Parex Resources Inc. (“Parex” or the “Company”) (TSX:PXT), is a

company headquartered in Calgary, Alberta that focuses on

sustainable, conventional oil and gas production.

All

amounts herein are in United States Dollars (“USD”) unless

otherwise stated.

Parex is pleased to announce its 2022 budget

guidance and provide an update to its framework for returning

capital to shareholders. Imad Mohsen, President and CEO of Parex

commented: "One of the elements that attracted me most to join

Parex in early 2021 was the depth and quality of the Company’s

development, appraisal, and exploration portfolio in Colombia. We

are excited to move forward with a plan that materially expands the

boundaries of our current development properties while also

unlocking substantial new opportunities within our production

portfolio. Underpinning the plans is a portfolio with substantial

exploitation potential that we believe can be unlocked using

techniques which are unfamiliar in Colombia but long proven

elsewhere. The returns of the organic 2022 development program are

very compelling at $70/bbl Brent oil prices. Combined with our

industry-leading balance sheet, our upgraded development program

further strengthens Parex’ ability to generate sustainable

long-term growth in free funds flow(1) and return meaningful

capital to shareholders. I am very proud of our team and confident

in our ability to execute and deliver significant value for our

shareholders."

2022 Corporate Guidance

As per the Company's normal annual disclosure

practices, provided below is Parex' corporate guidance for:

|

|

2021 Estimate |

2022 Guidance |

|

Brent crude average price ($/bbl) |

$72 |

$70 |

|

Production (average for period) (boe/d) |

46,500-47,500 |

52,000-54,000 |

|

Total capital expenditures ($ millions) |

$270-$290 |

$400-$450 |

|

Funds flow provided by operations ("FFO")(1)(2) ($ millions) |

$575-$595 |

$600-$650 |

(1) See "Non-GAAP Terms"(2) 2022 guidance

assumes Brent/Vasconia crude differential of $4.00/bbl.

2022 Capital Expenditure Program:

Building Long-term Sustainability

Parex has one of the deepest, most diversified,

development and exploration portfolios in Colombia, and is excited

to pursue additional organic opportunities in 2022 to maximize the

return profile of our asset base and continue to build a

sustainable business for the future.

In 2022, the Company will pursue a balanced

approach to capital allocation. The planned 2022 capital

expenditures are split between development, appraisal and

exploration/new growth programs, and are expected to provide

year-over-year annualized production growth of approximately 13%

(at the mid-point of guidance). We believe this growth will be

primarily driven by Capachos, Cabrestero, VIM-1, Arauca and

Fortuna, and does not include any potential additional volumes from

the estimated 15-18 gross wells in our appraisal and exploration

program.

|

Category |

Mid-point Capital ($ Millions) |

|

Development Activity |

$180 |

|

Development Facilities |

$90 |

|

Appraisal & Exploration |

$130 |

|

Seismic Activity |

$25 |

|

Total |

$425 |

- Continuing to lengthen the

runway for sustainable long-term growth and shareholder

returns. Our current appraisal and exploration program

includes an estimated 15-18 gross wells, 13-14 operated, and 2-4

partner operated. These projects are expected to expand the

boundaries of our current base/development properties, and grow

associated reserves, while also targeting new unbooked areas. The

2022 appraisal and exploration program will focus on a diverse set

of blocks, including: Boranda, Capachos, LLA-38 (Califa), CPO-11,

Fortuna, LLA-134, VIM-1, VIM-43 and LLA-94.

- Diversified and balanced

development program. A key focus for capital investment in

2022 is on development. There are currently 35-45 gross wells

planned, 15-20 operated and 20-25 partner operated. The areas with

development opportunities are LLA-34, Cabrestero, Capachos, Arauca,

VIM-1 and Boranda.

- Advancing exploration

prospects. Our 3D seismic program, in VIM-43, VMM-46 and

VSM-36, covers a total area greater than 800 square

kilometers.

The Company's 2022 priority is

continuing to build long-term sustainability. Parex will

be responsive to changes in commodity prices by managing its

production volumes and capital budget to maximize shareholder

value. However, the Company expects minimal changes to production

and capital expenditures in an above $60/bbl Brent oil pricing

scenario.

2022 Netback Sensitivity

Estimates

|

Brent crude price ($/bbl) |

$60 |

$70 |

$80 |

$90 |

|

Operating Netback ($/boe)(1) |

$34 |

$41 |

$48 |

$54 |

|

Effective tax rate (%)(2) |

16% |

19% |

21% |

22% |

|

FFO Netback ($/boe)(1)(3) |

$27 |

$32 |

$37 |

$41 |

(1) See "Non-GAAP terms"(2) Effective tax rate

is the expected current tax effective rate on FFO. (3) Assumes

Brent/Vasconia crude differential of $4.00/bbl.

Free Funds Flow Allocation

Strategy(1)

Parex is pleased to provide an update to its

free funds flow allocation strategy and framework for returning

capital to shareholders. In its press release dated July 7, 2021,

the Company announced the implementation of a quarterly dividend

with respect to its common shares. The Company remains committed to

its goal of returning significant capital to shareholders through

share buybacks, its quarterly dividend and special dividends, with

the declaration and amount of any dividend being at the discretion

of the Board of Directors ("Board")(2).

- November 2021 Special Cash

Dividend. The increase in commodity prices over the past

year has provided Parex with higher-than-expected free funds flow,

some of which will be returned to shareholders in the form of a

special cash dividend approved by the Board in the amount of

CAD$0.25 per common share. This special cash dividend will be

payable on November 22, 2021 to shareholders of record as of

November 16, 2021 and is designated as an “eligible dividend” for

the purposes of the Income Tax Act (Canada). See Parex' press

release respecting its third quarter 2021 results dated November 3,

2021 for more information on this special dividend.

- Sustainable Enhanced

Shareholder Return Options. Under our 2022 budget guidance

scenario, at forecast Brent pricing levels of $70/bbl, Parex

anticipates total capital expenditures to be approximately 68% of

funds flow provided by operations(1) (at the mid-point of

guidance), leaving material free funds flow for enhanced

shareholder return options such as share buy-backs and, as declared

by the Board at their discretion, the payment of dividends(2).

Further, the Company has significant opportunities to invest in

additional Colombian oil and gas growth if considered

appropriate.

(1) See "Non-GAAP terms"(2) See Dividend

Advisory

Q3 2021 Results Conference Call &

Audio Webcast

Parex will host a conference call and webcast to

discuss the Third Quarter financial and operating results on

Thursday, November 4, 2021 beginning at 9:30 am Mountain Time. To

participate in the conference call or webcast, see details

below.

|

Toll-free dial-in number (Canada/US): |

1-800-898-3989 |

|

Local dial-in number: |

416-340-2217 |

|

International dial-in numbers: |

https://www.confsolutions.ca/ILT?oss=7P1R8008983989 |

|

Participant passcode: |

5959006# |

This news release does not constitute an

offer to sell securities, nor is it a solicitation of an offer to

buy securities, in any jurisdiction.

For more information, please

contact:Mike KruchtenSenior Vice

President, Capital Markets & Corporate PlanningParex Resources

Inc.Phone: (403) 517-1733Investor.relations@parexresources.com

NOT FOR DISTRIBUTION OF FOR

DISSEMINATION IN THE UNITED STATES

Non-GAAP TermsThe Company

discloses several financial measures ("non-GAAP Measures") herein

that do not have any standardized meaning prescribed under

International Financial Reporting Standards ("IFRS"). These

financial measures include operating netback per boe, FFO, FFO

netback per boe and free funds flow. Management uses these non-GAAP

measures for its own performance measurement and to provide

shareholders and investors with additional measurements of the

Company’s efficiency and its ability to fund a portion of its

future capital expenditures.

The Company considers operating netback per boe

to be a key measure as it demonstrates Parex' profitability

relative to current commodity prices. The following is a

description of each component of the Company's operating netback

per boe and how it is determined:

- Oil and natural gas sales per boe

is determined by sales revenue excluding risk management contracts

divided by total equivalent sales volume including purchased oil

volume;

- Royalties per boe is determined by

dividing royalty expense by the total equivalent sales volume and

excludes purchased oil volumes;

- Production expense per boe is

determined by dividing production expense by total equivalent sales

volume and excludes purchased oil volumes; and

- Transportation expense per boe is

determined by dividing transportation expense by the total

equivalent sales volumes including purchased oil volumes.

Funds flow provided by operations is a non-GAAP

measure that includes all cash generated (used in) from operating

activities and is calculated before changes in non-cash working

capital. In Q2 2019, the Company changed how it presents FFO to

present a more comparable basis to industry presentation.

FFO netback per boe is a non-GAAP measure that

includes all cash generated (used in) from operating activities and

is calculated before changes in non-cash working capital, divided

by produced oil and natural gas sales volumes.

Free funds flow is determined by FFO mid-point

less capital expenditures

Shareholders and investors should be cautioned

that these measures should not be construed as an alternative to

net income or other measures of financial performance as determined

in accordance with IFRS. Parex' method of calculating these

measures may differ from other companies, and accordingly, they may

not be comparable to similar measures used by other companies.

Please see the Company's most recent Management’s Discussion and

Analysis, which is available at www.sedar.com for additional

information about these financial measures.

Oil & Gas Matters

AdvisoryThe term "Boe" means a barrel of oil equivalent on

the basis of 6 thousand cubic feet ("Mcf") of natural gas to 1 bbl.

Boe may be misleading, particularly if used in isolation. A boe

conversion ratio of 6 Mcf: 1 Bbl is based on an energy equivalency

conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. Given the value

ratio based on the current price of crude oil as compared to

natural gas is significantly different from the energy equivalency

of 6 Mcf: 1Bbl, utilizing a conversion ratio at 6 Mcf: 1 Bbl may be

misleading as an indication of value.

This press release contains a number of oil and

gas metrics, including operating netbacks and FFO netbacks. These

oil and gas metrics have been prepared by management and do not

have standardized meanings or standard methods of calculation and

therefore such measures may not be comparable to similar measures

used by other companies and should not be used to make comparisons.

Such metrics have been included herein to provide readers with

additional measures to evaluate the Company's performance; however,

such measures are not reliable indicators of the future performance

of the Company and future performance may not compare to the

performance in previous periods and therefore such metrics should

not be unduly relied upon. Management uses these oil and gas

metrics for its own performance measurements and to provide

security holders with measures to compare the Company's operations

over time. Readers are cautioned that the information provided by

these metrics, or that can be derived from the metrics presented in

this news release, should not be relied upon for investment or

other purposes.

Dividend AdvisoryFuture

dividend payments, if any, and the level thereof is uncertain. The

Company's dividend policy and any decision to pay further dividends

on the common shares, including any special dividends, will be

subject to the discretion of the Board and may depend on a variety

of factors, including, without limitation the Company's business

performance, financial condition, financial requirements, growth

plans, expected capital requirements and other conditions existing

at such future time including, without limitation, contractual

restrictions and satisfaction of the solvency tests imposed on the

Company under applicable corporate law. The actual amount, the

declaration date, the record date and the payment date of any

dividend are subject to the discretion of the Board. There can be

no assurance that dividends will be paid at the intended rate or at

any rate in the future.

Advisory on Forward Looking

StatementsCertain information regarding Parex set forth in

this document contains forward-looking statements that involve

substantial known and unknown risks and uncertainties. The use of

any of the words "plan", "expect", “prospective”, "project",

"intend", "believe", "should", "anticipate", "estimate",

“forecast”, "guidance", “budget” or other similar words, or

statements that certain events or conditions "may" or "will" occur

are intended to identify forward-looking statements. Such

statements represent Parex' internal projections, estimates or

beliefs concerning, among other things, future growth, results of

operations, production, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, plans for and results of drilling activity,

environmental matters, business prospects and opportunities. These

statements are only predictions and actual events or results may

differ materially. Although the Company’s management believes that

the expectations reflected in the forward-looking statements are

reasonable, it cannot guarantee future results, levels of activity,

performance or achievement since such expectations are inherently

subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors could

cause Parex' actual results to differ materially from those

expressed or implied in any forward-looking statements made by, or

on behalf of, Parex.

In particular, forward-looking statements

contained in this document include, but are not limited to,

statements with respect to the Company’s focus, plans, priorities

and strategies, including the Company's ability to deliver value

for shareholders; 2021 estimated and 2022 guidance for Brent crude

average price, average production, total capital expenditures, and

funds provided by operations and assumptions underlying such

estimates and guidance; ability to pursue additional organic

opportunities in 2022 and the benefits to be derived therefrom;

allocation of 2022 planned capital expenditures; year-over-year

anticipated production growth and the primary drivers of such

growth; the expected key activities in Parex' capital expenditure

program, including areas with development opportunities, the

Company's focus on certain blocks in Colombia, and the planned

number of wells to be drilled; expectation that there will be

minimal changes required to production and capital expenditures

under the disclosed Brent oil pricing scenario; 2022 netback

sensitivity estimates; anticipated capital expenditures as a

percentage of funds flow provided by operations and effect on free

cash flow; anticipated uses of free cash flow; the Company's focus

on and evaluation of M&A opportunities; terms of the dividends

payable on November 22, 2021 ; Parex' dividend; and anticipated

timing for quarterly conference call and webcast.

These forward-looking statements are subject to

numerous risks and uncertainties, including but not limited to, the

impact of general economic conditions in Canada and Colombia;

prolonged volatility in commodity prices; industry conditions

including changes in laws and regulations including adoption of new

environmental laws and regulations, and changes in how they are

interpreted and enforced in Canada and Colombia; impact of the

COVID-19 pandemic and the ability of the Company to carry on its

operations as currently contemplated in light of the COVID-19

pandemic; determinations by OPEC and other countries as to

production levels; competition; lack of availability of qualified

personnel; the results of exploration and development drilling and

related activities; obtaining required approvals of regulatory

authorities in Canada and Colombia; risks associated with

negotiating with foreign governments as well as country risk

associated with conducting international activities; volatility in

market prices for oil; fluctuations in foreign exchange or interest

rates; environmental risks; changes in income tax laws or changes

in tax laws and incentive programs relating to the oil industry;

changes to pipeline capacity; ability to access sufficient capital

from internal and external sources; failure of counterparties to

perform under contracts; risk that Brent oil prices are lower than

anticipated; risk that Parex' evaluation of its existing portfolio

of development and exploration opportunities is not consistent with

its expectations; risk that initial test results are not indicative

of future performance; risk that other formations do not contain

the expected oil bearing sands; risk that Parex does not have

sufficient financial resources in the future to pay a dividend;

risk that the Board does not declare dividends in the future or

that Parex' dividend policy changes; and other factors, many of

which are beyond the control of the Company. Readers are cautioned

that the foregoing list of factors is not exhaustive. Additional

information on these and other factors that could affect Parex'

operations and financial results are included in reports on file

with Canadian securities regulatory authorities and may be accessed

through the SEDAR website (www.sedar.com).

Although the forward-looking statements

contained in this document are based upon assumptions which

Management believes to be reasonable, the Company cannot assure

investors that actual results will be consistent with these

forward-looking statements. With respect to forward-looking

statements contained in this document, Parex has made assumptions

regarding, among other things: current and anticipated commodity

prices and royalty regimes; the impact (and the duration thereof)

that COVID-19 pandemic will have on the demand for crude oil and

natural gas, Parex’ supply chain and Parex’ ability to produce,

transport and sell Parex’ crude oil and natural; gas; availability

of skilled labour; timing and amount of capital expenditures;

future exchange rates; the price of oil, including the anticipated

Brent oil price; the impact of increasing competition; conditions

in general economic and financial markets; availability of drilling

and related equipment; effects of regulation by governmental

agencies; receipt of partner, regulatory and community approvals;

royalty rates; future operating costs; uninterrupted access to

areas of Parex' operations and infrastructure; recoverability of

reserves and future production rates; the status of litigation;

timing of drilling and completion of wells; on-stream timing of

production from successful exploration wells; operational

performance of non-operated producing fields; pipeline capacity;

that Parex will have sufficient cash flow, debt or equity sources

or other financial resources required to fund its capital and

operating expenditures and requirements as needed; that Parex'

conduct and results of operations will be consistent with its

expectations; that Parex will have the ability to develop its oil

and gas properties in the manner currently contemplated; that

Parex' evaluation of its existing portfolio of development and

exploration opportunities is consistent with its expectations;

current or, where applicable, proposed industry conditions, laws

and regulations will continue in effect or as anticipated as

described herein; that the estimates of Parex' production and

reserves volumes and the assumptions related thereto (including

commodity prices and development costs) are accurate in all

material respects; that Parex will be able to obtain contract

extensions or fulfill the contractual obligations required to

retain its rights to explore, develop and exploit any of its

undeveloped properties; that Parex will have sufficient financial

resources to pay dividends in the future; and other matters.

Management has included the above summary of

assumptions and risks related to forward-looking information

provided in this document in order to provide shareholders with a

more complete perspective on Parex' current and future operations

and such information may not be appropriate for other purposes.

Parex' actual results, performance or achievement could differ

materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what

benefits Parex will derive. These forward-looking statements are

made as of the date of this document and Parex disclaims any intent

or obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

This press release contains a financial outlook

about the Corporation's prospective capital expenditures and funds

flow provided by operations. Such financial information has been

prepared by management to provide an outlook of the Company's

financial results and activities and may not be appropriate for

other purposes. This information has been prepared based on a

number of assumptions including the assumptions discussed in this

press release. The actual results of operations of the Company and

the resulting financial results may vary from the amounts set forth

herein, and such variations may be material. The Company and

management believe that the financial outlook has been prepared on

a reasonable basis, reflecting management’s best estimates and

judgments. The financial outlook contained in this press release

was made as of the date of this press release and Parex disclaims

any intent or obligation to update publicly the press release,

whether as a result of new information, future events or otherwise,

unless required pursuant to applicable law.

PDF

available: http://ml.globenewswire.com/Resource/Download/087e784c-093c-46e4-9060-8b854334cf58

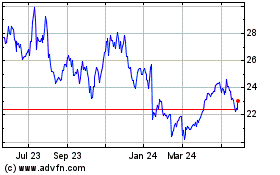

Parex Resources (TSX:PXT)

Historical Stock Chart

From Dec 2024 to Jan 2025

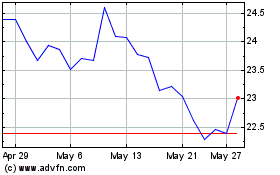

Parex Resources (TSX:PXT)

Historical Stock Chart

From Jan 2024 to Jan 2025