Anfield Energy Inc. (TSX.V: AEC; OTCQB: ANLDF; FRANKFURT:

0AD) (“

Anfield” or the

“

Company”) is pleased to announce, further to its

news release of June 6, that it has completed the acquisition (the

“

Transaction”) of Neutron Energy, Inc.

(“

Neutron”), a wholly-owned subsidiary of enCore

Energy Corp. (NYSE American: EU; TSXV: EU) (“

enCore”), which holds the Marquez-Juan Tafoya

uranium project (“

Juan Tafoya”) located in the

Grants Uranium Mineral District, 50 miles west-northwest of

Albuquerque, New Mexico.

Corey Dias, Anfield’s CEO commented: “We are

pleased to complete the acquisition of the Marquez-Juan Tafoya

Uranium Project as it both reinforces our acquisition strategy

whereby we pursue advanced uranium and or vanadium projects.

Moreover, the addition of Marquez-Juan Tafoya - now our

largest-single uranium project, in terms of resource size -

significantly expands our uranium resource base.

“With a global nuclear renaissance underway, we

believe that our pursuit of advanced uranium deposits that will

facilitate near-term uranium production is critical at this time as

the global uranium supply deficit continues to grow. As Kazakhstan

pivots East to support China in its robust nuclear growth plans, an

important piece of US utility uranium supply is increasingly at

risk. This scenario highlights an unquestionable opportunity for

uranium producers in the US.

“To that end, we will continue to advance both

our near-term strategy, which centers on our advanced Utah and

Colorado uranium and vanadium projects – Velvet Wood, West Slope

and Slick Rock – underpinned by our wholly-owned Shootaring Canyon

mill, one of only three licensed conventional mills in the U.S. and

our longer-term production strategy, which includes the acquisition

of complementary assets with potential to feed additional uranium

and vanadium resource to our Shootaring Canyon mill. We believe

that Marquez-Juan Tafoya will both complement our existing

portfolio of assets and serve as part of our longer-term uranium

production strategy.”

As consideration for the acquisition of Neutron,

the Company has issued 185,000,000 common shares (the

“Consideration Shares”) to enCore and has agreed

to pay C$5,000,000 in cash (the “Consideration

Payment”). Pursuant to an agreement reached with enCore,

C$4,000,000 of the Consideration Payment was made at closing, with

the balance due and owing on or before September 25, 2023. The

Company has also granted enCore the right to nominate one director

to the board of the Company, to serve so long as enCore continues

to hold at least 10% of the outstanding shares of the Company.

During this time, enCore has agreed to vote the Consideration

Shares in support of any decisions made by management of the

Company. Eugene Spiering has been appointed to the board of

directors of the Company as the initial nominee of enCore.

The Company is at arms-length from enCore and

Neutron. The Consideration Shares are subject to statutory

restrictions on resale until November 20, 2023 in accordance with

applicable securities laws. No finders’ fees or commissions are

owing by the Company in connection with the Transaction. For

further information regarding Juan Tafoya, readers are encouraged

to review the news release issued by the Company on June 6,

2023.

About Anfield

Anfield is a uranium and vanadium development

and near-term production company that is committed to becoming a

top-tier energy-related fuels supplier by creating value through

sustainable, efficient growth in its assets. Anfield is a publicly

traded corporation listed on the TSX-Venture Exchange (AEC-V), the

OTCQB Marketplace (ANLDF) and the Frankfurt Stock Exchange (0AD).

Anfield is focused on its conventional asset centre, as summarized

below:

Arizona/Utah/Colorado – Shootaring Canyon Mill

A key asset in Anfield’s portfolio is the

Shootaring Canyon Mill in Garfield County, Utah. The Shootaring

Canyon Mill is strategically located within one of the historically

most prolific uranium production areas in the United States, and is

one of only three licensed uranium mills in the United States.

Anfield’s conventional uranium assets consist of

mining claims and state leases in southeastern Utah, Colorado, and

Arizona, targeting areas where past uranium mining or prospecting

occurred. Anfield’s conventional uranium assets include the

Velvet-Wood Project, the Slick Rock Project, the West Slope

Project, the Frank M Uranium Project, as well as the Findlay Tank

breccia pipe. A combined NI 43-101 PEA has been completed for the

Velvet-Wood and Slick Rock Projects. The PEA is preliminary in

nature, and includes inferred mineral resources that are considered

too speculative geologically to have economic considerations

applied to them that would enable them to be categorized as mineral

reserves and, resultantly, there is no certainty that the included

preliminary economic assessment would be realized. All conventional

uranium assets are situated within a 200-mile radius of the

Shootaring Mill.

Technical Disclosure

Table 1. Anfield’s existing conventional

uranium-vanadium project portfolio resources.

|

Project |

Location |

Classification |

Tons (kt) |

UraniumGrade(%

U3O8) |

ContainedUranium(Mlbs

U3O8) |

VanadiumGrade(%

V2O5) |

ContainedVanadium(Mlbs

V2O5) |

|

Velvet-Wood |

Utah |

M & I |

811 |

0.29 |

% |

4.6 |

- |

|

- |

|

|

|

Inferred |

87 |

0.32 |

% |

0.6 |

0.404 |

% |

7.3 |

|

West Slope |

Colorado |

Indicated |

1,367 |

0.197 |

% |

5.4 |

- |

|

- |

|

|

|

Inferred |

1,367 |

- |

|

- |

0.984 |

% |

26.9 |

|

|

|

Historic* |

630 |

0.31 |

% |

3.9 |

1.59 |

% |

20.0 |

|

Slick Rock |

Colorado |

Inferred |

1,760 |

0.224 |

% |

7.9 |

1.35 |

% |

47.1 |

|

Frank M |

Utah |

Historic* |

1,137 |

0.101 |

% |

2.3 |

- |

|

- |

|

Findlay Tank |

Arizona |

Historic* |

211 |

0.226 |

% |

1.0 |

- |

|

- |

|

Date Creek/Artillery Peak |

Arizona |

Historic* |

2,602 |

0.054 |

% |

2.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Marquez-Juan Tafoya |

New Mexico |

Historic* |

7,100 |

0.127 |

% |

18.1 |

|

|

* The Company’s Qualified Person has not done

sufficient work to classify these historic estimates as current

mineral resources and Anfield is not treating such historical

resources as current mineral resources.

Velvet-Wood: The PEA for Velvet-Wood/Slick Rock

was authored by Douglas L. Beahm, P.E., P.G. Principal Engineer, of

BRS Inc., Harold H. Hutson, P.E., P.G., Carl D. Warren, P.E., P.G.,

and Terence P. (Terry) McNulty, P.E., D. Sc., of T.P. McNulty and

Associates Inc. (May 6, 2023). Mineral resources are not mineral

reserves and do not have demonstrated economic viability in

accordance with CIM standards. GT cut-off varies by locality from

0.25%-0.50%.

West Slope: NI 43-101 resource estimate for the

JD-6, JD-7, JD-8 and JD-9 properties, completed by BRS Inc.

(effective March 2022); Historic resource estimate for the SR-11,

SR-13A, SM-18 N, SM-18 S, LP-21 and CM-25 properties, completed by

Behre Dolbear for Cotter Corporation (August 2007). Indicated and

Inferred resources using GT cut-off of 0.1 ft% eU3O8; historic

resources using cut-off of 0.05% U3O8.

Slick Rock: The PEA for Velvet-Wood/Slick Rock

was authored by Douglas L. Beahm, P.E., P.G. Principal Engineer, of

BRS Inc., Harold H. Hutson, P.E., P.G., Carl D. Warren, P.E., P.G.,

and Terence P. (Terry) McNulty, P.E., D. Sc., of T.P. McNulty and

Associates Inc. (May 6, 2023). Mineral resources are not mineral

reserves and do not have demonstrated economic viability in

accordance with CIM standards. GT cut-off varies by locality from

0.25%-0.50%.

Frank M: Historic Technical Report for Frank M,

prepared for Uranium One Americas, was authored by Douglas L.

Beahm, P.E., P.G. Principal Engineer of BRS Inc., and Andrew C.

Anderson, P.E., P.G. Senior Engineer/Geologist of BRS Inc., dated

June 10, 2008. Frank M historic resource used a GT cut-off of

0.25%.

Findlay Tank: Historic Technical Report for

Findlay Tank, prepared for Uranium One Americas, was authored by

Douglas L. Beahm, P.E., P.G. Principal Engineer of BRS Inc., dated

October 2, 2008. Findlay Tank historic resource used a grade

cut-off of 0.05% eU3O8.

Artillery Peak: Artillery Peak Exploration

Project, Mohave County, Arizona, 43-101 Technical Report, authored

by Dr. Karen Wenrich, October 12, 2010. GT cut-off varies by

locality from 0.01%-0.05%.

Marquez-Juan Tafoya: The Historical Technical

Report, Preliminary Economic Assessment, for Marquez-Juan Tafoya,

prepared for Uranium Energy Corporation, was authored by Douglas L.

Beahm, P.E., P.G., Principal Engineer of BRS Inc., and Terence P.

McNulty, P.E., PhD, McNulty & Associates, dated June 9, 2021.

The mineral resources are reported at a 0.60 GT cut-off.

On behalf of the Board of DirectorsANFIELD

ENERGY INC.Corey Dias, Chief Executive Officer

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.Contact:Anfield Energy,

Inc.Clive MostertCorporate

Communications780-920-5044contact@anfieldenergy.comwww.anfieldenergy.com

Safe Harbor Statement

THIS NEWS RELEASE CONTAINS “FORWARD-LOOKING

STATEMENTS”. STATEMENTS IN THIS NEWS RELEASE THAT ARE NOT PURELY

HISTORICAL ARE FORWARD-LOOKING STATEMENTS AND INCLUDE ANY

STATEMENTS REGARDING BELIEFS, PLANS, EXPECTATIONS OR INTENTIONS

REGARDING THE FUTURE.

EXCEPT FOR THE HISTORICAL INFORMATION PRESENTED

HEREIN, MATTERS DISCUSSED IN THIS NEWS RELEASE CONTAIN

FORWARD-LOOKING STATEMENTS THAT ARE SUBJECT TO CERTAIN RISKS AND

UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY

FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR

IMPLIED BY SUCH STATEMENTS. STATEMENTS THAT ARE NOT HISTORICAL

FACTS, INCLUDING STATEMENTS THAT ARE PRECEDED BY, FOLLOWED BY, OR

THAT INCLUDE SUCH WORDS AS “ESTIMATE,” “ANTICIPATE,” “BELIEVE,”

“PLAN” OR “EXPECT” OR SIMILAR STATEMENTS ARE FORWARD-LOOKING

STATEMENTS. RISKS AND UNCERTAINTIES FOR THE COMPANY INCLUDE, BUT

ARE NOT LIMITED TO, THE RISKS ASSOCIATED WITH MINERAL EXPLORATION

AND FUNDING AS WELL AS THE RISKS SHOWN IN THE COMPANY’S MOST RECENT

ANNUAL AND QUARTERLY REPORTS AND FROM TIME-TO-TIME IN OTHER

PUBLICLY AVAILABLE INFORMATION REGARDING THE COMPANY. OTHER RISKS

INCLUDE RISKS ASSOCIATED FUTURE CAPITAL REQUIREMENTS AND THE

COMPANY’S ABILITY AND LEVEL OF SUPPORT FOR ITS EXPLORATION AND

DEVELOPMENT ACTIVITIES. THERE CAN BE NO ASSURANCE THAT THE

COMPANY’S EXPLORATION EFFORTS WILL SUCCEED OR THE COMPANY WILL

ULTIMATELY ACHIEVE COMMERCIAL SUCCESS. THESE FORWARD-LOOKING

STATEMENTS ARE MADE AS OF THE DATE OF THIS NEWS RELEASE, AND THE

COMPANY ASSUMES NO OBLIGATION TO UPDATE THE FORWARD-LOOKING

STATEMENTS, OR TO UPDATE THE REASONS WHY ACTUAL RESULTS COULD

DIFFER FROM THOSE PROJECTED IN THE FORWARD-LOOKING STATEMENTS.

ALTHOUGH THE COMPANY BELIEVES THAT THE BELIEFS, PLANS, EXPECTATIONS

AND INTENTIONS CONTAINED IN THIS NEWS RELEASE ARE REASONABLE, THERE

CAN BE NO ASSURANCE THOSE BELIEFS, PLANS, EXPECTATIONS OR

INTENTIONS WILL PROVE TO BE ACCURATE. INVESTORS SHOULD CONSIDER ALL

OF THE INFORMATION SET FORTH HEREIN AND SHOULD ALSO REFER TO THE

RISK FACTORS DISCLOSED IN THE COMPANY’S PERIODIC REPORTS FILED FROM

TIME-TO-TIME.

THIS NEWS RELEASE HAS BEEN PREPARED BY

MANAGEMENT OF THE COMPANY WHO TAKES FULL RESPONSIBILITY FOR ITS

CONTENTS.

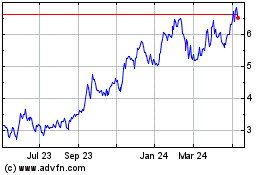

Encore Energy (TSXV:EU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Encore Energy (TSXV:EU)

Historical Stock Chart

From Dec 2023 to Dec 2024