,760 (164) (0.6%)

Lambton Mall 50,803 53,791 (2,988) (5.6%)

Midtown Plaza 135,396 130,385 5,011 3.8%

Northland Village 48,199 46,892 1,307 2.8%

Orchard Park Shopping Centre 145,008 150,949 (5,941) (3.9%)

Park Place Shopping Centre 80,019 81,749 (1,730) (2.1%)

Place Fleur de Lys 73,353 73,213 140 0.2%

Place du Royaume 105,008 102,922 2,086 2.0%

Stone Road Mall 116,435 117,368 (933) (0.8%)

-----------------------------------------------

$ 1,034,293 $ 1,045,848 $ (11,555) (1.1%)

-----------------------------------------------

The REIT's sales decreased 1.9% per square foot, while the

national average tenant sales as reported by the International

Council of Shopping Centers ("ICSC") for the 12-month period ended

May 31, 2009 decreased 0.9%. The REIT's sales productivity of $466

is lower than the ICSC average of $544, largely because the ICSC

includes sales from super regional malls that have the highest

sales per square foot in the country. However the ICSC data point

is for all tenant sales. The REIT's all tenant sales per square

foot decrease was 1.3% for same period, which is more than the ICSC

decrease of 0.9%.

Leasing activity

Primaris Retail REIT's property portfolio remains well

leased.

The portfolio occupancy rate decreased during the second quarter

and was 96.4% at June 30, 2009, down from 97.3% at March 31, 2009,

and down from 97.7% at June 30, 2008. These percentages include

space for which signed leases are in place but where the tenant may

not yet be in occupancy.

The REIT leased 332,729 square feet of space during the second

quarter of 2009. This represented 78 leases of generally smaller

stores and the renewal of one anchor store of approximately 95,000

square feet. Approximately 79% of the leased space during the

current quarter of 2009 resulted from the renewal of existing

tenants or 71% if the anchor store is excluded. The weighted

average new rent for renewals of existing tenants in the current

quarter, on a cash basis, represented a 3.3% increase over the

previous cash rent for all transactions (3.5% excluding the anchor

store).

Development Activity

At Lambton Mall in Sarnia, Ontario, Canadian Tire leased a

139,000 square foot store, previously occupied by Wal-Mart.

Canadian Tire began work on the premises in October 2008, and

opened on April 15, 2009. The former 106,331 square foot Canadian

Tire store remained in operation until the existing store opened.

The REIT's budget for this phase of the project was approximately

$3,500, and Canadian Tire spent additional funds in completing

their store and executing their move. The scope of work included a

small expansion as well as constructing a connection between the

existing store and the interior of the mall, something that did not

exist with the previous tenant. Now that the former Canadian Tire

store has been vacated, a second phase of the project will be

planned, with Lambton Mall modifying and re-leasing the vacated

space. Plans for this second phase are not yet finalized; however,

discussions are underway with a number of retailers to participate

in this second phase.

Comparison to Prior Period Financial Results

Variance to

Comparative

Three Months Three Months Period

Ended Ended Favourable/

June 30, 2009 June 30, 2008 (Unfavourable)

Revenue

Minimum rent $ 40,961 $ 39,379 $ 1,582

Recoveries from tenants 23,229 22,408 821

Percentage rent 560 649 (89)

Parking 1,549 1,555 (6)

Interest and other income 454 727 (273)

------------- ------------- --------------

$ 66,753 $ 64,718 $ 2,035

Expenses

Operating 28,380 26,673 (1,707)

Interest 14,521 14,032 (489)

Depreciation and

amortization 19,436 19,675 239

Ground rent 324 264 (60)

------------- ------------- --------------

$ 62,661 $ 60,644 $ (2,017)

------------- ------------- --------------

Income from operations 4,092 4,074 18

General and administrative (2,601) (2,017) (584)

Gain on sale of land - 298 (298)

Future income taxes (800) (1,320) 520

------------- ------------- --------------

Net income $ 691 $ 1,035 $ (344)

Depreciation of

income-producing

properties 17,807 18,297 (490)

Amortization of leasing costs 1,582 1,378 204

Accretion of convertible

debentures 269 247 22

Gain on sale of land - (298) 298

Future income taxes 800 1,320 (520)

------------- ------------- --------------

Funds from operations $ 21,149 $ 21,979 $ (830)

------------- ------------- --------------

Funds from operations

per unit - basic $ 0.339 $ 0.354 $ (0.015)

Funds from operations

per unit - diluted $ 0.337 $ 0.351 $ (0.014)

Funds from operations

- payout ratio 90.3% 86.8% 3.5%

Distributions per unit $ 0.305 $ 0.305 $ -

Weighted average units

outstanding - basic 62,384,749 62,103,730 281,019

Weighted average units

outstanding - diluted 67,119,386 67,064,978 54,408

Units outstanding,

end of period 62,413,012 62,179,175 233,837

Notes:

Funds from Operations, which is not a defined term within

Canadian generally accepted accounting principles, has been

calculated by management in accordance with REALPac's White Paper

on Funds from Operations. The White Paper defines Funds from

Operations as net income adjusted for depreciation and amortization

of assets purchased, including the net impact of above and below

market leases, amortization of leasing costs and accretion of

convertible debentures. Funds from Operations may not be comparable

to similar measures used by other entities.

Funds from operations for the quarter ended June 30, 2009 was

$0.8 million ($0.014 less per unit, diluted) less than the

comparative period.

Transition Update

As previously announced, the REIT is planning to fully

internalize its management on January 1, 2010. There is a fuller

discussion of this in the Management's Discussion and Analysis.

During the six-months ended June 30, 2009 the REIT incurred $3,830

of transition costs, of which $1,202 was expensed and $2,628 was

capitalized.

Leadership Update

As previously announced, Mr. John R. Morrison has been appointed

President and Chief Executive Officer of Primaris Retail REIT. Mr.

Morrison has been actively involved in Primaris since its launch in

2003, representing continuity of strategy and management for the

REIT, its portfolio and its team.

Reclassification Prior Years Amounts

The REIT has reclassified prior periods' results to reflect the

reclassification of recoverable improvements (previously called

recoverable operating costs) to a component of income-producing

properties. This is discussed more fully in Management's Discussion

and Analysis and the reclassification of the previous seven

quarters is contained therein.

Supplemental Information

The REIT's unaudited interim consolidated financial statements

and Management's Discussion and Analysis for the three-month and

six-month periods ended June 30, 2009 and 2008 are available on the

REIT's website at www.primarisreit.com.

Forward-Looking Information

The MD&A contains forward-looking information based on

management's best estimates and the current operating environment.

These forward-looking statements are related to, but not limited

to, the REIT's operations, anticipated financial performance,

business prospects and strategies. Forward-looking information

typically contains statements with words such as "anticipate",

"believe", "expect", "plan", or similar words suggesting future

outcomes. Such forward-looking statements are subject to risks,

uncertainties and other factors which could cause actual results to

differ materially from future results expressed, projected or

implied by such forward-looking statements.

Examples of such information include, but are not limited to,

factors relating to the business, financial position of the REIT,

operations and redevelopments including volatility of capital

markets, legislative changes, consumer spending, retail leasing

demand, strength of the retail sector, price volatility of

construction costs, availability of construction labour and timing

of regulatory and contractual approvals for developments.

Although the forward-looking statements contained in this

document are based on what management of the REIT believes are

reasonable assumptions, forward-looking statements involve

significant risks and uncertainties. They should not be read as

guarantees of future performance or results and will not

necessarily be an accurate indicator of whether or not such results

will be achieved. Readers are cautioned not to place undue reliance

on forward-looking statements as a number of factors could cause

actual future results to differ from targets, expectations or

estimates expressed in the forward-looking statements. Factors that

could cause actual results to differ materially include, but are

not limited to, economic, competitive and commercial real estate

conditions, unplanned compliance-related expenses, uninsured

property losses and tenant-related risks.

Non-GAAP Measures

Funds from operations ("FFO"), net operating income ("NOI") and

earnings before interest, taxes, depreciation and amortization

("EBITDA") are widely used supplemental measures of a Canadian real

estate investment trust's performance and are not defined under

Canadian generally accepted accounting principles ("GAAP").

Management uses these measures when comparing itself to industry

data or others in the marketplace. The MD&A describes FFO, NOI

and EBITDA and provides a reconciliation to net income as defined

under GAAP. FFO and EBITDA should not be considered alternatives to

net income or other measures that have been calculated in

accordance with GAAP and may not be comparable to measures

presented by other issuers.

Conference Call

Primaris invites you to participate in the conference call that

will be held on Friday, August 7, 2009 at 9am EST to discuss these

results. Senior management will speak to the results and provide a

brief corporate update. The telephone numbers for the conference

are: 416-340-2216 (within Toronto), and 1-866-226-1792 (within

North America).

Audio replays of the conference call will be available

immediately following the completion of the conference call, and

will remain active until Friday, August 14, 2009. The replay will

be accessible by dialing 416-695-5800 or 1-800-408-3053 and using

the pass code 8333846#.

The REIT is a TSX listed real estate investment trust (TSX:

PMZ.UN). The REIT owns 26 income-producing properties comprising

approximately 9.3 million square feet located in Canada. As of July

31, 2009, the REIT had 62,431,234 units issued and outstanding.

PRIMARIS RETAIL REAL ESTATE INVESTMENT TRUST

Interim Consolidated Balance Sheets

(In thousands of dollars)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

June 30, December 31,

2009 2008

---------------------------------------------------------------------------

(Unaudited)

Assets

Income-producing properties $ 1,424,042 $ 1,443,958

Leasing costs 41,350 38,200

Rents receivable 5,827 4,812

Other assets and receivables 38,830 24,438

Cash and cash equivalents 58,669 97,424

---------------------------------------------------------------------------

$ 1,568,718 $ 1,608,832

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Liabilities and Unitholders' Equity

Liabilities:

Mortgages payable $ 884,608 $ 890,258

Convertible debentures 90,427 95,438

Accounts payable and other liabilities 48,252 45,782

Distribution payable 6,365 6,334

Future income taxes 44,100 40,800

-------------------------------------------------------------------------

1,073,752 1,078,612

Unitholders' equity 494,966 530,220

---------------------------------------------------------------------------

$ 1,568,718 $ 1,608,832

---------------------------------------------------------------------------

---------------------------------------------------------------------------

PRIMARIS RETAIL REAL ESTATE INVESTMENT TRUST

Interim Consolidated Statements of Income

(In thousands of dollars, except per unit amounts)

(Unaudited)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Three months ended Six months ended

June 30, June 30,

2009 2008 2009 2008

---------------------------------------------------------------------------

Revenue:

Minimum rent $ 40,961 $ 39,379 $ 81,529 $ 78,950

Recoveries from tenants 23,229 22,408 48,540 46,197

Percentage rent 560 649 1,284 1,361

Parking 1,549 1,555 3,077 3,119

Interest and other 454 727 1,341 1,813

-------------------------------------------------------------------------

66,753 64,718 135,771 131,440

Expenses:

Property operating 15,758 14,612 33,597 30,228

Property taxes 12,622 12,061 25,184 24,272

Depreciation 17,854 18,297 34,901 37,118

Amortization 1,582 1,378 3,085 2,503

Interest 14,521 14,032 29,146 28,214

Ground rent 324 264 624 617

General and administrative 2,601 2,017 4,719 3,925

-------------------------------------------------------------------------

65,262 62,661 131,256 126,877

---------------------------------------------------------------------------

Income before gain on sale

of land and income taxes 1,491 2,057 4,515 4,563

Gain on sale of land - 298 - 298

---------------------------------------------------------------------------

Income before income taxes 1,491 2,355 4,515 4,861

Future income taxes 800 1,320 3,300 1,470

---------------------------------------------------------------------------

Net income $ 691 $ 1,035 $ 1,215 $ 3,391

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Basic and diluted net

income per unit $ 0.011 $ 0.017 $ 0.019 $ 0.055

---------------------------------------------------------------------------

---------------------------------------------------------------------------

PRIMARIS RETAIL REAL ESTATE INVESTMENT TRUST

Interim Consolidated Statements of Cash Flows

(In thousands of dollars)

(Unaudited)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Three months ended Six months ended

June 30, June 30,

2009 2008 2009 2008

---------------------------------------------------------------------------

Cash provided by (used in):

Operations:

Net income $ 691 $ 1,035 $ 1,215 $ 3,391

Items not involving cash:

Depreciation of income

-producing properties 16,993 17,486 33,165 35,491

Amortization of recoverable

improvements 814 811 1,641 1,627

Amortization of leasing

commissions and tenant

improvements 1,582 1,378 3,085 2,503

Accretion of convertible

debentures 269 247 538 496

Future income taxes 800 1,320 3,300 1,470

Gain on sale of land - (298) - (298)

-------------------------------------------------------------------------

21,149 21,979 42,944 44,680

Change in non-cash operating

items:

Gain on purchase of convertible

debentures under normal

course issuer bid (260) - (727) -

Depreciation of fixtures

and equipment 47 - 95 -

Amortization of above- and

below-market leases (442) (417) (1,063) (891)

Amortization of tenant

inducements 37 28 73 55

Amortization of financing costs 362 356 765 678

Other (2,900) (5,203) (12,532) (12,000)

Leasing commissions (292) (395) (512) (594)

Tenant inducements - (282) (53) (282)

-------------------------------------------------------------------------

17,701 16,066 28,990 31,646

Financing:

Mortgage principal repayments (4,621) (4,283) (9,176) (8,368)

Financing costs (14) (3) (14) (38)

Distributions to Unitholders (19,031) (18,938) (38,040) (37,840)

Issuance of units, net of costs 698 731 1,415 1,373

Purchase of convertible

debentures under normal

course issuer bid (2,839) - (5,127) -

-------------------------------------------------------------------------

(25,807) (22,493) (50,942) (44,873)

Investments:

Acquisition of income-producing

properties (3,594) (50) (3,594) (7,074)

Additions to buildings

and building improvements (2,351) (2,342) (4,172) (5,189)

Additions to tenant improvements (4,250) (4,447) (5,743) (6,467)

Additions to recoverable

improvements (3,226) (1,748) (3,294) (3,126)

Proceeds from sale of land - 425 - 425

-------------------------------------------------------------------------

(13,421) (8,162) (16,803) (21,431)

---------------------------------------------------------------------------

Decrease in cash and cash

equivalents (21,527) (14,589) (38,755) (34,658)

Cash and cash equivalents,

beginning of period 80,196 74,133 97,424 94,202

---------------------------------------------------------------------------

Cash and cash equivalents, end

of period $ 58,669 $ 59,544 $ 58,669 $ 59,544

---------------------------------------------------------------------------

---------------------------------------------------------------------------

PRIMARIS RETAIL REAL ESTATE

INVESTMENT TRUST

Reconciliation of Net Income to Funds from Operations

(In thousands of dollars)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Three Months Three Months

Ended Ended

June 30, 2009 June 30, 2008

---------------------------------------------------------------------------

Net income $ 691 $ 1,035

Depreciation of income producing properties 17,807 18,297

Amortization of leasing costs 1,582 1,378

Accretion of convertible debentures 269 247

Gain on sale of land - (298)

--- -----

Future income taxes 800 1,320

-------- ---------

Funds from operations $ 21,149 $ 21,979

-------- ---------

Funds from Operations, which is not a defined term within Canadian

generally accepted accounting principles, has been calculated by

management in accordance with REALPac's White Paper on Funds from

Operations. The White Paper defines Funds from Operations as net income

adjusted for depreciation and amortization of assets purchased, including

the net impact of above and below market leases, amortization of leasing

costs and accretion of convertible debentures. Funds from Operations may

not be comparable to similar measures used by other entities.

Calculation of Net Operating Income

(In thousands of dollars)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Three Months Three Months

Ended Ended

June 30, 2009 June 30, 2008

---------------------------------------------------------------------------

Revenue $66,753 $64,718

Less: Corporate interest and other income (356) (574)

Property operating expenses (15,758) (14,612)

Property tax expense (12,622) (12,061)

Ground rent (324) (264)

------------- -------------

Net operating income $ 37,693 $ 37,207

------------- -------------

Contacts: Primaris Retail REIT John R. Morrison President &

Chief Executive Officer (416) 642-7860 Primaris Retail REIT Louis

M. Forbes Senior Vice President, Chief Financial Officer (416)

642-7810

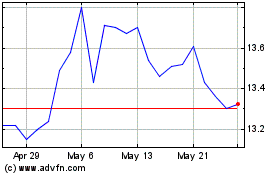

Primaris Real Estate Inv... (TSX:PMZ.UN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Primaris Real Estate Inv... (TSX:PMZ.UN)

Historical Stock Chart

From Jul 2023 to Jul 2024