Changfeng Reports Second Quarter 2013 Financial Results, and Provides Business Update

August 22 2013 - 12:47PM

Marketwired Canada

Changfeng Energy Inc., (TSX VENTURE:CFY) ("Changfeng" or the "Company"), is

pleased to announce that the Company has filed its unaudited condensed interim

consolidated financial results for the second quarter ended June 30, 2013. The

unaudited condensed interim consolidated financial results and Management

Discussion and Analysis can be downloaded from www.SEDAR.com or from the

Company's website at www.changfengenergy.com.

Summary of the Second Quarter of 2013 consolidated Financial Results

In thousands of Canadian Three months ended June

dollars 30, Six months ended June 30,

except percentages and

per 2013 2012 Change % 2013 2012 Change %

share amounts

----------------------------------------------------------------------------

Revenue 9,190 7,122 2,068 29% 18,813 14,487 4,326 30%

----------------------------------------------------------------------------

Gross margin 4,260 3,421 839 25% 9,769 7,323 2,446 33%

----------------------------------------------------------------------------

Other operating income - 723 (723) - 723 (723)

----------------------------------------------------------------------------

Net income 625 826 (201) -24% 1,897 1,652 245 15%

----------------------------------------------------------------------------

EBITDA 2,104 1,416 688 49% 5,105 3,532 1,573 45%

----------------------------------------------------------------------------

Adjusted net income (1) 625 283 342 121% 1,897 1,109 788 71%

----------------------------------------------------------------------------

Note (1): The adjusted net income excludes a government grant of $542,535, net

of tax.

Revenue for the three months ended June 30, 2013 was $ 9.2 million, representing

an increase of $2.1 million, or 29%, from $7.1 million for the same period of

2012. Revenue for the six months ended June 30, 2013 was $ 18.8 million,

representing an increase of $4.3 million, or 30%, from $14.5 million for the

same period of 2012. This increase is mainly attributable to continued gas

volume growth (16% for the three months ended June 30, 2013 and 20% for the six

months ended June 30, 2013) and higher average selling prices for both its CNG

refueling retail station in Changsha city and the natural gas distribution

utility in Sanya city for commercial and industrial customers.

Gross margin for the three months ended June 30, 2013 increased $0.8 million, or

25%, and increased $2.4 million or 33% for the six months ended June 30, 2013,

compared to the same periods in 2012. As a percentage of revenue, gross margin

increased to 52% in the six months ended June 30, 2013 from 51 % in the same

period of 2012.

As a percentage of revenue, the gross margin of the gas distribution utilities

decreased 3% (51% for the three months ended June 30, 2013 versus 54% for the

same period of 2012). As a percentage of revenue, the gross margin of the CNG

refueling station improved 12% (29% for the three months ended June 30, 2013

versus 17% for the same period of 2012) primarily due to increases in selling

price, as well as operating costs that increased at a lower rate than gas volume

sold.

EBITDA (non-GAAP measure as identified and defined under section "Non-GAAP

Measures") for the three months ended June 30, 2013 was $2.1 million, an

increase of 0.7 million, or 49%, from $1.4 million for the same period of 2012.

EBITDA for the six months ended June 30, 2013 was $5.1 million, an increase of

$1.6 million, or 45%, from $3.5 million for the same period of 2012. The

increase was driven primarily by higher sales. EBITDA as a percentage of revenue

for the three months ended June 30, 2013 was 23%, compared to 20% in the same

period in 2012. EBITDA as a percentage of revenue for the six months ended June

30, 2013 was 27%, compared to 24% in the same period of 2012, representing an

increase of 3%. This increase was due to higher sales partially offset by higher

operating expenses.

Net income for the three months ended June 30, 2013 was $0.6 million, or $0.01

per share (basic and diluted) compared to $0.8 million or $0.01 per share (basic

and diluted) for the same period in 2012. Net income for the six months ended

June 30, 2013 was $1.9 million, or $0.03 per share (basic and diluted) compared

to $1.7 million or $0.03 per share (basic and diluted) for the same period in

2012.

Adjusted net income is calculated as net income before other operating income.

Other operating income represents a government grant received by the Company.

There is no guarantee that the Company will receive this government grant every

year. Changfeng believes that adjusted net income is a useful supplemental

measure of the Company's operating results.

Financial Position

Cash increased by $3.3 million to $9.7 million at June 30, 2013 from $6.4

million at December 31, 2012, primarily resulting from cash of $2.6 million

provided by operating activities, cash flow from financing activities of $4.3

million, offset by cash used for capital expenditures of $4.3 million.

The working capital deficit as at June 30, 2013 decreased to $5.6 million from

$12.2 million as at December 31, 2012, primarily resulting from the effective

conversion of the Company's line of credit to long term debt and an increase of

current assets.

On December 21, 2012, the Company entered into a term loan facility with the

Bank of China, Pingxiang Branch for $3.4 million (RMB 20.0 million). As of June

30, 2013, the Company had withdrawn $3.4 million (RMB 20.0 million).

On January 15, 2013, the Company entered into an agreement with the Bank of

China, Sanya Branch to secure a term loan facility in the amount of $8.6 million

(RMB 50.0 million). As of June 30, 2013, the Company had withdrawn $6.9 million

(RMB 40.0 million).

Adjusted working capital

Adjusted working capital is calculated as current assets less adjusted current

liabilities. Adjusted current liabilities are calculated as current liabilities,

excluding:

i. deferred revenue in connection with gas connection fees, which are

deferred when Changfeng receives payments from customers in advance of

work having commenced and are recognized on the percentage of completion

method; and

ii. the line of credit, as in China, typically, lines of credit are renewed

when due.

Changfeng believes that adjusted working capital is a useful supplemental

measure as it provides an indication of its ability to settle its debt

obligations as they come due.

The calculation of adjusted working capital is provided in the table below:

In thousands of Canadian June 30, December 31,

dollars 2013 2012

----------------------------------------------------------------------------

Current assets 14,485 11,306

Less: Current liabilities 20,037 23,511

----------------------------------------------------------------------------

Working capital (deficit) (5,552) (12,205)

----------------------------------------------------------------------------

Add: Deferred revenue 10,461 8,911

Line of credit - 4,791

----------------------------------------------------------------------------

Adjusted working capital 4,909 1,497

----------------------------------------------------------------------------

Mr. Huajun Lin, the Chairman and C.E.O. of the Company commented that "We had

another very successful quarter and are pleased with the financial results

driven by the gas sales volume increase in both the piped natural gas

distribution operations in Sanya city and the CNG refueling station in Changsha

city as well as commencing gas sales to industrial and residential customers in

Xiangdong District, Pingxiang City. Going forward, we are hopeful that we will

have continuing market penetration in Sanya City and Xiangdong District, and

will endeavor to expand the business in Mainland China to bring long-term

sustainable value to the Company and to our shareholders."

Business Update

Sanya Piped Gas Distribution Operation, Sanya City, Hainan Province

Further to the Press Release dated February 22, 2012 regarding the Gas to

Electricity Exchange Program, the construction of the facilities has been

completed and is going through the acceptance inspection by the relevant

authorities. The gas sales and purchase agreement is negotiated through the

government's coordination. The Company will provide further details regarding

the price, expected annual volumes and supply schedule of the gas once the

agreement is finalized.

Xiangdong Piped Gas Distribution Operation, Xiangdong District, Pingxiang City,

Jiangxi Province

The Company is continuing its market penetration in the Xiangdong District. As

of the date of this release, the Company is supplying gas to four (4) ceramic

manufacturers and one residential gated community.

In addition the Company has extended its pipeline network to the downtown area

and the outskirts of the town. A citygate in the Park to depressurize the piped

gas from WEP II is under construction.

There is nothing further to report on the process for the approval of the

construction of the section of the interprovincial pipeline that is proposed to

link the Company's citygate and PetroChina's citygate. The Company is working

with the local energy boards and regulatory authorities on this regulatory

approval process.

About Changfeng Energy Inc.

Changfeng Energy Inc., is a natural gas service provider with operations located

throughout the People's Republic of China. The Company services industrial,

commercial and residential customers, providing them with natural gas for

heating purposes and fuel for transportation. The Company has developed a

significant natural gas pipeline network as well as urban gas delivery networks,

stations, substations and gas pressure regulating stations in Sanya City &

Haitang Bay. Through its network of pipelines, the Company provides safe and

reliable delivery of natural gas to both homes and businesses. The Company is

headquartered in Toronto, Ontario and its shares trade on the Toronto Venture

Exchange under the trading symbol "CFY". For more information, please visit the

Company website at www.changfengenergy.com.

Forward-Looking Statements

Information set forth in this news release may involve forward-looking

statements under applicable securities laws. The forward-looking statements

contained herein are expressly qualified in their entirety by this cautionary

statement. The forward-looking statements included in this document are made as

of the date of this document and the Company disclaims any intention or

obligation to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as expressly

required by applicable securities legislation. Although Management believes that

the expectations represented in such forward-looking statements are reasonable,

there can be no assurance that such expectations will prove to be correct. This

news release does not constitute an offer to sell or solicitation of an offer to

buy any of the securities described herein and accordingly undue reliance should

not be put on such.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSXV) accepts responsibility for the adequacy

or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Changfeng Energy Inc.

Mr. Yan Zhao CPA. CA

Chief Financial Officer

416.362.5032/647.528. 0115

yan.zhao@changfengenergy.com

Changfeng Energy Inc.

Ms. Ann S.Y.Lin

VP, Corporate Development and Corporate Secretary

416.362.5032

ann@changfengenergy.com

www.changfengenergy.com

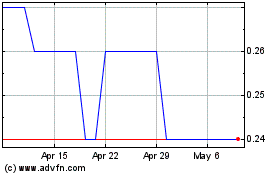

CF Energy (TSXV:CFY)

Historical Stock Chart

From Apr 2024 to May 2024

CF Energy (TSXV:CFY)

Historical Stock Chart

From May 2023 to May 2024