Brookfield Investments Corporation Announces Purchase of Shares of Western Forest Product Inc.

December 14 2011 - 2:53PM

Marketwired Canada

Brookfield Investments Corporation (TSX VENTURE:BRN.PR.A): ("Brookfield

Investments") today announced that it acquired 225,938,515 non-voting common

shares and 7,500,000 voting common shares Western Forest Products Inc. (TSX:WEF)

("Western") from a wholly owned subsidiary of Brookfield Asset Management Inc.

("Brookfield") for total proceeds of $168 million. After the transaction,

Brookfield Investments will own a 49% economic interest of Western. As

consideration for the acquisition, Brookfield Investments issued 5,200,000 Class

1 Junior Preferred Shares, Series B and 3,807,573 common shares.

In addition, a wholly owned subsidiary of Brookfield will subscribe for

12,000,000 Class 1 Junior Preferred Shares, Series B of Brookfield Investments

for an aggregate subscription price of $300,000,000.

Western is an integrated Canadian forest products company, managing timberlands

and producing lumber in coastal British Columbia. It has an annual available

harvest of approximately 7.4 million cubic metres, the vast majority of which

are from Crown lands. Western has a lumber capacity in excess of 1.5 billion

board feet produced from eight sawmills and three remanufacturing plants.

Principal activities conducted by Western include timber harvesting,

reforestation, sawmilling logs into lumber and wood chips, and value-added

remanufacturing.

Brookfield Investments Corporation holds investments in the property and forest

products sectors, as well as a portfolio of preferred shares issued by companies

within the Brookfield Asset Management Inc. group. The common shares of

Brookfield Investments Corporation are wholly owned by Brookfield Asset

Management Inc. and its affiliates, a global asset manager focused on property,

power and infrastructure assets.

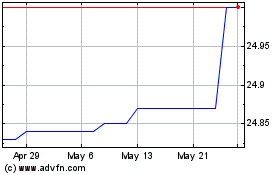

Brookfield Investments (TSXV:BRN.PR.A)

Historical Stock Chart

From May 2024 to Jun 2024

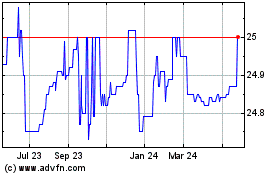

Brookfield Investments (TSXV:BRN.PR.A)

Historical Stock Chart

From Jun 2023 to Jun 2024