Changfeng Reports its Fiscal Year 2012 Results and Provides Business Update

April 25 2013 - 4:01PM

Marketwired Canada

Changfeng Energy Inc. (TSX VENTURE:CFY) ("Changfeng" or the "Company") is

pleased to announce that the Company has filed its audited consolidated

financial results for the fiscal year ended December 31, 2012. The audited

consolidated financial statements and Management Discussion and Analysis can be

downloaded from www.SEDAR.com or from the Company's website at

www.changfengenergy.com.

Summary of Consolidated Financial Results for the Fiscal 4th Quarter and the

Fiscal Year ended December 31, 2012

----------------------------------------------------------------------------

(in thousands in $Cdn)

except percentages

and per share data

Q4 Q4

2012 2011 Change % 2012 2011 Change %

----------------------------------------------------------------------------

Revenue 10,857 8,929 1,928 22% 33,273 28,176 5,097 18%

Gross profit 5,172 4,285 887 21% 15,659 11,708 3,951 34%

EBITDA 2,403 2,511 -108 -4% 8,006 5,861 2,145 37%

Net income 771 888 -117 -13% 2,478 1,371 1,107 81%

Basic and diluted EPS 0.011 0.013 -0.002 -15% 0.038 0.021 0.017 81%

----------------------------------------------------------------------------

Revenue for fiscal 2012 was $33.3 million, an increase of $5.1 million, or 18%,

from $28.2 million in 2011. This increase is mainly attributable to continued

gas volume growth (16%) and higher average selling prices for both its CNG

refueling retail station in Changsha city and the natural gas distribution

utility in Sanya city.

Gross margin for 2012 was $15.7 million, an increase of $4.0 million, or 34%,

from $11.7 million in 2011. Gross margin as a percentage of sales for 2012

increased by 5% to 47% compared to 42% for 2011. The increase in gross margin

percentage is mainly due to higher selling prices and improved margin on the CNG

sales from the refueling station.

Gas distribution utility gross margin as a percentage of sales year-over-year

improved 8% (52% for 2012 VS 44% for 2011) reflecting the reduced volume of gas

purchased at market rate prices and higher-value commercial customers from the

Haitang Bay district in the Sanya Region. The CNG refueling station gross margin

as a percentage of sales year-over-year improved 9% (22% for 2012 VS 13% for

2011) primarily due to selling price increases and lower operating costs as a

result of gas volume increase.

General and administrative expenses for fiscal 2012 were $6.9 million, an

increase of $1.8 million, or 36%, from $5.1 million in 2011. The increase was

attributable to general expenses including employee salary and benefits as a

result of a higher inflation rate in China, and sales increase. General and

administrative expenses as a percentage of sales for 2012 was 21%, compared to

18% in 2011, representing an increase of 3%.

Travel and business development expenses for fiscal 2012 were $3.6 million, an

increase of $0.9 million, or 35%, from $2.7 million in 2011. Travel and business

development expenses as a percentage of sales for 2012 increased to 11% from 10%

in 2011 as a result of increases in revenue. These expenses normally fluctuate

with its travel and business development activities in mainland China as the

Company seeks to develop new projects in close proximity to the new national

pipelines. The majority of travel and business development expenses does not

relate to the Company's business in Sanya City or the CNG refueling station but

instead to projects under consideration or development in mainland China.

Net income for 2012 was $2.5 million or $0.038 per basic and diluted share

compared to $1.4 million or $0.021 per basic and diluted share for the same

period in 2011, primarily due to the reasons stated above.

EBITDA for fiscal 2012 was $8.0 million, an increase of $2.1 million, or 37%,

from $5.9 million for 2011, as a result of sales increases. EBITDA as a as a

percentage of sales for 2012 was 24%, compared to 21% in 2011, representing an

increase of 3% due to the reasons noted above relating to the sales increases,

higher gross margins and a $0.7 million one-time government grant, partially

offset by higher operating expenses.

Financial Position

During 2012, 2011 and 2010, the Company's financial position was strengthened by

the positive cash flow from operating activities of $8.4 million, $4.2 million

and $4.8 million, respectively. As at December 31, 2012, the Company had a

working capital deficit of $12.2 million, which includes $8.9 million of

deferred revenue and $4.8 million of one-year line of credit.

On December 21, 2012, the Company entered into a term loan with the Bank of

China, Pingxiang Branch ("BOC, Pingxiang") for $3.2 million (RMB 20.0 million),

maturing six years from the date of the first withdrawal. The proceeds from this

term loan will be used to fund the construction of pipelines and related

property and equipment in the Xiangdong district, Pingxiang City, Jiangxi

province. As of the date of the press release, the Company withdrew $2.4 million

(RMB 15.0 million).

On January 15, 2013 the Company entered another agreement with BOC, Sanya Branch

to secure a bank loan facility in the amount of $8.0 million (RMB 50.0 million)

(the "Term Loan"). The Term Loan has a ten-year term from the date of the first

initial withdrawal, and bears interest of 110% of the prime rate set by the

People's Bank of China. Upon execution of the agreement, the Company made a

withdrawal of $6.4 million (RMB 40.0 million).

Business Update

Gas to Electricity Exchange Program, Sanya Operation, Hainan Province

As of the date of this press release, the first phase of the construction has

been completed and gone through the project acceptance. It is expected that the

project will be closed out in May 2013 and the gas will be available for the

Company's use.

Xiangdong Project, Pingxiang City, Jiangxi Province

The Company continues the pipeline installation and gas facility construction,

including the Citygate, in the Xiangdong Ceramic Production Park (the "Park").

And the Company endeavors to sign more industrial customers.

The construction of the 25 kilometers (approximately 15 miles) pipeline, sub

branch of Second West-East Pipeline ("WEP II"), to ship the gas from WEP II to

the Company's Citygate in Park, has been approved by the Jiangxi Energy Board,

and will be commenced in the second half of the year of 2013. This section of

pipeline will be built by a state- owned Company in Jiangxi Province.

Grangdong Program, Guangdong Province

Pursuant to the press release dated March 29, 2012, the Company announced a

proposed joint venture with CNPC Kunlun Natural Gas Exploitation Company Limited

("CNPC Kunlun Exploitation"), a wholly-owned subsidiary of PetroChina ("CNPC"),

to jointly develop a natural gas distribution business in four prefecture-level

cities in Guangdong Province, China, including Zhaoqing City, Jiangmen City,

Foshan City and Zhuhai City (collectively "the Yuexi Area") ("the Guangdong

project"). Due to the merge of the subsidiary of CNPC, the potential joint

venture partner has been changed from CNPC Kunlun Exploitation to PetroChina

Kunlun Gas Co., Ltd, Southern China Branch ("CNPC Kunlun Gas"), a wholly owned

subsidiary of CNPC. The Company is working with CNPC Kunlun Gas and waiting for

the approval from the head office of PetroChina.

"We are very pleased with solid performance for 2012, with strong performance in

almost every area of the Company," stated Mr. Huajun Lin, Chairman and CEO of

the Company, "During this year, we achieved several operational and project debt

financing goals. In 2013, we will focus on connecting more industrial customers

to our pipeline network in Xiangdong district, and move on the development of

the Guangdong Program."

About Changfeng Energy Inc.

Changfeng Energy Inc., is a natural gas service provider with operations located

throughout the People's Republic of China. The Company services industrial,

commercial and residential customers, providing them with natural gas for

heating purposes and fuel for transportation. The Company has developed a

significant natural gas pipeline network as well as urban gas delivery networks,

stations, substations and gas pressure regulating stations in Sanya City &

Haitang Bay. Through its network of pipelines, the Company provides safe and

reliable delivery of natural gas to both homes and businesses. The Company is

headquartered in Toronto, Ontario and its shares trade on the Toronto Venture

Exchange under the trading symbol "CFY". For more information, please visit the

Company website at www.changfengenergy.com.

Forward-Looking Statements

Information set forth in this news release may involve forward-looking

statements under applicable securities laws. The forward-looking statements

contained herein are expressly qualified in their entirety by this cautionary

statement. The forward-looking statements included in this document are made as

of the date of this document and the Company disclaims any intention or

obligation to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as expressly

required by applicable securities legislation. Although Management believes that

the expectations represented in such forward-looking statements are reasonable,

there can be no assurance that such expectations will prove to be correct. This

news release does not constitute an offer to sell or solicitation of an offer to

buy any of the securities described herein and accordingly undue reliance should

not be put on such.

FOR FURTHER INFORMATION PLEASE CONTACT:

Changfeng Energy Inc.

Mr. Kevin M. Zhang

Chief Financial Officer

416.362.5032

kevin@changfengenergy.com

Changfeng Energy Inc.

Ms. Ann S.Y. Lin

Corporate Secretary

416.362.5032

ann@changfengenergy.com

www.changfengenergy.com

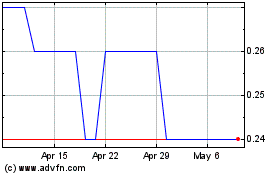

CF Energy (TSXV:CFY)

Historical Stock Chart

From Apr 2024 to May 2024

CF Energy (TSXV:CFY)

Historical Stock Chart

From May 2023 to May 2024