Brookfield Investments Corporation Announces 2010 Fourth Quarter Financial Results

April 29 2011 - 4:52PM

Marketwired

Brookfield Investments Corporation (TSX VENTURE: BRN.PR.A) reported

a net loss of $24 million for the year ended December 31, 2010

compared with a net loss of $130 million for 2009. The current

year's net results includes $41 million of non-cash foreign

exchange losses, compared with $13 million of foreign exchange

losses in the prior year. The prior year also includes a one-time

$67 million loss on the permanent impairment of the company's

investment in Fraser Papers Inc.

Net loss for the three months ended December 31, 2010 was $17

million, compared to a net loss of $73 million for the same period

in 2009.

The company's investment in Brookfield Europe contributed income

of $13 million in 2010 (2009 - $9 million). Panelboard investments,

held through Norbord Inc., contributed a net income of $2 million

for 2010, compared to a loss of $8 million in 2009. The investment

in Fraser Papers Inc. was written off in late 2009, and therefore

had no impact to the 2010 results, compared to a net loss of $123

million in 2009, which includes a $67 million provision.

Dividend and interest income for 2010 was $33 million, compared

to $29 million in 2009. Dividend payments, classified as interest

expense totalled $29 million in 2010, compared to $30 million in

2009.

Other loss for 2009 of $11 million was recorded due mainly to

the revaluation of the company's Norbord exchangeable debentures,

which were settled in the second quarter of 2009.

The Company's Board of Directors has declared a quarterly

dividend of C$0.29375 per share on its Senior Preferred Shares,

Series A payable on June 30, 2011 to shareholders of record on June

20, 2011.

Brookfield Investments Corporation holds investments in the

forest products and property sectors, as well as a portfolio of

preferred shares issued by companies within the Brookfield group.

The common shares of Brookfield Investments Corporation are wholly

owned by Brookfield Asset Management Inc., a global asset manager

focused on property, power and infrastructure assets.

----------------------------------------------------------------------------

Consolidated Balance Sheets

----------------------------------------------------------------------------

(unaudited) December 31 December 31

US$ millions 2010 2009

----------------------------------------------------------------------------

Assets

Securities $ 266 $ 262

Investments

Brookfield Properties Corporation 973 672

Brookfield Europe L.P. 127 119

Norbord Inc. 82 80

----------------------------------------------------------------------------

$ 1,448 $ 1,133

----------------------------------------------------------------------------

Liabilities

Deposits payable $ 35 $ 5

Accounts payable 11 9

Retractable preferred shares 708 700

Shareholders' equity 694 419

----------------------------------------------------------------------------

$ 1,448 $ 1,133

----------------------------------------------------------------------------

Consolidated Statements of Operations

---------------------------------------------------------------------------

Three months Twelve months

ended December ended December

(unaudited) 31 31

-----------------------------------

US$ millions 2010 2009 2010 2009

---------------------------------------------------------------------------

Income

Equity accounted income from

Brookfield Europe L.P. $ 1 $ 4 $ 13 $ 9

Equity accounted income (loss) from

Norbord Inc. (1) (1) 2 (8)

Equity accounted loss from Fraser

Papers Inc. - (11) - (56)

Dividend and interest income 8 9 33 29

Foreign exchange loss (18) (1) (41) (13)

Other loss - - - (11)

---------------------------------------------------------------------------

(10) - 7 (50)

Expenses

Interest 7 8 29 30

Provision for impairment - 67 - 67

---------------------------------------------------------------------------

7 75 29 97

---------------------------------------------------------------------------

Net loss before income taxes (17) (75) (22) (147)

Income taxes (expense) recovery - 2 (2) 17

---------------------------------------------------------------------------

Net loss $ (17) $ (73) $ (24) $ (130)

---------------------------------------------------------------------------

Net loss per common share $ (0.34) $ (1.59) $ (0.52) $ (2.82)

---------------------------------------------------------------------------

Consolidated Statements of Comprehensive Income (Loss)

----------------------------------------------------------------------------

Three months Twelve months

ended ended

(unaudited) December 31 December 31

-----------------------------------

US$ millions 2010 2009 2010 2009

----------------------------------------------------------------------------

Net loss $ (17) $ (73) $ (24) $ (130)

Other comprehensive income (loss)

Foreign currency translation (1) 1 (5) 9

Available-for-sale securities 113 50 305 186

Equity accounted other comprehensive

income (loss) 1 1 (1) 3

----------------------------------------------------------------------------

113 52 299 198

----------------------------------------------------------------------------

Comprehensive income (loss) $ 96 $ (21) $ 275 $ 68

----------------------------------------------------------------------------

---------------------------------------------------------------------------

Consolidated Statements of Accumulated Other Comprehensive Income (Loss)

---------------------------------------------------------------------------

Three months ended Twelve months ended

(unaudited) December 31 December 31

-------------------------------------------

US$ millions 2010 2009 2010 2009

----------------------------------------------------------------------------

Balance, beginning of period $ (18) $ (256) $ (204) $ (402)

Other comprehensive income 113 52 299 198

----------------------------------------------------------------------------

Balance, end of period $ 95 $ (204) $ 95 $ (204)

----------------------------------------------------------------------------

Consolidated Statements of Deficit

----------------------------------------------------------------------------

Three months ended Twelve months ended

(unaudited) December 31 December 31

-------------------------------------------

US$ millions 2010 2009 2010 2009

----------------------------------------------------------------------------

Deficit, beginning of period $ (428) $ (348) $ (421) $ (291)

Net loss (17) (73) (24) (130)

----------------------------------------------------------------------------

Deficit, end of period $ (445) $ (421) $ (445) $ (421)

----------------------------------------------------------------------------

Consolidated Statements of Cash Flows

---------------------------------------------------------------------------

Three months ended Twelve months ended

(unaudited) December 31 December 31

-------------------------------------------

US$ millions 2010 2009 2010 2009

----------------------------------------------------------------------------

Cash flow from (used in)

operating activities

Net loss $ (17) $ (73) $ (24) $ (130)

Adjusted for the following:

Equity accounted (income)

losses - 8 (15) 55

Provision for impairment - 67 - 67

Future income tax provisions - (2) 2 (17)

Net change in non-cash items 18 1 41 24

----------------------------------------------------------------------------

1 1 4 (1)

----------------------------------------------------------------------------

Cash flow used in investing

activities

Investment in Brookfield

Properties - - - (350)

----------------------------------------------------------------------------

- - - (350)

----------------------------------------------------------------------------

Cash and deposits receivable

(payable)

Increase / (Decrease) prior to

foreign currency revaluations 1 1 4 (351)

Impact of foreign exchange (13) 1 (34) 5

Balance, beginning of period (23) (7) (5) 341

----------------------------------------------------------------------------

Balance, end of period $ (35) $ (5) $ (35) $ (5)

----------------------------------------------------------------------------

Contacts: Sachin Shah, Vice President and Chief Financial

Officer, will be available at 416-363-9491 to answer any questions

on the company's financial results.

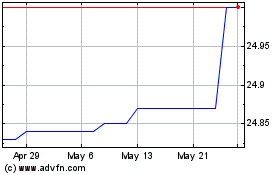

Brookfield Investments (TSXV:BRN.PR.A)

Historical Stock Chart

From May 2024 to Jun 2024

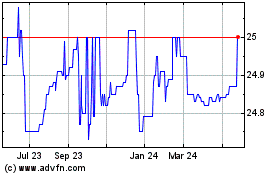

Brookfield Investments (TSXV:BRN.PR.A)

Historical Stock Chart

From Jun 2023 to Jun 2024