Sylogist Ltd. (TSX: SYZ) ("Sylogist" or the "Company"), a leading

public sector SaaS company, today announced its financial results

for the fourth quarter and full year ended December 31, 2023.

Q4 2023 Financial

Highlights

|

Total Revenue |

Recurring Revenue |

SaaS Subscription Revenue |

|

(in millions) |

|

Reported |

CC |

Reported |

CC |

Reported |

CC |

|

|

$16.2 |

|

|

$16.1 |

|

|

$10.5 |

|

|

$10.5 |

|

|

$7.0 |

|

|

$7.0 |

|

|

|

+5.4% |

|

|

+5.2% |

|

|

+8.5% |

|

|

+8.3% |

|

|

+15.7% |

|

|

+15.5% |

|

- Total revenue of $16.2 million, up

5.4% Y/Y;

- Recurring revenue of $10.5 million,

up 8.5% Y/Y;

- SaaS subscription revenue of $7.0

million, up 15.7% Y/Y;

- Total ARR of $42.2 million up 11%

Y/Y;

- SaaS ARR at $27.6 million up 13%

Y/Y;

- SaaS revenue as percentage of total

recurring revenue at 67%;

- SaaS NRR of 104%;

- Gross profit margin of 60%;

- Adjusted EBITDA of $4.8 million and

Adjusted EBITDA Margin of 29.4%;

- Bookings of $7.6 million;

- RPO of $31.0 million;

- Repurchase of 101,500 shares at a

total cost of $0.7 million

Full Year 2023

|

Total Revenue |

Recurring Revenue |

SaaS Subscription Revenue |

|

(in millions) |

|

Reported |

CC |

Reported |

CC |

Reported |

CC |

|

|

$65.5 |

|

|

$64.1 |

|

|

$40.2 |

|

|

$39.2 |

|

|

$26.1 |

|

|

$25.4 |

|

|

|

+16.1% |

|

|

+13.5% |

|

|

+10.2% |

|

|

+7.4% |

|

|

+14.1% |

|

|

+11.1% |

|

- Total revenue of $65.5 million, up

16.1% Y/Y;

- Recurring revenue of $40.2 million,

up 10.2% Y/Y;

- SaaS subscription revenue of $26.1

million, up 14.1% Y/Y;

- SaaS revenue as percentage of total

recurring revenue at 65%;

- Gross profit margin of 60%;

- Adjusted EBITDA of $17.3 million

and Adjusted EBITDA Margin of 26.3%;

- $4.0 million repayment on revolving

credit facility;

- Repurchase of 343,600 shares at a

total cost of $2.1 million

*Y/Y denotes comparison to the twelve-month

period ended December 31, 2022

Commentary

“Our team delivered continuing strong results in

Q4 and throughout 2023, pushing forward our plans to make Sylogist

into a SaaS leader in the public sector,” said Bill Wood, CEO of

Sylogist. “Our success metrics to watch, including annual recurring

growth, margins, net revenue retention, and customer net promoter

score, all trended to new highs for the Company in Q4. We

anticipate this momentum to continue in 2024.”

“Throughout 2024, particularly in the latter

half of the year, we foresee SaaS acceleration driven by expanding

traction in the Sylogist Mission sector, new contributions from our

Sylogist Ed and Gov sectors, and our growing partner community. Our

focus remains on profitable organic growth while being prepared to

seize strategic opportunities for scale or innovation, as seen with

our recent Time Clock Now tuck-in acquisition.”

Conference Call DetailsThe

Company will host a conference call at 8:30 AM Eastern Time on

March 14, 2024. Bill Wood, President and Chief Executive Officer,

and Sujeet Kini, Chief Financial Officer, will present the

Company's financial results, discuss performance as well as outlook

for 2024 and beyond. Q & A will follow, as time allows, and a

replay of the call will be archived in the investor section of the

Company’s website.

Date: Thursday, March 14, 2024Time: 8:30 a.m.

EDTParticipant Toll-Free Dial-In Number: + 1-800-319-4610

Participant Dial-In Number: +1-416-915-3239Webcast link:

https://services.choruscall.ca/links/sylogist2023q4.html

Please dial-in before the start of the

conference to secure a line and avoid delays.

About SylogistSylogist provides

mission-critical SaaS solutions to over 2,000 public sector

customers globally across the government, nonprofit, and education

verticals. The Company's stock is traded on the Toronto Stock

Exchange under the symbol SYZ. Information about Sylogist,

inclusive of full financial statements together with Management’s

Discussion and Analysis, can be found at

www.sylogist.com.

Forward-looking

Statements Certain statements in this news release

may be forward-looking statements within the meaning of applicable

securities laws and regulations. These statements typically use

words such as expect, foresee, believe, estimate, project,

anticipate, plan, may, should, could and would, or the negative of

these terms, variations thereof or similar terminology.

Forward-looking information in this news release includes

statements made, if any, with respect to Sylogist’s confidence in

future quarters or future fiscal years. By their very nature,

forward-looking statements are based on assumptions and involve

inherent risks and uncertainties, both general and specific in

nature. It is therefore possible that the beliefs and plans and

other forward-looking expectations expressed herein will not be

achieved or will prove inaccurate. Although Sylogist believes that

the expectations reflected in these forward-looking statements are

reasonable, it provides no assurance that these expectations will

prove to have been correct. Forward-looking information involves

risks, uncertainties and other factors that could cause actual

events, results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking

information, including its inability to attract key employees or

enlist customer support, its inability to develop innovative

technology, its inability to find opportunities to deploy free cash

flow, impacts of public health crises, and economic turmoil.

Additional information regarding some of these risks, uncertainties

and other factors may be found in the Company’s Annual Information

Form for the fiscal period ended December 31, 2022, and in the

Management’s Discussion and Analysis for the quarters ended March

31, 2023, June 30, 2023, and September 30, 2023 for the year ended

December 31, 2023 and other documents available on the Company’s

profile at www.sedarplus.ca. Material assumptions and factors that

could cause actual results to differ materially from such

forward-looking information include Sylogist’s ability to attract

and retain employees and customers and to realize on its

investments, the ability to expand technology partner and customer

relationships and the acceleration of organic and inorganic growth.

Although Sylogist believes that the material assumptions and

factors used in preparing the forward-looking information in this

news release are reasonable, undue reliance should not be placed on

such information, which only applies as of the date of this news

release, and no assurance can be given that such events will occur.

Sylogist disclaims any intention or obligation to update or revise

any forward-looking information, whether as a result of new

information, future events or otherwise, other than as required by

law.

Certain information set out herein may be

considered as “financial outlook” within the meaning of applicable

securities laws. The purpose of this financial outlook is to

provide readers with disclosure regarding Sylogist’s reasonable

expectations as to the anticipated results of its proposed business

activities for the periods indicated. Readers are cautioned that

the financial outlook may not be appropriate for other

purposes.

Non-IFRS Financial MeasuresThis

news release refers to certain non-IFRS measures. These measures

are not recognized measures under IFRS, do not have a standardized

meaning prescribed by IFRS and therefore may not be comparable to

similar measures presented by other issuers. These measures are

provided as additional information to complement measures under

IFRS by providing further understanding of the Company’s expected

results of operations from management’s perspective. Accordingly,

such measures should not be considered in isolation nor as a

substitute for analysis of the Company’s financial information

reported under IFRS.

Adjusted EBITDA, Adjusted EBITDA Margin, Annual

Recurring Revenue (“ARR”), Software as a Service ARR (“SaaS ARR”),

Software as a Service Net Revenue Retention (“NRR"), Constant

Currency (“CC”), Gross profit margin, , Bookings and Remaining

Performance Obligation (“RPO”) are non-IFRS financial measures.

These measures are provided to investors as alternative methods for

assessing the Company’s operating results in a manner that is

focused on the Company’s ongoing operations and to provide a more

consistent basis for comparison between periods. These measures

should not be construed as alternatives to profit or cash flow from

operating activities determined in accordance with IFRS as an

indicator of the Company’s performance.

- ARR refers to the annualized value

of monthly recurring revenues attributable to all our recurring

revenue customer contracts.

- SaaS ARR refers to annualized value

of monthly recurring revenues attributable to SaaS customer

contracts.

- SaaS NRR refers to the percentage

of recurring revenue retained from our existing SaaS customers over

a given 12-month period.

- Gross profit margin refers to Gross

Profit as a percentage of revenue.

- Adjusted EBITDA Margin refers to

Adjusted EBITDA as a percentage of revenue.

- Adjusted EBITDA is defined as GAAP

based net income(loss) for the period excluding the impact of

stock-based compensation expense, share-based payments, foreign

exchange gains or losses, net interest expense, bargain purchase

price on acquisitions, income taxes, acquisition-related costs,

change in purchase consideration fair value, and depreciation and

amortization.

- Bookings are the total value of

customer contracts, entered into during the reporting period, that

are new, committed and incremental to the Company’s existing

contracts and are inclusive of new, committed and incremental

project services engagements.

- RPO refers to the value of

contracted revenue that is not yet recognized and includes

unrecognized contracted revenues from SaaS subscription contracts

and maintenance and support contracts as well as project services

revenues that have not been recognized or have not been invoiced to

date but will be in future periods.

For further information regarding non-IFRS

measures used by the Company, please refer to the Management’s

Discussion and Analysis of the Company, copies of which are

available on Sylogist's SEDAR+ profile

at www.sedarplus.ca.

For further information

contact:Sujeet Kini, Chief Financial OfficerSylogist

Ltd.

Jennifer Smith, Investor RelationsLodeRock

Advisors

(416) 491-8004ir@sylogist.com

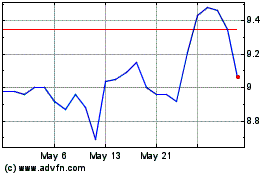

Sylogist (TSX:SYZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sylogist (TSX:SYZ)

Historical Stock Chart

From Jan 2024 to Jan 2025