Entourage Health Corp. (

TSX-V:

ENTG) (

OTCQX: ETRGF)

(

FSE:4WE) “

Entourage” or the

“

Company,” a Canadian producer and distributor of

award-winning cannabis products, today announced its financial

results for the three months and six months ending June 30, 2024.

The Company reported a total revenue of $12.2 million (net revenue

of $9.3 million, before excise duties and discounts). The Company

will host a conference call to discuss its financial and business

highlights on Tuesday, August 27, 2024, at 10 a.m. Eastern Time.

“Overall, our year-to-date performance aligns

with our expectations and prior achievements. As we move into Q3

and beyond, we are optimistic about the opportunities ahead,” said

George Scorsis, CEO and Chair. “This quarter, we focused on the

launch of new products and offerings under all our Entourage

Brands. The expansion of Dime Bag resulted in significant traction,

achieving over 90% distribution in Ontario. We remain dedicated to

bringing variety to our consumers and are confident that these

efforts will drive improved financial results as we progress

through the year.”

Summary of

Results

|

For the Quarter-Ended |

|

June 30, 2024 |

|

June 30, 2023 |

|

| |

|

($000’s) |

|

($000’s) |

|

| Total revenue |

|

12,218 |

|

13,365 |

|

| *Net revenue (less

Excise Tax) |

|

9,263 |

|

10,174 |

|

| Gross profit

before changes in fair value |

|

720 |

|

2,151 |

|

| Gross margin %

before changes in fair value |

|

8% |

|

21% |

|

| Loss and

comprehensive loss |

|

(10,325) |

|

(9,572) |

|

|

EBITDA** |

|

(3,238) |

|

(3,513) |

|

|

|

|

|

|

|

As at |

|

June 30, 2024 |

|

December 31, 2023 |

|

| |

|

($000’s) |

|

($000’s) |

|

| Cash and cash

equivalents |

|

2,694 |

|

11,254 |

|

| Inventory |

|

11,157 |

|

10,010 |

|

| Working

capital |

|

(163,248) |

|

(146,909) |

|

*Net revenue defined as revenue (i.e., gross

revenue less discounts and customer incentives but inclusive of

freight) less excise taxes** EBITDA is not a recognized measurement

under International Financial Reporting Standards (IFRS), and this

data may not be comparable to data presented by other companies.

Management defines EBITDA as adjusted to exclude interest, tax,

depreciation, stock compensation, fair value changes and other

non-cash items, and non-recurring items. This data is furnished to

provide additional information and does not have any standardized

meaning prescribed by IFRS. The Company uses this non-IFRS measure

to provide shareholders and others with supplemental measures of

its operating performance. The Company also believes that

securities analysts, investors, and other interested parties

frequently use this non-IFRS measure in evaluating companies, many

of which present similar metrics when reporting their results. As

other companies may calculate EBITDA differently than the Company,

this metric may not be comparable to similarly titled measures

reported by other companies. We caution readers that EBITDA should

not be substituted for determining net loss as an indicator of

operating results or as a substitute for cash flows from operating

and investing activities. See the Company management's discussion

and analysis for the three and six months ended June 30, 2024 (the

“Q2 2024 MD&A”), for a detailed reconciliation of adjusted

EBITDA to net income/(loss). The Company’s financial statements for

the three and six months ended June 30, 2024, and the Q2 2024

MD&A are available on SEDAR+ at www.sedarplus.ca.

“We have achieved stability despite a

challenging environment, highlighting the resilience of our

business model and the strength of our long-term strategy,” said

Vaani Maharaj, CFO. “Although Q2 presented its share of market

fluctuations, our steady performance over the past six months

demonstrates our commitment to overcoming these obstacles. As we

move forward, our focus on execution and capital efficiency will be

key to driving future growth and success.”

Revenue Highlights

|

|

|

Q2 2024 |

|

Q2 2023 |

|

Change YOY |

|

| |

|

($000’s) |

|

($000’s) |

|

% |

|

| Net Revenue by

Channel |

|

|

|

|

|

|

| Medical |

|

4,141 |

|

4,163 |

|

(1%) |

|

| Adult use |

|

4,104 |

|

5,786 |

|

(29%) |

|

| Bulk |

|

1,018 |

|

225 |

|

351% |

|

|

Total Net Revenue |

|

9,263 |

|

10,174 |

|

(9%) |

|

| |

|

|

|

|

|

|

|

Financial Highlights

- Entourage realized total revenues

of $12.2 million and $28.6 million for the three and six months

ended June 30, 2024. Despite a slight decrease of approximately 9%

in the most recent quarter, the overall six-month performance

remains consistent with the previous period, reflecting stable

operational performance and sustained revenue generation over the

six-month period.

- For the three and six months ended

June 30, 2024, the Company reported gross profit before changes in

fair value of $0.7 million, 8% of net revenue and $6.5 million, 30%

of net revenue, respectively. This compares to $2.1 million, 21% of

net revenue and $5.1 million, 23% of net revenue for the same

periods in the prior year.

- For the three months ended June 30,

2024, cost of goods sold (COGS) increased by 6% to $8.5 million

from $8.0 million in the prior year. For the six months ended June

30, 2024, COGS decreased by 8% to $15.4 million from $16.8 million,

mainly due to a reduction in provisions and write-downs, reflecting

better inventory management.

- During the three and six months

ended June 30, 2024, EBITDA increased by $274,701 or 8% to $3.2

million and $11.7 million or 159% to $4.3 million, compared to the

same periods in 2023.

Corporate Highlights During and After

the Second Quarter of 2024

- The Company announced in August

that it was in breach of certain financial covenants and other

obligations under each of its Senior Credit Agreement and

Subordinated Credit agreements with an affiliate of the LiUNA

Pension Fund of Central and Eastern Canada

(“LPF”). The Company is working collaboratively

with LPF to agree on amended debt terms. As a positive step

forward, the Company received a renewed forbearance letter dated

August 2, 2024, waiving the Company’s breaches until October 8,

2024, subject to the satisfaction or waiver of certain

conditions.

Operational and Commercial

Highlights

- Increased Production

Capacity: Entourage increased production to over 2.0

million monthly pre-rolls.

- Product Launches in

Alberta: During the second quarter, the Company introduced

six new products under Entourage Brands, including expanding 7g

flower and launching two new Color 10-pack SKUs: Sour Grapefruit

Haze and Pedro's Prima.

- Ontario Launches:

Entourage Brands rolled out three new products in Ontario,

highlighted by the launch of the latest Color Cannabis cultivar,

Pedro's Prima, a descendant of the popular Pedro's Sweet Sativa.

Additionally, Saturday introduced the Sour Blueberry-infused XL

blunt.

- Expansions in British

Columbia: In B.C., the Company launched four new SKUs,

including the expansion of Color Cannabis live resin pre-rolls and

two new 10-packs: Sour Grapefruit Haze and Phantom Sunset, now

available in over 50% of B.C.'s retail outlets.

- Dime Bag Growth in

Ontario: Dime Bag continued its strong performance in

Ontario, achieving quarter-over-quarter sales growth and reaching a

distribution milestone of over 90% coverage.

- Starseed

Medicinal: The successful launch of two new dried flower

products, Lemon Octane and Pineapple God, gained significant

traction, becoming popular choices among the medical patient

population.

Company Outlook

Entourage has demonstrated early successes that

set a strong, positive path for the remainder of 2024. The

Company's strategic initiatives, including the launch of innovative

products, the introduction of large-format offerings, and the

expansion of Saturday's portfolio, are paving the way for growth.

The favourable market response to Dime Bag, with its notable

distribution milestone, highlights the potential to grow market

share in the pre-roll segment.

The Company is strategically focusing on

expanding our distribution channels across Canada, launching

targeted products satisfying diverse consumer preferences, and

forming strategic partnerships to scale operations and meet demand.

By leveraging data-driven market insights, the Company is

well-positioned for sustainable growth and profitability.

Entourage’s focus on innovation, quality, and operational

excellence aims to strengthen the Company’s position within the

industry.

Conference Call Details

A conference call will be hosted by Mr. Scorsis

and Ms. Maharaj, with management available for questions following

opening remarks:

Date: Tuesday, August 27,

2024Time: 10 a.m. Eastern

TimeToll-Free Number: 1-800-267-6316

Conference ID: ETRGFQ2

Webcast:

https://events.q4inc.com/attendee/382521020

Company Update

The Company announced today that, in accordance

with the provisions of its omnibus equity incentive compensation

plan (the "Omnibus Plan"), the Company has

authorized the issuance of an aggregate of 1,200,000 deferred share

units (“DSUs”) to certain members of its Board of Directors as

compensation for services provided in the second quarter of 2024.

The DSUs will vest on June 30, 2025, and are granted in lieu of a

portion of cash compensation for services rendered during the

quarter.

The Company earlier announced on April 24, 2024,

that in accordance with the provisions of its Omnibus Plan, an

aggregate of 1,600,000 DSUs respectively were issued to the Board

of Directors of the Company as compensation for services for the

fourth quarter of 2023 and the first quarter of 2024 with vesting

dates of December 31, 2024, and March 31, 2025, respectively. The

Company wishes to clarify that the sum of 1,331,507 DSUs were

issued to certain members of the Board of Directors as compensation

for their services for the first quarter of 2024 and not 1,600,000

DSUs. 131,507 DSUs vest on January 30, 2024, and 1,200,000 DSUs

vest on March 31, 2025.

About Entourage Health

Corp. Entourage Health Corp. is the publicly traded

parent Company of Entourage Brands Corp., a licence holder

producing and distributing cannabis products for the medical and

adult-use markets. The Company owns and operates a fully licensed

26,000 sq. ft. Aylmer, ON processing facility. With its Starseed

Medicinal medical-centric brand, Entourage has expanded its

multi-channelled distribution strategy. Starseed's industry-first,

exclusive partnership with LiUNA, the largest construction union in

Canada, along with employers and union groups, complements

Entourage's direct sales to medical patients. Entourage's elite

adult-use product portfolio includes Color Cannabis, Saturday

Cannabis – and now Dime Bag and Syndicate – sold across eight

provincial distribution agencies. Exclusive Canadian producer and

distributor of award-winning U.S.-based wellness brand Mary's

Medicinals, sold in both medical and adult-use channels. In

addition, Entourage also entered into an exclusive agreement with

Irwin Naturals, a renowned nutraceutical and herbal supplement

formulator of branded wellness products sold across North

America.

Follow Entourage and its brands on:

LinkedIn

Instagram: Color Cannabis,

Saturday Cannabis, Starseed &

Syndicate

For additional information or investor or media

inquiries:Catherine FlamanSenior Director, Communications

& Corporate

Affairs416-910-0279catherine.flaman@entouragecorp.com

Forward Looking Information

This press release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation which are based upon Entourage's current internal

expectations, estimates, projections, assumptions and beliefs and

views of future events. Forward-looking information can be

identified using forward-looking terminology such as "expect",

"likely", "may", "will", "should", "intend", "anticipate",

"potential", "proposed", "estimate" and other similar words,

including negative and grammatical variations thereof, or

statements that certain events or conditions "may", "would" or

"will" happen, or by discussions of strategy.

The forward-looking information in this news

release is based upon the expectations, estimates, projections,

assumptions, and views of future events which management believes

to be reasonable in the circumstances. Forward-looking information

includes estimates, plans, expectations, opinions, forecasts,

projections, targets, guidance, or other statements that are not

statements of fact. Forward-looking information necessarily involve

known and unknown risks, including, without limitation, risks

associated with general economic conditions; adverse industry

events; loss of markets; future legislative and regulatory

developments; inability to access sufficient capital from internal

and external sources, and/or inability to access sufficient capital

on favourable terms; the cannabis industry in Canada generally; the

ability of Entourage to implement its business strategies;

competition; crop failure; and other risks.

Any forward-looking information speaks only as

of the date on which it is made, and, except as required by law,

Entourage does not undertake any obligation to update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise. New factors emerge from

time to time, and it is not possible for Entourage to predict all

such factors. When considering this forward-looking information,

readers should keep in mind the risk factors and other cautionary

statements in Entourage’s disclosure documents filed with the

applicable Canadian securities' regulatory authorities on SEDAR+ at

www.sedarplus.ca The risk factors and other factors noted in

the disclosure documents could cause actual events or results to

differ materially from those described in any forward-looking

information.

Third Party Information

This press release includes market and industry

data that has been obtained from third party sources, including

industry publications. The Company believes that the industry data

is accurate and that its estimates and assumptions are reasonable,

but there is no assurance as to the accuracy or completeness of

this data. Third party sources generally state that the information

contained therein has been obtained from sources believed to be

reliable, but there is no assurance as to the accuracy or

completeness of included information. Although the data is believed

to be reliable, the Company has not independently verified any of

the data from third party sources referred to in this press release

or ascertained the underlying economic assumptions relied upon by

such sources.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

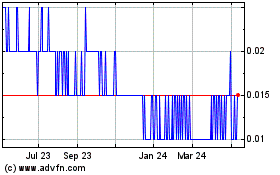

Entourage Health (TSXV:ENTG)

Historical Stock Chart

From Feb 2025 to Mar 2025

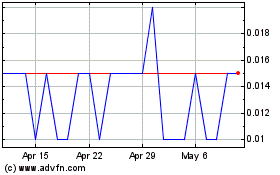

Entourage Health (TSXV:ENTG)

Historical Stock Chart

From Mar 2024 to Mar 2025