Gossan Receives $350,000 Manigotagan Payment from Claim Post

June 17 2014 - 1:00PM

Marketwired

Gossan Receives $350,000 Manigotagan Payment from Claim Post

WINNIPEG, MANITOBA--(Marketwired - Jun 17, 2014) - Gossan

Resources Limited (TSX-VENTURE:GSS)(FRANKFURT:GSR)

(Frankfurt/Freiverkehr Xetra:WKN 904435) has received a $350,000

cash payment from Claim Post Resources Inc. (TSX-VENTURE:CPS)

pertaining to the sale of its Manigotagan Silica Frac Sand Project,

comprised of 9 quarry leases located near Seymourville, Manitoba.

On June 18, 2013, Gossan agreed to sell the Manigotagan Project to

Claim Post under the terms of a sale agreement. Gossan has

previously received 3,000,000 common shares of Claim Post and the

agreement requires two further cash payments of $350,000 due

December 18, 2014 and $430,000 due June 18, 2015, as well as, a

royalty interest.

An initial annual advance royalty payment of $50,000 becomes

payable as of June 18, 2016, unless the operation has commenced

commercial production resulting in the payment of production

royalties. All frac sand produced, sold and paid from the nine

Manigotagan leases is subject to a $1.00 per tonne production

royalty payable quarterly and all other products are subject to a

$0.50 per tonne production royalty. Although the royalty is solely

payable on production from the Manigotagan leases, the agreement

also provides for a minimum production royalty from both the

Manigotagan and the adjacent Seymourville Property held by Claim

Post, based on their relative remaining mining reserves of frac

sand. Claim Post can acquire one-half of Gossan's production

royalty interest for $1.5 million at any time after making all of

the required property payments.

Claim Post has conducted an independent, NI 43-101 Technical

Report and Resource Estimate on the Seymourville Silica Sand

Project, prepared by P & E Mining Consultants Inc. ('P&E"),

which was filed on SEDAR on June 13, 2014.

In P&E's opinion, the drilling and assaying of the

Seymourville project supporting this resource estimate are

sufficient to indicate reasonable potential for economic extraction

and thus qualify it as a Mineral Resource under CIM definition

standards. The mineral resources were classified as Inferred based

on existing drill hole spacing. The resulting resource estimate is

summarized below:

|

| Table 1.1 Mineral Resource Estimate Statement(1-4) |

|

Tonnes |

|

SiO2 (%) |

|

Al2O3 (%) |

|

Fe2O3 (%) |

|

25,959,000 |

|

94.31 |

|

1.94 |

|

0.91 |

|

(1) |

|

Mineral resources which are not mineral reserves do not have

demonstrated economic viability. The estimate of mineral resources

may be materially affected by environmental, permitting, legal,

title, taxation, socio-political, marketing, or other relevant

issues. |

|

(2) |

|

The quantity and grade of reported Inferred resources in this

estimation are uncertain in nature and there has been insufficient

exploration to define these Inferred resources as an Indicated or

Measured mineral resource and it is uncertain if further

exploration will result in upgrading them to an Indicated or

Measured mineral resource category. |

|

(3) |

|

The mineral resources in this report were estimated using the

Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM

Standards on Mineral Resources and Reserves, Definitions and

Guidelines prepared by the CIM Standing Committee on Reserve

Definitions and adopted by the CIM Council. |

|

(4) |

|

Preliminary screening at SGS labs in Lakefield Ontario

indicates approximately 80% of the sand/clay matrix is in the frac

sand size range of 20 to 140 mesh. |

Mineral resources are not mineral reserves and do not have

demonstrated economic viability. There is no guarantee that all or

any part of the mineral resource will be converted into mineral

reserve. Confidence in the estimate of Inferred mineral resources

is insufficient to allow the meaningful application of technical

and economic parameters or to enable an evaluation of economic

viability worthy of public disclosure at this time.

Douglas Reeson, President of Gossan Resources stated: "Claim

Post's initial NI 43-101 resource calculation has defined an

Inferred Resource of over 25 million tonnes silica sand on the

Manigotogan Silica Frac Sand Project, which if put into production

should provide significant royalty payments over the next two

decades. Gossan also participates in the development of the

Seymourville Project through its equity holdings in Claim

Post."

Claim Post anticipates developing the Seymourville Deposit as a

source of frac sand for use as a proppant in hydraulic fracturing

in the oil and gas industry. The technical report recommends a work

program budgeted at $1,600,000 which includes 80 drill holes to an

average depth of 25 metres, API-ISO and beneficiation testwork, as

well as, preliminary engineering and economic analysis (PEA). On

June 17, 2014, Claim Post announced the closing of a private

placement totaling $1,753,360.

MaryAnn Mihychuk, P.Geo., is a director of Gossan Resources. She

is a qualified person as defined by NI 43-101 and she has reviewed

the technical contents of this news release.

Gossan Resources Limited is engaged in mineral exploration and

development in Manitoba and northwestern Ontario. It has a

well-diversified portfolio of properties hosting gold, platinum

group and base metals, as well as the specialty and minor metals,

vanadium, titanium, tantalum, lithium and chromium. The Company

also has a large deposit of high-purity, magnesium-rich dolomite.

The company trades on the TSX Venture and the Frankfurt/Freiverkehr

& Xetra Exchanges and has 33,170,400 common shares

outstanding.

Neither TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this news

release.

For further information, please bookmark www.gossan.ca.

Gossan Resources LimitedDouglas ReesonChairman & CEO(416)

533-9664info@gossan.cawww.gossan.ca

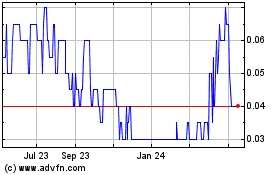

Gossan Resources (TSXV:GSS)

Historical Stock Chart

From Feb 2025 to Mar 2025

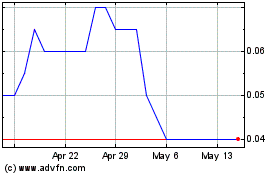

Gossan Resources (TSXV:GSS)

Historical Stock Chart

From Mar 2024 to Mar 2025