Parex Resources Inc. (“Parex” or the “Company”) (TSX:PXT) is a

company headquartered in Calgary that focuses on sustainable,

profitable, and conventional oil and gas production. All amounts

herein are in United States dollars (“USD”) unless otherwise

stated.

Strategic Partnership Agreements with

Ecopetrol in Colombia’s Arauca Province: Accessing High Quality

Llanos Basin Development & Exploration

Opportunities

Parex is pleased to be expanding its strategic

partnership with Ecopetrol S.A. (“Ecopetrol”), Colombia’s premier,

integrated oil and gas producer. Parex and Ecopetrol have executed

agreements whereby Parex will earn an operated, 50% interest in two

blocks, the Arauca and LLA-38 blocks (the “Blocks”), located in the

proven and highly prolific Llanos basin in the Arauca province of

north-eastern Colombia. Collectively, the Blocks contain proved

reserves along with development and drill ready exploration

prospects.

The agreements are consistent with Parex’

corporate strategy of acquiring assets with near term development

potential, industry leading netbacks and significant exploration

and appraisal opportunities in the Llanos Basin where Parex has a

proven track record of success.

The Blocks are situated approximately 40

kilometers north of Parex’ operated, Capachos producing block

(Ecopetrol partnered). In developing the Blocks, Parex expects to

be able to leverage its proven operating capabilities at Capachos

and replicate similar partnerships and mutual benefits with the

nearby communities.

The Arauca block is a production reactivation

opportunity. Parex plans to immediately commence working with local

authorities and communities with the objective of initiating

operations in late 2021.

On the adjacent LLA-38 exploration block,

initial activity will focus on the drill ready, 3D seismic defined,

Califa-1 exploration prospect. Further, Parex will acquire

additional 3D seismic to evaluate multiple exploration leads on the

block. Parex intends to commence drilling of the Califa-1

exploration prospect in 2022.

Parex’ independent qualified reserve evaluator,

GLJ Ltd. ("GLJ"), has recognized Company interest proved plus

probable reserves of 7.8 million barrels of light & medium

crude oil and future development capital of approximately $70

million associated with the Arauca block as of January 1, 2021. The

foregoing reserves information is obtained from information

contained in the independent reserves report prepared by GLJ dated

January 20, 2021 with an effective date of December 31, 2020. Such

report was prepared in accordance with definitions, standards and

procedures contained in the Canadian Oil and Gas Evaluation

Handbook and National Instrument 51-101 – Standards of Disclosure

for Oil and Gas Activities. The reserves presented in this press

release are based on GLJ's forecast pricing effective January 1,

2021. The report did not include the LLA-38 block.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d2f0366a-ff57-45c8-9c20-65a218a077f4

Arauca Block Oil Field

History

The Arauca block is a proven, shut-in oil field

which has undergone partial development dating back to the 1980s,

with cumulative light oil (34-41° API) production of approximately

10 million barrels from the Mirador formation. Peak production

rates from the Arauca block exceeded 4,000 bbl/d under restricted

rates associated with infrastructure limitations. (Source: IHS

Markit).

Existing pads, facilities, and infrastructure

along with oil export optionality support a broad range of both

development and exploration opportunities on the Arauca block.

Arauca & LLA-38 Blocks Initial Work

Plan

Parex and Ecopetrol have agreed to an initial

work plan for the Blocks, funded solely by Parex, that consists of

the drilling of 2 development wells, 1 exploration well and a

further capital program of $75.8 million. The overall timing and

activities of the capital program, across both the Blocks, will be

determined based on partner consultation, customary regulatory

approvals, surface access and exploration success, among other

factors.

Parex’ Ongoing Dedication and Integrated

ESG Strategy

As part of Parex’ ongoing dedication to its ESG

strategy, Parex will continue to investigate opportunities to

integrate and complement its growing operations with carbon

reduction initiatives. Although preliminary in nature, Parex

recognized the high subsurface reservoir temperatures in the region

that may be amenable to geothermal power generation in the future.

Parex, along with its partner Ecopetrol, will continue to evaluate

the Arauca Block going forward for technical and economic viability

for geothermal power while leveraging the expertise and findings

from its inaugural pilot and South America’s first geothermal power

generation project in the Las Maracas field in Casanare,

Colombia.

Production Update

Parex released a production update dated May 17,

2021 regarding production curtailments due to transportation

blockades throughout Colombia and withdrawing Q2 2021 guidance and

updating H2 2021 production guidance. Most of the civil

disturbances have been resolved and the transportation blockades

have been lifted, and Parex expects Q2 2021 production will average

approximately 43,975 boe/d. Currently, production is approximately

47,000 boe/d (see disclaimers at the end of this press release for

the breakdown of production into its constituent product types).

Parex is updating its H2 2021 production guidance set forth in the

press release dated May 17, 2021 at 44,000-50,000 boe/d, with Parex

expecting H2 2021 production to average 46,000-50,000 boe/d. The

lower end of the range incorporates the possibility of additional

disturbances.

Operational Update – Upcoming

Activity

Parex has resumed its drilling activities

following the transportation blockades being lifted, and provides

the below update on our exploration and growth activities:

|

Block |

Activity Description |

|

Cabrestero |

4-6 well program – drilling commenced June 2021. |

|

VIM-1 |

The Basilea-1 well has been drilled to a depth of 10,864 feet

encountering gas shows through the shallower Porquero Formation and

has now been temporarily suspended. The drilling rig will mobilize

to the Planadas pad to spud the Planadas nearfield exploration well

which is approximately 7 km west from La Belleza discovery,

targeting cienaga de oro limestones. The Company is

accelerating development for the La Belleza discovery drilled in

2019, including the production of compressed natural gas (“CNG”).

Subject to timing, partner and regulatory approval, the Joint

Venture anticipates preliminary production of approximately 7

million cubic feet/day plus liquids, for a total equivalent

production of 2,700 boe/d (gross) in Q4 2021. |

|

Capachos |

Since Parex’ drilling of the first earning well in 2017, over 5

million (gross) barrels of light oil has been produced from the

Parex operated (50% WI) Capachos Block, which at current Brent

pricing delivers approximately $50/bbl operating netbacks.

Following the re-processing of 3D seismic and generally strong

production performance to date in 2021, Parex plans to begin, in

late 2021, a high-impact 6 well program consisting of 3 appraisal

wells and 3 exploration wells, subject to partner definition and

approval process. |

|

VMM-46 |

Commenced acquisition of 215 square km of 3D seismic – completion

expected mid-October |

Environmental, Social and Governance

(“ESG”) Update

Over the last 3 years, Parex has made

significant progress to advance ESG disclosure and integrate

relevant ESG factors into the Company’s governance and management

structure, enterprise risk management, and compensation programs.

In particular, since 2018 Parex has transparently disclosed its

practices and performance related to greenhouse gas (“GHG”)

emissions through its response to the annual CDP (formerly Carbon

Disclosure Project) climate change questionnaire. The Company’s

sustainability performance is reflected in its above industry

average ESG ratings with CDP (B score) and other rating agencies

such as Sustainalytics (ranked 6th percentile or 9 out 172 among

oil and gas E&Ps)1.

Parex has taken substantial steps to reduce its

carbon footprint, investing in initiatives such as the construction

of pipelines to displace oil trucking, gas plants to limit flaring

volumes, and a geothermal power generation unit to replace carbon

intensive fuels. In 2020, the Company’s operational scopes 1 and 2

GHG emissions intensity per boe declined by 23.9% to 22.8 kg

CO2e/boe from 30.0 kg CO2e/boe in 2019. Building upon this

achievement, and in support of the Paris Agreement’s goals to

address climate change and to align with key stakeholders’ calls

for corporate climate action, Parex is dedicated to continue

lowering GHG emissions intensity per boe from operated assets. As a

result, the Company is dedicated to:

- Near-Term Goal: Eliminate routine flaring by

the end of 2025, supporting the World Bank’s Zero Routine Flaring

by 2030 initiative,

- Medium-Term

Target: Reduce scopes 1 and 2 GHG emissions intensity by

50% by 2030 from a 2019 baseline, and

- Long-Term

Ambition: As an aspirational goal, achieve net-zero scopes

1 and 2 GHG emissions by 2050.

Parex’ emission reduction strategy, in the

short- to mid-term, will focus on optimizing carbon footprint,

displacing carbon intensive power sources, and increasing power

generation from renewable sources. The Company’s long-term

low-carbon strategy will gradually emerge as Parex evaluates the

uncertainties it could face during the energy transition and

outlines sustainable pathways to achieving its net-zero ambition.

Parex will remain transparent, providing regular disclosure on

performance related to GHG emissions intensity targets and updates

on the evolving climate strategy. It is Parex’ aspiration to be

among the least carbon intensive oil and gas E&P companies

while continuing to deliver shareholder value and meet ongoing

global energy demand.

For more information on Parex’ performance on

ESG matters, visit the corporate sustainability webpage, with the

Company’s next annual sustainability report being expected in

August 2021.

Initiation of Quarterly

Dividend

Parex is pleased to announce the implementation

of a quarterly dividend program with respect to its common shares

(the “Common Shares”). The Board of Directors (the “Board”) has

approved the initiation of a dividend program pursuant to which the

Company expects to pay a regular quarterly cash dividend. If

declared, the quarterly dividend is expected to be paid in each of

March, June, September and December of each year. The Board has

approved the payment of a dividend for the third quarter of 2021 in

the amount of CAD$0.125 per Common Share, which will be payable on

September 30, 2021 to shareholders of record as of September 15,

2021. The dividend is designated as an “eligible dividend” for the

purpose of the Income Tax Act (Canada).

The decision to declare any quarterly dividend

and the amount of such dividend, if any, will be subject to the

discretion and determined by the Board taking into account, among

other things, business performance, financial condition, growth

plans and expected capital requirements as well as any contractual

restrictions and compliance with applicable law. There can be no

assurance that dividends will be paid at the intended rate or at

any rate in the future.

“The decision by the Board to initiate a

dividend represents a meaningful milestone in Parex’ history and

demonstrates confidence in our strong operating performance,

significant free cash flow and earnings generation, attractive cash

balance and positive long-term financial outlook,” said Imad

Mohsen, Parex’ Chief Executive Officer and President.

2021 Share Buy-Back Program – 60%

Complete – CAD$165 Million Repurchased

Parex will continue to maximize shareholder

value through its normal course issuer bid (“NCIB”) program, in

which the Company plans to purchase the maximum allowable 12.9

million Common Shares, prior to the NCIB’s expiry on December 22,

2021. As of June 30, 2021, the Company has repurchased for

cancellation 7.7 million Common Shares (for an aggregate purchase

price of approximately CAD$165 million) under its current NCIB,

which commenced on December 23, 2020. As of June 30, 2021, Parex

has approximately 124.9 million basic Common Shares outstanding.

The aggregate 2021 budgeted amount for Common Share purchases under

the current NCIB is approximately CAD$275 million (of which

approximately CAD$165 million has been incurred) or approximately

12% of Parex’ current enterprise value. Parex continues to have no

commodity price hedges in place such that any increases in Brent

oil prices would contribute to increases in Parex’ 2021 funds flow

provided by operations.

For more information, please

contact:

Mike KruchtenSenior

Vice-President Capital Markets & Corporate PlanningParex

Resources Inc.Phone: (403)

517-1733investor.relations@parexresources.com

NOT FOR DISTRIBUTION OR FOR

DISSEMINATION IN THE UNITED STATES

Advisory on Forward Looking

Statements

Certain information regarding Parex set forth in

this press release contains forward-looking statements that involve

substantial known and unknown risks and uncertainties. The use of

any of the words "plan", "expect", “prospective”, "project",

"intend", "believe", "should", "anticipate", "estimate",

"forecast", "budget" or other similar words, or statements that

certain events or conditions "may" or "will" occur are intended to

identify forward-looking statements. Such statements represent

Parex' internal projections, estimates or beliefs concerning, among

other things, future growth, results of operations, production,

future capital and other expenditures (including the amount, nature

and sources of funding thereof), competitive advantages, plans for

and results of drilling activity, business prospects and

opportunities. These statements are only predictions and actual

events or results may differ materially. Although the Company’s

management believes that the expectations reflected in the

forward-looking statements are reasonable, it cannot guarantee

future results, levels of activity, performance or achievement

since such expectations are inherently subject to significant

business, economic, competitive, political and social uncertainties

and contingencies. Many factors could cause Parex' actual results

to differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Parex.

In particular, forward-looking statements

contained in this document include, but are not limited to,

statements with respect to the Company's focus, plans, priorities

and strategies; terms of the contracts with Ecopetrol; expectation

that Parex will be able to leverage its proven operating

capabilities at Capachos and replicate similar partnerships and

mutual benefits with the nearby communities of the Blocks; the

benefits of the Blocks; timing of work commencement and operations

at the Blocks; expected activities and work plan on the Blocks and

the timing thereof; capital program on the Blocks; exploration

opportunities on the Arauca block; continued plan to evaluate the

Arauca Block going forward for technical and economic viability for

geothermal power; expected Q2 2021 production; H2 2021 production

range, with the lower end reflecting the possibility of additional

disturbances; H2 2021 production average; Parex' exploration and

growth activities following the transportation blockades being

lifted; Parex dedication to continue lowering GHG emissions

intensity per boe from operated assets; eliminating routine flaring

by the end of 2025; reducing scopes 1 and 2 GHG emissions

intensity; achieving net zero scopes 1 and 2 GHG emissions by 2050;

the Company's dividend policy; and Parex' expectation that it will

purchase the maximum allowable number of common shares under its

NCIB; the aggregate 2021 budgeted amount for Common Share purchases

under the NCIB; and anticipated funding of dividend payments. In

addition, statements relating to "reserves" are by their nature

forward-looking statements, as they involve the implied assessment,

based on certain estimates and assumptions that the resources

described can be profitably produced in the future. The recovery

and reserve estimates of Parex' reserves provided herein are

estimates only and there is no guarantee that the estimated

reserves will be recovered.

These forward-looking statements are subject to

numerous risks and uncertainties, including but not limited to, the

impact of general economic conditions in Colombia; industry

conditions including changes in laws and regulations, and changes

in how they are interpreted and enforced in Canada and Colombia;

lack of availability of qualified personnel; impact of the COVID-19

pandemic and the ability of the Company to carry on its operations

as currently contemplated in light of the COVID-19 pandemic; the

results of exploration and development drilling and related

activities; risks associated with negotiating with foreign

governments as well as country risk associated with conducting

international activities; environmental risks; ability to access

sufficient capital from internal and external sources; failure of

counterparties to perform under contracts; risk that Brent oil

prices are lower than anticipated; risk that Parex' evaluation of

its existing portfolio of development and exploration opportunities

is not consistent with its expectations; inability to lower GHG

emissions intensity per boe from operated assets and eliminate

routine flaring on the timeline anticipated or at all; risk that

Parex is unable to reduce scopes 1 and 2 GHG emissions in the

amount and timelines anticipated or achieve net zero scopes 1 and 2

GHG emissions on the timeline anticipated or at all; risk that

Parex does not have sufficient financial resources in the future to

pay a dividend; risk that the Board does not declare dividends in

the future or that Parex' dividend policy changes; and other

factors, many of which are beyond the control of the Company.

Depending on these and other factors, many of which will be beyond

the control of Parex, the dividend policy of Parex may change from

time to time and, as a result, future cash dividends could be

reduced or suspended entirely. Readers are cautioned that the

foregoing list of factors is not exhaustive. Additional information

on these and other factors that could affect Parex' operations and

financial results are included in reports on file with Canadian

securities regulatory authorities and may be accessed through the

SEDAR website (www.sedar.com).

Although the forward-looking statements

contained in this document are based upon assumptions which

Management believes to be reasonable, the Company cannot assure

investors that actual results will be consistent with these

forward-looking statements. With respect to forward-looking

statements contained in this document, Parex has made assumptions

regarding, among other things: current and anticipated commodity

prices and royalty regimes; the impact (and the duration thereof)

that COVID-19 pandemic will have on the demand for crude oil and

natural gas, Parex’ supply chain and Parex’ ability to produce,

transport and sell Parex’ crude oil and natural gas; availability

of skilled labour; timing and amount of capital expenditures;

future exchange rates; the price of oil, including the anticipated

Brent oil price; the impact of increasing competition; conditions

in general economic and financial markets; availability of drilling

and related equipment; effects of regulation by governmental

agencies; receipt of partner, regulatory and community approvals;

royalty rates; future operating costs; uninterrupted access to

areas of Parex' operations and infrastructure; recoverability of

reserves and future production rates; the status of litigation;

timing of drilling and completion of wells; on-stream timing of

production from successful exploration wells; operational

performance of non-operated producing fields; pipeline capacity;

that Parex will have sufficient cash flow, debt or equity sources

or other financial resources required to fund its capital and

operating expenditures and requirements as needed; that Parex'

conduct and results of operations will be consistent with its

expectations; that Parex will have the ability to develop its oil

and gas properties in the manner currently contemplated; that

Parex' evaluation of its existing portfolio of development and

exploration opportunities is consistent with its expectations;

current or, where applicable, proposed industry conditions, laws

and regulations will continue in effect or as anticipated as

described herein; that the estimates of Parex' production and

reserves volumes and the assumptions related thereto (including

commodity prices and development costs) are accurate in all

material respects; that Parex will be able to obtain contract

extensions or fulfill the contractual obligations required to

retain its rights to explore, develop and exploit any of its

undeveloped properties; ability to achieve reductions in GHG

emissions intensity per boe from operated assets; ability to

eliminate routine flaring and reduce scopes 1 and 2 GHG emissions

on the timeline anticipated; ability to achieve zero scopes 1 and 2

GHG emissions on the timeline anticipated; that Parex will have

sufficient financial resources to pay dividends in the future; and

other matters.

Management has included the above summary of

assumptions and risks related to forward-looking information

provided in this document in order to provide shareholders with a

more complete perspective on Parex' current and future operations

and such information may not be appropriate for other purposes.

Parex' actual results, performance or achievement could differ

materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what

benefits Parex will derive. These forward-looking statements are

made as of the date of this document and Parex disclaims any intent

or obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

Dividend Advisory

Future dividend payments, if any, and the level

thereof is uncertain. The Company's dividend policy and any

decision to pay further dividends on the Common Shares will be

subject to the discretion of the Board and may depend on a variety

of factors, including, without limitation the Company's business

performance, financial condition, financial requirements, growth

plans, expected capital requirements and other conditions existing

at such future time including, without limitation, contractual

restrictions and satisfaction of the solvency tests imposed on the

Company under applicable corporate law. The actual amount, the

declaration date, the record date and the payment date of any

dividend are subject to the discretion of the Board. There can be

no assurance that dividends will be paid at the intended rate or at

any rate in the future.

Oil and Gas Advisory

Current production of approximately 47,000 boe/d

consists of approximately 8,169 bbls/d of light crude oil and

medium crude oil, 37,123 bbls/d of heavy crude oil and 10,248 mcf/d

of conventional natural gas (96% crude oil).

The term "Boe" means a barrel of oil equivalent

on the basis of 6 thousand cubic feet ("Mcf") of natural gas to 1

bbl. Boe may be misleading, particularly if used in isolation. A

boe conversion ratio of 6 Mcf: 1 Bbl is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead.

Given the value ratio based on the current price of crude oil as

compared to natural gas is significantly different from the energy

equivalency of 6 Mcf: 1 Bbl, utilizing a conversion ratio at 6 Mcf:

1 Bbl may be misleading as an indication of value.

This press release contains a number of oil and

gas metrics, including operating netbacks. These oil and gas

metrics have been prepared by management and do not have

standardized meanings or standard methods of calculation and

therefore such measures may not be comparable to similar measures

used by other companies and should not be used to make comparisons.

Such metrics have been included herein to provide readers with

additional measures to evaluate the Company's performance; however,

such measures are not reliable indicators of the future performance

of the Company and future performance may not compare to the

performance in previous periods and therefore such metrics should

not be unduly relied upon. Management uses these oil and gas

metrics for its own performance measurements and to provide

security holders with measures to compare the Company's operations

over time. Readers are cautioned that the information provided by

these metrics, or that can be derived from the metrics presented in

this news release, should not be relied upon for investment or

other purposes.

Non-GAAP Terms

The Company discloses financial measures

("non-GAAP Measures") herein that do not have any standardized

meaning prescribed under International Financial Reporting

Standards ("IFRS"). These financial measures are operating netback

and funds flow provided by operations. Management uses these

non-GAAP measures for its own performance measurement and to

provide shareholders and investors with additional measurements of

the Company’s efficiency and its ability to fund a portion of its

future capital expenditures.

The Company considers operating netback to be a

key measure as it demonstrates Parex' profitability relative to

current commodity prices. The following is a description of each

component of the Company's operating netback and how it is

determined:

- Oil and

natural gas sales per boe is determined by sales revenue excluding

risk management contracts divided by total equivalent sales volume

including purchased oil volume;

- Royalties

per boe is determined by dividing royalty expense by the total

equivalent sales volume and excludes purchased oil volumes;

-

Production expense per boe is determined by dividing production

expense by total equivalent sales volume and excludes purchased oil

volumes; and

-

Transportation expense per boe is determined by dividing

transportation expense by the total equivalent sales volumes

including purchased oil volumes.

Funds flow provided by operations is a non-GAAP

measure that includes all cash generated from operating activities

and is calculated before changes in non-cash working capital. In Q2

2019, the Company changed how it presents funds flow provided by

operations to present a more comparable basis to industry

presentation.

Shareholders and investors should be cautioned

that these measures should not be construed as an alternative to

net income or other measures of financial performance as determined

in accordance with IFRS. Parex' method of calculating these

measures may differ from other companies, and accordingly, they may

not be comparable to similar measures used by other companies.

Please see the Company's most recent Management’s Discussion and

Analysis, which is available at www.sedar.com for additional

information about this financial measure.

1 Source: Sustainalytics ESG Risk Rating Report on Parex

Resources Inc. dated May 28, 2021

PDF

available: http://ml.globenewswire.com/Resource/Download/35c3898a-0bf8-44ea-b6c2-270466c35580

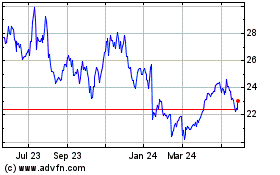

Parex Resources (TSX:PXT)

Historical Stock Chart

From Dec 2024 to Jan 2025

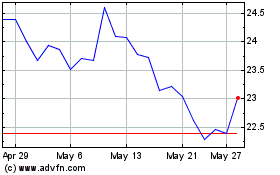

Parex Resources (TSX:PXT)

Historical Stock Chart

From Jan 2024 to Jan 2025