Consolidated Uranium Inc. (“

CUR”, the

“

Company” or “

Consolidated

Uranium”) (TSXV: CUR) (OTCQB: CURUF) is pleased

to announce the creation and planned spin-out of Labrador Uranium

Inc. (“

Labrador Uranium” or

“

LUR”), currently a majority-controlled subsidiary

of CUR focused on the consolidation, exploration and development of

uranium projects in Labrador. In connection with the proposed

spin-out of LUR, the Company has provided notice to exercise its

option pursuant to the option agreement announced on November 18,

2020 (the “

Option Agreement”) to acquire 100% of

the Moran Lake project (the “

Moran Lake Project”).

To effect the spin-out, the Company has entered

into an arrangement agreement with LUR (the “Arrangement

Agreement”), pursuant to which among other things the

Company will transfer ownership of Moran Lake Project to LUR in

exchange for common shares of LUR (“LUR Shares”)

which the Company intends to distribute to its shareholders on a

pro rata basis (the “Arrangement”). The Company

also intends to apply to list the LUR Shares (the

“Listing”) on the Canadian Securities Exchange

(the “CSE”). The Listing will be subject to LUR

fulfilling all of the requirements of the CSE.

In addition, the Company and Labrador Uranium

have entered into a purchase agreement (the “Altius

Agreement”) with Altius Resources Inc., a wholly-owned

subsidiary or Altius Minerals Corporation

(“Altius”), pursuant to which LUR has agreed to

acquire from Altius a 100% interest in the Central Mineral Belt

Uranium-Copper Project (the “CMB Project”) and the

Notakwanon project (the “Notakwanon Project”

together, the “Altius Projects”), both located in

Labrador (the “Altius Transaction”).

Transaction Highlights:

-

Labrador Uranium Formed as New Entrant into Resurgent

Uranium Market – Purpose built to explore for and develop

uranium in Labrador, it is anticipated to hold a dominant land

position in the Central Mineral Belt of Labrador (the

“CMB”), a well-known uranium and multi-commodity

metal district.

- Moran

Lake Expected to Form Cornerstone Project – Located on the

western side of the CMB, the Moran Lake Project hosts historical

uranium and vanadium mineral resources. LUR intends to focus on

confirming and potentially expanding the known historic mineral

resources as well as exploring the property more generally. See

“Technical Disclosure and Qualified Person” below.

-

Agreement with Altius Expected to Secure Large Land

Position – The ~125,000 hectare CMB Project is located

adjacent to the Moran Lake Project to the east, west and south and

spans to Paladin Energy’s Michelin Project in the east. In

addition, the Notakwanon Project, located in Northern Labrador, is

drill ready with previous evidence of high-grade uranium on

surface.

-

Proposed Spin-Out of Labrador Uranium is an Attempt to

Unlock Value for CUR Shareholders – LUR is being spun out

as a stand-alone, CSE-listed uranium exploration and development

company, with CUR shareholders receiving their pro-rata portion of

the LUR Shares issued to the Company.

-

Experienced Team in Place - Under the leadership

of Stephen Keith as Chief Executive Officer and Philip Williams as

Chairman, the LUR management team and anticipated board of

directors has decades of experience in exploration, development,

and finance, with a significant focus on uranium.

- Summer

2021 Work Programs Completed Setting Up For Active 2022 -

Work programs completed this summer at the Moran Lake Project and

the CMB Project included: collecting and analysing data from

decades of historical exploration work on the CMB Project by

previous owners and government programs and field work to verify

the >140 targets generated by this data collection and analysis.

Results pending from this work are expected to be used in designing

an aggressive field exploration program for 2022.

Philip Williams,

President and CEO of CUR, commented “We are pleased to be

announcing the partnership with Altius in the formation of Labrador

Uranium. We believe that the Central Mineral Belt is an important

uranium camp in Canada, which has tremendous exploration potential

for uranium and other metals. As CUR focuses on near-term

production in the United States, we determined that repositioning

the Moran Lake Project as a part of a larger, Labrador-focused

exploration portfolio would be the best way to unlock value for our

shareholders. We liken this transaction to the original IPO of

Aurora Energy in 2006 whose main asset was the Michelin Project.

That company garnered a peak market cap of over $1.3b in 2007 and

was ultimately taken over by Paladin Energy in 2011.”

Stephen Keith, CEO of

LUR commented “I am looking forward to working with such an

experienced team on this exciting new uranium exploration vehicle.

LUR is expected to have all the underpinnings of a dynamic and

successful new player in the resurgent uranium sector; a dominant

land position in a prolific camp, historic mineral resources,

backing by key uranium and mining industry players in CUR and

Altius, and a strong team in place with significant uranium

exploration, development and finance experience. Exploration

success is driven by strong teams and quality assets. Combining the

excellent work completed by, and historical successes of, these

companies give me great confidence in the future of Labrador

Uranium. I plan on hitting the ground running with the benefit of

recently completed work programs on the projects. These programs

have already generated over 140 targets setting the stage for an

aggressive 2022 exploration season”.

Moran Lake Option Exercise

On October 17, 2021, CUR provided notice to the

vendor of the Moran Lake Project that it has exercised the option

to acquire the Moran Lake Project, for total consideration of

$1,000,000 with $500,000 to be satisfied through the issuance of

191,570 common shares of CUR (“CUR Shares”), at a

deemed price of $2.61 per CUR Share based on the five-day volume

weighted average price of the CUR Shares up to October 15, 2021 and

$500,000 in cash. In addition, the vendor will be entitled to

receive certain future payments contingent upon the attainment of

certain milestones tied to the spot price of uranium, as further

described in the Company’s press release dated November 18,

2020.

In accordance with the terms of the Option

Agreement, the vendor will be granted a 1.5% net smelter returns

royalty (the “Moran Lake

Royalty”) from the sale of the mineral products

extracted or derived from the Moran Lake Project by CUR, which will

be transferred to LUR in connection with the Arrangement. CUR shall

have the right and option to purchase 0.5% of the Moran Lake

Royalty for a price equal to $500,000, which CUR intends to retain

following the transfer of the Moran Lake Project to LUR pursuant to

the Arrangement.

All CUR securities

issued in connection with the Option Agreement are subject to final

approval of the TSX Venture Exchange (the “TSXV”)

and will be subject to a hold period expiring four months and one

day from the applicable date of issuance.

The

Arrangement Agreement

Pursuant to the

Arrangement Agreement, among other things, CUR has agreed to

transfer the Moran Lake Project to LUR in exchange for 16,000,000

LUR Shares. Under the terms of the Arrangement, the CUR

shareholders will receive the LUR Shares on a pro-rata basis based

on the number of CUR Shares held at the effective date of the

Arrangement. There will be no change in CUR shareholders'

proportionate ownership in CUR as a result of the Arrangement. In

addition, holders of options and warrants of CUR as of the

effective date of the Arrangement will have such securities

adjusted in accordance with their terms as a result of the

Arrangement.

The Arrangement will

be effected by way of a court-approved plan of arrangement under

the Business Corporations Act (Ontario). The Arrangement will be

subject to regulatory approval, including the approval of the TSXV,

court approval, conditional approval from the CSE for the Listing,

as well as approval by not less than two-thirds of the votes cast

at the special meeting (the “Meeting”) of the CUR

shareholders, anticipated to be held in the first quarter of 2022.

Full details of the Arrangement will be included in the management

information circular to be sent to CUR shareholders in connection

with the Meeting.

It is anticipated that

the Arrangement and Listing will be completed in the first quarter

of 2022.

The Altius Agreements

On October 17, 2021, the Company and Labrador

Uranium entered into the Altius Agreement with Altius pursuant to

which LUR has agreed to acquire the Altius Projects from Altius in

exchange for 8,000,000 LUR Shares and a 2% gross overriding royalty

on the CMB Project. Completion of the Altius Transaction is subject

to certain closing conditions including, among other things,

completion of the Arrangement and the conditional approval from the

CSE for the Listing.

In the event that the Arrangement and Listing

are not completed, Altius has the right (the “Put

Right”) to require CUR to acquire the Altius Projects in

exchange for $3,000,000 to be satisfied by the issuance of CUR

Shares based on the volume weighted average price of the CUR Shares

at the time of the exercise of the Put Right, subject to approval

of the TSXV. In the event that the Put Right is not exercised by

Altius, CUR has the right to acquire the Altius Projects on the

same terms and conditions as the Put Right, subject to approval of

the TSXV. Any CUR securities issued in connection with the Altius

Transaction are subject to final approval of the TSXV and will be

subject to a hold period expiring four months and one day from the

applicable date of issuance.

Additionally, Altius, LUR and CUR have agreed on

an area of interest whereby the two companies will work together in

generating new targets and claims to bring to LUR.

In connection with closing of the Altius

Transaction, LUR and Altius have agreed to enter into an investor

rights agreement pursuant to which, for so long as Altius’ equity

ownership in LUR remains at or above 10%, Altius will be entitled

to equity participation rights to maintain its pro rata equity

ownership in LUR. Altius has also agreed to certain resale

restrictions on the LUR Shares it will hold and to provide voting

support in certain circumstances.

About Labrador Uranium Inc.

Management and Board of

Directors

- Stephen Keith

P.Eng, Chief Executive Officer

- Experienced

engineer, investment banker and executive with over 20 years in the

natural resources industry.

- Lead Director

of Aura Minerals Inc., Director of Sterling Metals Corp.

- Previous

positions include President and CEO of several public companies,

including Rio Verde Minerals Development Corp., which Mr. Keith

co-founded and took from a small private company, making several

acquisitions and a public listing on the Toronto Stock Exchange

through to its eventual sale to one of Brazil’s largest private

equity firms.

- Greg Duras,

Chief Financial Officer

- Over 10 years

of corporate and project finance experience in the resource

sector.

- Currently the

CFO of Consolidated Uranium

- Previous

positions include, VP of Finance and Administration at S.C. Rosia

Montana Gold Corporation S.A. (RMGC) as well as Controller of

TSX-listed Gabriel Resources Ltd. and High River Gold Mines

Ltd.

- Philip Williams

CFA, Chairman

- Over 20 years

of mining and finance industry experience.

- Currently the

President, CEO & Chairman of Consolidated Uranium.

- Extensive

uranium and metals and mining experience in corporate development,

as a sell-side research analyst, in fund management, investment

banking.

The Projects

Moran Lake Project (Uranium-Vanadium)

The Moran Lake Project is an advanced-stage

exploration project located within the Central Mineral Belt

of Labrador, approximately 140 km north of the town

of Happy Valley-Goose Bay and 85 km southwest of the

coastal community of Postville on Kaipokok Bay. Access to

the property is by helicopter and float plane out of Goose Bay.

Uranium was first

discovered near Moran Lake by British Newfoundland Exploration

Limited (Brinex) who conducted prospecting, geological mapping and

radiometric surveying in the area from 1956 to 1958. The uranium

mineralization is structurally controlled, typically hosted within

fracture systems and to a lesser extent within shear zones. In

outcrop, it is clear that local faulting, brecciation and

alteration, all of uncertain age, are associated with the U-Cu

mineralization at the Moran Lake C Zone. The mineralization is

epigenetic and occurs in mafic volcanics of the Joe Pond Formation,

Moran Lake Group, as well as in overlying sedimentary rocks of the

Heggart Lake Formation, Bruce River Group.

Uranium mineralization

at the C Zone mainly occurs in two distinct zones, referred to as

the Upper C (“UC”) and Lower C

(“LC”). Mineralization in the UC is hosted within

brecciated, hematite altered and/or bleached mafic volcanics and

hematitic cherts of the Joe Pond Formation, while mineralization in

the structurally underlying LC is hosted predominantly within

chloritized (reduced) sandstones of the Heggart Lake Formation. The

UC also contains vanadium mineralization hosted mainly by hematized

and brecciated mafic volcanic rocks of the Joe Pond Formation and

brecciated gabbro or diabasic intrusives. In many areas, the

vanadium concentration is directly proportional to the intensity of

hematization and brecciation. The occurrence of vanadium

mineralization may coincide with, but is not restricted to, zones

of uranium mineralization.

In January

2011 (revised March 2011), Crosshair Exploration &

Mining Corp. published a report entitled “Technical Report on the

Central Mineral Belt (CMB) Uranium – Vanadium

Project, Labrador, Canada”, which includes the mineral

resource estimate set out in the table below for the C Zone. This

mineral resource estimate is considered to be a “historical

estimate” as defined under NI 43-101 – Standards of Disclosure for

Mineral Projects (“NI 43-101”). A Qualified Person

has not done sufficient work to classify the historical estimate as

a current mineral resource, and CUR is not treating the historical

estimate as a current mineral resource. An updated technical report

in prepared in accordance with NI 43-101 is underway and is

expected to be completed in the fourth quarter of 2021. See below

under “Technical Disclosure and Qualified Person”.

|

Indicated Vanadium Resources Within Uranium

Resource |

|

U3O8 |

Tonnes > |

Grade > Cutoff |

Contained Million |

|

Cutoff (%) |

Cutoff (tonnes) |

U3O8 (%) |

V2O5 (%) |

Pounds (U3O8) |

Pounds (V2O5) |

|

0.015 |

6,920,000 |

0.034 |

0.078 |

5.19 |

11.9 |

|

Inferrred Vanadium Resources Within Uranium

Resource |

|

Upper C Zone |

|

|

|

|

|

U3O8 |

Tonnes > |

Grade > Cutoff |

Contained Million |

|

Cutoff (%) |

Cutoff (tonnes) |

U3O8 (%) |

V2O5 (%) |

Pounds (U3O8) |

Pounds (V2O5) |

|

0.015 |

5,320,000 |

0.024 |

0.089 |

2.84 |

10.44 |

|

Indicated Vanadium Resources Within Uranium

Resource |

|

Lower C Zone |

|

|

|

|

|

U3O8 |

Tonnes > |

Grade > Cutoff |

Contained Million |

|

Cutoff (%) |

Cutoff (tonnes) |

U3O8 (%) |

V2O5 (%) |

Pounds (U3O8) |

Pounds (V2O5) |

|

0.035 |

1,450,000 |

0.05 |

0.058 |

1.6 |

1.85 |

|

Indicated Vanadium Resources Outside of Uranium

Resource |

|

V2O5 Cutoff (%) |

Tonnes > Cutoff (tonnes) |

V2O5 (%) |

Million Pounds (V2O5) |

|

0.15 |

7,790,000 |

0.18 |

30.92 |

|

Inferred Vanadium Resources Outside of Uranium

Resource |

|

V2O5 Cutoff (%) |

Tonnes > Cutoff (tonnes) |

V2O5 (%) |

Million Pounds (V2O5) |

|

0.15 |

21,570,000 |

0.171 |

81.33 |

CMB Project (Uranium and Other Metals)

The CMB Project comprises ~125,000 hectares

covering a significant portion of the Central Mineral Belt in

Labrador. There are several known uranium prospects along the CMB

which have been identified over decades of historical work in the

region. To date, LUR, in combination with Altius, CUR and its

advisors, has generated more than 140 targets meriting further

exploration work.

We believe the CMB is a globally significant

Copper and Uranium region. It is an approximately 260 km long by 75

km wide belt endowed with hundreds of copper, uranium, silver,

gold, REE, iron and molybdenum showings. It overlies the junction

of four major geological provinces and affected by major magmatic

and orogenic events. Originally recognized for its copper

potential, copper exploration was mostly displaced in favour of

uranium in the early 2000s. This land package contains numerous

occurrences of copper, gold, silver, uranium, iron and REEs, with

copper, gold and magnetite content showing a strong positive

correlation. Uranium occurs with hematite and/or albite

dominant alteration, in breccias or along shear zones.

Notakwanon Project (Uranium)

Located in northern Labrador, approximately 60 km west of the

Labrador coast, the Notakwanon Project straddles the Churchill and

Nain Provinces boundary. The Notakwanon Project is accessible by

float plane or helicopter from Hopedale, Nain or Happy Valley-Goose

Bay.

Previous exploration has identified a cluster of uranium

prospects with greater than 20 occurrences. Three main zones with

traces of high-grade uranium mineralization have been identified.

These historical exploration results include:

- Rumble: Grab

samples have returned values of up to 3.49% U3O8 and saw-cut

channel samples have yielded up to 0.48% U3O8 over 2.5 metres.

- Old School: Grab

samples have yielded up to 2.08% U3O8.

- Notak-1: Grab

samples have yielded up to 1.81% U3O8

Overall, the Notakwanon prospect is an untested, drill-ready,

multi-target project with similarities to basement-style uranium

deposits.

Technical

Disclosure and Qualified Person

The scientific and technical information

contained in this news release was reviewed and approved by Peter

Mullens (FAusIMM), CUR’s VP Business Development, who is a

“Qualified Person” (as defined in NI 43-101).

The mineral resource estimate contained in this

presentation is considered to be a “historical estimate” as defined

under NI 43-101, and has been derived from a report entitled

“Technical Report on the Central Mineral Belt (Cmb) Uranium –

Vanadium Project, Labrador, Canada” dated January 20, 2011 as

revised March 10, 2011 prepared for Crosshair Exploration &

Mining Corp. The historical estimate was prepared by C. Stewart

Wallis P. Geo, Barry A. Sparkes, P. Geo., Gary H. Giroux, P. Eng.

(Qualified Person) using three-dimensional block models utilizing

ordinary kriging to interpolate grades into each 10m x 10m x 4m

high block. For the purpose of the vanadium mineral resource

estimate, a vanadium specific model was created in the Upper C rock

package above the C Zone thrust fault. The vanadium model is based

on a wireframe solid defining the vanadium mineralized envelope

using an external cut-off of approximately 0.1% V2O5. For the

purposes of the estimates, a specific gravity of 2.83 was used.

A Qualified Person has not done sufficient work

to classify the historical estimate as a current mineral resource,

and CUR is not treating the historical estimate as a current

mineral resource. The Company would need to conduct an exploration

program, including twinning of historical drill holes in order to

verify the Moran Lake historical estimate as a current mineral

resource.

About Consolidated Uranium

Inc.

Consolidated Uranium Inc. (TSXV: CUR) (OTCQB:

CURUF) was created in early 2020 to capitalize on an anticipated

uranium market resurgence using the proven model of diversified

project consolidation. To date, the company has acquired or has the

right to acquire uranium projects in Australia, Canada, Argentina

and the United States each with significant past expenditures and

attractive characteristics for development. Most recently, the

Company entered a transformational strategic acquisition agreement

and alliance with Energy Fuels Inc (NYSE American: UUUU) (TSX:

EFR), a leading U.S.-based uranium mining company, to acquire a

portfolio of permitted, past-producing conventional uranium and

vanadium mines in the Utah and Colorado. These mines are currently

on stand-by, ready for rapid restart as market conditions permit,

positioning CUR as a near-term uranium producer.

Philip Williams

President and CEO+1 778 383

3057pwilliams@consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information.

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. “Forward-looking information” includes, but is not

limited to, statements with respect to the completion of the

Arrangement and the Altius Transaction; the anticipated timing of

the Meeting, closing of the Arrangement and the Listing; the

anticipated timing of a technical report on the Moran Lake project.

the anticipated benefits of the Arrangement for CUR shareholders;

the satisfaction or waiver of the closing conditions set out in the

Arrangement Agreement and the purchase agreement for the Altius

Projects, including receipt of all regulatory approvals; the field

exploration program anticipated for 2022; the anticipated

management team and board of directors of LUR; and the satisfaction

final approval of the Agreement by the TSX Venture Exchange and

other activities, events or developments that the Company expects

or anticipates will or may occur in the future. Generally, but not

always, forward-looking information and statements can be

identified by the use of words such as “plans”, “expects”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates”, or “believes” or the negative connotation

thereof or variations of such words and phrases or state that

certain actions, events or results “may”, “could”, “would”, “might”

or “will be taken”, “occur” or “be achieved” or the negative

connotation thereof. Such forward-looking information and

statements are based on numerous assumptions, including the ability

of the parties to receive, in a timely manner and on satisfactory

terms, the necessary regulatory, court and shareholder approvals;

the ability of the parties to satisfy, in a timely manner, the

other conditions to the completion of the Arrangement, the Listing

and the Altius Transaction; that general business and economic

conditions will not change in a material adverse manner, that

financing will be available if and when needed and on reasonable

terms, and that third party contractors, equipment and supplies and

governmental and other approvals required to conduct the Company’s

planned exploration activities will be available on reasonable

terms and in a timely manner. Although the assumptions made by the

Company in providing forward-looking information or making

forward-looking statements are considered reasonable by management

at the time, there can be no assurance that such assumptions will

prove to be accurate.

Forward-looking information and statements also

involve known and unknown risks and uncertainties and other

factors, which may cause actual events or results in future periods

to differ materially from any projections of future events or

results expressed or implied by such forward-looking information or

statements, including, among others: the diversion of management

time on Transaction-related issues; expectations regarding negative

operating cash flow and dependence on third party financing,

uncertainty of additional financing, no known mineral reserves or

resources, reliance on key management and other personnel,

potential downturns in economic conditions, actual results of

exploration activities being different than anticipated, changes in

exploration programs based upon results, and risks generally

associated with the mineral exploration industry, environmental

risks, changes in laws and regulations, community relations and

delays in obtaining governmental or other approvals.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to update or reissue

forward-looking information as a result of new information or

events except as required by applicable securities laws.

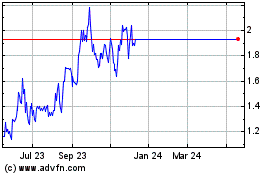

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Feb 2025 to Mar 2025

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Mar 2024 to Mar 2025