Bellatrix Exploration Ltd. (“

Bellatrix” or the

“

Company”) (TSX: BXE) today announced the

completion of the recapitalization transaction (the

“

Recapitalization Transaction”) described in the

Company’s management information circular dated April 18, 2019 (the

“

Information Circular”) and

implemented pursuant to the court-approved plan of arrangement

under the Canada Business Corporations Act (the “

Plan of

Arrangement”).

“We are pleased to announce the completion of

the Recapitalization Transaction, significantly reducing our

outstanding debt obligations and annual cash interest payments and

strengthening our financial position” said Brent Eshleman,

President & Chief Executive Officer of Bellatrix. “The Company

believes that our successful closing of the Recapitalization

Transaction will better position Bellatrix to effectively pursue

our ongoing business and strategic objectives. We thank all

stakeholders and employees for their continued commitment to

Bellatrix.”

The Recapitalization Transaction includes, among others, the

following key elements:

- the Company’s total debt has been

reduced by approximately $110 million;

- the Company’s previously

outstanding 8.5% senior unsecured notes due 2020 (“Senior

Unsecured Notes”) in the aggregate principal amount of

approximately US$145.8 million, plus all accrued and unpaid

interest, have been exchanged for, in the aggregate and taking into

account early consent consideration, (i) approximately US$50

million of new second lien notes due September 2023 (the

“New Second Lien Notes”), (ii)

approximately US$54.8 million of new third lien notes due

December 2023 (the “New Third Lien Notes”), and

(iii) new common shares of Bellatrix representing

approximately 51% of the common shares of Bellatrix outstanding

upon implementation of the Recapitalization Transaction;

- the Company’s previously

outstanding 6.75% convertible debentures due 2021 in the aggregate

principal amount of $50 million, plus all accrued and unpaid

interest, have been exchanged for, in the aggregate and taking into

account early consent consideration, new common shares of Bellatrix

representing approximately 32.5% of the common shares of Bellatrix

outstanding upon implementation of the Recapitalization

Transaction;

- the Company’s common shareholders

prior to the implementation of the Recapitalization Transaction

retained their common shares, subject to a 1-for-12 common share

consolidation (the “Share Consolidation”), such

that such common shareholders own approximately 16.5% of the common

shares of Bellatrix outstanding upon implementation of the

Recapitalization Transaction;

- Bellatrix and its wholly-owned

subsidiary, 11260049 Canada Limited, amalgamated pursuant to the

Plan of Arrangement;

- pursuant to the Plan of Arrangement

and the final order of the Ontario Superior Court of Justice

(Commercial List) granted on May 28, 2019 (the “Final

Order”), claims relating to, among other things, the

Recapitalization Transaction and the CBCA proceedings have been

released as against the Company and the other parties set out in

the Plan of Arrangement on the terms set out in the Plan of

Arrangement and Final Order;

- pursuant to the Plan of Arrangement

and the Final Order, defaults resulting from, among other things,

the Recapitalization Transaction and the CBCA proceedings, and

third party change of control provisions that may have been

triggered by the implementation of the Recapitalization

Transaction, have been permanently waived on the terms set out in

the Plan of Arrangement and Final Order; and

- obligations to employees,

suppliers, customers and governmental authorities were not affected

by the Recapitalization Transaction.

The Share Consolidation completed as part of the

Recapitalization Transaction reduced the number of issued and

outstanding Bellatrix common shares to approximately 6,742,244

(prior to taking into account the issuance of the new common shares

pursuant to the Plan of Arrangement). Together with the new

common shares issued pursuant to the Plan of Arrangement, the

Company has a total of approximately 40,863,008 issued and

outstanding common shares, which are expected to commence trading

on the Toronto Stock Exchange (the “TSX”) on or

about June 7, 2019, under the symbol BXE.

In connection with the implementation of the

Recapitalization Transaction, Bellatrix has extended the revolving

period under its senior secured bank facilities (the “Credit

Facilities”) by one year with the term-out period expiring one year

after the end of the revolving period, in each case pursuant to a

second amended and restated credit agreement (the “Second

Amended and Restated Credit Agreement”).

Under the terms of the Second Amended and Restated Credit

Agreement, the revolving period under the Credit Facilities will

expire on May 30, 2020, and is extendible annually thereafter at

the option of the Company, subject to lender approval. As part of

the renewal of the Credit Facilities, the borrowing base under the

Credit Facilities has been reconfirmed at $100 million (unchanged),

with total commitments set at $90 million. The next semi-annual

redetermination pursuant to the Second Amended and Restated Credit

Agreement is scheduled for November 2019. Other than as

described herein, the terms of the Second Amended and Restated

Credit Agreement are substantially similar to those in place prior

to implementation of the Recapitalization Transaction.

The Company has also amended the exercise price

of the warrants previously issued to the holders (the

“Existing Second Lien Noteholders”) of the

Company’s 8.5% second lien notes due September 2023 outstanding

prior to the implementation of the Recapitalization Transaction

(the “Existing Second Lien Notes”, and together

with the New Second Lien Notes, the “Second Lien

Notes”) to reflect an exercise price of $3.03 per common

share (post-Share Consolidation), and has issued additional

warrants to the Existing Second Lien Noteholders which, together

with those warrants originally held by Existing Second Lien

Noteholders, are exercisable for an aggregate of 2,043,162

post-Share Consolidation common shares of Bellatrix.

Also as a condition pursuant to the support

agreement entered into with certain holders of previously

outstanding Senior Unsecured Notes (the “Initial Consenting

Noteholders”) and in connection with the implementation of

the Recapitalization Transaction, the Company and the Initial

Consenting Noteholders have entered into a registration rights

agreement (the “Registration Rights Agreement”),

pursuant to which the Company has granted the Initial Consenting

Noteholders certain customary demand and “piggy-back” registration

rights in respect of Company’s common shares held by them, on the

terms set out in the Registration Rights Agreement.

Copies of the final executed versions of the

Second Amended and Restated Credit Agreement, the indentures

governing the Second Lien Notes and the New Third Lien Notes, and

the Registration Rights Agreement will be posted on the Company’s

website at www.bxe.com and under the Company’s profile on SEDAR at

www.sedar.com.

Board of Directors

As part of the Recapitalization Transaction, and

in accordance with the Plan of Arrangement, certain of Bellatrix’s

directors resigned effective upon implementation of the Plan of

Arrangement and four new directors have been appointed to the board

of directors of Bellatrix pursuant to the Plan of Arrangement,

resulting in a board of directors comprised of 7 individuals.

“We would like to thank each of John

Cuthbertson, W.C. (Mickey) Dunn, Lynn Kis, Keith Turnbull and

Murray Todd for all of their hard work and support for Bellatrix

over the years, as well as their help and assistance with the

Company’s recapitalization transaction efforts,” said Mr.

Eshleman.

Bellatrix’s new directors are:

Todd Dillabough

Mr. Dillabough has over 35 years of experience

as a business leader including his current role as Board Observer

for Preferred Proppants, LLC, a private U.S. based oil and gas

services and technology company. Throughout his career, he has held

executive, director and crisis management roles at various energy

and industrial companies with global operations.

His board and governance experience includes

serving as Chairman of San Antonio Oil and Gas Services Ltd. (2017

– 2018), Director and Interim Chairman of Catalyst Paper

Corporation (2012 – 2019), Chairman of Collaborative Energy

Services Inc. (2017 – 2019), President, Chief Executive Officer,

Chief Operating Officer of both Trident Resources Corp. (2007 –

2014), and Pioneer Natural Resources Canada Inc. (2004 – 2007) and

Director of Aveos Fleet Performance (Air Canada’s former

Maintenance Division, 2012).

Mr. Dillabough is a Registered Public Company

Director in Canada, Registered Company Director in Bermuda, current

member of Association of Professional Engineers and Geoscientists

of Alberta (APEGA), Society of Petroleum Engineers (SPE) and

Turnaround Management Association (TMA), and former governor of

Canadian Association of Petroleum Producers (CAPP). He holds a

Bachelor of Science in Geology from the University of Calgary.

Cody Church

Mr. Church has over 25 years of experience as a

business leader including as Co-founder and Senior Managing

Director of TriWest Capital Partners (TriWest), a leading private

equity firm in Canada, from 1997 until his retirement in

2018. During his tenure, he served on TriWest’s Board of

Directors and Investment Committee and was involved in raising over

$1.25 billion of equity capital over the course of five

funds.

His board and governance experience includes

serving as Chairman of several of TriWest’s portfolio companies

including Source Energy Services Ltd. (TSX: SHLE; 2013 – 2019),

NCSG Crane & Heavy Haul Services (2014 – 2018), Edgefront Real

Estate Investment Trust (TSX: NXR; 2014 – 2018), and RTL WestCan

Bulk Transport Ltd. (2003 – 2007). In addition, Mr. Church

served on a further 17 Boards of TriWest portfolio companies across

a wide spectrum of industries.

Prior to co-founding TriWest, Mr. Church held

roles at Credit Suisse First Boston and Exor America, a New York

based private equity firm. He graduated cum laude with a Bachelor

of Economics from Harvard University. Mr. Church was

awarded the Top 40 under 40 in Canada in 2010.

Brian Frank

Brian Frank has over 35 years of experience in

the oil and gas sector, including executive and director roles at

various energy and industrial companies in Canada, the U.S. and

U.K. His board and governance experience spans two decades and

includes numerous joint venture boards, private companies, public

companies, not-for-profit organizations and Chairing Special

Committees of large transactions. Mr. Frank currently serves

as an independent director for Corval Energy, LLC (a private oil

and gas company), and until recently, was an independent director

with the Enbridge Income Fund (a large mid-stream company). Mr.

Frank also serves on the boards of several not-for-profit

organizations.

As an executive, Mr. Frank's experience includes

President and CEO of TimberWest Forest Corp. (2012 -2014), Chief

Executive of Global Oil and Finance Europe (2010-2011), President

of BP North American Gas & Power (2006 – 2010), Chairman and

CEO of BP Canada (2003 – 2006), and President of BP Canada Gas

& Power (1999-2003). Mr. Frank also held several roles with

Amoco Canada (1995 – 1999) and as a Director in the Energy

Commodities Branch at Natural Resources Canada (Government of

Canada 1984 – 1994). He started his career with Nova Corporation in

Calgary.

He holds a Bachelor of Arts, Economics & Law

and Master of Arts, Public Administration, from Carleton University

in Ottawa.

Mark Smith

Mr. Smith is a Professional Engineer with over

35 years of oil and gas industry experience primarily focused on

the Western Canadian Sedimentary Basin. Throughout his

career, he has held operational and executive leadership roles in

several Canadian exploration and production companies.

His board and governance experience includes

Chief Operating Officer of Trident Exploration (2017 – 2018),

Director and Chief Operating Officer of Candour Resources

Development Corp. (2015 – 2017), and Chief Operating Officer of

Arcan Resources Ltd. (2012 – 2015). Prior experience includes

exploration and development roles at Baytex Energy Ltd., and

Burlington Resources Canada Ltd.

Mr. Smith holds a Bachelor of Science of

Chemical Engineering from University of Western Ontario and is a

Professional Engineer in Alberta.

The following individuals are continuing as

Bellatrix directors:

Brent Eshleman

Mr. Eshleman is a Professional Engineer with

over 30 years of oil and gas experience and is President and Chief

Executive Officer of Bellatrix, a role he has held since February

15, 2017. Mr. Eshleman has held senior executive roles with

Bellatrix since July 2012, including Interim President and Chief

Executive Officer, Chief Operating Officer and Executive

Vice-President.

Prior to joining Bellatrix, Mr. Eshleman was

Vice-President Engineering and Exploitation of Daylight Energy

Ltd., from December 2004 to January 2012, Director Northern Alberta

of Calpine Canada, from May 2000 to November 2004 and Manager

Engineering of Ulster Petroleum Ltd. from May 1998 to April

2000.

Keith MacDonald

Mr. MacDonald is a Chartered Accountant and has

over 30 years’ experience in senior financial and directorship

roles within the oil and gas industry. He served as a

director of Surge Energy Inc, a TSX listed intermediate exploration

and development company, from 2010 until 2019 and was previously a

director of Madalena Energy Inc. from 2010 to 2017 and Mountainview

Energy Ltd. from 2010 to 2017.

Mr. MacDonald is President of Bamako Investment

Management Ltd., a private holding and financial consulting

company, since July 1994, and is the Chairman and CEO of Drakkar

Energy Ltd., a private oil and gas company, since 2015. Mr.

Macdonald was the Chief Executive Officer and a director of EFLO

Energy Inc. from March 2011 to January 2015.

Tom MacInnisMr. MacInnis is a

seasoned energy-focused financial executive. Most recently

Mr. MacInnis was Head of Financial Markets for National Bank

Financial where he was responsible for leading the firm's global

energy practice. Prior thereto, Mr. MacInnis was a founder

and Managing Director of Tristone Capital, an energy focused

boutique investment banking practice in Calgary, Alberta.

Mr. MacInnis holds an MBA from the Richard Ivey

School of Business and an ICD.D. Certification from the Institute

of Corporate Directors. Mr. MacInnis is currently a director

of Crestwynd Exploration Ltd., and Canadian Premium Sand Inc.

The Company’s legal advisors in connection with

the Recapitalization Transaction were Goodmans LLP and Vinson &

Elkins L.L.P. and its financial advisor was National Bank Financial

Inc. Burnet, Duckworth & Palmer LLP acted as legal

counsel to the special committee of Bellatrix’s board of

directors.

About Bellatrix

Bellatrix Exploration Ltd. is a publicly traded

Western Canadian based growth oriented oil and gas company engaged

in the exploration for, and the acquisition, development and

production of oil and natural gas reserves, with highly

concentrated operations in west central Alberta, principally

focused on profitable development of the Spirit River liquids rich

natural gas play.

For further information, please

contact:

Steve Toth, CFA, Vice President, Investor Relations &

Corporate Development (403) 750-1270

Bellatrix Exploration Ltd. 1920,

800 – 5th Avenue SW Calgary, Alberta, Canada T2P 3T6 Phone: (403)

266-8670 Fax: (403) 264-8163 www.bxe.com

FORWARD LOOKING STATEMENTS: Certain information

contained in this press release may contain forward looking

statements within the meaning of applicable securities laws. The

use of any of the words “continue”, “plan”, “propose”, “would”,

“will”, “believe”, “expect”, “position”, “anticipate”, “improve”,

“enhance” and similar expressions are intended to identify

forward-looking statements. More particularly and without

limitation, this document contains forward-looking statements

concerning: the effect and benefits of the Recapitalization

Transaction; Bellatrix’s ability to effectively pursue its business

and strategic objectives; the continued listing and trading of

Bellatrix’s common shares on the TSX and the expected timing in

respect thereof; and the public posting of certain documents

entered into by Bellatrix in connection with the Recapitalization

Transaction.

Forward-looking statements necessarily involve

risks, including, without limitation, risks associated with the

ability of the Company to achieve its financial goals including

with respect to the nature of any agreement with its debtholders;

the ability of the Company to continue to realize its assets and

discharge its liabilities and commitments; the ability of the

Company to comply with its contractual obligations, including,

without limitation, its obligations under debt arrangements; the

general regulatory environment in which the Company operates; the

tax treatment of the Company and the materiality of any legal and

regulatory proceedings; the general economic, financial, market and

political conditions impacting the industry and markets in which

the Company operates; the ability of the Company to generate

sufficient cash flow from operations; the impact of competition;

the ability of the Company to obtain and retain qualified staff,

equipment and services in a timely and efficient manner; and the

ability of the Company to retain members of the senior management

team, including but not limited to, the officers of the

Company.

Events or circumstances may cause actual results

to differ materially from those predicted, as a result of the risk

factors set out and other known and unknown risks, uncertainties,

and other factors, many of which are beyond the control of

Bellatrix. In addition, forward looking statements or information

are based on a number of factors and assumptions which have been

used to develop such statements and information but which may prove

to be incorrect and which have been used to develop such statements

and information in order to provide stakeholders with a more

complete perspective on Bellatrix’s future operations. Such

information may prove to be incorrect and readers are cautioned

that the information may not be appropriate for other purposes.

Although the Company believes that the expectations reflected in

such forward looking statements or information are reasonable,

undue reliance should not be placed on forward looking statements

because the Company can give no assurance that such expectations

will prove to be correct. In addition to other factors and

assumptions which may be identified herein, assumptions have been

made regarding, among other things: the general stability of the

economic and political environment in which Bellatrix operates; the

timely receipt of any required regulatory approvals; future

commodity prices; currency, exchange and interest rates; and the

regulatory framework regarding royalties, taxes and environmental

matters in the jurisdictions in which Bellatrix operates.

Readers are cautioned that the foregoing list is not exhaustive of

all factors and assumptions which have been used. As a consequence,

actual results may differ materially from those anticipated in the

forward-looking statements. Additional information on these and

other factors that could affect Bellatrix’s operations and

financial results are included in reports, including under the

heading “Risk Factors” in the Information Circular and the

Company’s annual information form for the year ended December 31,

2018, on file with Canadian securities regulatory authorities and

may be accessed through the SEDAR website (www.sedar.com) and at

Bellatrix’s website (www.bxe.com). Furthermore, the forward looking

statements contained herein are made as at the date hereof and

Bellatrix does not undertake any obligation to update publicly or

to revise any of the included forward looking statements, whether

as a result of new information, future events or otherwise, except

as may be required by applicable securities laws.

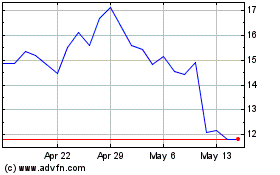

Source Energy Services (TSX:SHLE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Source Energy Services (TSX:SHLE)

Historical Stock Chart

From Nov 2023 to Nov 2024