Torex Gold Resources Inc. (the “Company” or “Torex”) (TSX: TXG) is

pleased to report initial results from the 2023 drilling program at

EPO, a deposit located to the north of the Media Luna deposit, in

close proximity to the Guajes Tunnel, south of the Balsas River.

Results from the 2023 program continue to highlight the potential

to upgrade Inferred resources to the Indicated category and expand

Inferred resources through step-out drilling to the north and south

of the deposit.

Jody Kuzenko, President & CEO stated:

“The geology of the Morelos Property continues

to impress and support our strategy to enhance the production and

cash flow profile beyond 2027 and extend the overall life of the

Morelos Complex. The focus of our renewed investment in exploration

and drilling is on expanding the resource potential of the Media

Luna Cluster and making stand-alone discoveries across the broader

Morelos Property.

“We are pleased with the results to date from

the 2023 drilling program at EPO as the assay results indicate the

potential to upgrade additional Inferred mineral resources while

expanding mineralization. We are also optimistic about the

potential to further increase the size of EPO, as the deposit

remains highly prospective with mineralization open to the north,

south, and potentially at depth. Results from the 2023 program will

be incorporated into the year-end Mineral Resource update and will

form the basis of an internal study evaluating the feasibility of

developing an economic mining front at EPO, which could leverage

the infrastructure currently being developed for Media Luna,

including the Guajes Tunnel.

“Drill results from the resource categorization

program have been positive, with infill drilling along the southern

end of the deposit returning intercepts with similar grades and

widths as previous drilling. Several drill holes returned

favourable assay results including 9.78 grams per tonne

gold equivalent (“gpt AuEq”) over 21.3 metres

(“m”) in drill hole ML23-957D; 11.08 gpt AuEq over

5.3 m in ML23-941D; 5.08 gpt AuEq over 5.0

m in ML23-954D; 7.11 gpt AuEq over 14.1 m

in ML23-938D; and 3.96 gpt AuEq over 49.75 m in

ML23-933D.

“Initial results from the resource expansion

program have also been encouraging, with four step-out holes

confirming the mineralized footprint of the deposit approximately

500 m to the north of the current block model. Notable assay

results from the resource expansion program include 6.14

gpt AuEq over 15.75 m and 4.04 gpt AuEq

over 11.2 m in drill hole ML23-942; 4.69 gpt AuEq

over 3.1 m, 4.49 gpt AuEq over 3.4 m, and 6.26 gpt

AuEq over 3.0 m in ML23-935; 4.80 gpt AuEq over

8.6 m in ML23-956; as well as 7.99 gpt AuEq over

7.1 m and 8.81 gpt AuEq over 6.2 m in

ML23-949A. The intercepts show a strong structural control of the

mineralization by the dykes with assays demonstrating a higher

proportion of copper mineralization relative to gold.

“Additionally, an evolving structural

interpretation for the Morelos Property, in conjunction with

historical drill results, indicate the potential to extend the

mineralized footprint of EPO to the south. Drilling to test the

southern extensions of the deposit and validate the structural

interpretation is planned for the second half of the year.

“Overall, initial results from the 2023 drilling

program at EPO are very encouraging and, combined with the success

of the 2022 drilling campaign, continue to demonstrate the

potential for EPO to become a new mining front on the south side of

the Balsas River, which would support our strategic goal of filling

the mill with higher-grade feed beyond 2027.”

The gold equivalent grade calculation accounts

for the same metal prices ($1,550/oz gold (“Au”), $20/oz silver

(“Ag”), and $3.50/lb copper (“Cu”)) as well as metallurgical

recoveries (85% Au, 75% Ag, and 89% Cu) used in the current Mineral

Resource estimate for the EPO deposit (effective date of December

31, 2022).

Assay results from the resource categorization

program at EPO can be found in Table 3 and results from the

expansion drilling program at EPO can be found in Table 4.

2023 EPO DRILLING

PROGRAM

Through the end of July, approximately 24,140 m

and 54 holes were drilled as part of the 2023 drilling program at

EPO, with assays received for 34 holes. This represents 72% of the

approximately 35,000 m of total drilling planned at EPO in

2023.

A recent structural study has identified at

least three north-south oriented thick-skin faults, with the

Cuajiote fault believed to be responsible for the El Limón Guajes

and Media Luna Cluster mineralization. Specifically at EPO, this

structural interpretation highlights the exploration potential to

the south and to the north, towards the highly prospective Todos

Santos target, all of which further demonstrates the continuity of

the Media Luna Cluster.

RESOURCE CATEGORIZATION PROGRAM

The resource categorization program in 2023 is

aimed at upgrading Inferred resources along the southern portion of

the deposit to the Indicated category. The initial results

suggest a portion of the Inferred resources in the area of focus

will be upgraded to Indicated resource category (Figures 1 and

2).

Assay results have been received for 30 holes

drilled under the resource categorization program (approximately

21,280 m), 24 of which returned intercepts with mineralization in

excess of 2.0 gpt AuEq and over 3 m in length.

Table 1: Highlights from the 2023

resource categorization program at EPO

|

Drill Hole |

From(m) |

To(m) |

Core Length1(m) |

Au(g/t) |

Ag(g/t) |

Cu(%) |

AuEq2(g/t) |

|

ML23-932D |

503.33 |

507.04 |

3.71 |

4.70 |

9.89 |

0.50 |

5.63 |

|

ML23-933D |

469.25 |

519.00 |

49.75 |

3.49 |

6.51 |

0.24 |

3.96 |

|

ML23-934D |

712.00 |

718.17 |

6.17 |

0.44 |

38.81 |

2.29 |

4.60 |

|

ML23-937D |

653.79 |

660.93 |

7.14 |

3.03 |

22.45 |

0.62 |

4.29 |

|

ML23-938D |

462.04 |

468.40 |

6.36 |

1.50 |

61.12 |

1.54 |

4.69 |

|

|

485.86 |

500.00 |

14.14 |

6.56 |

9.41 |

0.27 |

7.11 |

|

ML23-939D |

643.09 |

658.22 |

15.13 |

1.41 |

29.71 |

0.94 |

3.27 |

|

ML23-941D |

735.83 |

741.10 |

5.27 |

9.80 |

12.97 |

0.70 |

11.08 |

|

ML23-943D |

481.00 |

502.00 |

21.00 |

2.98 |

5.02 |

0.10 |

3.19 |

|

|

588.90 |

598.60 |

9.70 |

2.19 |

15.86 |

0.53 |

3.24 |

|

ML23-954D |

683.26 |

688.30 |

5.04 |

2.94 |

20.72 |

1.18 |

5.08 |

|

ML23-957D |

511.61 |

532.94 |

21.33 |

9.29 |

9.11 |

0.24 |

9.78 |

|

ML23-962D |

505.28 |

510.00 |

4.72 |

2.77 |

38.46 |

0.55 |

4.10 |

Notes to Table:1) Intercepts are reported as

core length (not true width/thickness). Core lengths reflect

drilling core recovery.2) The gold equivalent

grade calculation used is as follows: AuEq (g/t) = Au (g/t) + Ag

(g/t) * 0.011385 + Cu (%) * 1.621237 and use the same metal prices

($1,550/oz gold, $20/oz silver, and $3.50/lb copper) and

metallurgical recoveries (85% gold, 75% silver, and 89% copper)

used in the Mineral Resource estimate for the EPO deposit.

The returned intercepts generally exhibit

similar thickness and grades to those defined by the 2022 drilling

program, which supports the goal of upgrading Inferred resources to

the Indicated category within the southern portion of the deposit

while also indicating the potential to expand Inferred resources

immediately to the west and east of the current block model.

RESOURCE EXPANSION PROGRAM

Initial results from the resource expansion

program at EPO have been successful, with 4 step-out drill holes

confirming the mineralized footprint of EPO approximately 500 m to

the north of the current block model. Drilling for the remainder of

2023 will be focused on extending mineralization to the north and

south of the deposit.

The control of the Cuajiote fault on EPO

suggests that mineralization could extend to the north and to the

south, with the latter interpretation being supported by historical

drill results within the interpreted extent of the

deposit. Step-out drilling planned for the second half of 2023

will be targeted at both validating the structural interpretation

and extending the mineralized footprint of the deposit to the south

(Figure 3).

Table 2: Highlights from the 2023

resource expansion program at EPO

|

Drill Hole |

From(m) |

To(m) |

Core Length1(m) |

Au(g/t) |

Ag(g/t) |

Cu(%) |

AuEq2(g/t) |

|

ML23-935 |

673.42 |

676.50 |

3.08 |

3.44 |

17.78 |

0.65 |

4.69 |

|

|

747.00 |

750.36 |

3.36 |

3.17 |

30.71 |

0.60 |

4.49 |

|

|

775.14 |

778.18 |

3.04 |

1.33 |

127.53 |

2.15 |

6.26 |

|

ML23-942 |

791.93 |

807.68 |

15.75 |

3.26 |

58.86 |

1.36 |

6.14 |

|

|

912.50 |

923.66 |

11.16 |

1.54 |

27.10 |

1.35 |

4.04 |

|

ML23-949A |

747.00 |

754.07 |

7.07 |

0.64 |

115.61 |

3.72 |

7.99 |

|

|

774.17 |

783.49 |

9.32 |

0.63 |

59.14 |

1.57 |

3.84 |

|

|

834.83 |

841.00 |

6.17 |

2.52 |

100.10 |

3.18 |

8.81 |

|

ML23-956 |

668.00 |

676.59 |

8.59 |

1.57 |

42.05 |

1.70 |

4.80 |

Notes to Table:1) Intercepts are reported as

core length (not true width/thickness). Core lengths reflect

drilling core recovery.2) The gold equivalent

grade calculation used is as follows: AuEq (g/t) = Au (g/t) + Ag

(g/t) * 0.011385 + Cu (%) * 1.621237 and use the same metal prices

($1,550/oz gold, $20/oz silver, and $3.50/lb copper) and

metallurgical recoveries (85% gold, 75% silver, and 89% copper)

used in the Mineral Resource estimate for the EPO deposit.

EPO GEOLOGY

The EPO deposit is part of the Media Luna

Cluster, hosted within the Mesozoic carbonate-rich Morelos

Platform, overlayed by Cuautla and Mezcala formation, and has been

intruded by Paleocene stocks, sills, and dykes of granodioritic to

tonalitic composition.

The north-south Cuajiote thick-skin fault

controls the architecture of the deposit with other sub-parallel

second order faults generating the favorable trap for the different

event of fluids at multiple stages of deformation.

Skarn-hosted copper was deposited in an

early-stage mineralization event. Gold-silver mineralization was

developed in the ground preparation of intense flat fractures found

in the footwall of the faults at the contact of Morelos limestone

and Media Luna granodiorite during reverse movement, as well as

within altered dykes and sills of the skarn envelope associated

with minor deformation stages.

The main portion of this mineralized package

dips slightly to the west at approximately 30°; in the lowest part

of the known mineralization, the dip steepens to approximately 60°,

while the northernmost portion of the deposit dips to the north,

resulting in a broad antiformal geometry of the deposit.

The skarn is characterized by a mineral

assemblage of pyroxene, garnet, and magnetite. Metal deposition and

sulfidation occurred during retrograde alteration and is associated

with a mineral assemblage comprising amphibole, phlogopite,

chlorite, and calcite ± quartz ± epidote as well as variable

amounts of magnetite and sulfides, primarily pyrrhotite. Additional

mineralization is associated with skarn developed within and along

dykes and sills above the main granodiorite intrusion.

Additional information on the Media Luna

deposit, the Media Luna Feasibility Study, and the analytical and

sampling process is available in the Company’s technical report

entitled the “Morelos Property, NI 43-101 Technical Report, ELG

Mine Complex Life of Mine Plan and Media Luna Feasibility Study,

Guerrero State, Mexico”, dated effective March 16, 2022 filed on

March 31, 2022 (the “Technical Report”) on SEDAR at www.sedar.com

and the Company’s website at www.torexgold.com.

QUALITY ASSURANCE / QUALITY CONTROL

At the Company’s Morelos Property (see

description below), all the Media Luna Project drill core is logged

and sampled at the core facility within the project camp under the

supervision of Nicolas Landon, Chief Exploration Geologist for the

Media Luna Project. A geologist marks the individual samples for

analysis and sample intervals, sample numbers, standards and blanks

are entered into the database. The core is cut in half lengthwise

using an electric core saw equipped with a diamond tipped blade.

One half of the core is placed into a plastic sample bag and sealed

with zip ties in preparation for shipment. The other half of the

core is returned to the core box and retained for future reference

in the Company core shack with the assay pulps and coarse rejects.

The core samples are picked up at the project camp and delivered to

Bureau Veritas (“BV”) to conduct all the analytical work.

Sample preparation is carried out by BV at its

facilities in Durango, Mexico and consists of crushing a 1 kg

sample to >70% passing 2 mm followed by pulverisation of 500 g

to >85% passing 75 μm. Gold is analyzed at the BV facilities in

Hermosillo, Mexico following internal analytical protocols (FA430)

and comprises a 30g fire assay with an atomic absorption finish.

Samples yielding results >10 g/t Au are re-assayed by fire assay

with gravimetric finish (FA530-Au). Copper and silver analyses are

completed at the BV facilities in Vancouver, Canada as part of a

multi-element geochemical analysis by an aqua regia digestion with

detection by ICP-ES/MS using BV internal analytical protocol AQ270.

Overlimits for the multi-element package are analyzed by internal

protocol AQ374.

Torex has a sampling and analytical Quality

Assurance/Quality Control (“QA/QC”) program in place that has been

approved by BV and is overseen by Nicolas Landon, Chief Exploration

Geologist for the Media Luna Project. The program includes 5% each

of Certified Reference Materials and Blanks; blind duplicates are

not included, but Torex evaluates the results of internal BV

laboratory duplicates. Torex uses an independent laboratory to

check selected assay samples and reference materials and has

retained a consultant to audit the QA/QC data for every drill

campaign at Media Luna. The QA/QC procedure is described in more

detail in the Technical Report filed on SEDAR.

QUALIFIED PERSONS

The scientific and technical data contained in

this news release has been reviewed and approved by Carolina Milla,

P.Eng. Ms. Milla is a member of the Association of Professional

Engineers and Geoscientists of Alberta (Member ID #168350), has

experience relevant to the style of mineralization under

consideration, is a qualified person under NI 43-101, and is an

employee of Torex. Ms. Milla has verified the data disclosed,

including sampling, analytical, and test data underlying the drill

results; verification included visually reviewing the drill holes

in three dimensions, comparing the assay results to the original

assay certificates, reviewing the drilling database, and reviewing

core photography consistent with standard practice. Ms. Milla

consents to the inclusion in this release of said data in the form

and context in which they appear.

ABOUT TOREX GOLD RESOURCES

INC.

Torex is an intermediate gold producer based in

Canada, engaged in the exploration, development, and operation of

its 100% owned Morelos Property, an area of 29,000 hectares in the

highly prospective Guerrero Gold Belt located 180 kilometres

southwest of Mexico City. The Company’s principal asset is the

Morelos Complex, which includes the El Limón Guajes (“ELG”) Mine

Complex, the Media Luna Project, a processing plant, and related

infrastructure. Commercial production from the Morelos Complex

commenced on April 1, 2016 and an updated Technical Report for the

Morelos Complex was released in March 2022. Torex’s key strategic

objectives are to optimize and extend production from the ELG Mine

Complex, de-risk and advance Media Luna to commercial production,

build on ESG excellence, and to grow through ongoing exploration

across the entire Morelos Property.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

| TOREX GOLD RESOURCES INC. |

|

| Jody

Kuzenko |

Dan Rollins |

| President and CEO |

Senior Vice President, Corporate

Development & Investor Relations |

| Direct: (647) 725-9982 |

Direct: (647) 260-1503 |

|

jody.kuzenko@torexgold.com |

dan.rollins@torexgold.com |

| |

|

CAUTIONARY NOTES ON FORWARD LOOKING

STATEMENTSThis press release contains "forward-looking

statements" and "forward-looking information" within the meaning of

applicable Canadian securities legislation. Forward-looking

information also includes, but is not limited to, statements about:

results from 2023 drilling at EPO support strategy to fill the mill

with higher-grade feed beyond 2027; results from the 2023 program

continue to highlight the potential to upgrade Inferred resources

to the Indicated category and expand Inferred resources through

step-out drilling to the north and south of the deposit; the

geology of the Morelos Property continues to impress and support

the Company’s strategy to enhance the production and cash flow

profile of the Morelos Complex beyond 2027 and extend the overall

life of the Morelos Complex; the focus of the Company’s renewed

investment in exploration and drilling is on expanding the resource

potential of the Media Luna Cluster and making stand-alone

discoveries across the broader Morelos Property; the assay results

indicate the potential to upgrade additional Inferred mineral

resources while expanding mineralization; the Company is also

optimistic about the potential to further increase the size of EPO,

as the deposit remains highly prospective with mineralization open

to the north, south, and potentially at depth; the results from the

2023 program will be incorporated into the year-end Mineral

Resource update and will form the basis of an internal study

evaluating the feasibility of developing an economic mining front

at EPO, which could leverage the infrastructure currently being

developed for Media Luna, including the Guajes Tunnel; the

intercepts from the initial results from the resource expansion

program show a strong structural control of the mineralization by

the dykes with assays demonstrating a higher proportion of copper

mineralization relative to gold; an evolving structural

interpretation for the Morelos Property, in conjunction with

historical drill results, indicate the potential to extend the

mineralized footprint of EPO to the south; overall, initial results

from the 2023 drilling program at EPO are very encouraging and,

combined with the success of the 2022 drilling campaign, continue

to validate the potential for EPO to become a new mining front on

the south side of the Balsas River, which would support the

Company’s strategic goal of filling the mill with higher-grade feed

beyond 2027; a recent structural study has identified at least

three north-south oriented thick-skin faults, with the Cuajiote

fault believed to be responsible for the El Limón Guajes and Media

Luna Cluster mineralization, specifically at EPO, this structural

interpretation highlights the exploration potential to the south

and to the north, towards the highly prospective Todos Santos

target, all of which further demonstrates the continuity of the

Media Luna Cluster; the initial results of the 2023 resource

categorization program suggest a portion of the Inferred resources

in the area of focus will be upgraded to Indicated resource

category to the south and potentially expanding Inferred resources

immediately to the west and east of the current block model; the

returned intercepts generally exhibit similar thickness and grades

to those defined by the 2022 drilling program, which supports the

goal of upgrading Inferred resources to the Indicated category

within the southern portion of the deposit while also indicating

the potential to expand Inferred resources immediately to the west

and east of the current block model; the control of the Cuajiote

fault on EPO suggests that mineralization could extend to the north

and to the south, with the latter interpretation being supported by

historical drill results within the interpreted extent of the

deposit; and the Company’s key strategic objectives to extend and

optimize production from the ELG Mining Complex, de-risk and

advance Media Luna to commercial production, build on ESG

excellence, and to grow through ongoing exploration across the

entire Morelos Property. Generally, forward-looking information can

be identified by the use of forward-looking terminology such as

“objective”, “strategy”, “target”, “continue”, “potential”,

“focus”, “demonstrate”, “aim” or variations of such words and

phrases or statements that certain actions, events or results

“will”, “would”, or “is expected to" occur. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking information, including, without limitation, risks

and uncertainties associated with: the ability to upgrade mineral

resources categories of mineral resources with greater confidence

levels or to mineral reserves; risks associated with mineral

reserve and mineral resource estimation; uncertainty involving

skarn deposits; and those risk factors identified in the Technical

Report and the Company’s annual information form and management’s

discussion and analysis or other unknown but potentially

significant impacts. Forward-looking information is based on the

assumptions discussed in the Technical Report and such other

reasonable assumptions, estimates, analysis and opinions of

management made in light of its experience and perception of

trends, current conditions and expected developments, and other

factors that management believes are relevant and reasonable in the

circumstances at the date such statements are made. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

the forward-looking information, there may be other factors that

cause results not to be as anticipated. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such information. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update any forward-looking information, whether as a

result of new information or future events or otherwise, except as

may be required by applicable securities laws.Figure 1:

2023 resource categorization program at EPO is expected to result

in additional Inferred resources being upgraded to the Indicated

resource category.

Figure 2: Infill drilling carried out as

part of the 2023 resource categorization program at EPO have

returned assay results with similar grades and widths as previous

drilling.

Figure 3: 2023 resource expansion

program at EPO has confirmed the continuity of mineralization

approximately 500 m to the north of the current block model.

Mineralization at EPO remains open to the north, to the south, and

potentially at depth.

Table 3: Initial results from 2023

resource categorization drilling program at EPO

|

|

|

|

|

|

|

|

|

|

|

Final |

|

|

|

Intercept |

|

|

|

|

|

Drill Hole |

Area |

Purpose |

UTM-E |

UTM-N |

Elevation |

Hole Type |

Mother Hole |

Azimuth |

Dip |

Depth |

From |

To |

Core Length |

Au |

Ag |

Cu |

AuEq |

Lithology |

|

|

|

|

(m) |

(m) |

(m) |

|

|

(°) |

(°) |

(m) |

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

(%) |

(g/t) |

|

|

ML23-932D |

EPO |

IND |

422199.22 |

1985614.78 |

1460.91 |

DD |

ML22-927 |

|

|

575.50 |

503.33 |

507.04 |

3.71 |

4.70 |

9.89 |

0.50 |

5.63 |

Skarn composite 2 |

|

ML23-933D |

EPO |

IND |

422199.22 |

1985614.78 |

1460.91 |

DD |

ML22-927 |

|

|

593.50 |

469.25 |

519.00 |

49.75 |

3.49 |

6.51 |

0.24 |

3.96 |

Skarn composite 2 |

|

ML23-934D |

EPO |

IND |

421932.52 |

1985579.20 |

1432.26 |

DD |

ML23-930 |

|

|

754.25 |

712.00 |

718.17 |

6.17 |

0.44 |

38.81 |

2.29 |

4.60 |

Skarn composite 2 |

|

ML23-937D |

EPO |

IND |

421932.52 |

1985579.20 |

1432.26 |

DD |

ML23-930 |

|

|

680.50 |

653.79 |

660.93 |

7.14 |

3.03 |

22.45 |

0.62 |

4.29 |

Skarn composite 2 |

|

ML23-938D |

EPO |

IND |

422199.22 |

1985614.78 |

1460.91 |

DD |

ML22-927 |

|

|

576.50 |

462.04 |

468.40 |

6.36 |

1.50 |

61.12 |

1.54 |

4.69 |

Skarn composite 1 |

|

|

EPO |

IND |

422199.22 |

1985614.78 |

1460.91 |

DD |

ML22-927 |

|

|

576.50 |

485.86 |

500.00 |

14.14 |

6.56 |

9.41 |

0.27 |

7.11 |

Skarn composite 3 |

|

ML23-939D |

EPO |

IND |

421932.52 |

1985579.20 |

1432.26 |

DD |

ML23-930 |

|

|

746.50 |

643.09 |

658.22 |

15.13 |

1.41 |

29.71 |

0.94 |

3.27 |

Skarn composite 1 |

|

ML23-940D |

EPO |

IND |

422199.22 |

1985614.78 |

1460.91 |

DD |

ML22-927 |

|

|

620.50 |

468.59 |

476.94 |

8.35 |

1.83 |

4.51 |

0.08 |

2.01 |

Skarn composite 2 |

|

|

EPO |

IND |

422199.22 |

1985614.78 |

1460.91 |

DD |

ML22-927 |

|

|

620.50 |

577.00 |

582.42 |

5.42 |

0.64 |

69.76 |

0.95 |

2.98 |

Skarn composite 5 |

|

ML23-941D |

EPO |

IND |

421932.52 |

1985579.20 |

1432.26 |

DD |

ML23-930 |

|

|

800.50 |

735.83 |

741.10 |

5.27 |

9.80 |

12.97 |

0.70 |

11.08 |

Skarn composite 1 |

|

ML23-943D |

EPO |

IND |

422199.22 |

1985614.78 |

1460.91 |

DD |

ML22-927 |

|

|

632.85 |

469.46 |

475.08 |

5.62 |

0.59 |

34.19 |

1.06 |

2.69 |

Skarn composite 1 |

|

|

EPO |

IND |

422199.22 |

1985614.78 |

1460.91 |

DD |

ML22-927 |

|

|

632.85 |

481.00 |

502.00 |

21.00 |

2.98 |

5.02 |

0.10 |

3.19 |

Skarn composite 2 |

|

|

EPO |

IND |

422199.22 |

1985614.78 |

1460.91 |

DD |

ML22-927 |

|

|

632.85 |

588.90 |

598.60 |

9.70 |

2.19 |

15.86 |

0.53 |

3.24 |

Skarn composite 5 |

|

ML23-945D |

EPO |

IND |

422199.22 |

1985614.78 |

1460.91 |

DD |

ML22-927 |

|

|

578.50 |

443.05 |

449.10 |

6.05 |

1.32 |

33.27 |

0.72 |

2.87 |

Skarn composite 1 |

|

|

EPO |

IND |

422199.22 |

1985614.78 |

1460.91 |

DD |

ML22-927 |

|

|

578.50 |

524.00 |

531.90 |

7.90 |

0.90 |

49.05 |

0.77 |

2.71 |

Skarn composite 4 |

|

ML23-954D |

EPO |

IND |

422197.73 |

1985617.10 |

1460.87 |

DD |

ML23-947A |

|

|

715.80 |

683.26 |

688.30 |

5.04 |

2.94 |

20.72 |

1.18 |

5.08 |

Skarn composite 2 |

|

ML23-957D |

EPO |

IND |

422197.73 |

1985617.10 |

1460.87 |

DD |

ML23-947A |

|

|

671.70 |

511.61 |

532.94 |

21.33 |

9.29 |

9.11 |

0.24 |

9.78 |

Skarn composite 1 |

|

ML23-962D |

EPO |

IND |

422194.88 |

1985621.29 |

1460.91 |

DD |

ML22-809 |

|

|

602.10 |

505.28 |

510.00 |

4.72 |

2.77 |

38.46 |

0.55 |

4.10 |

Skarn composite 3 |

Notes to Table

- Intercepts are reported as core length (not true

width/thickness). Core lengths reflect drilling core recovery.

- The gold equivalent grade calculation used is as follows: AuEq

(g/t) = Au (g/t) + Ag (g/t) * 0.011385 + Cu (%) * 1.621237 account

for the same metal prices ($1,550/oz gold, $20/oz silver and

$3.50/lb copper) and metallurgical recoveries (85% gold, 75% silver

and 89% copper) used in the Mineral Resource estimate for the EPO

deposit.

Table 4: Initial results from 2023 resource expansion

drilling program at EPO

|

|

|

|

|

|

|

|

|

|

|

Final |

|

|

|

Intercept |

|

|

|

|

|

Drill Hole |

Area |

Purpose |

UTM-E |

UTM-N |

Elevation |

Hole Type |

Mother Hole |

Azimuth |

Dip |

Depth |

From |

To |

Core Length |

Au |

Ag |

Cu |

AuEq |

Lithology |

|

|

|

|

(m) |

(m) |

(m) |

|

|

(°) |

(°) |

(m) |

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

(%) |

(g/t) |

|

|

ML23-935 |

EPO |

EXP |

421981.00 |

1985606.75 |

1440.44 |

CD |

|

349.80 |

-49.95 |

890.55 |

673.42 |

676.50 |

3.08 |

3.44 |

17.78 |

0.65 |

4.69 |

Skarn composite 1 |

|

|

EPO |

EXP |

421981.00 |

1985606.75 |

1440.44 |

CD |

|

349.80 |

-49.95 |

890.55 |

747.00 |

750.36 |

3.36 |

3.17 |

30.71 |

0.60 |

4.49 |

Skarn composite 4 |

|

|

EPO |

EXP |

421981.00 |

1985606.75 |

1440.44 |

CD |

|

349.80 |

-49.95 |

890.55 |

775.14 |

778.18 |

3.04 |

1.33 |

127.53 |

2.15 |

6.26 |

Skarn composite 5 |

|

ML23-942 |

EPO |

EXP |

421981.62 |

1985606.98 |

1440.43 |

CD |

|

16.28 |

-49.89 |

682.95 |

791.93 |

807.68 |

15.75 |

3.26 |

58.86 |

1.36 |

6.14 |

Skarn composite 3 |

|

|

EPO |

EXP |

421981.62 |

1985606.98 |

1440.43 |

CD |

|

16.28 |

-49.89 |

682.95 |

912.50 |

923.66 |

11.16 |

1.54 |

27.10 |

1.35 |

4.04 |

Skarn composite 5 |

|

ML23-949A |

EPO |

EXP |

421983.76 |

1985606.59 |

1440.46 |

CD |

ML23-949 |

|

|

987.55 |

747.00 |

754.07 |

7.07 |

0.64 |

115.61 |

3.72 |

7.99 |

Skarn composite 2 |

|

|

EPO |

EXP |

421983.76 |

1985606.59 |

1440.46 |

CD |

ML23-949 |

|

|

987.55 |

774.17 |

783.49 |

9.32 |

0.63 |

59.14 |

1.57 |

3.84 |

Skarn composite 4 |

|

|

EPO |

EXP |

421983.76 |

1985606.59 |

1440.46 |

CD |

ML23-949 |

|

|

987.55 |

834.83 |

841.00 |

6.17 |

2.52 |

100.10 |

3.18 |

8.81 |

Skarn composite 9 |

|

ML23-956 |

EPO |

INF |

421985.74 |

1985602.92 |

1440.53 |

CD |

|

29.42 |

-60.66 |

821.60 |

668.00 |

676.59 |

8.59 |

1.57 |

42.05 |

1.70 |

4.80 |

Skarn composite 3 |

Notes to Table

- Intercepts are reported as core length (not true

width/thickness). Core lengths reflect drilling core recovery.

- The gold equivalent grade calculation used is as follows: AuEq

(g/t) = Au (g/t) + Ag (g/t) * 0.011385 + Cu (%) * 1.621237 account

for the same metal prices ($1,550/oz gold, $20/oz silver and

$3.50/lb copper) and metallurgical recoveries (85% gold, 75% silver

and 89% copper) used in the Mineral Resource estimate for the EPO

deposit.

Table 5: References to historical drilling at EPO (prior

to 2023)

|

|

|

|

|

|

|

|

|

|

|

Final |

|

|

|

Intercept |

|

|

|

|

|

Drill Hole |

Area |

Purpose |

UTM-E |

UTM-N |

Elevation |

Hole Type |

Mother Hole |

Azimuth |

Dip |

Depth |

From |

To |

Core Length |

Au |

Ag |

Cu |

AuEq |

Lithology |

|

|

|

|

(m) |

(m) |

(m) |

|

|

(°) |

(°) |

(m) |

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

(%) |

(g/t) |

|

|

MLN-04 |

EPO |

EXP |

422396.11 |

1986295.07 |

1328.42 |

CD |

|

310.00 |

-70.00 |

655.50 |

561.22 |

570.23 |

9.01 |

5.09 |

14.68 |

0.28 |

5.72 |

Skarn Composite 1 |

|

MLN-09 |

EPO |

EXP |

422102.88 |

1985625.75 |

1447.69 |

CD |

|

220.00 |

-82.00 |

668.00 |

614.10 |

624.07 |

9.97 |

1.24 |

10.90 |

0.53 |

2.23 |

Skarn Composite 1 |

|

MLN-20 |

EPO |

EXP |

422200.08 |

1985619.58 |

1460.95 |

CD |

|

220.00 |

-83.00 |

701.35 |

552.42 |

555.96 |

3.54 |

6.85 |

10.23 |

0.23 |

7.33 |

Skarn composite 1 |

|

|

EPO |

EXP |

422200.08 |

1985619.58 |

1460.95 |

CD |

|

220.00 |

-83.00 |

701.35 |

623.35 |

632.06 |

8.71 |

2.82 |

10.76 |

0.50 |

3.75 |

Skarn composite 2 |

|

|

EPO |

EXP |

422200.08 |

1985619.58 |

1460.95 |

CD |

|

220.00 |

-83.00 |

701.35 |

665.50 |

673.36 |

7.86 |

1.49 |

9.66 |

0.62 |

2.60 |

Skarn composite 3 |

|

NWZML-10 |

EPO |

EXP |

422392.18 |

1985546.09 |

1493.79 |

CD |

|

40.00 |

-86.00 |

517.85 |

451.53 |

454.37 |

2.84 |

4.21 |

73.87 |

0.25 |

5.46 |

Skarn composite 1 |

|

ML21-753 |

MLSW |

EXP |

421867.82 |

1984351.08 |

1113.52 |

CD |

|

234.83 |

-74.89 |

938.00 |

836.00 |

847.00 |

11.00 |

4.00 |

19.44 |

0.78 |

5.48 |

Breccia |

|

ML22-803D |

EPO |

IND |

422195.89 |

1985617.85 |

1460.66 |

DD |

ML22-766 |

|

|

695.20 |

568.77 |

577.62 |

8.85 |

1.79 |

13.04 |

0.06 |

2.03 |

Skarn Composite 1 |

|

ML22-843D |

EPO |

IND |

421981.42 |

1985602.89 |

1440.40 |

DD |

ML22-834 |

|

|

737.65 |

683.67 |

706.31 |

22.64 |

1.43 |

19.69 |

0.82 |

2.98 |

Skarn Composite 1 |

|

ML22-899 |

EPO |

INF |

421984.71 |

1985607.11 |

1440.34 |

CD |

|

114.77 |

-73.09 |

708.20 |

556.81 |

563.00 |

6.19 |

0.57 |

26.34 |

0.83 |

2.21 |

Skarn composite 1 |

|

|

EPO |

INF |

421984.71 |

1985607.11 |

1440.34 |

CD |

|

114.77 |

-73.09 |

708.20 |

639.00 |

655.70 |

16.70 |

1.92 |

18.41 |

0.77 |

3.38 |

Skarn composite 3 |

|

SP22-004 |

SPL_UG |

UG |

421892.16 |

1984629.51 |

913.83 |

CD |

|

220.21 |

-64.25 |

393.55 |

343.95 |

350.04 |

6.09 |

19.16 |

29.03 |

0.45 |

20.22 |

Granodiorite with ISO level |

Notes to Table

- Intercepts are reported as core length (not true

width/thickness). Core lengths reflect drilling core recovery.

- The gold equivalent grade calculation used is as follows: AuEq

(g/t) = Au (g/t) + Ag (g/t) * 0.011385 + Cu (%) * 1.621237 account

for the same metal prices ($1,550/oz gold, $20/oz silver and

$3.50/lb copper) and metallurgical recoveries (85% gold, 75% silver

and 89% copper) used in the Mineral Resource estimate for the EPO

deposit.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/b9059ee7-f328-4ee9-ba01-6a3fc4fd9665https://www.globenewswire.com/NewsRoom/AttachmentNg/ba5aeaf7-2bde-48c0-b4bf-db350c02b96d https://www.globenewswire.com/NewsRoom/AttachmentNg/26789588-7d92-43ef-ad3e-ef9ff0b110b1

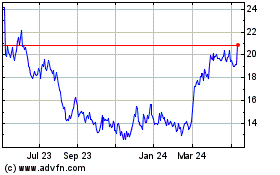

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Feb 2025 to Mar 2025

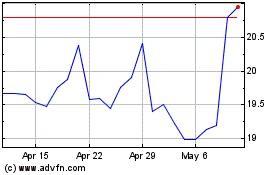

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Mar 2024 to Mar 2025