(TSXV: BRZ) Bearing Lithium Corp. (the "

Company"

or "

Bearing") is pleased to announce it has

entered into an arm’s-length definitive agreement (the

"

Agreement") dated June 21st 2022, with Lithium

Power International Limited ("

LPI") (Australian

Securities reimbursement Exchange, (“

ASX”), code

LPI), its joint venture partner in the Maricunga Lithium Brine

Project in Chile (the "

Project"), pursuant to

which LPI has agreed to acquire all of the issued and outstanding

common shares of Bearing in an all share transaction to be

completed by way of a statutory plan of arrangement (the

"

Transaction") under the provisions of the

Business Corporations Act (British Columbia) as part of a three way

transaction that consolidates

100% interest in the

Project into a single entity (the

“

Consolidation”).

HIGHLIGHTS

-

The merger of Bearing will be structured as a plan of

arrangement whereby Bearing shareholders will receive 0.7 of an LPI

share for every one Bearing share held (“Exchange Ratio”) (up to

94.5 million LPI shares) 1, and

in addition Bearing shareholders will receive a cash distribution

(by way of a capital return) estimated at C$0.02 per

share.

-

MSB SpA (a Chilean private entity which owns

31.31% interest in the

Project) has also entered into a merger agreement with LPI

whereby MSB SpA will receive 161.6 million LPI shares pursuant to

the Consolidation. This transaction is subject to

the approval of LPI shareholders.

-

Based on the 1-month volume weighted average share price

(“VWAP”) of Bearing and LPI at June 20th

2022 of C$0.218 and A$0.464 respectively, and current

exchange rates, the value of the share consideration is C$0.293 per

Bearing share, providing a total value of ~C$0.313 per share

(including the capital return estimated at C$0.02 per share) –

representing a 43% premium over Bearing’s 1-month VWAP

price.

-

Pursuant to the Agreement, LPI shares issued to Bearing

shareholders are not subject to any hold period and will be freely

tradable.

-

According to the Transaction, BRZ Options

and Warrants which are not exercised prior to completion of the

Transaction will remain outstanding and will automatically become

exercisable for LPI ordinary shares based on the Exchange Ratio

under their current terms.

-

LPI announced in January 2022 that it intends to spin out

its Western Australian lithium exploration assets into a separate

entity with the expectation of unlocking accretive value for LPI

shareholders. Should the spin-off take place, it will complete

after closing of the Transaction, so Bearing shareholders holding

LPI Shares at the time of the spin-out will then receive a

pro-rated allocation of the shares in this new entity, subject to

the terms of that transaction.

-

Bearing currently has a 17.14% interest in the Project. As

a result of the Consolidation, Bearing shareholders will have a

15.6% interest in LPI, which will hold:

- 100% interest in the

Project.

-

100% interest in LPI’s Western Australian lithium

exploration assets.

-

Consolidating 100% of the Project into a single entity will

eliminate the current fragmented ownership structure of the

Project, which is expected to yield significant financial and

corporate benefits, unlocking value for all of the joint venture

stakeholders by creating one entity focused on advancing the

Project, which will enhance the ability to arrange project

financing, streamline the decision-making process and reduce

overheads.

- Under the Agreement, LPI has agreed to fund 100% of the

cash calls for the Project starting from January 2022 until

completion which has provided approximately C$1 million of cash

saving for Bearing. Consequently, Bearing estimates its

net-cash balance at closing to be approximately C$2.6

million2, which will be

distributed to Bearing shareholders as a capital

return.

-

The Consolidation has been unanimously endorsed by the

Boards of all three shareholders of the Project: LPI, MSB SpA and

Bearing.

Gil Playford, Chairman and CEO of Bearing

stated: “The Bearing Board of Directors are in unanimous agreement

with our MSB Joint Venture Partners, Lithium Power International

(LPI) and Mr. Martin Borda the owner of MSB SpA to consolidate our

ownership in MSB for an equity interest in ASX listed LPI, which

will hold 100% of the Project. The Officers and Directors have

agreed to vote in favor their stock and recommend to the Bearing

Shareholders to vote in favor of the Transaction at the Annual and

Special Shareholders Meeting to be held in September. The Board

firmly believes the Bearing shareholders will benefit from the

numerous advantages of consolidating 100% of the Project into LPI

as well as substantially improved liquidity of LPI3."

Background

Bearing’s principal asset is its 17.14% interest

in the Project. LPI is currently the majority partner in the

Project with a 51.55% interest, along with a third joint venture

partner (MSB SpA), who owns the remaining 31.31% interest (the

"JV Partner"). Concurrently with the Agreement,

LPI has also entered into a definitive agreement to acquire MSB

SpA’s interest in the Project (the "JV Acquisition

Agreement"), thereby consolidating a 100% interest of the

Project into a single entity: LPI, following completion of the

Consolidation.

Maricunga Lithium Brine

Project

The Project is the most advanced, high-grade

lithium salar in the Americas which is located in Salar de

Maricunga, 170km northeast of Copiapó, in the Atacama Region of

northern Chile. In January 2022, LPI announced the results of its

updated Definitive Feasibility Study (“DFS”) for

the Stage One Maricunga Lithium Brine Project, which supports

15,200 t/a production of battery grade lithium carbonate for 20

years. The DFS provides for a Project NPV (leveraged basis) of

US$1.4B (after tax) at an 8% discount rate, providing an IRR of

39.6%, a 2-year payback and estimated steady-state annual EBITDA of

US$324 million.

The study confirmed that Maricunga could be one

of the world’s lowest-cost producers of lithium carbonate with an

operating cost of US$3,718 per tonne not including credits from

potassium chloride by-product. The Project will have an exceptional

Environmental, Social, Governance (ESG) profile, aiming to

achieving carbon neutrality, setting new standards for

social/community relationships.

Fairness Opinion

The independent financial advisor to Bearing,

Sequeira Partners (“Sequeira”), has provided a

fairness opinion to the Board of Directors of Bearing dated June

19th 2022, which concludes that, based upon details of the

Transaction [and such other matters as Sequeira], is of the opinion

that the consideration to be received in the Transaction is fair,

from a financial point of view, to the Bearing shareholders.

Exchange Ratio

Under the terms of the Agreement, Bearing

shareholders will receive 0.7 of an ordinary share of LPI (each, an

"LPI Share") for each one (1) common share in the

capital of Bearing (each, a "Bearing Share") (the

"Exchange Ratio").

The Transaction implies a value of the LPI

Shares to be issued for Bearing of approximately $0.293 per Bearing

Share on a fully-diluted basis (based on 1-month VWAP on June 21st,

2022 for Bearing of C$0.218 per share (excluding the capital

distribution) and LPI of A$0.464 per share on their respective

stock exchanges). In addition, each option and warrant to purchase

a Bearing Share will entitle the holder thereof to receive LPI

Shares upon exercise based upon the Exchange Ratio. Further

discussion on options and warrants is provided under the heading

“Options and Warrants” below

The implied price and premium for Bearing

shareholders is based on a Canadian dollar/Australian dollar

exchange rates using IRESS closing rates during the VWAP

period.

Bearing Cash Distribution

Immediately prior to closing of the Transaction,

Bearing intends to distribute approximately C$2.6 million to its

shareholders, by way of a capital return (representing

approximately C$0.02 per Bearing share)4.

Options and Warrants

Any Option or Warrant which is not exercised

prior to completion of the Transaction shall continue to be

governed by and be subject to the terms of the applicable Option or

Warrant agreements but will automatically become exercisable for

LPI Shares based on the Exchange Ratio.

The distribution of available excess cash to

Bearing shareholders under the Transaction does not include cash

received from the exercise of Options or Warrants post this

announcement of the Bearing Transaction. Any funds received by

Bearing from the exercise of its Options or Warrants between

announcement of the Transaction and completion are to remain in the

business on completion of the Transaction.

Highlights of the Consolidated

Company

- As

consideration for the Transaction, LPI will issue up to 76.3

million LPI Shares for Bearing’s common shares on issue, and up to

a maximum 18.2 million LPI Shares for the Options and Warrants

assuming all Options and Warrants are exercised prior to completion

of the Transaction, for a total of 94.5 million LPI Shares.

- The

consolidation of 100% of the Project into LPI will provide benefits

to Bearing Shareholders from enhanced market positioning, larger

free float and trading liquidity, broader research coverage, deeper

access to debt and equity capital markets and potential inclusion

in relevant ASX indices.

-

The consolidated company will be able to source funding from a

wider range of capital partners than any of the Project partners

would be able to access on their own.

Spin off of LPI’s Western Australian

lithium Exploration assets

On January 12th 2022, LPI announced to the ASX

that it intends to spin out its Western Australian lithium

exploration assets (“WA Spin-off”) into a separate

entity ("DemergeCo") with the intention of

unlocking strategic value of these assets and to allow LPI to focus

on developing the flagship Maricunga project in Chile. LPI have

undertaken that this spin off will occur subsequent to the Closing

of the Transaction with Bearing, and as such, Bearing shareholders

holding LPI Shares at the time of the spin-out will participate in

the WA Spin-off and will receive their pro-rated allocation of

shares in DemergeCo.

LPI’s Western Australian lithium exploration

assets comprise:

-

Greenbushes tenements cover approximately 40,000

hectares located immediately along strike from the Talison mine

which is the world’s largest hard rock lithium producer owned by

Albemarle and Tianqi of China.

-

Pilgangoora tenements cover approximately 14,000

hectares adjacent to assets owned by Pilbara Minerals

Further information can be found on LPI’s website at

https://lithiumpowerinternational.com

Required Approvals and

Timeline

The implementation of the Transaction will be

subject to the approval of at least 66 ⅔% of the votes cast by

holders of Bearing Shares at an annual and special meeting of

Bearing shareholders expected to take place in August or September,

2022. In addition to the shareholder approvals, the Transaction is

also subject to the receipt of certain regulatory, court and stock

exchange approvals and other closing conditions customary in

transactions of this nature. The Transaction is expected to close

in September 2022.

Although under ASX listing rules, the

Transaction would be subject to the approval of LPI shareholders (a

simple majority vote of those shareholders attending being

required), LPI has undertaken to seek a waiver of this requirement

from ASX as soon as practical. If a waiver is not granted, the

directors of LPI have undertaken to enter into voting support

agreements with Bearing committing to vote their shares in favor of

the Transaction at the meeting of LPI shareholders.

The issuance of LPI Shares under the JV

Acquisition Agreement is subject to the approval of the LPI

shareholders and the receipt of certain regulatory, court and stock

exchange approvals, and other closing conditions customary in

transactions of this nature.

Agreement – other

provisions

The Agreement includes a non-solicitation

covenant of Bearing and gives Bearing the right to accept a

superior proposal in certain circumstances and terminate the

Agreement in exchange for a C$2.5 million termination fee. LPI has

a five-business day right to match any superior proposal. The

Agreement also includes the mutual payment of C$1 million in

respect of reimbursement expenses related to the Transaction in

certain circumstances. Bearing has the right to terminate the

Agreement if the JV Acquisition Agreement does not proceed.

The WA Spin-off will be executed after the

Transaction and, as such, should the Transaction complete Bearing

shareholders will receive a pro-rata interest in the DemergeCo.

Further information regarding the Transaction

will be contained in an information circular

("Circular") that Bearing will prepare, file and

mail in due course to its shareholders in connection with the

annual and special meeting of the Bearing shareholders to be held

to consider the Transaction. All shareholders are urged to read the

information circular once available as it will contain additional

important information concerning the Transaction. The Agreement

will be filed on the SEDAR profiles of Bearing on the SEDAR website

at www.sedar.com.

Proforma Holdings

Post Consolidation, Bearing shareholders will

hold a ~15.6%5 interest in the proforma LPI that will hold 100% of

the Project.

|

Entity |

MaximumNumber of Shares(millions) |

% Interest inProformaLPI |

|

LPI Current Ordinary Shareholders |

349.1 |

57.7% |

|

|

MSB SpA |

161.66 |

26.7% |

|

|

Bearing Shareholders |

94.57 |

15.6% |

|

|

Total LPI Ordinary Shares Outstanding |

605.2 |

100.0% |

|

Indicative Timetable

|

LPI Shareholder Meeting to approve the Consolidation

transactions |

August 2022 |

|

Bearing Shareholder Meeting to approve the

Transaction |

August / September 2022 |

|

Completion of the Transaction |

September 2022 |

|

WA Spin-off |

Post completion of the Transaction |

Bearing Board of Directors’

Recommendation and Voting Support

The Transaction has been unanimously approved by

the Bearing Board of Directors, which will be recommending

shareholders to vote in favor of the Transaction at the upcoming

annual and special meeting of Bearing shareholders.

Directors and officers of Bearing, representing

10.3% of the Bearing shares on issue have also indicated their

support for the Transaction, via voting and support agreements,

confirming their intent to vote in favor.

LPI Board of Directors’

Recommendation

The Transaction has been approved by the LPI

Board of Directors (other than Martin Borda who abstained due to

his interest in the JV Acquisition Agreement), which will be

recommending that LPI shareholders vote in favor of the

Consolidation at the upcoming shareholder meeting.

Statement of LPI

LPI’s Chairman, David Hannon said: “We are

extremely pleased to have reached an agreement with both MSB SpA

and Bearing to consolidate 100% ownership of Maricunga. The updated

DFS released on 20 January 2022 demonstrates that Maricunga could

be one of the lowest cost producers of lithium carbonate in the

world, with the Project’s strong economics underpinning a highly

attractive asset.”Statement of MSB SpA

Martin Borda, the owner of MSB SpA (current

31.13% owner of the Project) and a director and substantial

shareholder of LPI, said: “I am excited to consolidate ownership of

Maricunga in a logical transaction that places the Company ideally

to pursue the development of the Project and greatly enhances LPI’s

ability to deliver the full value of the Maricunga project to LPI’s

shareholders.”

Advisors

DS Lawyers Canada LLP acted as legal advisors

and Torretti y Cia acted as Chilean legal advisors to Bearing in

relation to this transaction.

Other

There may be potential tax consequences

associated with the Transaction. See "Forward-Looking Information

and Disclaimers" below.

For more information, please visit

www.bearinglithium.com and www.sedar.com BRZ.V.

For more

Information, please

contact:

Ray BaterinaCorporate

SecretaryInfo@bearinglithium.com604-262-8835

Forward-Looking Information and

Disclaimers

Certain information contained in this news

release may be deemed “forward-looking” within the meaning of

applicable securities laws. Forward-looking statements and

information relate to future events and future performance and

reflect Bearing and LPI’s expectations regarding the execution of

business strategy, future development and construction, future

growth, estimated costs, results of operations, the terms of the

Transaction, the anticipated cash distribution, the anticipated WA

Spin-off, business prospects and opportunities of Bearing, LPI and

the JV Partner. Any statements that express or involve discussions

with respect to predictions, expectations, beliefs, plans,

projections, objectives, assumptions or future events or

performance (often, but not always, using words or phrases such as

"expects" or "does not expect", "is expected", "anticipates" or

"does not anticipate", "plans", "estimates" or "intends", or

stating that certain actions, events or results "may", "could",

"would", "might" or "will" be taken, occur or be achieved) are not

statements of historical fact and may be forward- looking

statements.

Forward-looking statements are subject to a

variety of risks and uncertainties which could cause actual events

or results to differ materially from those expressed in the

forward-looking statements and information. They include, among

others, the accuracy of mineral reserve and resource estimates and

related assumptions, inherent operating risks, the failure to

obtain shareholder, regulatory or court approvals in connection

with the Transaction, adverse changes in the construction timetable

or progress at the Project, and those risk factors identified in

Bearing’s Management Discussion and Analysis, prepared and filed

with securities regulators which is available on SEDAR at

www.sedar.com under the Bearing’s name.

Forward-looking statements are not a guarantee

of future performance and involve a number of risks and

uncertainties, some of which are described herein. Such

forward-looking statements necessarily involve known and unknown

risks and uncertainties, which may cause Bearing's actual

performance and financial results in future periods to differ

materially from any projections of future performance or results

expressed or implied by such forward-looking statements. These

risks and uncertainties include, but are not limited to, the risk

that the Transaction is delayed or is not completed for any reason,

the risk that the anticipated benefits of the Transaction are not

realized, the risk that the cash distribution is less than

anticipated or does not become payable for any reason, the risk

that the WA Spin-off is not completed for any reason, the actual

results of Bearing's future operations, factors beyond Bearing's

control, and the risks identified in Bearing's management

discussion and analysis for the period ended January 31, 2022 (the

“MD&A”), which are available for viewing on

SEDAR at www.sedar.com. There is no assurance that any amount will

become payable under the cash distribution. Any forward-looking

statements are made as of the date hereof and, except as required

by law, Bearing assumes no obligation to publicly update or revise

such statements to reflect new information, subsequent or

otherwise.

There may be tax consequences for Bearing

shareholders associated with the Transaction, including: (1)

consequences associated with the exchange of shares of a Canadian

corporation for shares of an Australian corporation; and (2)

additional Chilean tax consequences for Bearing

shareholders who own or control 10% or more of the Bearing

Shares at closing date (inclusive of stock options,

warrants, and Bearing Shares sold within 12 months prior to the

closing of the Transaction). Shareholders should consult with their

tax advisors and refer to the information contained in the

Circular.

The mineral report for the Project dated January

7, 2022 referred to herein (and available on the Corporation's

SEDAR profile) at www.sedar.com was prepared by Worley and Atacama

Water for MSB and was prepared to provide a National Instrument

43-101 (“NI 43-101”) compliant Definitive

Feasibility Study (“DFS”) of the Project. Resource

estimates for the Project are for lithium and potassium contained

in brine. The DFS report was prepared under the guidelines of NI

43-101 and in conformity with its standards.

All items related to geology, hydrogeology,

mineral resources and reserves were prepared by Atacama Water.

Peter Ehren was responsible for preparing all technical items

related to brine chemistry and mineral processing. Capital and

operating expenditures mentioned in the NI 43-101 report were

estimated by Worley, relying on quotations requested from

equipment, chemicals and other suppliers, as well as from its

project data base. Worley relied extensively on Minera Salar Blanco

and its consultants, as cited in the text of the study and the

references, for information on future prices of lithium carbonate,

legislation and tax in Chile, as well as for general project data

and information. The report was reviewed by Mr. Marek Dworzanowski,

CEng., BSc (Hons), HonFSAIMM, FIMMM of Worley, Mr. Peter Ehren,

MSc, MAusIMM and Mr. Frits Reidel, CPG. Mr. Marek Dworzanowski, Mr.

Peter Ehren and Mr. Frits Reidel are “qualified persons” (QP) and

are independent of MSB as such terms are defined by NI 43-101.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the U.S. Securities Act or any state securities

laws and may not be offered or sold within the United States or to

U.S. Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available

Reader Advisory

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE

ADEQUACY OR ACCURACY OF THIS RELEASE.

__________________________

1 Assumes all outstanding options and warrants are exercised

resulting in 135.1 million Bearing Shares. 2 The net-cash balance

excludes any proceeds from the exercise of Bearing options and

warrants.3 Over the last 20 trading days up to and including June

21st, 2022, Bearing averaged 22,585 shares traded daily (including

two days with no trading volume), while LPI averaged 5.405 million

shares traded daily or approximately 239 times more daily trading

volume.4 Based on the fully diluted number of shares on issue.

Assumes all outstanding options and warrants are exercised

resulting in 135.1 million BRZ shares.6 Martin Borda, the owner of

MSB SpA already holds ~16.3m shares in LPI. The number stated in

this table only states the shares issued to MSB SpA as part of the

Transactions. Post completion of the Transactions MSB SpA,

controlled by Martin Borda, will hold an interest in LPI of 177.8m

LPI shares 7 Shows fully diluted Bearing shares including all

Options and Warrants, some Options and Warrants and not currently

in-the-money based on the offer price.

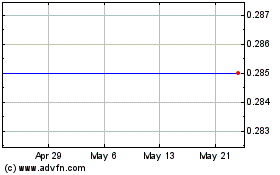

Bearing Lithium (TSXV:BRZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bearing Lithium (TSXV:BRZ)

Historical Stock Chart

From Dec 2023 to Dec 2024