Solaris Closes $54 Million in Financing

June 10 2024 - 8:39AM

Solaris Resources Inc. (TSX: SLS; NYSE: SLSR)

(“Solaris” or the “Company”) is pleased to announce that it has

closed its previously announced bought deal equity offering (the

“Offering”). The Company issued, on a bought deal basis, 8,222,500

common shares of the Company (“Common Shares”), including 1,072,500

Common Shares pursuant to the underwriters’ full exercise of the

over-allotment option, at a price of $4.90 per Common Share for

aggregate gross proceeds of $40,290,250.

The Offering was completed pursuant to an

underwriting agreement dated May 27, 2024, between the Company and

a syndicate of underwriters led by National Bank Financial Markets,

RBC Capital Markets and BMO Capital Markets, as Joint

Bookrunners.

The net proceeds of the Offering will be used to

fund an expanded exploration and infill drilling program at the

Company’s flagship Warintza Project in southeastern Ecuador,

together with enhanced regional exploration activities, including

fieldwork on ten new exploration concessions which were recently

awarded to the Company, and for working capital and general

corporate purposes.

The Company also issued, on a private placement

basis, 2,795,102 Common Shares at a price of $4.90 per Common Share

for aggregate gross proceeds of $13,696,000 (US$10,000,000)

pursuant to the drawdown of its second equity tranche of the

Company’s previously announced offtake financing package. See the

Company’s news release dated December 11, 2023, for additional

information.

Unless otherwise stated, all dollar amounts

disclosed herein are expressed in Canadian dollars.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy the Common Shares nor

shall any sale of the Common Shares occur in any jurisdiction,

including the United States, in which such offer, solicitation or

sale is unlawful. The securities have not been and will not be

registered under the U.S. Securities Act or any securities laws of

any state of the United States and may not be offered or sold

within the United States unless registered under the U.S.

Securities Act and applicable securities laws of any state of the

United States unless an exemption from such registration

requirements is available.

On behalf of the Board of Solaris

Resources Inc.

“Daniel Earle”President & CEO, Director

For Further Information

Jacqueline Wagenaar, VP Investor RelationsDirect: 416-366-5678

Ext. 203Email: jwagenaar@solarisresources.com

About Solaris Resources

Inc.

Solaris is advancing a portfolio of copper and

gold assets in the Americas, which includes a world class copper

resource with expansion and discovery potential at its Warintza

Project in Ecuador; a series of grass roots exploration projects

with discovery potential in Peru and Chile; and significant

leverage to increasing copper prices through its 60% interest in

the La Verde joint-venture project with a subsidiary of Teck

Resources in Mexico.

Cautionary Notes and Forward-Looking

Statements

This document contains certain forward-looking

information and forward-looking statements within the meaning of

applicable securities legislation (collectively “forward-looking

statements”). The use of the words “will” and “expected” and

similar expressions are intended to identify forward-looking

statements. These statements include statements regarding the use

of proceeds raised in the Offering. Although Solaris believes that

the expectations reflected in such forward-looking statements

and/or information are reasonable, readers are cautioned that

actual results may vary from the forward-looking statements. The

Company has based these forward-looking statements and information

on the Company’s current expectations and assumptions about future

events including the Company’s future plans. These statements also

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements, including the

risks, uncertainties and other factors identified in the Solaris

Management’s Discussion and Analysis, for the year ended December

31, 2023 available at www.sedarplus.ca. Furthermore, the

forward-looking statements contained in this news release are made

as at the date of this news release and Solaris does not undertake

any obligation to publicly update or revise any of these

forward-looking statements except as may be required by applicable

securities laws.

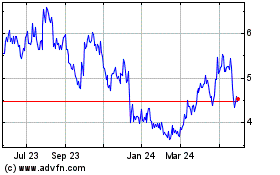

Solaris Resources (TSX:SLS)

Historical Stock Chart

From Dec 2024 to Jan 2025

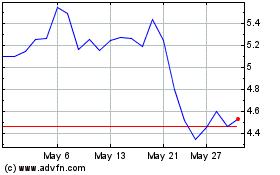

Solaris Resources (TSX:SLS)

Historical Stock Chart

From Jan 2024 to Jan 2025