Vanguard Announces Cash Distributions for the Vanguard ETFs

October 24 2023 - 1:25PM

Vanguard Investments Canada Inc. today announced the final October

2023 cash distributions for certain Vanguard ETFs, listed below,

that trade on Toronto Stock Exchange (TSX). Unitholders of record

on November 01, 2023 will receive cash distributions payable on

November 08, 2023. Details of the “per unit” distribution amounts

are as follows:

|

Vanguard ETF® |

TSX Ticker Symbol |

Distribution per Unit ($) |

CUSIP |

ISIN |

Payment Frequency |

|

Vanguard Canadian Aggregate Bond Index ETF |

VAB |

0.061395 |

92203E101 |

CA92203E1016 |

Monthly |

|

Vanguard Canadian Short-Term Bond Index ETF |

VSB |

0.052269 |

92203G106 |

CA92203G1063 |

Monthly |

|

Vanguard Canadian Short-Term Corporate Bond Index ETF |

VSC |

0.067119 |

92203N101 |

CA92203N1015 |

Monthly |

|

Vanguard Canadian Long-Term Bond Index ETF |

VLB |

0.069232 |

92211H104 |

CA92211H1047 |

Monthly |

|

Vanguard Canadian Corporate Bond Index ETF |

VCB |

0.075566 |

92210P107 |

CA92210P1071 |

Monthly |

|

Vanguard Canadian Government Bond Index ETF |

VGV |

0.056103 |

92210N102 |

CA92210N1024 |

Monthly |

|

Vanguard Retirement Income ETF Portfolio |

VRIF |

0.085871 |

92211X109 |

CA92211X1096 |

Monthly |

|

Vanguard FTSE Canadian Capped REIT Index ETF |

VRE |

0.067226 |

92203B107 |

CA92203B1076 |

Monthly |

|

Vanguard FTSE Canadian High Dividend Yield Index ETF |

VDY |

0.152182 |

92203Q104 |

CA92203Q1046 |

Monthly |

To learn more about the TSX-listed Vanguard

ETFs, please visit: www.vanguard.ca

About Vanguard

Canadians own CAD $84 billion in Vanguard

assets, including Canadian and U.S.-domiciled ETFs and Canadian

mutual funds. Vanguard Investments Canada Inc. manages CAD $58

billion in assets (as of July 31, 2023) with 37 Canadian ETFs and

six mutual funds currently available. The Vanguard Group, Inc. is

one of the world's largest investment management companies and a

leading provider of company-sponsored retirement plan services.

Vanguard manages USD $8.2 trillion (CAD $11.1 trillion) in global

assets, including over USD $2.4 trillion (CAD $3.5 trillion) in

global ETF assets (as of July 31, 2023). Vanguard has offices in

the United States, Canada, Mexico, Europe, Australia and Asia. The

firm offers 430 funds, including ETFs, to its more than 30 million

investors worldwide.

Vanguard operates under a unique operating

structure. Unlike firms that are publicly held or owned by a small

group of individuals, The Vanguard Group, Inc. is owned by

Vanguard's U.S.-domiciled funds and ETFs. Those funds, in turn, are

owned by Vanguard clients. This unique mutual structure aligns

Vanguard interests with those of its investors and drives the

culture, philosophy, and policies throughout the Vanguard

organization worldwide. As a result, Canadian investors benefit

from Vanguard's stability and experience, low-cost investing, and

client focus. For more information, please visit vanguard.ca.

For more information, please

contact:Matt GierasimczukVanguard Canada Public

RelationsPhone: 416-263-7087matthew_gierasimczuk@vanguard.com

Important information

Commissions, management fees, and

expenses all may be associated with investment funds. Investment

objectives, risks, fees, expenses, and other important information

are contained in the prospectus; please read it before investing.

Investment funds are not guaranteed, their values change

frequently, and past performance may not be repeated. Vanguard

funds are managed by Vanguard Investments Canada Inc. and are

available across Canada through registered dealers.

London Stock Exchange Group companies include

FTSE International Limited ("FTSE"), Frank Russell Company

("Russell"), MTS Next Limited ("MTS"), and FTSE TMX Global Debt

Capital Markets Inc. ("FTSE TMX"). All rights reserved. "FTSE®",

"Russell®", "MTS®", "FTSE TMX®" and "FTSE Russell" and other

service marks and trademarks related to the FTSE or Russell indexes

are trademarks of the London Stock Exchange Group companies and are

used by FTSE, MTS, FTSE TMX and Russell under licence. All

information is provided for information purposes only. No

responsibility or liability can be accepted by the London Stock

Exchange Group companies nor its licensors for any errors or for

any loss from use of this publication. Neither the London Stock

Exchange Group companies nor any of its licensors make any claim,

prediction, warranty or representation whatsoever, expressly or

impliedly, either as to the results to be obtained from the use of

the FTSE Indexes or the fitness or suitability of the Indexes for

any particular purpose to which they might be put.

The S&P 500 Index is a product of S&P

Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by

The Vanguard Group, Inc. (Vanguard). Standard & Poor’s®,

S&P® and S&P 500® are registered trademarks of Standard

& Poor’s Financial Services LLC (“S&P”); Dow Jones® is a

registered trademark of Dow Jones Trademark Holdings LLC (“Dow

Jones”); and these trademarks have been licensed for use by SPDJI

and sublicensed for certain purposes by Vanguard. Vanguard ETFs are

not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones,

S&P, their respective affiliates, and none of such parties make

any representation regarding the advisability of investing in such

product(s) nor do they have any liability for any errors,

omissions, or interruptions of the S&P 500 Index.

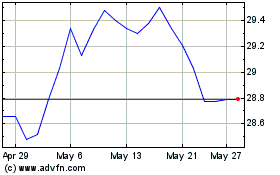

Vanguard FTSE Canadian C... (TSX:VRE)

Historical Stock Chart

From Nov 2024 to Dec 2024

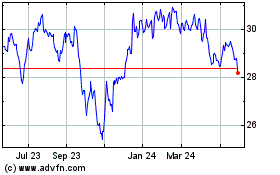

Vanguard FTSE Canadian C... (TSX:VRE)

Historical Stock Chart

From Dec 2023 to Dec 2024