Arrow Exploration Announces 2019 Year-End Audited Financial Statements and MD&A, and Filing of 2019 Year-End Reserve Report

June 02 2020 - 7:12AM

ARROW Exploration Corp. (“Arrow” or the “Company”) (TSXV: AXL) is

pleased to announce the filing of its 2019 year-end audited

Financial Statements and MD&A, and the filing of its 2019

year-end reserve report, all of which are available on SEDAR

(www.sedar.com).

FINANCIAL AND OPERATING HIGHLIGHTS

| (in United

States dollars, except as otherwise noted) |

Three monthsendedDecember 31,2019 |

Year endedDecember 31,2019 |

Three monthsendedDecember 31,2018 |

Year endedDecember 31,2018 |

| Total natural

gas and crude oil revenues, net of royalties |

|

5,585,531 |

|

|

25,440,370 |

|

|

5,911,425 |

|

|

6,077,423 |

|

| |

|

|

|

|

| Funds flow from (used in) operations (1) |

|

(165,879 |

) |

|

3,281,216 |

|

|

(855,321 |

) |

|

(2,671,986 |

) |

| Per share – basic ($) and diluted ($) |

|

(0.00 |

) |

|

0.05 |

|

|

(0.01 |

) |

|

(0.04 |

) |

| |

|

|

|

|

| Net income (loss) |

|

(2,089,036 |

) |

|

(5,976,895 |

) |

|

1,242,936 |

|

|

(665,123 |

) |

| Per share – basic ($) and diluted ($) |

|

(0.03 |

) |

|

(0.09 |

) |

|

$0.02 |

|

|

($0.01 |

) |

| Adjusted EBITDA (1) |

|

(126,893 |

) |

|

5,206,566 |

|

|

1,120,369 |

|

|

(693,687 |

) |

| Weighted average shares outstanding – basic and diluted |

|

68,674,602 |

|

|

68,674,602 |

|

|

68,674,602 |

|

|

68,674,602 |

|

| Common shares end of period |

|

68,674,602 |

|

|

68,674,602 |

|

|

68,674,602 |

|

|

68,674,602 |

|

| Capital expenditures |

|

(171,138 |

) |

|

9,414,464 |

|

|

7,007,580 |

|

|

7,007,580 |

|

| Cash and cash equivalents |

|

1,085,655 |

|

|

1,085,655 |

|

|

1,994,233 |

|

|

1,994,233 |

|

| Current Assets |

|

7,811,889 |

|

|

7,811,889 |

|

|

8,599,160 |

|

|

8,599,160 |

|

| Current liabilities |

|

10,675,530 |

|

|

10,675,530 |

|

|

17,157,942 |

|

|

17,157,942 |

|

| Working capital (deficit) (1) |

|

(2,863,641 |

) |

|

(2,863,641 |

) |

|

(8,558,782 |

) |

|

(8,558,782 |

) |

| Long-term portion of restricted cash (2) |

|

449,288 |

|

|

449,288 |

|

|

3,154,839 |

|

|

3,154,839 |

|

| Total assets |

|

72,750,706 |

|

|

72,750,706 |

|

|

76,962,315 |

|

|

76,962,315 |

|

| |

|

|

|

|

|

Operating |

|

|

|

|

| |

|

|

|

|

| Natural gas and crude oil production, before

royalties |

|

|

|

|

| Natural gas (Mcf/d) |

|

531 |

|

|

623 |

|

|

733 |

|

|

734 |

|

| Natural gas liquids (bbl/d) |

|

6 |

|

|

6 |

|

|

7 |

|

|

7 |

|

| Crude oil (bbl/d) |

|

1,502 |

|

|

1,671 |

|

|

1,553 |

|

|

1,547 |

|

| Total (boe/d) |

|

1,595 |

|

|

1,781 |

|

|

1,682 |

|

|

1,676 |

|

| |

|

|

|

|

| Operating netbacks ($/boe) (1) |

|

|

|

|

| Natural gas ($/Mcf) |

$0.25 |

|

|

($0.43 |

) |

|

($1.97 |

) |

|

($1.92 |

) |

| Crude oil ($/bbl) |

$13.95 |

|

$21.22 |

|

$19.15 |

|

$19.22 |

|

| Total ($/boe) |

$13.14 |

|

$19.86 |

|

$16.88 |

|

$16.96 |

|

(1)Non-IFRS measures – see “Non-IFRS Measures” section within

the MD&A(2)Long term restricted cash not included in working

capital

Marshall Abbott, CEO of Arrow commented, “2019

represented the first full year of operations for Arrow as a new

company. The Company made a significant commercial discovery in May

2019 on its Tapir Block, through successfully drilling the Rio

Cravo Este-1 (RCE-1) well. We have identified two additional RCE

well locations on the Tapir Block. On our LLA-23 block, production

rates over the past several months have been negatively impacted by

significantly lower oil prices, in addition to well-specific issues

which Arrow’s new management team intends on addressing contingent

on the availability of additional capital. Production at Ombu

(Arrow holds 10%) remains shut-in pending the recovery of oil

prices and the resolution of community issues.”

Mr. Abbott continued, “The Company wishes to

extend our gratitude to all of its stakeholders for their continued

support of Arrow during these exceptionally challenging times for

our industry. Arrow’s management and Board, including myself, are

committed to creating value from the Company’s significant asset

base.”

2019 Year-End Reserves

Arrow has filed, on SEDAR, the Company’s

Statement of Reserves Data and Other Oil and Gas Information,

Report on Reserves Data by Independent Qualified Reserves

Evaluator, and Report of Management and Directors on Oil and Gas

Disclosure for the year ended December 31, 2019, as required by

section 2.1 of National Instrument 51-101 - Standards of Disclosure

for Oil and Gas Activities (together, the “Reserve Report”).

To recap, the Company’s Year-End 2019 Company

Gross Reserves Highlights include:

- 4.10 MMboe of Proved Reserves

- 10.32 MMboe of Proved plus Probable

Reserves

- Proved Reserves estimated net

present value before income taxes of US $34.7 million calculated at

a 10% discount rate

- Proved plus Probable Reserves

estimated net present value before income taxes of US $86.7 million

calculated at a 10% discount rate

- Reserve Life Index of 7.0 for

Proved Reserves and 17.7 for Proved plus Probable Reserves based on

average fourth quarter 2019 corporate production of 1,595

boe/d

- Proved plus Probable Reserve

Replacement Ratio of 154% and F&D costs of US $9.47/boe

Arrow refers readers to the Company’s press

release of April 14, 2020 for additional details, as well as to the

Reserve Report filed on SEDAR.

About ARROW Exploration

Arrow Exploration Corp. (operating in Colombia

via a branch of its 100% owned subsidiary Carrao Energy S.A.) is a

publicly-traded company with a portfolio of premier Colombian oil

assets that are under-exploited, under-explored and offer high

potential growth. The Company’s business plan is to expand oil

production from some of Colombia’s most active basins, including

the Llanos, Middle Magdalena Valley (MMV) and Putumayo Basin. The

asset base is predominantly operated with high working interests,

and the Brent-linked light oil pricing exposure combines with low

royalties to yield attractive potential operating margins. Arrow’s

seasoned team is led by a hands-on and in-country executive team

supported by an experienced board. Arrow is listed on the TSX

Venture Exchange under the symbol “AXL”.

For further information

contact:

Marshall AbbottChief Executive

Officermabbott@arrowexploration.ca(403) 651-5995

Neither the TSX Venture Exchange (TSXV)

nor its regulation services provider (as that term is defined in

the policies of the TSXV) accepts responsibility for the adequacy

or accuracy of this release.

Forward-looking Statements

This news release contains certain statements or

disclosures relating to Arrow that are based on the expectations of

its management as well as assumptions made by and information

currently available to Arrow which may constitute forward-looking

statements or information (“forward-looking statements”) under

applicable securities laws. All such statements and disclosures,

other than those of historical fact, which address activities,

events, outcomes, results or developments that Arrow anticipates or

expects may, could or will occur in the future (in whole or in

part) should be considered forward-looking statements. In some

cases, forward-looking statements can be identified by the use of

the words “continue”, “expect”, “opportunity”, “plan”, “potential”

and “will” and similar expressions. The forward-looking statements

contained in this news release reflect several material factors and

expectations and assumptions of Arrow, including without

limitation, Arrow’s evaluation of the impacts of COVID-19, the

potential of Arrow’s Colombian assets to remain in production and

Arrow’s business plan to expand oil production and achieve

attractive potential operating margins. Arrow believes the

expectations and assumptions reflected in the forward-looking

statements are reasonable at this time but no assurance can be

given that these factors, expectations and assumptions will prove

to be correct.

The forward-looking statements included in this

news release are not guarantees of future performance and should

not be unduly relied upon. Such forward-looking statements involve

known and unknown risks, uncertainties and other factors that may

cause actual results or events to differ materially from those

anticipated in such forward-looking statements. The forward-looking

statements contained in this news release are made as of the date

hereof and the Company undertakes no obligations to update publicly

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities laws.

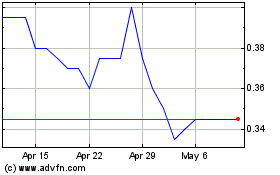

Arrow Exploration (TSXV:AXL)

Historical Stock Chart

From Mar 2025 to Apr 2025

Arrow Exploration (TSXV:AXL)

Historical Stock Chart

From Apr 2024 to Apr 2025