Primaris and H&R Announce Unitholder Approvals and Proration Results

March 22 2013 - 11:36AM

Marketwired

H&R Real Estate Investment Trust ("H&R REIT") and H&R

Finance Trust ("H&R Finance Trust", collectively, "H&R")

(TSX:HR.UN)(TSX:HR.DB.C)(TSX:HR.DB.D)(TSX:HR.DB.E) and Primaris

Retail Real Estate Investment Trust (TSX:PMZ.UN) ("Primaris") are

pleased to announce that at special meetings held earlier today,

their respective unitholders approved the previously announced

transactions involving Primaris, H&R and a KingSett Capital-led

consortium. In addition, Primaris will be applying this afternoon

to the Court of Queen's Bench of Alberta for a final order

approving the plan of arrangement.

Primaris also announced the proration results contemplated by

the plan of arrangement. Unitholders who elected cash for their

Primaris units will receive $28 cash per unit for approximately 55%

of their units and will receive 1.166 H&R stapled units per

unit for the balance. All other Primaris unitholders will receive

1.166 H&R stapled units for each Primaris unit they hold.

Primaris and H&R currently expect to close the proposed

transactions on or about April 4, 2013.

About H&R

H&R REIT is an open-ended real estate investment trust,

which owns a North American portfolio of 41 office, 113 industrial

and 138 retail properties comprising over 44 million square feet

and 2 development projects, with a fair value of approximately $10

billion. The foundation of H&R's REIT success since inception

in 1996 has been a disciplined strategy that leads to consistent

and profitable growth. H&R REIT leases its properties long term

to creditworthy tenants and strives to match those leases with

primarily long-term, fixed-rate financing.

H&R Finance Trust is an unincorporated investment trust,

which primarily invests in notes issued by a U.S. corporation,

which is a subsidiary of H&R REIT. As at December 31, 2012, the

note receivable balance is U.S. $162.5 million. In 2008, H&R

REIT completed an internal reorganization, which resulted in each

issued and outstanding H&R REIT unit trading together with a

unit of H&R Finance Trust as a "Stapled Unit" on the Toronto

Stock Exchange.

About Primaris

Primaris is a TSX listed real estate investment trust that

specializes in owning and operating Canadian enclosed shopping

centres that are dominant in their local trade areas. Merchandising

for each property is dynamic in order to meet the unique needs of

its local customers and the community. Primaris maintains a high

occupancy rate at its shopping centres and has retail tenants that

offer new and exciting brands. Primaris owns 43 income-producing

properties comprising approximately 15.9 million square feet

located in Canada. As of February 28, 2013, Primaris had

100,743,915 units issued and outstanding (including exchangeable

units for which units have yet to be issued).

Forward Looking Information

This press release contains forward looking statements that

reflect current expectations of each of Primaris and H&R about

their future results, performance, prospects and opportunities,

including with respect to the closing, costs and benefits of the

proposed transaction and all other statements that are not

historical facts. The timing and completion of the proposed

transaction is subject to customary closing conditions, termination

rights and other risks and uncertainties. Accordingly, there can be

no assurance that the proposed transaction will occur, or that it

will occur on the timetable or on the terms and conditions

contemplated in this news release. The proposed transaction could

be modified, restructured or terminated. Readers are cautioned not

to place undue reliance on forward looking information. Each of

Primaris and H&R has tried to identify these forward looking

statements by using words such as "may", "will", "should" "expect",

"anticipate", "believe", "intend", "plan", "estimate",

"potentially" and similar expressions. By its nature, such forward

looking information necessarily involves known and unknown risks

and uncertainties that may cause actual results, performance,

prospects and opportunities in future periods of Primaris or

H&R to differ materially from those expressed or implied by

such forward looking statements.

Contacts: Primaris Unitholders: Kingsdale Shareholder Services

Inc. 1 (866) 581-1571 (English and Français) toll-free in North

America (416) 867-2272 outside of North America (collect calls

accepted)contactus@kingsdaleshareholder.com Primaris John Morrison

President & Chief Executive Officer (416) 642-7860 Primaris

Louis Forbes Executive Vice President & Chief Financial Officer

(416) 642-7810 Media Contact for Primaris Retail REIT NATIONAL

Public Relations Peter Block (416) 848-1431 Media Contact for

Primaris Retail REIT NATIONAL Public Relations Jennifer Lee (416)

848-1383 H&R Unitholders: CST Phoenix Advisors 1-866-822-1245

(toll-free within Canada/United States) 1-201-806-2222 (banks,

brokers and collect calls outside Canada and the United

States)inquiries@phoenixadvisorscst.com H&R Tom Hofstedter

President & Chief Executive Officer (416) 635-7520 H&R

Larry Froom Chief Financial Officer (416) 635-7520 Media Contact

for H&R REIT Longview Communications Louise Kozier (604) 644

6090

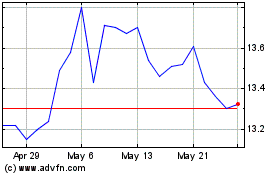

Primaris Real Estate Inv... (TSX:PMZ.UN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Primaris Real Estate Inv... (TSX:PMZ.UN)

Historical Stock Chart

From Mar 2024 to Mar 2025