Highlights -- For the third quarter of 2011, net income

attributable to SNC-Lavalin shareholders increased by 15.8% to

$125.6 million ($0.83 per share on a diluted basis) compared to

$108.5 million ($0.71 per share on a diluted basis), excluding a

2010 gain from the disposal of technology solution assets of $19.6

million. -- For the nine-month period ended September 30, 2011, net

income attributable to SNC-Lavalin shareholders was $300.2 million

($1.97 per share on a diluted basis), compared to $311.7 million

($2.05 per share on a diluted basis) for the same period in 2010,

excluding the 2010 gain from disposal of technology solution assets

of $19.6 million. -- Revenues for the nine-month period ended

September 30, 2011 increased by 21.7% to $5.1 billion, compared to

$4.2 billion for the nine-month period ended September 30, 2010. --

Revenue backlog totalled $9.4 billion at the end of September 2011

compared to $9.7 billion at the end of December 2010. Services

backlog increased by 55.7% to a new record level of $2.2 billion.

-- Financial position remained solid with cash and cash equivalents

of $1.0 billion at September 30, 2011. -- Return on average

shareholders' equity was 24.0% for the 12-month period ended

September 30, 2011. -- The Board of Directors declared a cash

dividend of $0.21 per share for the third quarter of 2011.

MONTREAL, Nov. 4, 2011 /CNW Telbec/ - SNC-Lavalin Group Inc.

Financial Highlights (unaudited) Nine months ended Third Quarter

September 30 (in thousands of Canadian dollars, unless otherwise

indicated) 2011 2010 2011 2010 Revenues by activity Services $

597,992 $ 493,637 $ 1,642,533 $ 1,452,449 Packages 758,799 610,501

2,082,923 1,466,227 Operations and Maintenance 308,284 308,041

1,016,739 946,840 Infrastructure Concession Investments (ICI)

115,031 100,820 345,515 315,529 $ 1,780,106 $ 1,512,999 $ 5,087,710

$ 4,181,045 Net income excluding ICI $ 100,023 $ 111,640 $ 208,518

$ 251,056 SNC-Lavalin's net income from ICI 25,597 16,422 91,721

80,285 Net income attributable to SNC-Lavalin shareholders 125,620

128,062 300,239 331,341 Net income attributable to non-controlling

interests 3,010 1,509 8,405 7,857 Net income $ 128,630 $ 129,571 $

308,644 $ 339,198 Diluted earnings per share ($) $ 0.83 $ 0.84 $

1.97 $ 2.18 Shares outstanding (in thousands) Weighted average

number of outstanding shares - Basic 150,889 150,967 150,888

150,963 Weighted average number of outstanding shares - Diluted

151,800 151,970 152,027 152,142 Return on average shareholders'

equity(ROASE)(1) 24.0% 27.4% As at As at September30 December 31

Revenue backlog by activity 2011 2010 Services $ 2,196,600 $

1,410,700 Packages 4,840,000 5,556,000 Operations and Maintenance

2,393,200 2,732,800 $ 9,429,800 $ 9,699,500

------------------------------ ((1)) Corresponds to the

trailing 12-month net income attributable to SNC-Lavalin

shareholders, divided by a trailing 13-month average equity

attributable to SNC-Lavalin shareholders, excluding "other

components of equity". N.B.: All amounts indicated are in Canadian

dollars. SNC-Lavalin Group Inc. announced its results today for the

third quarter and nine-month period ended September 30, 2011. For

the third quarter of 2011, net income attributable to SNC-Lavalin

shareholders was $125.6 million ($0.83 per share on a diluted

basis), compared to $128.1 million ($0.84 per share on a

diluted basis) for the comparable quarter in 2010, or $108.5

million ($0.71 per share on a diluted basis) excluding the 2010

gain of $19.6 million from the disposal of technology solution

assets. This 15.8% increase in 2011, excluding the 2010 gain,

mainly reflects higher contributions from the Chemicals &

Petroleum, Power, Mining & Metallurgy and Infrastructure

Concession Investments segments, partially offset by a lower

contribution from the Infrastructure & Environment segment. For

the nine-month period ended September 30, 2011, net income

attributable to SNC-Lavalin shareholders was $300.2 million

($1.97 per share on a diluted basis), compared to

$331.3 million ($2.18 per share on a diluted basis) for the

comparable period in 2010, or $311.7 million ($2.05 per share on a

diluted basis) excluding the 2010 gain of $19.6 million from the

disposal of technology solution assets. This decrease reflects a

lower net income excluding Infrastructure Concession Investments,

partially offset by a higher net income from Infrastructure

Concession Investments. Net income, excluding Infrastructure

Concession Investments, was $208.5 million compared to $251.0

million, or $231.4 million excluding the 2010 gain. This decrease

mainly reflects a lower contribution from the Infrastructure &

Environment segment, partially offset by higher contributions from

all other segments. The net income from Infrastructure Concession

Investments was $91.7 million, compared to $80.3 million for

the first nine months of 2010, mainly due to higher dividends from

Highway 407. Revenues for the nine-month period ended September 30,

2011 increased by 21.7% to $5.1 billion compared to

$4.2 billion for the same period in 2010. Revenues increased

in all the Company's segments of activity and in all revenue

categories, with Packages revenues growing by 42.1% and Services

revenues growing by 13.1%. For the third quarter of 2011, Packages

and Services revenues increased by 24.3% and 21.1% respectively

compared to the third quarter 2010. "We are pleased with our

quarterly results and our revenue backlog, where the Services

category has reached an all-time high. We continue to expect our

2011 net income to remain in line with 2010, when we exclude the

gains from the disposals of certain assets and investments

recognized in 2010," said Pierre Duhaime, President and Chief

Executive Officer, SNC-Lavalin Group Inc. "We are also pleased to

have completed two new acquisitions this fall; Interfleet

Technology, which brings us additional world class expertise in the

high growth rail sector worldwide, and Arcturus Realty Corporation,

a well-established manager of third party real estate assets. These

acquisitions will open up new opportunities and markets, and expand

others for us all over the world. We also closed the transaction

for full ownership of AltaLink, and concluded the acquisition of

certain assets of Atomic Energy of Canada Limited. All in all, it

has been a very active and successful few months in terms of

acquisitions." Revenue backlog remained strong at $9.4 billion

at the end of September 2011, compared to $9.7 billion at the

end of December 2010. The Packages and Operations & Maintenance

revenue backlog decreased while the Services revenue backlog

increased by 55.7% to a record level of $2.2 billion. The Company's

financial position remained solid with cash and cash equivalents

totalling $1.0 billion as at September 30, 2011. The Company's

return on average shareholders' equity was 24.0% for the 12-month

period ended September 30, 2011. The Board of Directors today

declared a cash dividend of $0.21 per share, payable on

December 2, 2011 to shareholders of record on November 18,

2011. This dividend is an "eligible dividend" for income tax

purposes. SNC-Lavalin is one of the leading engineering and

construction groups in the world and a major player in the

ownership of infrastructure, and in the provision of operations and

maintenance services. SNC-Lavalin has offices across Canada and in

over 40 other countries around the world, and is currently working

in some 100 countries. In business since 1911, the Company

celebrates its 100(th) anniversary in 2011. www.snclavalin.com

_____________________________________________________________________

|Reference in this press release, and hereafter, to the "Company"

or | |to "SNC-Lavalin" means, as the context may require,

SNC-Lavalin Group| |Inc. and all or some of its subsidiaries or

joint ventures, or | |SNC-Lavalin Group Inc. or one or more of its

subsidiaries or joint | |ventures. Statements made in this press

release that describe the | |Company's or management's budgets,

estimates, expectations, | |forecasts, objectives, predictions or

projections of the future may | |be "forward-looking statements",

which can be identified by the use | |of the conditional or

forward-looking terminology such as | |"anticipates", "believes",

"estimates", "expects", "may", "plans", | |"projects", "should",

"will", or the negative thereof or other | |variations thereon. The

Company cautions that, by their nature, | |forward-looking

statements involve risks and uncertainties, and that | |its actual

actions and/or results could differ materially from those |

|expressed or implied in such forward-looking statements, or could

| |affect the extent to which a particular projection materializes.

For | |more information on risks and uncertainties, and assumptions

that | |would cause the Company's actual results to differ from

current | |expectations, please refer to the section "Risks and

Uncertainties" | |and the section "How We Analyze and Report our

Results", | |respectively, in the Company's 2010 Financial Report

under | |"Management's Discussion and Analysis". The

forward-looking | |statements herein reflect the Company's

expectations as at the date | |of this press release and are

subject to change after this date. The | |Company does not

undertake any obligation to update publicly or to | |revise any

such forward-looking statements, unless required by | |applicable

legislation or regulation. |

|_____________________________________________________________________|

SNC-Lavalin's Consolidated Financial Statements and Management's

Discussion and Analysis and other relevant financial materials are

available in the Investor Relations section of the Company's

website at www.snclavalin.com. These and other Company reports are

also available on the website maintained by the Canadian Securities

regulators at www.sedar.com. SNC-LAVALIN

CONTACT: Investors: Media:Denis Jasmin Leslie

QuintonVice-President, Investor Relations Vice-President, Global

Corporate514-390-8000, ext. 7553

Communicationsdenis.jasmin@snclavalin.com 514-390-8000, ext.

7354leslie.quinton@snclavalin.com

Copyright

SNC Lavalin (TSX:SNC)

Historical Stock Chart

From Jul 2024 to Aug 2024

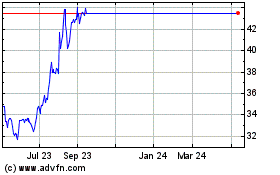

SNC Lavalin (TSX:SNC)

Historical Stock Chart

From Aug 2023 to Aug 2024