Pinetree Capital Announces Partial Closing of Private Placement

May 26 2014 - 3:15PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Pinetree Capital Ltd. (TSX:PNP) announces the partial closing today of its

previously announced non-brokered private placement (the "Financing"), pursuant

to which Pinetree raised aggregate gross proceeds of $8,500,000 from the

issuance and sale of 18,888,889 units, at a price of $0.45 per unit. The company

expects the remaining portion of the Financing, representing gross proceeds of

$2,000,000, to be completed within the next few days.

Each Unit was comprised of one common share and one-half of one common share

purchase warrant of Pinetree. Each whole warrant entitles the holder to purchase

one common share of the company, at a price of $0.75, until expiry on May 26

2017, provided that, if the weighted-average trading price of the company's

common shares on the Toronto Stock Exchange is $1.25 or more for any period of

twenty consecutive trading days commencing after September 26, 2014, Pinetree

may accelerate the expiry date of the warrants upon at least 30 days' notice to

the holders.

The proceeds of the Financing will be used for working capital purposes, which

may include the purchase for cancellation of a portion of the company's

outstanding convertible debentures.

Officers and directors of Pinetree (and their associates) purchased an aggregate

of 3,933,333 units under the Financing, representing approximately 21% of the

total number of units sold today and 17% of the total number of units

anticipated to be sold upon completion of the entire Financing.

Pinetree paid finders' fees in the form of an aggregate of 976,001 units to

third parties who assisted the company in the Financing. The units have the same

terms and conditions as the units sold in the Financing.

The securities offered have not been registered under the U.S. Securities Act of

1933, as amended, and may not be offered or sold in the United States absent

registration or an applicable exemption from the registration requirements. This

press release shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful.

About Pinetree

Pinetree Capital Ltd. ("Pinetree") was incorporated under the laws of the

Province of Ontario and its shares are publicly-traded on the Toronto Stock

Exchange ("TSX") under the symbol "PNP". Pinetree is a diversified investment

and merchant banking firm focused on the small cap market. Pinetree's

investments are primarily in the following sectors: Precious Metals, Uranium and

Technology. Pinetree's investment approach is to develop a macro view of a

sector, build a position consistent with the view by identifying micro-cap

opportunities within that sector, and devise an exit strategy designed to

maximize our relative return in light of changing fundamentals and

opportunities. Pinetree is recognized as a value added partner.

FOR FURTHER INFORMATION PLEASE CONTACT:

Pinetree Capital Ltd.

Sheldon Inwentash, CPA, CA.

Chairman & CEO

Pinetree Capital Ltd.

Gerry Feldman, CPA, CA.

CFO & Vice President, Corporate Development

416-643-3884

feldman@pinetreecapital.com

Pinetree Capital Ltd.

130 King Street West, Suite 2500

Toronto, Ontario, Canada, M5X 2A2

ir@pinetreecapital.com

www.pinetreecapital.com

Investor Relations:

Richard Patricio, LL.B.

Vice President, Legal and Corporate Affairs

416-941-9600

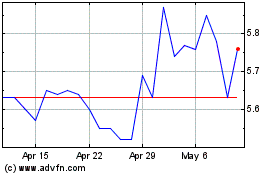

Pinetree Capital (TSX:PNP)

Historical Stock Chart

From Apr 2024 to May 2024

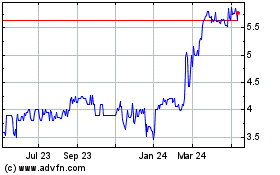

Pinetree Capital (TSX:PNP)

Historical Stock Chart

From May 2023 to May 2024

Real-Time news about Pinetree Capital Ltd (Toronto Stock Exchange): 0 recent articles

More Pinetree Capital Ltd. News Articles