Bitcoin Well Inc. (“

Bitcoin

Well” or the “

Company”) (

TSXV:

BTCW; OTCQB: BCNWF), the non-custodial bitcoin business on

a mission to enable independence, is pleased to announce that it

has entered into an agreement with Haywood Securities Inc.

(“

Haywood”) dated February 29, 2024 to act as sole

agent and sole bookrunner to assist the Company in selling on a

commercially reasonable efforts private placement basis, units of

the Company (each, a “

Unit”) at a price of C$0.175

per Unit (the “

Issue Price”) for gross proceeds of

a minimum of C$1,250,000 (from the sale of a minimum 7,142,857

Units) and a maximum of C$2,100,000 (from the sale of a maximum of

12,000,000 Units) (the “

Offering”).

Each Unit will consist of one common share of

the Company (a “Common Share”) and one-half of one

Common Share purchase warrant of the Company (each whole warrant, a

“Warrant”). Each Warrant will entitle the holder

thereof to purchase one additional Common Share at a price of

C$0.275, subject to adjustment in certain events, for a period of

36 months following the closing date of the Offering (the

“Closing Date”).

The Company has granted to Haywood an option

(the “Agent’s Option”), exercisable in whole or in

part by Haywood at any time up to 48 hours prior to the Closing

Date, to offer for sale up to an additional 2,520,000 Units at the

Issue Price for additional gross proceeds to the Company of

C$441,000. In the event that the Agent’s Option is exercised in its

entirety, the total gross proceeds to the Company from the Offering

will be a maximum of C$2,541,000 (from the sale of a maximum of

14,520,000 Units).

The Company intends to use the net proceeds of

the Offering for sales and marketing, working capital and general

corporate purposes.

Subject to compliance with applicable regulatory

requirements and in accordance with National Instrument 45-106 -

Prospectus Exemptions (“NI 45-106”), the Offering

is being made to purchasers resident in all provinces and

territories of Canada, except Quebec, pursuant to the listed issuer

financing exemption under Part 5A of NI 45-106 (the “Listed

Issuer Financing Exemption”). The securities offered under

the Listed Issuer Financing Exemption will not be subject to a

statutory hold period in accordance with applicable Canadian

securities laws. There is an offering document (the

“Offering Document”) related to the Offering that

can be accessed under the Company's profile at www.sedarplus.ca and

on the Company's website at bitcoinwell.com/financing. Prospective

investors should read this Offering Document before making an

investment decision.

Haywood will also be entitled to offer the Units

for sale in jurisdictions outside of Canada provided it is

understood that no prospectus filing or comparable obligation

arises in such other jurisdiction. All securities not issued

pursuant to the Listed Issuer Financing Exemption will be subject

to a hold period in accordance with applicable Canadian securities

law, expiring four months and one day following the Closing

Date.

The Company expects to close the Offering on or

about March 22, 2024, or such other date as the Company and Haywood

may agree. The Offering is subject to certain conditions including,

but not limited to, the receipt of all necessary TSX Venture

Exchange and regulatory approvals.

Upon closing of the Offering, the Company shall

pay to Haywood: (i) a cash commission equal to 7% of the aggregate

gross proceeds of the Offering; and (ii) non-transferrable broker

warrants of the Company exercisable at any time prior to the date

that is 36 months from the Closing Date to acquire that number of

Units equal to 7% of the number of Units issued under the Offering

at an exercise price equal to the Issue Price, subject to

adjustment in certain events.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy securities in the

United States, nor shall there be any sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful. The securities being offered have not been, nor will they

be, registered under the U.S. Securities Act of 1933, as amended

(the “1933 Act”) or under any U.S. state

securities laws, and may not be offered or sold in the United

States absent registration or an applicable exemption from the

registration requirements of the 1933 Act, as amended, and

applicable state securities laws.

About Bitcoin Well

Bitcoin Well is on a mission to enable

independence. We do this by making bitcoin useful to everyday

people to give them the convenience of modern banking and the

benefits of bitcoin. We like to think of it as future-proofing

money. Our existing Bitcoin ATM and Online Bitcoin Portal business

units drive cash flow to help fund this mission.

Join our investor community and follow us on

Nostr, LinkedIn, Twitter and YouTube to keep up to date with our

business.

Bitcoin Well contact

information

To book a virtual meeting with our Founder &

CEO Adam O’Brien please use the following link:

https://bitcoinwell.com/meet-adam

For additional investor & media information, please

contact:Tel: 1 888 711 3866ir@bitcoinwell.com

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Forward-looking

information Certain statements contained in this news

release may constitute forward-looking information. Forward-looking

information is often, but not always, identified by the use of

words such as "anticipate", "plan", "estimate", "expect", "may",

"will", "intend", "should", or the negative thereof and similar

expressions. All statements herein other than statements of

historical fact constitute forward-looking information, including

but not limited to statements in respect of: closing of the

Offering; TSX Venture Exchange approval of the Offering; exercise

of the Agent’s Option; use of proceeds from the Offering; and

Bitcoin Well’s business plans, strategy and outlook.

Forward-looking information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking information. Bitcoin Well actual results could

differ materially from those anticipated in this forward-looking

information as a result of inability to obtain TSX Venture Exchange

approval, regulatory decisions, competitive factors in the

industries in which Bitcoin Well operates, prevailing economic

conditions, and other factors, many of which are beyond the control

of Bitcoin Well.

Bitcoin Well believes that the expectations

reflected in the forward-looking information are reasonable, but no

assurance can be given that these expectations will prove to be

correct and such forward-looking information should not be unduly

relied upon. Any forward-looking information contained in this news

release represents Bitcoin Well expectations as of the date hereof,

and is subject to change after such date. Bitcoin Well disclaims

any intention or obligation to update or revise any forward-looking

information whether as a result of new information, future events

or otherwise, except as required by applicable securities

legislation. For more information, see the Cautionary Note

Regarding Forward Looking Information found in the Bitcoin Well

quarterly Management Discussion and Analysis.

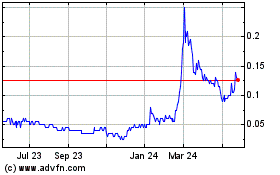

Bitcoin Well (TSXV:BTCW)

Historical Stock Chart

From Dec 2024 to Jan 2025

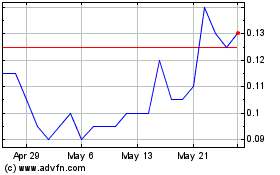

Bitcoin Well (TSXV:BTCW)

Historical Stock Chart

From Jan 2024 to Jan 2025