Erdene Resource Development Corp. ("Erdene" or "Company") (TSX:ERD), today

provided a review of the 2012 activities on the Company's principal projects in

conjunction with the release of its year-end financial results.

2012 Quarterly Highlights

- First Quarter

-- High Grade, Near Surface Gold Discovery at Altan Nar; 29m of 4.3 g/t Gold

-- Granite Hill Quarry Commenced Production

-- Erdene Board Strengthened

- Second Quarter

-- Finalized Sale of Granite Hill Quarry for US$3.35 million

-- Reported Xstrata's Intent to Sell Their Interest in Donkin Coal Project

-- Expanded Size of Altan Nar Gold Discovery Through Drilling

-- Announced Planned Restructuring of Company

- Third Quarter

-- Secured Second Mining License for Zuun Mod-Khuvyn Khar Project

-- Announced Planned CEO and Board for Newco - Morien Resources Corp.

-- Completed Regional Metals and Coal Exploration in Mongolia

- Fourth Quarter

-- Sold Operating Kaolin Assets of Controlled Subsidiary for $923,000

-- Intersected 47m of 1.3 g/t Gold on 1.3km Step-Out Drill Hole at Altan Nar

-- Completed Restructuring with Separation of Mongolian and North American Assets

-- Completed Private Placement, limited to $1 million at $0.17 per share

Mongolia Exploration

Altan Nar Gold Project

The Altan Nar gold discovery was made in late 2011 following a large regional

exploration program carried out by Erdene's technical team. Initial drill

results from Altan Nar included 55 metres of 1.02 g/t gold and 12 g/t silver and

follow up drilling intersected 29 metres averaging 4.3 g/t gold and 24.1 g/t

silver, including 11 metres of 9.1 g/t gold and 22.7 g/t silver. The 2011

drilling confirmed the presence of near-surface gold-silver mineralization over

a strike length of 300 metres, with widths up to 125 metres. This area is

referred to as the Discovery Zone ("DZ").

Exploration work in 2012 expanded the DZ to 400 metres in strike length with

near-surface holes in the northern portion returning 27 metres of 1.78 g/t gold,

including 8 metres of 4.5 g/t gold and 25.4 g/t silver, and high grade gold

mineralized zones at depth with 4 metres of 10.5 g/t gold and 55.5 g/t silver.

The most northerly hole in the DZ returned 94 metres of 0.45 g/t gold and

includes a 4.5 metre interval at the bottom of the hole averaging 2.4 g/t gold,

18.8 g/t silver, 2.80% lead and 0.86% zinc. The potential for higher grade zones

at depth within the DZ was further supported by the project's deepest hole to

date (approximately 191 metre vertical depth) which ended in 5 metres of 4.77

g/t gold, 6.0 g/t silver 0.52% lead and 0.59% zinc. These results confirm that

the gold mineralization within the DZ is open to the north and continues to the

depths tested and additional drilling will be required to determine the true

vertical extent of the gold mineralization.

Reconnaissance drilling outside the DZ identified multiple new targets over a 3

kilometre strike length, including a substantial new gold-polymetallic zone

intersected within 50 metres of surface, located 1.3 kilometres northwest of the

DZ. Multiple high grade gold zones separated by post-mineralization dykes which,

when included in the overall assay results, yielded an average grade of 1.3 g/t

gold over 47 metres, including 4.4 g/t gold over 9 metres.

It is anticipated work at Altan Nar will commence in the second quarter leading

to additional drilling in 2013.

Khuvyn Khar - Zuun Mod Copper & Molybdenum Project

In 2012, work was completed on a pit optimization study that included high level

production scheduling, a review of operating and capital costs, and economic

modeling. The study will be used to determine the parameters of additional

pre-feasibility level studies expected to be carried out as the project

advances. Although depressed molybdenum prices have resulted in a cautious

approach to advancing the project, the location relative to China, large

resource size, unexplored areas, a significant copper component in other areas

of the porphyry complex, and positive longer term outlook for molybdenum demand

and pricing, are all positive factors in evaluating the future potential of the

project.

The Zuun Mod property covers a large porphyry system with multiple exploration

targets. One such target is the Khuvyn Khar copper prospect located 2.2

kilometres northwest of the Zuun Mod molybdenum-copper deposit. In 2011,

drilling at Khuvyn Khar intersected 34 metres of 1.3% copper and 9.24 g/t silver

from 308 to 342 metres depth. The 2012 exploration program at Khuvyn Khar

included a review of technical data, an expanded mobile metal ion ("MMI")

geochemical survey, reprocessing of geophysical data, as well as a review of

surface and drill hole geological data. This work has identified areas and

criteria for a follow-up exploration program to be carried out in 2013 designed

to test the mineral potential of the Khuvyn Khar prospect.

Altan Arrow Gold Project

Early stage surface exploration on a new prospect (Altan Arrow), located 15

kilometres south-southeast of the Company's Altan Nar gold discovery, has

returned significant gold and silver mineralization associated with epithermal

quartz veins over a one-square-kilometre area. Results include an average grade

from rock chip samples over a 1 kilometre strike length of 3.5 g/t Au and 60 g/t

Ag, including samples with up to 57 g/t Au and 416 g/t Ag.

Galshar Coal Project Royalty

The Company retains a royalty interest in the Galshar thermal coal project in

Mongolia. The project is operated by Xanadu Coal Mongolia LLC ("Xanadu"), a 100%

owned subsidiary of ASX listed Xanadu Mines Ltd. Xanadu has delineated a JORC

compliant thermal coal resource of 70 million tonnes ("Mt") Indicated and 100 Mt

Inferred. At Galshar, the basal seam, which contains a resource of 48 Mt

Indicated and 53 Mt Inferred, is classified as medium to low ash, high moisture

sub-bituminous coal suitable for power generation or Coal to Liquids (CTL)

technologies. Xanadu has commenced the permit process to obtain a mining license

at Galshar. The project is subject to a royalty payable to Erdene, its

successors and assigns, of US$1.50 for each tonne of the first 5 Mt of coal

mined from the property and a royalty of US$0.75 per tonne for any additional

tonnes of coal mined.

Restructuring

During 2012, Erdene successfully completed a major restructuring of the Company,

with the objective of maximizing shareholder value, minimizing dilution of its

core assets, and to focus the resulting Companies' resources on specific

projects. The key element of the restructuring was the separation of the core

projects into two public companies.

Morien Resources Corp. ("Morien") now holds all of Erdene's former North

American property interests, consisting primarily of a 25% interest in the

Donkin Coal Project in Eastern Canada. Morien trades on the TSX-V under the

symbol "MOX".

Erdene Resource Development continued under the same name and trading symbol and

will continue to focus on precious and base metal exploration in Mongolia. Key

elements of the restructuring included the following:

Aggregate Project Sale

The sale of the Company's 100% interest in a 339 acre parcel of land and the

associated royalty interest in the Granite Hill aggregate property located in

Hancock County, Georgia, USA, was completed in June of 2012 for $3.4 million

cash.

Advanced Primary Minerals Sale

As a function of the restructuring, the Company's majority owned subsidiary,

Advanced Primary Minerals Corporation ("APM"), completed the sale of its

operating assets and select real estate property in Georgia, USA for $923,000

and a retained royalty interest.

Donkin Coal Project

In April of 2012, Xstrata Coal Canada ("Xstrata") announced its intention to

sell their interest in the Donkin Coal Project. During this process Xstrata

committed to maintaining the project timelines with the planned completion of

the environmental assessment, progression of engineering work and obtaining the

necessary approvals for commencement of the underground exploration phase. The

Canadian Environmental Assessment Agency ("CEAA") approval process, which is

required for project permission, is on track and full environmental approval is

anticipated in 2013. Visit www.morienres.com for more updates on Morien and the

Donkin Coal Project.

Executive Management Team Strengthened

John Budreski, who was initially added as a director of Erdene to assist with

the strategic development and restructuring, was appointed as the new President

and CEO of Morien Resources Corp. to manage the North American assets. With over

25 years of broad experience in senior positions in the resource and resource

investment banking industries, Mr. Budreski added significant depth to the

Erdene and Morien executive and board. Subsequently, Charles Pitcher, formerly

President and CEO of Western Canadian Coal, and a mining engineer with over 40

years of experience, was added to the Morien board.

Year End Financial Results Summary

Erdene's year end 2012 financial statements, Management's Discussion and

Analysis and Annual Information Form were filed with regulatory authorities on

April 2, 2013 and are available on the Company's website at www.erdene.com and

on SEDAR at www.sedar.com.

On November 9, 2012, the Company successfully completed a Plan of Arrangement

with Advanced Primary Minerals Corporation. As a result of the transaction, the

Company distributed its North American assets, predominantly its 25% interest in

the Donkin Coal Project, to Shareholders via the distribution of Morien

Resources Corp. shares. The revenue and expenses associated with the North

American assets are categorized under Loss from Discontinued Operations in the

Consolidated Statements of Loss and related notes.

For the 12 months ended December 31, 2012, loss from continuing operations was

$4,641,082 compared to $8,986,812 in 2011.

Exploration expenses totalled $3,167,762 in fiscal 2012 compared to $4,098,634

in 2011. Expenditures were primarily directed toward the gold discovery at Altan

Nar as well as the continued advancement of the Zuun Mod molybdenum-copper

porphyry project. Specifically, expenditures by project were as follows:

- Altan Nar (Tsenkher Nomin): Approximately $2.0 million for the 12 months ended

December 31, 2012 (2011 - $1.4 million)

- Zuun Mod: Approximately $392,000 for the 12 months ended December 31, 2012

(2011 - $774,000).

Administrative expenses totalled $1,678,298 in 2012 (including $186,559 in

non-cash stock based compensation), compared to $4,970,245 in 2011 (including

$3,146,422 in non-cash stock based compensation). Cash administration costs

decreased $328,811, or 18%, compared to the prior year, evidence of management's

focus on the reduction of overhead and administrative costs.

The Company recognized a loss from discontinued operations of $2,704,728 in 2012

compared to a loss of $4,771,559 in 2011. This loss represents the

reclassification of revenue and expenses associated with North American assets

disposed of in 2012.

Net loss to Erdene equity holders was $7,047,487, or $0.15 per share in fiscal

2012 compared with a loss of $11,861,320, or $0.26 per share in fiscal 2011.

Deferred Share Units Granted

On March 31, 2013, the Company granted a total of 211,191 Deferred Share Units

("DSU") at $0.14 per share to certain officers, directors and employees of the

Company.

The DSU Plan was established to assist the Company in attracting and retaining

talented employees and directors and to promote a greater alignment of interests

between the directors, employees and the Company's Shareholders. The DSU Plan

was approved by Shareholders at the Company's Special Meeting of Shareholders on

October 26, 2012. Executive, directors and certain employees of the Company have

agreed to take a portion of their annual compensation in the form of DSUs,

thereby reducing the cash compensation requirements of the Company.

Qualified Person

J.C. (Chris) Cowan, P.Eng. (Ontario) is a Qualified Person as that term is

defined in National Instrument 43-101 and has reviewed and approved the

technical information contained in this news release. All samples have been

assayed at SGS Laboratory in Ulaanbaatar, Mongolia. In addition to internal

checks by SGS Laboratory, the company incorporates a QA/QC sample protocol

utilizing prepared standards, blanks and duplicates.

About Erdene Resource Development Corp.

Erdene is a Canada-based junior resource company focussed on the acquisition,

exploration, and development of base and precious metals in underexplored and

highly prospective Mongolia. Our strength comes from a major new gold discovery,

a large molybdenum-copper porphyry resource, and a new copper porphyry target,

200 kilometres from the China border in southwest Mongolia. These 100%

Erdene-owned projects are managed by a highly experienced management team with

over 15 years' experience in the country, providing the Company with a unique

opportunity to participate in this period of unprecedented economic growth in

Mongolia. This growth is fuelled by proximity to China and the discovery and

development of a number of world-class mineral projects that are transforming

the country into one of Asia's natural resource capitals. For further

information on the Company, please visit www.erdene.com. Erdene has 53,785,299

issued and outstanding common shares and, a fully diluted position of 59,314,168

common shares.

Forward-Looking Statements

Certain information regarding Erdene contained herein may constitute

forward-looking statements within the meaning of applicable securities laws.

Forward-looking statements may include estimates, plans, expectations, opinions,

forecasts, projections, guidance or other statements that are not statements of

fact. Although Erdene believes that the expectations reflected in such

forward-looking statements are reasonable, it can give no assurance that such

expectations will prove to have been correct. Erdene cautions that actual

performance will be affected by a number of factors, most of which are beyond

its control, and that future events and results may vary substantially from what

Erdene currently foresees. Factors that could cause actual results to differ

materially from those in forward-looking statements include market prices,

exploitation and exploration results, continued availability of capital and

financing and general economic, market or business conditions. The

forward-looking statements are expressly qualified in their entirety by this

cautionary statement. The information contained herein is stated as of the

current date and is subject to change after that date. The Company does not

assume the obligation to revise or update these forward-looking statements,

except as may be required under applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Erdene Resource Development Corp.

Peter C. Akerley

President and CEO

(902) 423-6419

Erdene Resource Development Corp.

Ken W. MacDonald

Vice President Business Strategy and CFO

(902) 423-6419

info@erdene.com

www.erdene.com

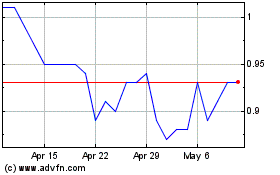

Andean Precious Metals (TSXV:APM)

Historical Stock Chart

From Apr 2024 to May 2024

Andean Precious Metals (TSXV:APM)

Historical Stock Chart

From May 2023 to May 2024