Parex Resources Inc. (“Parex” or the “Company”) (TSX: PXT) is

pleased to announce that it is resuming full operations at its

Capachos Block (50% W.I.). The Company also provides an update on

its Arauca Block (50% W.I.), announces that it will release its Q1

2023 financial and operating results on Wednesday, May 10, 2023,

and will hold its Annual General and Special Meeting of

shareholders at 9:30 am MT (11:30 am ET) on Thursday, May 11, 2023.

Resuming Operations at Capachos Block

(50% W.I.) and Update on Arauca Block (50% W.I.)

“Parex’s top priority is the safety of its

employees and contractors. I want to personally recognize our

workforce, community members as well as national and local

authorities, for their work in helping us progress the first step

of carefully resuming full activities in the Northern Llanos. After

continuous dialogue and coordination with various government

entities, as well as a robust safety and security assessment in

alignment with our workforce, we are confident in safely restarting

activity in the area. We are excited to say that we have begun the

first steps to resume full operations at our Capachos block, and

will continue to proactively work with all stakeholders in order to

resume activities at our Arauca block,” commented Daniel Ferreiro,

President & Country Manager of Parex Resources Colombia.

In the Northern Llanos, on January 21, 2023, the

Company shut-in its Capachos Block (50% W.I.) and halted drilling

operations at the Arauca Block (50% W.I.) due to heightened

security concerns. Following the successful engagement with

stakeholders at all levels, safe conditions have been restored at

the Capachos Block (50% W.I.) and initial production has been

restarted. Following the positive progress at Capachos, the Company

is aiming to resume drilling operations at its Arauca Block (50%

W.I.) in Q2 2023.

Corporately, the shut-ins were limited to the

Capachos and Arauca Blocks (50% W.I.) and are expected to affect

Parex’s Q1 2023 results. Net production was impacted by

approximately 6,500 boe/d during the suspension of operations, in

addition to slowing the pace of new wells that could be drilled and

brought online.

Q1 2023 Results and 2023 Annual General & Special

Meeting of Shareholders

Parex will release its Q1 2023 financial and

operating results after markets close on Wednesday, May 10,

2023.

On Thursday, May 11, 2023, the Company will hold

its Annual General and Special Meeting of shareholders at 9:30 am

MT (11:30 am ET) in-person and virtually. Participants looking to

attend in-person can at the 4th Floor Conference Center, Eight

Avenue Place, East Tower, 525, 8th Ave SW, Calgary, Alberta – and

those wishing to participate can do so virtually through the

following link: https:meetnow.global/M9TT6PK.

Further information regarding the Annual General

and Special Meeting, including meeting materials, can be found at

www.parexresources.com under Investors.

About Parex Resources Inc.

Parex is the largest independent oil and gas

company in Colombia, focusing on sustainable, conventional

production. The Company’s corporate headquarters are in Calgary,

Canada, with an operating office in Bogotá, Colombia. Parex is a

member of the S&P/TSX Composite ESG Index and its shares trade

on the Toronto Stock Exchange under the symbol PXT.

For more information, please contact:

Mike KruchtenSenior Vice President, Capital Markets &

Corporate PlanningParex Resources Inc.

403-517-1733investor.relations@parexresources.com

Steven EirichInvestor Relations & Communications

AdvisorParex Resources

Inc.587-293-3286investor.relations@parexresources.com

Not for distribution or for dissemination in the United

States.

Advisory on Forward Looking

Statements

Certain information regarding Parex set forth in

this document contains forward-looking statements that involve

substantial known and unknown risks and uncertainties. The use of

any of the words "plan", "expect", “prospective”, "project",

"intend", "believe", "should", "anticipate", "estimate" or other

similar words, or statements that certain events or conditions

"may" or "will" occur are intended to identify forward-looking

statements. Such statements represent Parex's internal projections,

estimates or beliefs concerning, among other things: the Company’s

strategy, plans and focus; that the Company will resume full

operations in the Northern Llanos basin; that the Company will

proactively work with all stakeholders in order to resume

activities at its Arauca Block; Parex's expectations that it will

resume drilling operations at its Arauca Block and the anticipated

timing thereof; Parex's expectations that the proactive shut-in

will affect its results for Q1 2023; anticipated production; the

anticipated timing of when Parex will release its financial and

operating results for Q1 2023; and the anticipated timing of when

Parex will hold its Annual General and Special Meeting of its

shareholders. These statements are only predictions and actual

events, or results may differ materially. Although the Company’s

management believes that the expectations reflected in the

forward-looking statements are reasonable, it cannot guarantee

future results, levels of activity, performance or achievement

since such expectations are inherently subject to significant

business, economic, competitive, political and social uncertainties

and contingencies. Many factors could cause Parex's actual results

to differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Parex.

These forward-looking statements are subject to

numerous risks and uncertainties, including but not limited to, the

impact of general economic conditions in Canada and Colombia;

industry conditions including changes in laws and regulations

including adoption of new environmental laws and regulations, and

changes in how they are interpreted and enforced, in Canada and

Colombia; impact of the COVID-19 pandemic and the ability of the

Company to carry on its operations as currently contemplated in

light of the COVID-19 pandemic; determinations by OPEC and other

countries as to production levels; prolonged volatility in

commodity prices; risk of delay in completing or non-competition of

required transfers of the applicable operating and environmental

permits; failure of counterparties to perform under contracts;

competition; lack of availability of qualified personnel; the

results of exploration and development drilling and related

activities; obtaining required approvals of regulatory authorities,

in Canada and Colombia; risks associated with negotiating with

foreign governments as well as country risk associated with

conducting international activities; volatility in market prices

for oil; fluctuations in foreign exchange or interest rates;

environmental risks; changes in income tax laws or changes in tax

laws and incentive programs relating to the oil industry; ability

to access sufficient capital from internal and external sources;

failure of counterparties to perform under the terms of their

contracts; the risk that the Company may not resume full operations

in the Northern Llanos basin when anticipated, or at all; the risk

that the Company may not resume activities at its Arauca Block when

anticipated, or at all; risk that the Company's production is less

than anticipated; risk that the Company operations continue to be

affected in the Northern Llanos basin; and other factors, many of

which are beyond the control of the Company. Readers are cautioned

that the foregoing list of factors is not exhaustive. Additional

information on these and other factors that could affect Parex's

operations and financial results are included in reports on file

with Canadian securities regulatory authorities and may be accessed

through the SEDAR website (www.sedar.com).

Although the forward-looking statements

contained in this document are based upon assumptions which

Management believes to be reasonable, the Company cannot assure

investors that actual results will be consistent with these

forward-looking statements. With respect to forward-looking

statements contained in this document, Parex has made assumptions

regarding: current commodity prices and royalty regimes; the impact

(and the duration thereof) that COVID-19 pandemic will have on the

demand for crude oil and natural gas, Parex’s supply chain and

Parex’s ability to produce, transport and sell Parex’s crude oil

and natural gas; availability of skilled labour; timing and amount

of capital expenditures; future exchange rates; the price of oil;

the impact of increasing competition; conditions in general

economic and financial markets; availability of drilling and

related equipment; effects of regulation by governmental agencies;

royalty rates; future operating costs; effects of regulation by

governmental agencies; uninterrupted access to areas of Parex's

operations and infrastructure; recoverability of reserves and

future production rates; the status of litigation; timing of

drilling and completion of wells; that Parex will have sufficient

cash flow, debt or equity sources or other financial resources

required to fund its capital and operating expenditures and

requirements as needed; that Parex's conduct and results of

operations will be consistent with its expectations; that Parex

will have the ability to develop its oil and gas properties in the

manner currently contemplated; current or, where applicable,

proposed industry conditions, laws and regulations will continue in

effect or as anticipated as described herein; that the estimates of

Parex's reserves volumes and the assumptions related thereto

(including commodity prices and development costs) are accurate in

all material respects; that Parex will be able to obtain contract

extensions or fulfill the contractual obligations required to

retain its rights to explore, develop and exploit any of its

undeveloped properties; that full operations will resume in the

Northern Llanos basin; and other matters.

Management has included the above summary of

assumptions and risks related to forward-looking information

provided in this document in order to provide shareholders with a

more complete perspective on Parex's current and future operations

and such information may not be appropriate for other purposes.

Parex's actual results, performance or achievement could differ

materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what

benefits Parex will derive. These forward-looking statements are

made as of the date of this document and Parex disclaims any intent

or obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

Advisory on Oil & Gas

Matters

The term "Boe" means a barrel of oil equivalent

on the basis of 6 Mcf of natural gas to 1 barrel of oil ("bbl").

Boe’s may be misleading, particularly if used in isolation. A boe

conversation ratio of 6 Mcf: 1 Bbl is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead.

Given the value ratio based on the current price of crude oil as

compared to natural gas is significantly different from the energy

equivalency of 6 Mcf: 1Bbl, utilizing a conversion ratio at 6 Mcf:

1 Bbl may be misleading as an indication of value.

PDF

available: http://ml.globenewswire.com/Resource/Download/0d3a962f-0403-421d-b206-fd48571cfa66

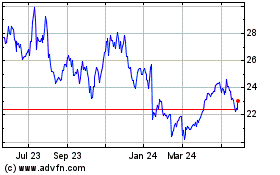

Parex Resources (TSX:PXT)

Historical Stock Chart

From Dec 2024 to Jan 2025

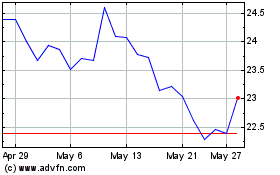

Parex Resources (TSX:PXT)

Historical Stock Chart

From Jan 2024 to Jan 2025