Changfeng Revenue Up 26%, Gross Profit Up 27% and Net Income Up 14% for Year Ended December 31, 2013

April 25 2014 - 10:43AM

Marketwired Canada

Changfeng Energy Inc., (TSX VENTURE:CFY) ("Changfeng" or the "Company"), is

pleased to announce that the Company has filed its audited consolidated

financial statements for the fiscal year ended December 31, 2013. The audited

consolidated financial statements and Management Discussion and Analysis can be

downloaded from www.SEDAR.com or from the Company's website at

www.changfengenergy.com.

Summary of Consolidated Financial Results for Fiscal Year Ended December 31,

2013 and 2012

In thousands of Canadian dollars

except percentages and per share

amounts 2013 2012 Change %

-------------------------------- ----------------------------------------

Revenue 42,049 33,273 8,776 26%

-------------------------------- ----------------------------------------

Gross margin 19,998 15,775 4,243 27%

-------------------------------- ----------------------------------------

Other operating income - 717 (717) -100%

-------------------------------- ----------------------------------------

Net income 2,814 2,478 336 14%

-------------------------------- ----------------------------------------

EBITDA (1) 9,806 8,006 1,800 22%

-------------------------------- ----------------------------------------

Adjusted net income (1) (2) 2,814 1,935 879 45%

-------------------------------- ----------------------------------------

Note:

1. See Non- GAAP Financial Measures in this Press Release.

2. The adjusted net income for 2012 excludes a one-time government grant of

$543,000, net of tax.

Sales revenue from the gas distribution utility for 2013 was $34.2 million, an

increase of $6.5 million, or 23%, from $27.7 million in 2012. This increase is

mainly attributable to increased gas volume sold including newly added gas

volume sold in Xiangdong operation, higher average selling price to industrial

and commercial residents in the Sanya operation, higher pipeline connection

revenue, as well as Chinese RMB appreciation.

Sales revenue from the CNG refueling retail station for 2013 was $7.9 million,

an increase of $2.3 million, or 41%, from $5.6 million in 2012. The significant

increase was attributable to the combined effect of the increased gas volume

sold (13.3 million m3 in 2013 compared to 10.1 million m3 in 2012) and higher

average selling prices. Effective August 13, 2012, the local natural gas pricing

authority approved a 15% price increase for CNG retail stations in Changsha City

as a response to a gasoline price increase. In addition, the Company has been

upgrading its station's refueling capacity to meet the increasing demand that is

primarily driven by both rising gasoline prices and continued government support

for clean energy vehicles. It is expected that more existing gasoline-fueled

buses in the city will be converted into dual-fuel vehicles (gasoline/CNG).

Gross margin for 2013 was $20.0 million, an increase of $4.2 million, or 27%,

from $15.8 million in 2012. The gross margin percentage of 48% for 2013 is

approximately the same as for 2012.

Gas distribution utility gross margin as a percentage of sales year-over-year

improved 1% (53% for 2013 VS 52% for 2012) reflecting the reduced volume of gas

purchased at market rate prices and higher-value commercial customers from the

Haitang Bay district in the Sanya Region. The CNG refueling station gross margin

as a percentage of sales year-over-year increased 3% (25% for 2013 VS 22% for

2012) primarily to selling price increases.

General and administrative expenses for 2013 were $9.3 million, an increase of

$1.8 million, or 24%, from $7.5 million in 2012. The increase was attributable

to higher employee salaries and benefits as a result of a higher inflation rate

in China, additional employees, and higher conference and professional fees.

General and administrative expenses as a percentage of sales for 2013 were 22%

which is approximately the same as for 2012.

Travel and business development expenses for 2013 were $3.3 million, an increase

of $0.4 million, or 13%, from $2.9 million in 2012. As a percentage of sales,

travel and business development expenses for 2013 was 8%, a decrease from 9% in

2012. These expenses normally fluctuate with travel and business development

activities in mainland China as the Company seeks to develop new projects in

close proximity to the new national pipelines.

Net income for fiscal 2013 was $2.8 million, or $0.045 per share (basic and

diluted) compared to $2.5 million or $0.038 per share (basic and diluted) in

2012.

EBITDA (non-GAAP measure as identified and defined under section "Non-GAAP

Measures") for fiscal 2013 was $9.8 million, an increase of $1.8 million, or

22%, from $8.0 million for 2012. The increase was driven primarily by higher

sales. EBITDA as a percentage of revenue for 2013 was 23%, compared to 24% in

the same period in 2012. This decrease is largely attributable to the other

operating income earned in 2012.

Adjusted net income (non-GAAP measure as identified and defined under section

"Non-GAAP Measures") for fiscal 2013 was $2.8 million, compared to $1.9 million

for the same period in 2012 as increase of 45%.

Financial Position

Cash increased by $8.8 million to $15.2 million at December 31, 2013 from $6.4

million at December 31, 2012.

Net cash provided by operations was $10.0 million for fiscal 2013 compared to

$8.4 million in 2012.

Cash provided by financing activities in 2013 included a $10.0 million

withdrawal from the term loan facility and $3.3 million from line of credit,

offset by the short term loan payment of $5.0 million, $0.8 million term loan

principal payment and $0.5 million paid for the share buyback.

Cash used in investing activity included capital expenditures of $9.3 million

for fiscal 2013 compared to $6.3 million in 2012. The expenditures were mainly

related to the purchase of equipment for the Xiangdong project and the on-going

construction of pipeline networks to connect new customers in the Sanya region.

Non-GAAP Financial Measures

The Company uses the following non-GAAP financial measures: EBITDA and adjusted

net income. The Company believes these non-GAAP financial measures provide

useful information to both management and investors in measuring the financial

performance and financial condition of the Company for the reasons outlined

below.

Management uses these non-GAAP financial measures to exclude the impact of

certain expenses and income that must be recognized under GAAP when analyzing

consolidated operating performance, as the excluded items are not necessarily

reflective of the Company's underlying operating performance and make

comparisons of underlying financial performance between periods difficult. From

time to time, the Company may exclude additional items if it believes doing so

would result in a more effective analysis of underlying operating performance.

The exclusion of certain items does not imply that they are non-recurring.

These measures do not have a standardized meaning prescribed by GAAP and

therefore they may not be comparable to similarly titled measures presented by

other publicly traded companies and should not be construed as an alternative to

other financial measures determined in accordance with GAAP. These measures are

listed and defined below:

EBITDA

EBITDA is defined herein as income before income tax expense, interest expense,

depreciation and amortization, share of loss of investment in associate, as well

as non-cash stock-based compensation expense. EBITDA does not have any

standardized meaning prescribed by IFRS and therefore may not conform to the

definition used by other companies. A reconciliation of net income to EBITDA for

each of the periods presented as follows:

--------------------------------------------------------------------------

In thousands

(except for % figures) 2013 2012 Change %

--------------------------------------------------------------------------

Net Income 2,814 2,478 336 14%

Add (less):

Income tax 2,594 1,886 708 38%

Interest (income) expense (37) 26 (63) -242%

Share of loss of investment

in associate 1 24 (23) -95%

Stock-based compensation 382 180 202 112%

Amortization 2,414 1,959 455 23%

Interest on borrowing 1,638 1,453 185 13%

--------------------------------------------------------------------------

EBITDA 9,806 8,006 1,800 22%

--------------------------------------------------------------------------

Adjusted net income

Adjusted net income is calculated as net income before other operating income.

Other operating income represents a government grant received by the Company.

There is no guarantee that the Company will receive this government grant every

year. Changfeng believes that adjusted net income is a useful supplemental

measure of the Company's operating results.

The calculation of adjusted net income is provided in the table below:

In thousands of Canadian dollars

except percentages and per share amounts 2013 2012

--------------------------------------------- ----------------------------

Net income 2,814 2,478

Less: Other operating income, net of tax - 543

--------------------------------------------- ----------------------------

Adjusted net income 2,814 1,935

--------------------------------------------- ----------------------------

About Changfeng Energy Inc.

Changfeng Energy Inc., is a natural gas service provider with operations located

throughout the People's Republic of China. The Company services industrial,

commercial and residential customers, providing them with natural gas for

heating purposes and fuel for transportation. The Company has developed a

significant natural gas pipeline network as well as urban gas delivery networks,

stations, substations and gas pressure regulating stations in Sanya City &

Haitang Bay. Through its network of pipelines, the Company provides safe and

reliable delivery of natural gas to both homes and businesses. The Company is

headquartered in Toronto, Ontario and its shares trade on the Toronto Venture

Exchange under the trading symbol "CFY". For more information, please visit the

Company website at www.changfengenergy.com.

Forward-Looking Statements

Information set forth in this news release may involve forward-looking

statements under applicable securities laws. The forward-looking statements

contained herein are expressly qualified in their entirety by this cautionary

statement. The forward-looking statements included in this document are made as

of the date of this document and the Company disclaims any intention or

obligation to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as expressly

required by applicable securities legislation. Although Management believes that

the expectations represented in such forward-looking statements are reasonable,

there can be no assurance that such expectations will prove to be correct. This

news release does not constitute an offer to sell or solicitation of an offer to

buy any of the securities described herein and accordingly undue reliance should

not be put on such.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSXV) accepts responsibility for the adequacy

or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Changfeng Energy Inc.

Mr. Yan Zhao CPA. CA

Chief Financial Officer

416.362.5032/647.528.0115

yan.zhao@changfengenergy.com

Changfeng Energy Inc.

Ms. Ann S.Y.Lin

VP, Corporate Development and Corporate Secretary

416.362.5032

ann@changfengenergy.com

www.changfengenergy.com

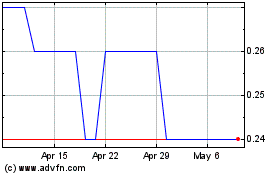

CF Energy (TSXV:CFY)

Historical Stock Chart

From Apr 2024 to May 2024

CF Energy (TSXV:CFY)

Historical Stock Chart

From May 2023 to May 2024