Asia Packaging Group Inc. Announces Fiscal 2013 Annual Financial Results and Update on Acquisitions

July 31 2013 - 4:53PM

Marketwired Canada

Asia Packaging Group Inc. (TSX VENTURE:APX) ("Asia Packaging" or the "Company")

announces its annual financial statements for the fiscal year ending March 31,

2013. The Company has also successfully closed the acquisition of Yuanxing

Packaging (China) Co Ltd. ("Yuanxing") as well as the purchase of the land use

right and buildings for this company's manufacturing operations in Fujian

Province.

Annual Financial Results

Highlights

-- Company achieved revenues of $47.0 million for the year ended March 31,

2013, representing 10.0% growth over the corresponding year ended March

31, 2012. This improvement was largely due to a change in product mix

towards higher price, higher margin products.

-- Higher margin product sales contributed to an increase in gross profit

margin during the year to 26.9% from 26.2% of the year ended March 31,

2012.

-- The Company achieved EBITDA before share based compensation and listing

expenses of $11.6 million during the year ended March 31, 2013,

representing a 10.1% improvement over the year ended March 31, 2012.

-- Net income increased 36.3% for the year ended March 31, 2013 to $9.0

million compared with $6.6 million during the year ended March 31, 2012.

The increase was contributed by the improvement in the change in product

mix towards higher price and higher margin products.

-- As at March 31, 2013, the Company had $5.9 million in cash and no debt.

-- Subsequent to the year end the Company successfully closed it's

acquisition of Yuanxing as well as acquiring the land right use and

buildings associated with the Yuanxing operation.

"The closing of the Yuanxing acquisition was a significant step in expanding our

product base and growing our geographic reach in China" stated Mr. Wenge Hong,

President and CEO of Asia Packaging. "Further, the purchasing of the land use

rights and buildings for Yuanxing will help strengthen the business".

During the fiscal year ended March 31, 2013 total sales volume increased by 3.5%

with contributed to a 10.0% improvement in sales compared with the previous

year.

The Company's increased volumes of higher value, medical packaging and metalized

polyester film products contributed to a 0.7% increase in gross margins to 26.9%

during the year.

SUMMARY FINANCIAL STATEMENTS

Fiscal Year Ended March 31

2013 2012 % Change

Sales 46,997,765 42,743,371 10.0%

Gross profit 12,635,450 11,186,338 13.0%

Gross margin (% of Sales) 26.9% 26.2% 2.7%

Operating expenses 1,539,234 2,027,356 -24.1%

Income from operations 11,096,216 9,158,982 21.2%

Other income (expenses) (256,712) (1,225,525) -79.1%

Income taxes 1,816,481 1,315,257 38.1%

Net income 9,023,023 6,618,200 36.3%

EBITDA 11,473,324 8,455,253 35.7%

Adjusted EBITDA (i) 11,614,715 10,551,635 10.1%

Earnings Per Share

Basic 0.07 0.06

Diluted 0.07 0.06

Weighted average number of shares

Basic 128,216,063 119,105,052

Diluted 128,817,029 119,449,540

(i)Adjusted EBITDA is before stock-based compensation and Listing expenses

Both Adjusted EBITDA and net income improved during the year ended March 31,

2013 by 10.1% and 35.7% respectively compared to the previous year.

The Company continues to maintain a strong balance sheet with over $15 million

in working capital and $5.9 million in cash as at March 31, 2013. The Company

continues to maintain no debt and has total equity of $46.7 million at March 31,

2013.

Acquisition of Anhai Hongrizhong Plastic Color Printing Co. Ltd.

The previously announced acquisition of JinJiang City Anhai Hongrizhong Plastic

Color Printing Co., Ltd. was discontinued due to the delay in receipt of a

business licenses and other permits. As at March 31, 2013, $5.9 million of the

$6.4 million acquisition deposit was returned to the Company.

About Asia Packaging Group Inc.

Asia Packaging Group, through its wholly-owned subsidiaries in the People's

Republic of China ("PRC"), is in the business of manufacturing packaging

products and services to the food pharmaceutical and retail industries in China.

The Company operates a manufacturing plant in City, Jiangxi China where it

produces a variety of film and plastic packaging products. With the completion

of the acquisition of Yuanxing Packaging earlier this year, the Company has

added a bag manufacturing facility located in Fujian Province and sales offices

in Guangzhou and Shanghai.

This news release contains certain statements that may be deemed "forward

looking statements". Forward looking statements are statements that are not

historical facts and are generally, but not always, identified by the words

"expects,", "plans", "anticipates", "believes", "intends", "estimates",

"projects", "potential" and similar expressions, or that events or conditions

"will", "would", "may", "could" or "should" occur. Although the Company believes

the expectations expressed in such forward looking statements are based on

reasonable assumptions, such statements are not guarantees of future performance

and actual results may differ materially from those in forward looking

statements. Forward looking statements are based on the beliefs, estimates and

opinions of the Company's management on the date the statements are made. The

Company undertakes no obligation to update these forward looking statements,

except as required by law, in the event that management's beliefs, estimates or

opinions, or other factors, should change.

NON-IFRS MEASURES

Throughout this news release we use certain non-IFRS measures such as the term

"EBIDTA" to analyze operating performance. We define EBITDA as operating

revenues less operating expenses from continuing operations and therefore

reflect earnings before interest, income tax, depreciation and amortization,

non-controlling interest and any non-operating and non-recurring items. These

non-IFRS measures do not have a standardized meaning prescribed by IFRS and may

not be comparable to similarly titled measures presented by other companies.

These non-IFRS measures are referred to in this news release because we believe

they are indicative measures of a company's performance and are generally used

by investors to evaluate companies in the resort operations and resort

development industries. Figures used in calculation of EBITDA are in compliance

with IFRS, therefore no reconciliation is needed.

FOR FURTHER INFORMATION PLEASE CONTACT:

Asia Packaging Group

Jin Kuang

CFO

604-443-5041

Jin.kuang@asiapackaging.ca

Asia Packaging Group

Robert Wilson

Vice President

416-666-4005

Robert.wilson@asiapackaging.ca

Apex Resources (TSXV:APX)

Historical Stock Chart

From Apr 2024 to May 2024

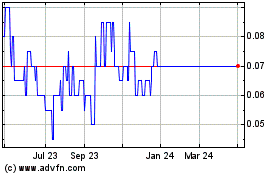

Apex Resources (TSXV:APX)

Historical Stock Chart

From May 2023 to May 2024