Asia Packaging Group Inc. Announces First Quarter Financial Results

September 06 2013 - 5:19PM

Marketwired Canada

Asia Packaging Group Inc. (TSX VENTURE:APX) ("Asia Packaging" or the "Company")

announces its interim financial statements for the three-month period ending

June 30, 2013.

Interim Financial Results

Highlights

-- Through the successful closing of the Yuanxing packaging acquisition

during the first quarter, the Company has effectively doubled the size

of its business.

-- With just over one month contribution from the Yuanxing acquisition,

revenues increased by 48.3% during the first quarter compared with the

same period of last year.

-- Improved product mix together with the higher margin from Yuanxing

products sales, gross margin improved to a record 30.1% during the

quarter.

-- The Company achieved EBITDA before share-based compensation of $5.2

million during the first quarter, representing a 64.2% improvement over

the first quarter of last year.

-- Net income increased 35.8% for the three months ended June 30, 2013 to

$3.5 million ($0.024 per share) compared with $2.6 million ($0.020 per

share) during the three months ended June 30, 2012.

-- As at June 30, 2013, the Company had $8.8 million in cash and no bank

debt.

"We are pleased to report the successful closing of our acquisition of Yuanxing

Packaging during the first quarter and we are excited about the contribution

Yuanxing will make to the performance and market presence of our Company,"

stated Mr. Wenge Hong, President and CEO of Asia Packaging. "Even with only 33

days of the Yuanxing results included in our numbers, we have seen a significant

impact on revenues and earnings."

During the first quarter, sales at Asia Packaging increased to $19.0 million

representing a 48.3% increase compared with the corresponding period of last

year. This increase was achieved as a result of a $6.4 million contribution from

Yuanxing products representing just over one month's sales. Compared with the

first quarter of the prior year, historical products for the company experienced

20.5% lower volumes in CPP film while there was softer pricing in medical

packaging and fruit jelly cups.

Reduced volume of lower margin CPP coupled with high margin bag products from

the Yuanxing acquisition resulted in improved gross margin during the first

quarter to 30.1% from 26.6% during the same quarter of last year. The addition

of the Yuanxing bag products have contributed to the Company' overall margin

because these products have a higher gross margin than the average for the

Company historical products.

SUMMARY FINANCIAL STATEMENTS

---------------------------------

Three Months Period Ended

June 30

(Unaudited)

-------------------------

2013 2012 Change

---------------------------------

Sales 18,983,983 12,802,761 48.3%

Gross profit 5,721,261 3,407,668 67.9%

Gross margin (% of Sales) 30.1% 26.6% 13.2%

Operating expenses 850,610 425,102 100.1%

Income from operations 4,870,651 2,982,566 63.3%

Other income (expenses) (45,246) 14,893 N/A

Income taxes 1,310,482 408,315 220.9%

Net income 3,514,923 2,589,144 35.8%

EBITDA 5,191,179 3,160,547 64.2%

EBITDA before share-based compensation 5,214,587 3,223,776 61.8%

Earnings per share

Basic 0.024 0.020

Diluted 0.024 0.020

Weighted average number of shares

Basic 146,934,219 127,895,998

Diluted 146,934,219 128,466,965

---------------------------------

Income from operations increased by 63.3% during the quarter while EBITDA

increased 64.2% compared with the same quarter last year.

As a result of the above, net income for the three months ended June 30, 2013

improved by 35.8% to $3.5 million from $2.6 million during the corresponding

period of last year.

Update Regarding the Yuanxing Acquisition

Pursuant to the terms of the acquisition agreement with shareholders of Jiayuan

Investment Limited (the holding company of Yuanxing Packaging) the first cash

instalment payment was made in the amount of $8.8 million. This amount was

adjusted down from $9 million in accordance with the acquisition agreement.

About Asia Packaging Group Inc.

Asia Packaging Group, through its wholly-owned subsidiaries in the People's

Republic of China ("PRC"), is in the business of manufacturing packaging

products and services to the food pharmaceutical and retail industries in China.

The Company operates a manufacturing plant in Yichun City, Jiangxi China where

it produces a variety of film and plastic packaging products. With the

completion of the acquisition of Yuanxing Packaging earlier this year, the

Company has added a bag manufacturing facility located in Fujian Province and

sales offices in Guangzhou and Shanghai.

This news release contains certain statements that may be deemed

"forward-looking statements". Forward-looking statements are statements that are

not historical facts and are generally, but not always, identified by the words

"expects", "plans", "anticipates", "believes", "intends", "estimates",

"projects", "potential" and similar expressions, or that events or conditions

"will", "would", "may", "could" or "should" occur. Although the Company believes

the expectations expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of future performance

and actual results may differ materially from those in forward-looking

statements. Forward-looking statements are based on the beliefs, estimates and

opinions of the Company's management on the date the statements are made. The

Company undertakes no obligation to update these forward-looking statements,

except as required by law, in the event that management's beliefs, estimates or

opinions, or other factors, should change.

FOR FURTHER INFORMATION PLEASE CONTACT:

Asia Packaging Group

Jin Kuang

CFO

604-443-5041

Jin.kuang@asiapackaging.ca

Asia Packaging Group

Robert Wilson

Vice President

416-666-4005

Robert.wilson@asiapackaging.ca

Apex Resources (TSXV:APX)

Historical Stock Chart

From Apr 2024 to May 2024

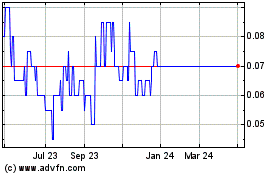

Apex Resources (TSXV:APX)

Historical Stock Chart

From May 2023 to May 2024