Perseus Mining Limited: VAT Refund & Operational Update

June 13 2014 - 2:12AM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Perseus Mining Limited ("Perseus" or the "Company") (TSX:PRU)(ASX:PRU) wishes to

advise of two recent developments relating to its Edikan Gold Mine in Ghana

("Edikan").

PARTIAL REFUND OF VAT DEBT

On 11 June 2014, Perseus received GH cents20.0M (USD6.7M) as a partial payment

of the outstanding VAT debt of GH cents97.5M (USD32.7M) owed to the Company by

the Government of Ghana. Based on dialogue with the Government, two further

payments of GH cents10.0M (USD 3.3M) and GH cents 17.6M (USD 5.8M) are currently

scheduled to be made on or around 24 June 2014 and 8 July 2014 respectively.

Following the recent payment of GH cents20million, the outstanding VAT position

is as follows:

GH cents

Million USD Million(i)

--------------------------------

Approved VAT claims 103.730 34.741

VAT claims pending audit 10.169 3.406

Less: Cash refunds received to date (27.400) (9.177)

Less: Offsets using Treasury Credit Notes (8.987) (3.010)

VAT Refunds Due and Payable 77.512 25.960

Less: Statutory Tax payments deferred (14.190) (4.752)

Net Refund Due for payment 63.322 21.208

(i)Assumes USD1.00=GH cents2.9858 as at 12 June 2014

The Company is continuing to work with the Government to agree a schedule for

the repayment of the balance of the outstanding debt and also to avoid a repeat

of the current situation where a large VAT receivable accumulates and remains

unpaid for an extended period.

Comment from Managing Director, Jeff Quartermaine

"It's pleasing to receive GH cents 20 million of the debt owing from the

Ghanaian government and to have been informed of a payment schedule for a

further GH cents 27.6 million. Perseus remains debt free with a strong cash

position which will be further enhanced by receiving the full VAT payment from

the Ghanaian Government. We are looking forward to putting the issue of the

outstanding VAT receivable behind us.

The availability of grid power to the Edikan Gold Mine has also been frustrating

in recent times. We have been working extremely hard to address the matters that

we can control such as operating performance and operating costs, and in the

past 12 months we have made major advances on both fronts.

When it comes to repayment of VAT and the availability of grid power, these are

outside of our control but they certainly do take the gloss off what would

otherwise be a creditable performance at the Edikan Gold Mine by our hard

working team of employees and contractors."

GRIDCO SUBSTATION FAILURE

At 7:40pm on Saturday 7 June 2014, a current transformer (CT) failed in the

sub-station owned and operated by the government owned power company GridCo,

which is located on the site of Perseus's Edikan Gold Mine. The exact cause of

the failure of the CT is unknown.

The failure of the CT resulted in damage to all three Voltage Transformers (VTs)

on the circuit, failure of insulators and damage to several of the cables that

feed power to the Edikan processing plant. This resulted in a total power outage

to the plant and subsequent significant downtime for Edikan's ore crushing and

milling operation while the repairs could be completed. As the failure occurred

on the 11,000 volt line that is rated to 1,200amps, the repairs had to be

performed by GridCo who operate and maintain the substation.

The CTs and VTs that failed were not standard GridCo components and were not

carried as spares by GridCo, however suitable CT replacements of a different

design/configuration were able to be sourced after a short delay. The different

design/configuration of the replacement CTs also necessitated replacement of

some busbars and removal, modification and installation of the mounting plates,

brackets, and platforms. These tasks were all carried out by GridCo.

As a remedial measure, the VTs and damaged insulators were removed from the

power factor correction circuit. This has rendered the power factor correction

circuit inoperable until full repairs can be carried out. As a result, Edikan is

required to reduce its power demand in the evenings during the peak demand

period until Gridco is able to source the replacement parts. Gridco is expected

on site during the planned SAG mill maintenance shutdown on 17 June 2014 to

carry out additional works on the substation.

Due to high voltage and current involved there was also damage to the main

feeder cables to the plant. This required two of the cables to be terminated and

the replacement of a connection lug. This work was carried out by Perseus's

maintenance personnel.

Following the repairs, the SAG mill was restarted at approximately 21:00 hours

on Tuesday 10 June 2014 after approximately 73 hours of unscheduled downtime.

The impact of this interruption to gold production at Edikan is that Perseus

will be challenged to achieve its revised production guidance for the three, six

and 12-month periods ending 30 June 2014. This is extremely disappointing to

management as following the resumption of gold production after the fire in the

cyclone nest at the Edikan processing plant in April 2014 the Edikan operation

has performed strongly and was on target to achieve guidance as a result of the

continued improvement in operating performance as illustrated by the key

indicators in the Table below:

Further details of the impact of the substation failure on gold production for

the three, six and 12-month periods ending 30 June 2014 will be documented in

the Company's June 2014 Quarterly Report that will be published in mid July

2014.

----------------------------------------------------------------------------

Description Unit Sep-13 Dec-13 Mar-14 Apr-14 May-14 Jun-14

Month to

Quarter Quarter Quarter Month(1) Month Date(2)

----------------------------------------------------------------------------

Primary

Crusher

Tonnes

Crushed(1) Wmt 1,577,104 1,661,562 1,522,031 372,779 592,791 69,785

Runtime % 56% 58% 54% 41% 60% 38%

Run Time hrs 1,229 1,285 1,171 294 447 54

Throughput

rate wmtph 1,284 1,293 1,300 1,268 1,327 1,325

SAG Mill

Tonnes Milled Dmt 1,628,900 1,791,410 1,723,143 421,061 606,436 119,333

Run Time % 84% 85% 88% 65% 90% 99%

Run Time hrs 1,863 1,877 1,909 469 672 143

Throughput

rate dmtph 874 954 902 897 903 836

Recovery % 83% 84% 84% 84% 86% 87%

Head Grade g/t 1.05 1.00 0.95 1.01 1.02 0.95

----------------------------------------------------------------------------

Notes:

1. Includes 7 days of lost production time (plus additional time required

to stabilise the circuit) as a result of a fire in the cyclone nest;

2. Up to and including 6 June 2014

Caution Regarding Forward Looking Information: This report contains

forward-looking information which is based on the assumptions, estimates,

analysis and opinions of management made in light of its experience and its

perception of trends, current conditions and expected developments, as well as

other factors that management of the Company believes to be relevant and

reasonable in the circumstances at the date that such statements are made, but

which may prove to be incorrect. Assumptions have been made by the Company

regarding, among other things: the price of gold, continuing commercial

production at the Edikan Gold Mine without any major disruption, development of

a mine at Tengrela, the receipt of required governmental approvals, the accuracy

of capital and operating cost estimates, the ability of the Company to operate

in a safe, efficient and effective manner and the ability of the Company to

obtain financing as and when required and on reasonable terms. Readers are

cautioned that the foregoing list is not exhaustive of all factors and

assumptions which may have been used by the Company. Although management

believes that the assumptions made by the Company and the expectations

represented by such information are reasonable, there can be no assurance that

the forward-looking information will prove to be accurate. Forward-looking

information involves known and unknown risks, uncertainties, and other factors

which may cause the actual results, performance or achievements of the Company

to be materially different from any anticipated future results, performance or

achievements expressed or implied by such forward-looking information. Such

factors include, among others, the actual market price of gold, the actual

results of current exploration, the actual results of future exploration,

changes in project parameters as plans continue to be evaluated, as well as

those factors disclosed in the Company's publicly filed documents. The Company

believes that the assumptions and expectations reflected in the forward-looking

information are reasonable. Assumptions have been made regarding, among other

things, the Company's ability to carry on its exploration and development

activities, the timely receipt of required approvals, the price of gold, the

ability of the Company to operate in a safe, efficient and effective manner and

the ability of the Company to obtain financing as and when required and on

reasonable terms. Readers should not place undue reliance on forward-looking

information. Perseus does not undertake to update any forward-looking

information, except in accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Perseus Mining Limited

Managing Director:

Jeff Quartermaine

+61 8 6144 1700

jeff.quartermaine@perseusmining.com (Perth)

Perseus Mining Limited

Investor Relations:

Nathan Ryan

+61 4 2058 2887

nathan.ryan@nwrcommunications.com.au (Melbourne)

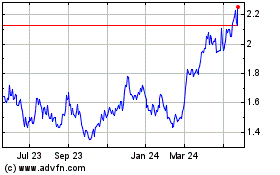

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Mar 2025 to Apr 2025

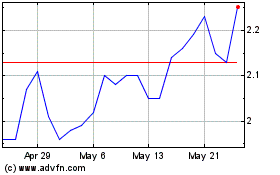

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Apr 2024 to Apr 2025