Parex Resources Inc. (“Parex” or the “Company”) (TSX: PXT) is

pleased to announce the results of its annual independent reserves

assessment as at December 31, 2022, as well as a corporate update.

The financial and operational information contained below is based

on the Company’s unaudited estimated results for year-end December

31, 2022. All currency amounts are in United States dollars unless

otherwise stated. The following reserves categories are discussed

in this news release: proved developed producing ("PDP"); proved

("1P"); proved plus probable ("2P"); and proved plus probable plus

possible ("3P").

Key Highlights

- Twelve

consecutive years of PDP, 1P and 2P reserves per share growth (on a

boe basis), with double digit percentage increases from 2021.

- Achieved

a strong 1P reserve replacement ratio of 128%.

-

Strategically deployed $100 million of working capital to complete

a voluntary, internal corporate entity restructuring that increases

2023 funds flow and free funds flow guidance by $65 million

(midpoint) as well as provides the Company with an increased

outlook through 2027.

- Declared

a Q1 2023 regular dividend of C$0.375 per share or C$1.50 per share

annualized, representing a 50% increase from the Company’s Q4 2022

regular dividend; Parex first initiated a regular dividend at

C$0.125 per share quarterly in 2021.

-

Repurchased approximately 1 million shares year-to-date 2023 under

the current normal course issuer bid.

-

Recognized for leadership in ESG, where Parex was one of three

Canadian-listed exploration and production companies included in

the 2023 Bloomberg Gender-Equality Index.

Imad Mohsen, President and Chief Executive

Officer, commented: “Parex achieved strong reserve replacement

ratios in 2022 from the implementation of new technology and

focused investments that are resulting in an outlook for reduced

maintenance capital and further optimized production from key

assets. The results that we are seeing today, in addition to our

positive outlook for the business, gives us the confidence to

sustainably increase our regular dividend to shareholders. With

investments across our world-class Colombian asset base, the

portfolio is well positioned to deliver a step-change in capital

efficiency and continue being the foundation for increased

shareholder returns.”

2022 Year-End Corporate Reserves Report:

Highlights

For year-ended December 31, 2022, Parex:

- Grew

reserves per share (on a boe basis) across PDP, 1P and 2P for the

12th consecutive year:

- PDP: 13%

increase from 2021;

- 1P: 15%

increase from 2021;

- 2P: 12%

increase from 2021.

- More than

replaced total 2022 production (approximately 19.0 million barrels

of oil equivalent (“MMboe”)) with reserve replacement ratios of:

- PDP:

112%, with reserve additions of 21.2 MMboe;

- 1P: 128%,

with reserve additions of 24.4 MMboe;

- 2P: 110%,

with reserve additions of 20.9 MMboe.

- Realized

estimated finding, development & acquisition (“FD&A”) costs

(using estimated 2022 adjusted funds flow from operations of $42.43

per boe(1)) of:

- PDP:

$25.35 per boe resulting in a 1.7x recycle ratio(1);

- 1P:

$25.92 per boe resulting in a 1.6x recycle ratio(1);

- 2P:

$28.39 per boe resulting 1.5x recycle ratio(1).

- Realized

growth in its after-tax net asset value (“NAV”) per share

(discounted at 10% and using the GLJ Brent forecast) even after

incorporating the estimated impact of the recent Colombia

government tax reform:

- PDP:

C$23.83 (6% increase from 2021)(1);

- 1P:

C$31.63 (9% increase from 2021)(1);

- 2P:

C$43.45 (13% increase from 2021)(1).

- After

accounting for the 2022 drilling campaign, expanded corporate gross

2P future locations to 147 from 108 last year, demonstrating

significant running room.

- Added 1P

and 2P reserves at the Cabrestero Block (100% W.I.) of 8.9 and 8.8

MMboe, respectively.

- Increased

its Q4 2022 average production by approximately 9% over the

comparative quarter in 2021 and maintained a 2P reserve life index

of over 10 years.

(1) Non-GAAP ratio. See "Non-GAAP and Other Financial Measures

Advisory".

Production Update

2022 Review

|

|

|

For the three months endedDec.

31 |

|

For the year endedDec. 31 |

|

|

|

|

|

Product Type |

|

2022(1) |

2021 |

|

2022(1) |

2021 |

|

Light & Medium Crude Oil (bbl/d) |

|

10,511 |

6,376 |

|

7,471 |

6,831 |

| Heavy Crude Oil (bbl/d) |

|

42,746 |

41,534 |

|

43,008 |

38,449 |

|

Conventional Natural Gas (mcf/d) |

|

6,000 |

11,214 |

|

9,420 |

10,308 |

|

Oil Equivalent (boe/d) |

|

54,257 |

49,779 |

|

52,049 |

46,998 |

(1) Production volumes for the three months ended

December 31, 2022, and for the year-ended December 31,

2022, are estimated.

- Q4 2022

average production is estimated to be 54,257 boe/d, up 9% from Q4

2021.

- FY 2022

average production is estimated to be 52,049 boe/d, an increase of

11% from FY 2021.

2023 Outlook

- In the

Northern Llanos, on January 21, 2023, the Company proactively

shut-in its Capachos Block (50% W.I.) and halted drilling

operations at the Arauca Block (50% W.I.), due to heightened

security concerns related to peace talks at the Federal Government

level in Colombia.

- As a

result of this shut-in, net production is being impacted by

approximately 6,000 boe/d and is affecting the pace that new wells

can be drilled and brought online.

- The

Company is actively engaging with national and regional

stakeholders and is optimistic that it will be able to resume full

operations in the Northern Llanos in Q1 2023; however, the

Company’s top priority is the safety of our employees and

contractors.

- Parex’s

average production guidance of 57,000 to 63,000 boe/d for FY 2023

had been widened relative to previous years in order to better

account for above ground factors that can at times impact Colombian

operations.

- Due to

the Northern Llanos shut-in, for Q1 2023 Parex expects its

production to be below its 2023 annual average production guidance

range, subject to the length of the shut-in and halted drilling

operations; however, Parex expects to be within its 2023 annual

average production guidance range in Q2 2023 and for the full year

2023.

- Prior to

the heightened security concerns, Parex was making steady progress

at the Arauca Block (50% W.I.), where civil work activities were

ongoing in 2022 and the first well of a material, multi-year

drilling campaign was successfully spud in early January 2023.

Voluntary Restructuring Increases 2023

Funds Flow and Free Funds Flow Guidance as well as Outlook Through

2027

Parex has completed a voluntary, internal

corporate entity restructuring to consolidate certain assets in the

Southern Llanos into one corporate entity for operational and

administrative optimization.

The financial impact of this restructuring is

that the Company will incur Colombia capital gains taxes in Q4

2022, while gaining an expected increase of $325 million to the

Company’s deferred tax asset balance as at year-end December 31,

2022, which is anticipated to provide benefits over the 2023-2027

fiscal year period. The restructuring has an estimated cost, in the

form of an increased current tax expense for Q4 2022, of $100

million. The Company’s Q4 2022 current tax expense is now expected

to be roughly $175 million, compared to the Company’s original

internal forecast of approximately $75 million; full-year 2022 net

income will increase by approximately $225 million due to a

deferred tax recovery, offset by the incremental Q4 2022 current

tax expense of $100 million.

As a result of the restructuring, the Company

expects a lower effective tax rate over the 2023-2027 fiscal year

period. At the previously budgeted $80 per barrel Brent oil price

assumption and existing Colombian tax regulations, the expected

benefits of the lower effective tax rate in 2023, which are higher

funds flow provided by operations and free funds flow, are

reflected in the updated 2023 guidance below.

|

Category |

2023 Guidance(Previous) |

2023 Guidance(Updated) |

|

Brent Crude Average Price ($/bbl) |

|

$80 |

|

|

$80 |

|

|

Effective Tax Rate Estimate (%)(1) |

|

32% |

|

|

25% |

|

|

Funds Flow Provided by Operations Netback ($/boe)(2) |

|

$31 |

|

|

$34 |

|

|

Production Average (boe/d) |

57,000-63,000 |

57,000-63,000 |

|

Capital Expenditures ($ millions)(3) |

$425-475 |

$425-475 |

|

Funds Flow Provided by Operations ($ millions)(4) |

$645-715 |

$705-780 |

|

Free Funds Flow ($ millions; midpoint)(3) |

|

$230 |

|

|

$295 |

|

(1) Supplementary financial measure. See "Non-GAAP and Other

Financial Measures Advisory”.(2) Non-GAAP ratio. See "Non-GAAP and

Other Financial Measures Advisory".(3) Non-GAAP financial measure.

See "Non-GAAP and Other Financial Measures Advisory".(4) Capital

management measure. See "Non-GAAP and Other Financial Measures

Advisory".

Parex will fund the corporate restructuring with

existing working capital surplus, which post-restructuring is

estimated to be $65 million as at December 31, 2022(1).

(1) Capital management measure. See "Non-GAAP and Other

Financial Measures Advisory".

Updated 2023 Netback Sensitivity Estimates

The below netback sensitivity estimates have

been updated to take into account the corporate restructuring.

|

Brent Crude Price ($/bbl) |

|

$60 |

|

|

$70 |

|

|

$80 |

|

|

$90 |

|

|

$100 |

|

|

Effective Tax Rate Estimate (%)(1) |

|

13% |

|

|

20% |

|

|

25% |

|

|

30% |

|

|

33% |

|

|

Funds Flow Provided by Operations Netback ($/boe)(2)(3) |

|

$27 |

|

|

$31 |

|

|

$34 |

|

|

$36 |

|

|

$40 |

|

(1) Supplementary financial measure. See "Non-GAAP and Other

Financial Measures Advisory”.(2) Non-GAAP ratio. See "Non-GAAP and

Other Financial Measures Advisory".(3) Assumes an unchanged from

budget Brent/Vasconia crude differential of $4/bbl.

Return of Capital Update

50% Increase to the Q1 2023 Dividend

Parex’s Board of Directors has approved a Q1

2023 regular dividend of C$0.375 per share to be paid on March 31,

2023, to shareholders of record on March 15, 2023, representing a

50% increase from the Company’s Q4 2022 regular dividend of C$0.25

per share. The Company first initiated a regular dividend at

C$0.125 per share quarterly in 2021.

This quarterly dividend payment to shareholders

is designated as an “eligible dividend” for purposes of the Income

Tax Act (Canada).

Commenced 2023 Share Buybacks under Current

Normal Course Issuer Bid

As at January 31, 2023, Parex has repurchased

approximately 1 million shares under its normal course issuer bid

(“NCIB”) at an average price of C$21.70 per share, for total

consideration of roughly C$21.7 million. Over and above the

increased regular dividend, the Company intends on continuing to

utilize its current NCIB in line with Parex’s commitment to return

100% of free funds flow to its shareholders.

Parex Resources Included in the 2023

Bloomberg Gender-Equality Index

Parex has joined 483 other companies as a member

of the 2023 Bloomberg Gender-Equality Index (GEI), a modified

market capitalization-weighted index developed to gauge the

performance of public companies dedicated to reporting

gender-related data. The Company submitted a social survey created

by Bloomberg, in collaboration with subject matter experts

globally. Those included on this year’s index scored at or above a

global threshold established by Bloomberg to reflect disclosure and

the achievement or adoption of best-in-class statistics and

policies.

2022 Year-End Corporate Reserves Report:

Discussion of Reserves

The following tables summarize information

contained in the independent reserves report prepared by GLJ Ltd.

(“GLJ”) dated February 2, 2023 with an effective date of December

31, 2022 (the "GLJ 2022 Report"), with comparatives to the

independent reserves report prepared by GLJ dated February 3, 2022

with an effective date of December 31, 2021 (the "GLJ 2021

Report"), and the independent reserves report prepared by GLJ dated

February 4, 2021 with an effective date of December 31, 2020 ("GLJ

2020 Report", and collectively with the GLJ 2022 Report and the GLJ

2021 Report, the "GLJ Reports"). Each GLJ Report was prepared in

accordance with definitions, standards and procedures contained in

the Canadian Oil and Gas Evaluation Handbook ("COGE Handbook") and

National Instrument 51-101 - Standards of Disclosure for Oil and

Gas Activities ("NI 51-101"). Additional reserve information as

required under NI 51-101 will be included in the Company's Annual

Information Form for the 2022 fiscal year which will be filed on

SEDAR by March 31, 2023.

The recovery and reserve estimates provided in

this news release are estimates only, and there is no guarantee

that the estimated reserves will be recovered. Actual reserves may

eventually prove to be greater than, or less than, the estimates

provided herein. In certain of the tables set forth below, the

columns may not add due to rounding.

All December 31, 2022 reserves presented are

based on GLJ's forecast pricing effective January 1, 2023; all

December 31, 2021 reserves presented are based on GLJ's forecast

pricing effective January 1, 2022 and all December 31, 2020

reserves presented are based on GLJ's forecast pricing effective

January 1, 2021.

Five-Year Crude Oil Price Forecast – GLJ Report

(January 2022 and 2023)

|

|

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

|

ICE Brent (US$/bbl) - January 1, 2022 |

76.00 |

72.51 |

71.24 |

72.66 |

74.12 |

75.59 |

|

ICE Brent (US$/bbl) - January 1, 2023 |

99.04(1) |

80.00 |

80.50 |

81.50 |

82.00 |

82.53 |

(1) Actual 2022 ICE Brent average price.

2022 Year-End Gross Reserves Volumes

|

|

|

Dec. 31 |

Change over |

|

|

|

2020 |

2021 |

2022 |

Dec. 31, |

|

Reserve Category |

|

Mboe(1) |

Mboe(1) |

Mboe(1)(2) |

2021 |

|

Proved Developed Producing (PDP) |

|

72,373 |

80,559 |

82,788 |

3 |

% |

| Proved Developed

Non-Producing |

|

15,087 |

9,685 |

11,767 |

21 |

% |

| Proved

Undeveloped |

|

40,623 |

35,022 |

36,100 |

3 |

% |

|

Proved (1P) |

|

128,083 |

125,266 |

130,655 |

4 |

% |

|

Probable |

|

66,408 |

73,559 |

70,050 |

(5 |

%) |

|

Proved + Probable (2P) |

|

194,491 |

198,825 |

200,704 |

1 |

% |

|

Possible(3) |

|

85,995 |

88,102 |

80,891 |

(8 |

%) |

|

Proved + Probable + Possible (3P) |

|

280,486 |

286,927 |

281,595 |

(2 |

%) |

(1) Mboe is defined as thousand barrels of oil

equivalent.(2) All reserves are presented as Parex working interest

before royalties. 2022 net reserves after royalties are: PDP 70,436

Mboe, proved developed non-producing 10,140 Mboe, proved

undeveloped 31,464 Mboe, 1P 112,040 Mboe, 2P 172,958 Mboe and 3P

243,525 Mboe.(3) Please refer to the “Reserves Advisory” section

for a description of each reserve category. Possible reserves are

those additional reserves that are less certain to be recovered

than probable reserves. There is a 10% probability that the

quantities recovered will equal or exceed the sum of proved plus

probable plus possible reserves.

2022 Year-End Gross Reserves Volumes Per

Share

|

|

|

Dec. 31 |

Change over |

Change over |

|

|

|

2020 |

2021 |

2022(1) |

Dec. 31, 2020 |

Dec. 31, 2021 |

|

Year-End Basic Outstanding Shares (000s) |

|

130.9 |

120.3 |

109.1 |

(17 |

%) |

(9 |

%) |

|

Proved Developed Producing (PDP) (boe/share) |

|

0.55 |

0.67 |

0.76 |

38 |

% |

13 |

% |

| Proved (1P) (boe/share) |

|

0.98 |

1.04 |

1.20 |

22 |

% |

15 |

% |

| Proved + Probable (2P)

(boe/share) |

|

1.49 |

1.65 |

1.84 |

23 |

% |

12 |

% |

| Proved

+ Probable + Possible (3P)(2) (boe/share) |

|

2.14 |

2.39 |

2.58 |

21 |

% |

8 |

% |

(1) All reserves are presented as Parex working interest before

royalties. 2022 net reserves after royalties are: PDP 70,436 Mboe,

proved developed non-producing 10,140 Mboe, proved undeveloped

31,464 Mboe, 1P 112,040 Mboe, 2P 172,958 Mboe and 3P 243,525

Mboe.(2) Please refer to the “Reserves Advisory” section for a

description of each reserve category. Possible reserves are those

additional reserves that are less certain to be recovered than

probable reserves. There is a 10% probability that the quantities

recovered will equal or exceed the sum of proved plus probable plus

possible reserves.

2022 Gross Reserves by Area

|

|

|

Proved |

Proved + Probable |

Proved + Probable + Possible |

|

Area |

|

Mboe(1) |

Mboe(1) |

Mboe(1) |

|

LLA-34 |

|

74,860 |

113,625 |

151,266 |

| Southern Llanos |

|

26,735 |

36,244 |

47,778 |

| Northern Llanos |

|

16,773 |

25,824 |

32,574 |

| Magdalena |

|

12,287 |

25,011 |

49,977 |

|

Total |

|

130,655 |

200,704 |

281,595 |

(1) All reserves are presented as Parex working

interest before royalties. Please refer to the “Reserves Advisory”

section for a description of each reserve category. Possible

reserves are those additional reserves that are less certain to be

recovered than probable reserves. There is a 10% probability that

the quantities recovered will equal or exceed the sum of proved

plus probable plus possible reserves. The estimates of reserves and

future net revenue for individual properties may not reflect the

same confidence level as estimates of reserves and future net

revenue for all properties, due to the effects of aggregation.

2022 Gross Year-End Reserves Volumes by Product

Type(1)

|

Product Type |

|

Proved DevelopedProducing |

Total Proved |

Total Proved +Probable |

Total Proved +Probable + Possible |

|

Light & Medium Crude Oil (Mbbl)(2) |

|

9,105 |

30,268 |

51,258 |

79,157 |

| Heavy Crude Oil (Mbbl) |

|

70,320 |

93,895 |

136,583 |

179,980 |

| Natural Gas Liquids

(Mbbl) |

|

199 |

1,306 |

1,835 |

2,345 |

|

Conventional Natural Gas (MMcf)(3) |

|

18,983 |

31,118 |

66,171 |

120,676 |

|

Oil Equivalent

(Mboe)(4) |

|

82,788 |

130,655 |

200,704 |

281,595 |

(1) All reserves are presented as Parex working

interest before royalties. Please refer to the “Reserves Advisory”

section for a description of each reserve category. Possible

reserves are those additional reserves that are less certain to be

recovered than probable reserves. There is a 10% probability that

the quantities recovered will equal or exceed the sum of proved

plus probable plus possible reserves.(2) Mbbl is defined as

thousands of barrels.(3) MMcf is defined as one million cubic

feet.(4) Columns may not add due to rounding.

Summary of Reserve Metrics – Company

Gross(1)

|

|

2022 |

3-Year |

|

USD$ |

Proved DevelopedProducing |

Proved |

Proved + Probable |

Proved + Probable |

|

|

|

|

|

|

| F&D Costs ($/boe)(2) |

25.35 |

25.92 |

28.39 |

21.56 |

| FD&A Costs ($/boe)(2) |

25.35 |

25.92 |

28.39 |

19.77 |

|

Recycle Ratio - F&D(2) |

1.7 x |

1.6 x |

1.5 x |

1.5 x |

| Recycle

Ratio - FD&A(2) |

1.7 x |

1.6 x |

1.5 x |

1.6 x |

(1) All reserves are presented as Parex working interest before

royalties. Please refer to the “Reserves Advisory” section for a

description of each reserve category.(2) Non-GAAP ratio. See

“Non-GAAP and Other Financial Measures Advisory”.

Reserve Life Index (“RLI”)

|

|

|

Dec. 31, 2020(1) |

Dec. 31, 2021(2) |

Dec. 31, 2022(3) |

|

Proved Developed Producing (PDP) |

|

4.3 years |

4.4 years |

4.2 years |

| Proved (1P) |

|

7.5 years |

6.9 years |

6.6 years |

| Proved

Plus Probable (2P) |

|

11.4 years |

10.9 years |

10.1 years |

(1) Calculated by dividing the amount of the

relevant reserves category by average Q4 2020 production of 46,642

boe/d annualized (consisting of 6,637 bbl/d of light crude oil and

medium crude oil, 38,332 bbl/d of heavy crude oil and 10,038 mcf/d

of conventional natural gas).(2) Calculated by dividing the amount

of the relevant reserves category by average Q4 2021 production of

49,779 boe/d annualized (consisting of 6,376 bbl/d of light crude

oil and medium crude oil, 41,534 bbl/d of heavy crude oil and

11,214 mcf/d of conventional natural gas).(3) Calculated by

dividing the amount of the relevant reserves category by estimated

average Q4 2022 production of 54,257 boe/d annualized (consisting

of 10,511 bbl/d of light crude oil and medium crude oil, 42,746

bbl/d of heavy crude oil and 6,000 mcf/d of conventional natural

gas).

Future Development Capital (“FDC”) (000s) – GLJ

2022 Report(1)

|

Reserve Category |

|

2023 |

|

2024 |

|

2025 |

|

2026 |

2026+ |

Total FDC |

Total FDC/boe |

|

PDP |

$ |

37,522 |

$ |

2,916 |

$ |

— |

$ |

— |

$ |

— |

$ |

40,439 |

$ |

0.49 |

|

1P |

$ |

296,797 |

$ |

91,624 |

$ |

48,564 |

$ |

18,129 |

$ |

36,483 |

$ |

491,597 |

$ |

3.76 |

|

2P |

$ |

335,557 |

$ |

141,080 |

$ |

87,647 |

$ |

18,129 |

$ |

37,659 |

$ |

620,072 |

$ |

3.09 |

(1) FDC are stated in USD, undiscounted and based on GLJ January

1, 2023 price forecasts.

Reserves Net Present Value After Tax Summary –

GLJ Brent Forecast(1)(2)

|

|

|

NPV10 |

NPV10 |

NAV |

CAD/sh Changeover |

| |

|

December 31, |

December 31, |

December 31, |

| |

|

|

2021 |

|

2022 |

|

2022 |

Dec. 31, |

|

Reserve Category |

|

(000s)(2) |

(000s)(2) |

(CAD/sh)(3) |

2021 |

|

Proved Developed Producing (PDP) |

|

$ |

1,801,167 |

$ |

1,855,066 |

$ |

23.83 |

6 |

% |

| Proved Developed

Non-Producing |

|

|

174,419 |

|

194,710 |

|

|

| Proved

Undeveloped |

|

|

452,933 |

|

433,557 |

|

|

|

Proved (1P) |

|

$ |

2,428,519 |

$ |

2,483,333 |

$ |

31.63 |

9 |

% |

|

Probable |

|

|

899,434 |

|

952,229 |

|

|

|

Proved + Probable (2P) |

|

$ |

3,327,953 |

$ |

3,435,562 |

$ |

43.45 |

13 |

% |

|

Possible(4) |

|

|

1,096,001 |

|

1,020,018 |

|

|

|

Proved + Probable + Possible (3P) |

|

$ |

4,423,954 |

$ |

4,455,579 |

$ |

56.11 |

12 |

% |

(1) Net present values are stated in USD and are

discounted at 10 percent. All reserves are presented as Parex

working interest before royalties. Please refer to the “Reserves

Advisory” section for a description of each reserve category. The

forecast prices used in the calculation of the present value of

future net revenue are based on the GLJ January 1, 2022 and GLJ

January 1, 2023 price forecasts, respectively. The GLJ January 1,

2023 price forecast will be included in the Company's Annual

Information Form for the 2022 fiscal year.(2) Includes FDC as at

December 31, 2021 of $15 million for PDP, $372 million for 1P,

$540 million for 2P and $658 million for 3P and FDC as at

December 31, 2022 of $40 million for PDP, $492 million for 1P,

$620 million for 2P and $707 million for 3P. (3) NAV is calculated,

as at December 31, 2022, as after tax NPV10 plus estimated

working capital of USD$65 million (converted at USDCAD=1.3544),

divided by 109 million basic shares outstanding as at

December 31, 2022. NAV per share is a Non-GAAP ratio, refer to

“Non-GAAP Terms” section below for further details. (4) Possible

reserves are those additional reserves that are less certain to be

recovered than probable reserves. There is a 10% probability that

the quantities recovered will equal or exceed the sum of proved

plus probable plus possible reserves.

2022 Year-End Gross Reserves Reconciliation

Company

|

|

|

Total Proved |

Total Proved + Probable |

Total Proved + Probable + Possible |

|

|

|

Mboe |

Mboe |

Mboe |

|

December 31, 2021 |

|

125,266 |

|

198,825 |

|

286,927 |

|

| Technical Revisions(1) |

|

11,151 |

|

4,587 |

|

(6,929 |

) |

| Discoveries(2) |

|

1,253 |

|

1,676 |

|

2,118 |

|

| Extensions and Improved

Recovery(3) |

|

11,983 |

|

14,614 |

|

18,477 |

|

|

Production |

|

(18,998 |

) |

(18,998 |

) |

(18,998 |

) |

|

December 31, 2022(4) |

|

130,655 |

|

200,704 |

|

281,595 |

|

(1) Reserves technical revisions are associated

with the evaluation of additions on LLA-34 and the Capachos Block,

offset by negative revisions on the Fortuna Block. (2) Discoveries

are associated with the evaluations of LLA-40, Cabrestero and

Capachos blocks.(3) Reserve extensions are associated with the

evaluations of the Cabrestero, Arauca, and Boranda blocks; improved

recovery associated with evaluations of the Cabrestero Block. (4)

Subject to final reconciliation adjustments. All reserves are

presented as Parex working interest before royalties. Please refer

to the “Reserves Advisory” section for a description of each

reserve category. Possible reserves are those additional reserves

that are less certain to be recovered than probable reserves. There

is a 10% probability that the quantities recovered will equal or

exceed the sum of proved plus probable plus possible reserves. The

estimates of reserves and future net revenue for individual

properties may not reflect the same confidence level as estimates

of reserves and future net revenue for all properties, due to the

effects of aggregation.

Q4 2022 Results – Conference Call &

Webcast

We are holding a conference call and webcast for

investors, analysts and other interested parties on Thursday, March

9, 2023, at 9:30 am MT (11:30 am ET). To participate in the

conference call or webcast, please see access information

below:

| Toll-free dial

number (Canada/US): |

|

1-800-806-5484 |

| International dial-in numbers: |

|

https://www.confsolutions.ca/ILT?oss=7P1R8008065484 |

| Passcode: |

|

8807145# |

| Webcast: |

|

https://edge.media-server.com/mmc/p/b33h49qn |

About Parex Resources Inc.

Parex is the largest independent oil and gas

company in Colombia, focusing on sustainable, conventional

production. The Company’s corporate headquarters are in Calgary,

Canada, with an operating office in Bogotá, Colombia. Parex is a

member of the S&P/TSX Composite ESG Index and its shares trade

on the Toronto Stock Exchange under the symbol PXT.

For more information, please contact:

Mike KruchtenSenior Vice President, Capital Markets &

Corporate PlanningParex Resources Inc.

403-517-1733investor.relations@parexresources.com

Steven EirichInvestor Relations & Communications

AdvisorParex Resources

Inc.587-293-3286investor.relations@parexresources.com

Not for distribution or for dissemination in the United

States.

Reserves Advisory

The recovery and reserve estimates of crude oil

reserves provided in this news release are estimates only, and

there is no guarantee that the estimated reserves will be

recovered. Actual crude oil reserves may eventually prove to be

greater than, or less than, the estimates provided herein. All

December 31, 2022 reserves presented are based on GLJ's

forecast pricing effective January 1, 2023. All December 31,

2021 reserves presented are based on GLJ's forecast pricing

effective January 1, 2022. All December 31, 2020 reserves

presented are based on GLJ's forecast pricing effective January 1,

2021.

It should not be assumed that the estimates of

future net revenues presented herein represent the fair market

value of the reserves. There are numerous uncertainties inherent in

estimating quantities of crude oil, reserves and the future cash

flows attributed to such reserves.

“Proved Developed Producing Reserves" are those

reserves that are expected to be recovered from completion

intervals open at the time of the estimate. These reserves may be

currently producing or, if shut-in, they must have previously been

on production, and the date of resumption of production must be

known with reasonable certainty.

"Proved Developed Non-Producing Reserves" are

those reserves that either have not been on production or have

previously been on production but are shut-in and the date of

resumption of production is unknown.

"Proved Undeveloped Reserves" are those reserves

expected to be recovered from known accumulations where a

significant expenditure (e.g. when compared to the cost of drilling

a well) is required to render them capable of production. They must

fully meet the requirements of the reserves category (proved,

probable, possible) to which they are assigned.

"Proved" reserves are those reserves that can be

estimated with a high degree of certainty to be recoverable. It is

likely that the actual remaining quantities recovered will exceed

the estimated proved reserves.

"Probable" reserves are those additional

reserves that are less certain to be recovered than proved

reserves. It is equally likely that the actual remaining quantities

recovered will be greater or less than the sum of the estimated

proved plus probable reserves.

“Possible” reserves are those additional

reserves that are less certain to be recovered than probable

reserves. There is a 10 percent probability that the quantities

actually recovered will equal or exceed the sum of proved plus

probable plus possible reserves. It is unlikely that the actual

remaining quantities recovered will exceed the sum of the estimated

proved plus probable plus possible reserves.

The term "Boe" means a barrel of oil equivalent

on the basis of 6 Mcf of natural gas to 1 barrel of oil ("bbl").

Boe’s may be misleading, particularly if used in isolation. A boe

conversation ratio of 6 Mcf: 1 bbl is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead.

Given the value ratio based on the current price of crude oil as

compared to natural gas is significantly different from the energy

equivalency of 6:1, utilizing a conversion ratio at 6:1 may be

misleading as an indication of value.

Light crude oil is crude oil with a relative

density greater than 31.1 degrees API gravity, medium crude oil is

crude oil with a relative density greater than 22.3 degrees API

gravity and less than or equal to 31.1 degrees API gravity, and

heavy crude oil is crude oil with a relative density greater than

10 degrees API gravity and less than or equal to 22.3 degrees API

gravity.

With respect to F&D costs, the aggregate of

the exploration and development costs incurred in the most recent

financial year and the change during that year in estimated future

development costs generally will not reflect total F&D costs

related to reserve additions for that year.

The estimates of reserves and future net revenue

for individual properties may not reflect the same confidence level

as estimates of reserves and future net revenue for all properties,

due to the effects of aggregation.

This press release contains several oil and gas

metrics, including reserve replacement, reserve additions including

acquisitions, and RLI. In addition, the following non-GAAP

financial measures and non-GAAP ratios, as described below under

"Non-GAAP and Other Financial Measures", can be considered to be

oil and gas metrics: F&D costs, FD&A costs, F&D recycle

ratio, FD&A recycle ratio, funds flow provided by operations,

funds flow from operations netback, reserve replacement and NAV.

Such oil and gas metrics have been prepared by management and do

not have standardized meanings or standard methods of calculation

and therefore such measures may not be comparable to similar

measures used by other companies and should not be used to make

comparisons. Such metrics have been included herein to provide

readers with additional measures to evaluate the Company's

performance; however, such measures are not reliable indicators of

the future performance of the Company and future performance may

not compare to the performance in previous periods and therefore

such metric should not be unduly relied upon. Management uses these

oil and gas metrics for its own performance measurements and to

provide security holders with measures to compare the Company's

operations over time. Readers are cautioned that the information

provided by these metrics, or that can be derived from the metrics

presented in this news release, should not be relied upon for

investment or other purposes. A summary of the calculations of

reserve replacement and RLI are as follows, with the other oil and

gas metrics referred to above being described herein under

"Non-GAAP and Other Financial Measures":

- Reserve replacement is calculated by dividing the annual

reserve additions by the annual production.

- Reserve additions including acquisitions is calculated by the

change in reserves category and adding current year annual

production.

- RLI is calculated by dividing the applicable reserves category

by the annualized fourth quarter production.

The following abbreviations used in this press

release have the meanings set forth below:

| |

bbl |

|

one

barrel |

| |

bbls |

|

barrels |

| |

bbls/d |

|

barrels per day |

| |

boe |

|

barrels of oil equivalent of natural gas; one barrel of oil or

NGLs for six thousand cubic feet of natural gas |

| |

boe/d |

|

barrels of oil equivalent of natural gas per day |

| |

mbbl |

|

thousands of barrels |

| |

mboe |

|

thousand barrels of oil equivalent |

| |

mcf |

|

thousand cubic feet |

| |

mcf/d |

|

thousand cubic feet per day |

| |

mmboe |

|

one million barrels of oil equivalent |

| |

mmcf |

|

one million cubic feet |

| |

W.I. |

|

working interest |

Unaudited Financial

Information

Certain financial and operating results included

in this news release, including capital expenditures, production

information, funds flow provided by operations, operating costs and

the deferred tax asset balance are based on unaudited estimated

results. These estimated results are subject to change upon

completion of the Company’s audited financial statements for the

year ended December 31, 2022, and any changes could be

material. Parex anticipates filing its audited financial statements

and related management’s discussion and analysis for the year ended

December 31, 2022 on SEDAR on or before March 31, 2023.

Non-GAAP and Other Financial Measures

Advisory

This press release uses various “non-GAAP

financial measures”, “non-GAAP ratios”, “financial measures” and

“capital management measures” (as such terms are defined in NI

52-112), which are described in further detail below. Such measures

are not standardized financial measures under IFRS and might not be

comparable to similar financial measures disclosed by other

issuers. Investors are cautioned that non-GAAP financial measures

should not be construed as alternatives to or more meaningful than

the most directly comparable GAAP measures as indicators of Parex'

performance.

These measures facilitate management’s

comparisons to the Company’s historical operating results in

assessing its results and strategic and operational decision-making

and may be used by financial analysts and others in the oil and

natural gas industry to evaluate the Company’s performance.

Further, management believes that such financial measures are

useful supplemental information to analyze operating performance

and provide an indication of the results generated by the Company's

principal business activities.

Please refer to the Company’s Management’s

Discussion and Analysis of the financial condition and results of

operations for the period ended September 30, 2022 dated November

3, 2022 (the “MD&A”), which is available at the Company’s

website at www.parexresources.com and on the Company’s profile on

SEDAR at www.sedar.com for additional information about such

financial measures, including reconciliations to the nearest GAAP

measures, as applicable.

Set forth below is a description of the non-GAAP

financial measures, non-GAAP ratios, supplementary financial

measures and capital management measures used in this press

release.

Non-GAAP Financial Measures

Capital expenditures, is a

non-GAAP financial measure which the Company uses to describe its

capital costs associated with oil and gas expenditures. The measure

considers both property, plant and equipment expenditures and

exploration and evaluation asset expenditures which are items in

the Company’s statement of cash flows for the period. In Q3 2022,

the Company changed how it presents exploration and evaluation

expenditures. Amounts have been restated for prior periods to

conform to the current year's presentation, refer to note 2 of the

Company's consolidated interim financial statements for the period

ended September 30, 2022.

| |

For the three months ended December 31, |

|

For the year-endedDecember 31, |

|

($000s) |

2022 (estimate, unaudited) |

|

|

2021 |

|

2022 (estimate, unaudited) |

|

|

2021 |

|

Property, plant and equipment expenditures |

$ |

111,033 |

|

$ |

76,454 |

|

$ |

389,500 |

|

$ |

212,153 |

|

Exploration and evaluation expenditures |

|

36,961 |

|

|

37,814 |

|

|

123,000 |

|

|

60,081 |

|

Capital expenditures |

$ |

147,994 |

|

$ |

114,268 |

|

$ |

512,500 |

|

$ |

272,234 |

Free funds flow, is a non-GAAP

financial measure that is determined by funds flow provided by

operations less capital expenditures. In Q3 2022, the Company

changed how it presents exploration and evaluation expenditures

included in total capital expenditures. Amounts have been restated

for prior periods to conform to the current year's presentation,

refer to note 2 of the Company's consolidated interim financial

statements for the period ended September 30, 2022. The Company

considers free funds flow or free cash flow to be a key measure as

it demonstrates Parex’ ability to fund return of capital, such as

the NCIB or dividends, without accessing outside funds and is

calculated as follows:

| |

For the three months endedDecember 31, |

|

For the year-endedDecember 31, |

|

($000s) |

2022 (estimate, unaudited) |

|

|

2021 |

|

|

2022 (estimate, unaudited) |

|

|

2021 |

|

Cash provided by operating activities |

$ |

310,967 |

|

|

$ |

176,003 |

|

|

$ |

997,000 |

|

|

$ |

534,301 |

|

Net change in non-cash working capital |

|

(248,663 |

) |

|

|

(7,742 |

) |

|

|

(295,000 |

) |

|

|

43,244 |

|

Funds flow provided by operations |

|

62,304 |

|

|

|

168,261 |

|

|

|

702,000 |

|

|

|

577,545 |

|

Capital expenditures, excluding corporate acquisitions |

|

147,994 |

|

|

|

114,268 |

|

|

|

512,500 |

|

|

|

272,234 |

|

Free funds flow |

$ |

(85,690 |

) |

|

$ |

53,993 |

|

|

$ |

189,500 |

|

|

$ |

305,311 |

Non-GAAP Financial Ratios

Funds flow provided by operations per

boe or funds flow netback per boe, is a non-GAAP ratio

that includes all cash generated from operating activities and is

calculated before changes in non-cash working capital, divided by

produced oil and natural gas sales volumes. The Company considers

funds flow netback to be a key measure as it demonstrates Parex’

profitability after all cash costs relative to current commodity

prices.

Finding & development Costs (F&D

costs) and finding, development and acquisition Costs (FD&A

costs), is a non-GAAP ratio that helps to explain the cost

of finding and developing additional oil and gas reserves. F&D

costs are determined by dividing capital expenditures plus the

change in FDC in the period divided by BOE reserve additions in the

period. FD&A costs are determined by dividing capital

expenditures in the period plus the change in FDC plus acquisition

costs divided by BOE reserve additions in the period.

|

F&D and FD&A Costs(1) |

2022 |

3-Year |

|

USD$(‘000) |

Proved Developed Producing |

Proved |

Proved + Probable |

Proved + Probable |

|

|

|

|

|

|

| Capital

Expenditures(1) |

512,500 |

512,500 |

512,500 |

929,721 |

|

Capital Expenditures - change in FDC |

25,701 |

119,567 |

80,243 |

97,443 |

|

Total Capital |

538,201 |

632,067 |

592,743 |

1,027,164 |

| |

|

|

|

|

| Net Acquisitions |

— |

— |

— |

— |

|

Net Acquisitions - change in FDC |

— |

— |

— |

69,482 |

|

Total Net Acquisitions |

— |

— |

— |

69,482 |

|

|

|

|

|

|

|

Total Capital including Acquisitions |

538,201 |

632,067 |

592,743 |

1,096,646 |

|

|

|

|

|

|

| Reserve Additions |

21,227 |

24,387 |

20,877 |

47,645 |

|

Net Acquisitions Reserve Additions |

— |

— |

— |

7,814 |

|

Reserve Additions including

Acquisitions(2)

(Mboe) |

21,227 |

24,387 |

20,877 |

55,459 |

|

|

|

|

|

|

| F&D Costs

($/boe) |

25.35 |

25.92 |

28.39 |

21.56 |

|

FD&A Costs ($/boe) |

25.35 |

25.92 |

28.39 |

19.77 |

(1) All reserves are presented as Parex working

interest before royalties. Please refer to the “Reserves Advisory”

section for a description of each reserve category.(2) Calculated

using unaudited estimated capital expenditures for the period ended

December 31, 2022.

Recycle ratio, is a non-GAAP

ratio that measures the profit per barrel of oil to the cost of

finding and developing that barrel of oil. The recycle ratio is

determined by dividing the annual funds flow provided by operations

per boe by the F&D costs and FD&A costs in the period.

|

|

2022 |

3-Year |

|

USD$ |

Proved Developed Producing |

Proved |

Proved + Probable |

Proved + Probable |

|

|

|

|

|

|

|

Estimated 2022 funds flow per boe ($/boe) - adjusted(2) |

42.43 |

42.43 |

42.43 |

31.60 |

|

|

|

|

|

|

| F&D Costs(2) ($/boe) |

25.35 |

25.92 |

28.39 |

21.56 |

|

FD&A Costs(2) ($/boe) |

25.35 |

25.92 |

28.39 |

19.77 |

|

|

|

|

|

|

| Recycle ratio -

F&D(1) |

1.7 x |

1.6 x |

1.5 x |

1.5 x |

|

Recycle ratio -

FD&A(1) |

1.7 x |

1.6 x |

1.5 x |

1.6 x |

(1) Recycle ratio is calculated as funds flow

provided by operations per boe divided by F&D or FD&A as

applicable. Three-year funds flow provided by operations on a per

boe basis is calculated using weighted average sales volumes. (2)

Adjusted estimated 2022 funds flow per boe reflects the one-time

$100 million tax transaction cost related to the voluntary,

internal corporate entity restructuring.

Net Asset Value per share, is a

non-GAAP ratio that combines the 51-101 NPV10 value after tax with

the Company’s estimated working capital at the period end date

divided by common shares outstanding at the period end date. The

Company uses the Net Asset Value per share as a way to reflect the

Company’s value considering both existing working capital on hand

plus the NPV10 after tax value on Oil and Gas Reserves. NAV per

share is stated in CAD dollars using an exchange rate of

USDCAD=1.3544. Net asset value is defined as total assets less

total liabilities.

Capital Management Measures

Funds flow provided by

operations, is a capital management measure that includes

all cash generated from operating activities and is calculated

before changes in non-cash working capital. The Company considers

funds flow provided by operations to be a key measure as it

demonstrates Parex’ profitability after all cash costs relative to

current commodity prices. A reconciliation from cash provided by

operating activities to funds flow provided by operations is as

follows:

| |

For the three months endedDecember 31, |

|

For the year-endedDecember 31, |

|

($000s) |

2022 (estimate, unaudited) |

|

|

2021 |

|

|

2022 (estimate, unaudited) |

|

|

2021 |

|

Cash provided by operating activities |

$ |

310,967 |

|

|

$ |

176,003 |

|

|

$ |

997,000 |

|

|

$ |

534,301 |

|

Net change in non-cash working capital |

|

(248,663 |

) |

|

|

(7,742 |

) |

|

|

(295,000 |

) |

|

|

43,244 |

|

Funds flow provided by operations |

$ |

62,304 |

|

|

$ |

168,261 |

|

|

$ |

702,000 |

|

|

$ |

577,545 |

Adjusted funds flow provided by

operations, is a capital management measure that includes

all cash generated from operating activities and is calculated

before changes in non-cash working capital and adjusted for the

one-time tax transaction cost related to the internal corporate tax

reorganization. The Company considers adjusted funds flow provided

by operations to be a key measure as it demonstrates Parex’

profitability after all cash costs relative to current commodity

prices after adjustment for the one-time tax transaction cost

related to the internal corporate tax reorganization. A

reconciliation from cash provided by operating activities to

adjusted funds flow provided by operations is as follows:

| |

For the three months endedDecember 31, |

|

For the year-endedDecember 31, |

|

($000s) |

2022 (estimate, unaudited) |

|

|

2021 |

|

|

2022 (estimate, unaudited) |

|

|

2021 |

|

Cash provided by operating activities |

$ |

(22,680 |

) |

|

$ |

176,003 |

|

|

$ |

651,927 |

|

$ |

534,301 |

|

Net change in non-cash working capital |

|

96,410 |

|

|

|

(7,742 |

) |

|

|

50,073 |

|

|

43,244 |

|

Funds flow provided by operations |

$ |

73,730 |

|

|

$ |

168,261 |

|

|

$ |

702,000 |

|

$ |

577,545 |

|

One-time tax transaction cost related to internal corporate tax

reorganization |

$ |

100,000 |

|

|

$ |

— |

|

|

$ |

100,000 |

|

$ |

— |

|

Adjusted funds flow provided by operations |

$ |

173,730 |

|

|

$ |

168,261 |

|

|

$ |

802,000 |

|

$ |

577,545 |

Working capital surplus, is a

capital management measure which the Company uses to describe its

liquidity position and ability to meet its short-term liabilities.

Working capital surplus is defined as current assets less current

liabilities:

| |

For the three months ended December 31, |

|

For the year-endedDecember 31, |

|

($000s) |

2022 (estimate, unaudited) |

|

|

2021 |

|

2022 (estimate, unaudited) |

|

|

2021 |

|

Current assets |

$ |

618,500 |

|

$ |

574,038 |

|

$ |

618,500 |

|

$ |

574,038 |

| Current

liabilities |

|

553,500 |

|

|

248,258 |

|

|

553,500 |

|

|

248,258 |

|

Working capital surplus |

$ |

65,000 |

|

$ |

325,780 |

|

$ |

65,000 |

|

$ |

325,780 |

Supplementary Financial

Measures

"Current tax effective rate as a percent

of funds flow provided by operations" is comprised of

current income tax expense, as determined in accordance with IFRS,

divided by funds flow provided by operations.

Dividend Advisory

The Company's future shareholder distributions,

including but not limited to the payment of dividends and the

acquisition by the Company of its shares pursuant to an NCIB, if

any, and the level thereof is uncertain. Any decision to pay

further dividends on the common shares (including the actual

amount, the declaration date, the record date and the payment date

in connection therewith and any special dividends) or acquire

shares of the Company will be subject to the discretion of the

Board of Directors of Parex and may depend on a variety of factors,

including, without limitation the Company's business performance,

financial condition, financial requirements, growth plans, expected

capital requirements and other conditions existing at such future

time including, without limitation, contractual restrictions and

satisfaction of the solvency tests imposed on the Company under

applicable corporate law. Further, the actual amount, the

declaration date, the record date and the payment date of any

dividend are subject to the discretion of the Board. There can be

no assurance that the Company will pay dividends or repurchase any

shares of the Company in the future.

Advisory on Forward Looking

Statements

Certain information regarding Parex set forth in

this document contains forward-looking statements that involve

substantial known and unknown risks and uncertainties. The use of

any of the words "plan", "expect", “prospective”, "project",

"intend", "believe", "should", "anticipate", "estimate" or other

similar words, or statements that certain events or conditions

"may" or "will" occur are intended to identify forward-looking

statements. Such statements represent Parex's internal projections,

estimates or beliefs concerning, among other things: the Company’s

strategy, plans and focus; the Company's anticipated results of

operations, production, business prospects and opportunities; terms

of the dividends payable on March 30, 2023; the Company's

expectation that it will return 100% of free funds flow to its

shareholders; Parex's expectations that it will reduce maintenance

capital requirements on its key assets; Parex's expectations of

future growth resulting from its infrastructure investments across

its Colombia asset base; Parex's estimated Q4 2022 and annual 2022

production; Parex's 2023 production guidance; Parex's expectations

regarding the shut-in at the Northern Llanos basin, including its

impact on production volumes and when it will return to full

operations; Parex's expectations that it will be outside of its

annual average production guidance range for Q1 2023 and within the

such range for Q2 2023 and for the year; the anticipated benefits

to be derived from Parex's internal corporate entity restructuring

in Colombia and the anticipated costs and timing thereof; Parex's

anticipated Q4 2022 current tax expense and 2022 full year net

income; Parex's expectations that additional reserve information

will be included in the Company's Annual Information Form for the

2022 fiscal year and the anticipated timing thereof; Parex's

updated 2023 guidance, including its anticipated effective tax

rate, funds flow provided by operations netback, production

average, capital expenditures, funds flow provided by operations,

free funds flow and working capital; Parex's anticipated reserve

life index; Parex's anticipated future development capital; and

Parex's updated 2023 funds flow provided by operations netback

sensitivity estimates; and that the Company will hold a conference

call and webcast for investors, analysts and other interested

parties and the anticipated timing thereof. These statements are

only predictions and actual events, or results may differ

materially. Although the Company’s management believes that the

expectations reflected in the forward-looking statements are

reasonable, it cannot guarantee future results, levels of activity,

performance or achievement since such expectations are inherently

subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors could

cause Parex's actual results to differ materially from those

expressed or implied in any forward-looking statements made by, or

on behalf of, Parex.

In addition, forward-looking statements

contained in this document include, statements relating to

"reserves", which are by their nature forward-looking statements,

as they involve the implied assessment, based on certain estimates

and assumptions that the reserves described can be profitably

produced in the future. The recovery and reserve estimates of

Parex's reserves provided herein are estimates only and there is no

guarantee that the estimated reserves will be recovered.

These forward-looking statements are subject to

numerous risks and uncertainties, including but not limited to, the

impact of general economic conditions in Canada and Colombia;

industry conditions including changes in laws and regulations

including adoption of new environmental laws and regulations, and

changes in how they are interpreted and enforced, in Canada and

Colombia; impact of the COVID-19 pandemic and the ability of the

Company to carry on its operations as currently contemplated in

light of the COVID-19 pandemic; determinations by OPEC and other

countries as to production levels; prolonged volatility in

commodity prices; risk of delay in completing or non-competition of

required transfers of the applicable operating and environmental

permits; failure of counterparties to perform under contracts;

competition; lack of availability of qualified personnel; the

results of exploration and development drilling and related

activities; obtaining required approvals of regulatory authorities,

in Canada and Colombia; risks associated with negotiating with

foreign governments as well as country risk associated with

conducting international activities; volatility in market prices

for oil; fluctuations in foreign exchange or interest rates;

environmental risks; changes in income tax laws or changes in tax

laws and incentive programs relating to the oil industry; ability

to access sufficient capital from internal and external sources;

failure of counterparties to perform under the terms of their

contracts; risk that Parex does not have sufficient financial

resources in the future to pay a divided; risk that the Board does

not declare dividends in the future or that Parex's dividend policy

changes; that Parex may not return 100% of free funds flow to its

shareholders; the risk that Parex may not be able to reduce

maintenance capital requirements on its key assets; the risk that

Parex may not receive the benefits that are expected to be derived

from its internal corporate reorganization in Colombia when

anticipated, or at all; the risk that Parex may not meet its 2023

production guidance; and other factors, many of which are beyond

the control of the Company. Readers are cautioned that the

foregoing list of factors is not exhaustive. Additional information

on these and other factors that could affect Parex's operations and

financial results are included in reports on file with Canadian

securities regulatory authorities and may be accessed through the

SEDAR website (www.sedar.com).

Although the forward-looking statements

contained in this document are based upon assumptions which

Management believes to be reasonable, the Company cannot assure

investors that actual results will be consistent with these

forward-looking statements. With respect to forward-looking

statements contained in this document, Parex has made assumptions

regarding: current commodity prices and royalty regimes; the impact

(and the duration thereof) that COVID-19 pandemic will have on the

demand for crude oil and natural gas, Parex’s supply chain and

Parex’s ability to produce, transport and sell Parex’s crude oil

and natural gas; availability of skilled labour; timing and amount

of capital expenditures; future exchange rates; the price of oil;

the impact of increasing competition; conditions in general

economic and financial markets; availability of drilling and

related equipment; effects of regulation by governmental agencies;

royalty rates; future operating costs; effects of regulation by

governmental agencies; uninterrupted access to areas of Parex's

operations and infrastructure; recoverability of reserves and

future production rates; the status of litigation; timing of

drilling and completion of wells; that Parex will have sufficient

cash flow, debt or equity sources or other financial resources

required to fund its capital and operating expenditures and

requirements as needed; that Parex's conduct and results of

operations will be consistent with its expectations; that Parex

will have the ability to develop its oil and gas properties in the

manner currently contemplated; current or, where applicable,

proposed industry conditions, laws and regulations will continue in

effect or as anticipated as described herein; that the estimates of

Parex's reserves volumes and the assumptions related thereto

(including commodity prices and development costs) are accurate in

all material respects; that Parex will be able to obtain contract

extensions or fulfill the contractual obligations required to

retain its rights to explore, develop and exploit any of its

undeveloped properties; that Parex will have sufficient financial

resources in the future to pay a dividend; that the Board will

declare dividends in the future; that Parex will have sufficient

financial resources to purchase shares under its NCIB and return

100% of its free funds flow to its shareholders; and other

matters.

Management has included the above summary of

assumptions and risks related to forward-looking information

provided in this document in order to provide shareholders with a

more complete perspective on Parex's current and future operations

and such information may not be appropriate for other purposes.

Parex's actual results, performance or achievement could differ

materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what

benefits Parex will derive. These forward-looking statements are

made as of the date of this document and Parex disclaims any intent

or obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

This press release contains information that may

be considered a financial outlook under applicable securities laws

about the Company's potential financial position, including, but

not limited to: the Company's expectation that it will return 100%

of free funds flow to its shareholders; Parex's anticipated Q4 2022

current tax expense and 2022 full year net income; Parex's updated

2023 guidance, including its anticipated effective tax rate, funds

flow provided by operations netback, capital expenditures, funds

flow provided by operations, free funds flow and working capital;

Parex's anticipated future development capital; and updated 2023

funds flow provided by operations netback sensitivity estimates;

all of which are subject to numerous assumptions, risk factors,

limitations and qualifications, including those set forth in the

above paragraphs. The actual results of operations of the Company

and the resulting financial results will vary from the amounts set

forth in this press release and such variations may be material.

This information has been provided for illustration only and with

respect to future periods are based on budgets and forecasts that

are speculative and are subject to a variety of contingencies and

may not be appropriate for other purposes. Accordingly, these

estimates are not to be relied upon as indicative of future

results. Except as required by applicable securities laws, the

Company undertakes no obligation to update such financial outlook.

The financial outlook contained in this press release was made as

of the date of this press release and was provided for the purpose

of providing further information about the Company's potential

future business operations. Readers are cautioned that the

financial outlook contained in this press release is not conclusive

and is subject to change.

PDF

available: http://ml.globenewswire.com/Resource/Download/8adde08e-a77e-4984-9089-ad3925e79fb0

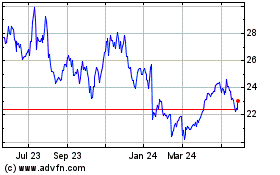

Parex Resources (TSX:PXT)

Historical Stock Chart

From Dec 2024 to Jan 2025

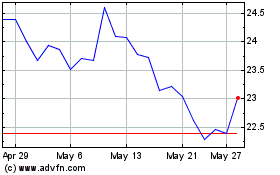

Parex Resources (TSX:PXT)

Historical Stock Chart

From Jan 2024 to Jan 2025