Resverlogix Announces US$6 Million Debenture Financing

May 05 2021 - 9:01AM

Resverlogix Corp. (“Resverlogix” or the "Company") (TSX: RVX) today

announces that it has entered into an investment agreement with a

subsidiary of Shenzhen Hepalink Pharmaceutical Group Co., Ltd.

(“Hepalink”) which provides for Hepalink to purchase 10% secured

convertible debentures of the Company in the aggregate principal

amount of US$6 million (the “Debentures”) for a purchase price

equal to the principal amount of the Debentures (the “Debenture

Financing”).

The Debentures will bear interest at a rate of

10% per annum and mature one year from the first closing date of

the Debenture Financing. Hepalink may elect to convert the

principal amount of the Debentures and accrued and unpaid interest

thereon into common shares of the Company at a conversion price

equal to the lesser of CAD$0.93 per share and the 5-day volume

weighted average trading price of the common shares on the date of

conversion. The Company has agreed to grant Hepalink a security

interest in all of its assets, including its patents and other

intellectual property, as security for its obligations under the

Debentures. In addition, Hepalink will receive an aggregate of

300,000 common share purchase warrants exercisable for a period of

four years from the first closing date of the Debenture Financing

at a price of CAD$0.93 per share (the “Warrants”).

The completion of the Debenture Financing is

subject to satisfaction of customary conditions for a transaction

of this nature, including the approval of the Toronto Stock

Exchange. The Company plans to complete the Debenture Financing by

issuing the Debentures and Warrants to Hepalink in two equal

tranches, with the first tranche scheduled to be completed upon

satisfaction of all closing conditions in the next three days and

the second tranche to be completed by May 31, 2021.

The Company has a total of 238,766,021 common

shares issued and outstanding. Hepalink holds 85,286,524 common

shares and 11,466,619 common share purchase warrants which

represents 35.72 percent of the common shares outstanding before

giving effect to any outstanding warrants and 38.67 percent of the

outstanding common shares assuming the exercise by Hepalink of its

warrants. After giving effect to the Debenture Financing, in the

event of conversion of the principal amount of the Debentures at a

price of CAD$0.93, Hepalink would hold 37.78 percent of the common

shares outstanding before giving effect to any outstanding warrants

and 40.62 percent of the outstanding common shares assuming the

exercise by Hepalink of its warrants.

The net proceeds of the Debenture Financing will

be used to fund research and development activities, including but

not limited to, clinical trial activities, general and

administrative expenses, working capital needs and other general

corporate purposes.

The subscription for the Debentures and Warrants

by Hepalink is a related party transaction within the meaning of

applicable Canadian securities laws as Hepalink is an insider of

the Company. The subscription by Hepalink is exempt from the formal

valuation and minority approval requirements applicable to related

party transactions on the basis that the value of the transaction

insofar as it involves a related party is less than 25 percent of

the Company's market capitalization.

About Resverlogix

Resverlogix is developing apabetalone (RVX-208),

a first-in-class, small molecule that is a selective BET

(bromodomain and extra-terminal) inhibitor. Apabetalone is the

first therapy of its kind to have been granted US FDA Breakthrough

Therapy Designation – for a major cardiovascular indication – to

help facilitate a time-efficient drug development program including

planned clinical trials and plans for expediting the manufacturing

development strategy.

BET inhibition is an epigenetic mechanism that

can regulate disease-causing genes. Apabetalone is a BET inhibitor

selective for the second bromodomain (BD2) within the BET proteins.

This selective inhibition of apabetalone on BD2 produces a specific

set of biological effects with potentially important benefits for

patients with high-risk cardiovascular disease, diabetes mellitus,

chronic kidney disease, end-stage renal disease treated with

hemodialysis, neurodegenerative disease, Fabry disease, peripheral

artery disease and other orphan diseases, while maintaining a well

described safety profile.

Resverlogix common shares trade on the Toronto Stock Exchange

(TSX:RVX).

Follow us on:

- Twitter: @Resverlogix_RVX

- LinkedIn:

https://www.linkedin.com/company/resverlogix-corp-/

For further information please contact:

Investor RelationsEmail: ir@resverlogix.comPhone: 403-254-9252Or

visit our website: www.resverlogix.com

This news release may contain certain

forward-looking information as defined under applicable Canadian

securities legislation, that are not based on historical fact,

including without limitation statements containing the words

"believes", "anticipates", "plans", "intends", "will", "should",

"expects", "continue", "estimate", "forecasts" and other similar

expressions. In particular, this news release includes forward

looking information related to the Debenture Financing, including

the terms of the Debenture Financing, the completion of the

Debenture Financing and the use of proceeds therefrom, and the

potential role of apabetalone in the treatment of patients with

high-risk cardiovascular disease, diabetes mellitus, chronic kidney

disease, end-stage renal disease treated with hemodialysis,

neurodegenerative disease, Fabry disease, peripheral artery disease

and other orphan diseases. Our actual results, events or

developments could be materially different from those expressed or

implied by these forward-looking statements. We can give no

assurance that any of the events or expectations will occur or be

realized. By their nature, forward-looking statements are subject

to numerous assumptions and risk factors including those discussed

in our Annual Information Form and most recent MD&A which are

incorporated herein by reference and are available through SEDAR at

www.sedar.com. The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement

and are made as of the date hereof. The Company disclaims any

intention and has no obligation or responsibility, except as

required by law, to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

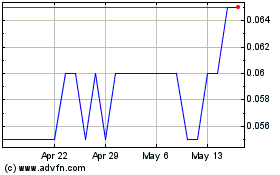

Resverlogix (TSX:RVX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Resverlogix (TSX:RVX)

Historical Stock Chart

From Jan 2024 to Jan 2025