HIVE Blockchain Technologies Ltd. (TSX.V:HIVE) (Nasdaq:HIVE)

(FSE:HBFA.F) (the “Company” or “HIVE”) is pleased to announce the

production figures from the Company’s global Bitcoin and Ethereum

mining operations for the month of July 2022, with a BTC HODL

balance of 3,091 Bitcoin and 6,820 Ethereum as of August 4, 2022.

July 2022 Production

Figures

HIVE is pleased to announce its July 2022

production figures and mining capacity:

- 279.9 BTC Produced

- 2.2 Exahash of Bitcoin mining

capacity at beginning of July

- Increased to 2.26 Exahash of

Bitcoin mining capacity during the month of July, with an average

hashrate of 2.03 Exahash of Bitcoin mining capacity during the

month of July

- 2,957 ETH Produced*

- 5.77 Terahash of Ethereum mining

capacity at beginning of July, some miners were taken offline

temporarily for layout optimization due to higher summer

temperatures

- 6.49 Terahash of Ethereum mining

capacity at end of July, with an average hashrate of 6.19 Terahash

of Ethereum mining capacity during the month of July

*The Company’s production of ETH from GPU mining

(including selective optimizations of GPU hashrate) has yielded a

total ETH production of 2,957 ETH.

Frank Holmes, Executive Chairman of HIVE stated,

“In July we produced an average of 15.0 Bitcoin Equivalent per day,

comprised of approximately 9.0 BTC per day and our Ethereum

production of approximately 95 Ethereum per day. We are pleased to

note that as of today, we are producing approximately 10 BTC a day

in addition to approximately 95 Ethereum per day.”

Aydin Kilic, President & COO of HIVE noted,

“We continue to strive for operational excellence, ensuring that as

we scale our hashrate, we also optimize our uptime, to ensure ideal

Bitcoin and Ethereum output figures.” Mr. Kilic continued, “We also

would like to provide an update on the BTC and ETH equivalency,

where one can equate value of the coins produced daily. As such the

ETH that HIVE produced during the month of July, equated on a daily

basis, is approximately equal a monthly total of 185.2 BTC, which

we refer to as Bitcoin Equivalent or BTC Equivalent. This is in

addition to the 279.9 BTC produced from our Bitcoin mining

operations during July, for a total of 465.1 Bitcoin

equivalent”

The Company’s total Bitcoin Equivalent

production in July 2022 was:

- 465.1 BTC Equivalent Produced

- 15.0 BTC Equivalent produced per

day on average

- 3.77 Exahash of BTC Equivalent

Hashrate (BTC hashrate plus equivalent ETH hashrate) as of July

31), with average hashrate of 3.36 Exahash of BTC Equivalent

hashrate throughout July

Ethereum Outlook and

Strategy

The Company acknowledges there has been recent

discussions surrounding the potential Ethereum “Merge” to Proof of

Stake (“PoS”).

With respect to a timeline to PoS, the Company

notes that a specific block for the Ethereum Merge has not been

specified. Until a specific block has been identified and

universally accepted by the Ethereum Foundation, the Company

believes it is indeterminate if or when the Merge will happen. For

comparison, every Bitcoin halving event is at a specifically

prescribed block height (notably, every 210,000 blocks).

HIVE acknowledges there could be execution risk

in implementing a business strategy if Ethereum goes to PoS, and we

believe there will be continued demand for GPU based Proof of Work

(“PoW”) mining. As such, the Company has a strategy in the event

the Merge occurs.

HIVE believes there is intrinsic value in a

broadly decentralized PoW blockchain with Layer 2 smart contracts,

as the majority of such projects exist on the Ethereum blockchain.

If NFT and DeFi developers realize that a secure PoW Layer 1

blockchain is the best playing field for their code-based projects,

there could be an increase in Layer 2 applications on the Ethereum

Classic blockchain, after the Merge.

The Company has already commenced case studies,

analyzing hashrate economics of Ethereum Classic and other GPU

mineable coins at an industrial scale. HIVE has also been

performing GPU optimizations throughout calendar 2022, which are

proprietary and provide the Company with a competitive edge.

If the Merge occurs, the Company expects that

there will be a competitive edge required in technical proficiency

as GPU mining is more involved than ASIC mining. It reasons that

companies or hobby miners who are the best at GPU optimizations,

will prosper. We expect that there will be more algorithmic driven

application of GPU mining, where users may mine several coins. This

will be in addition to the competitive edge miners typically seek

of having the best energy economics, so they have the lowest

operating cost per hash generated. GPU miners will need to have a

low cost of hashing, while also being innovative to drive the

highest yield (revenue) per hash, through optimizations.

GPUs which currently mine Ethereum are only one

facet of HIVE’s operations which complements its fleet of Bitcoin

mining ASICs. HIVE’s GPU fleet is comprised of two types of cards,

our legacy fleet comprised mostly of RX580s, and can be repurposed

for other GPU mineable coins. The second type being our data center

grade cards, namely our Nvidia fleet which we announced last year

when we joined the Nvidia Partner Network; these cards have other

applications in high-performance computing (HPC) applications. HIVE

has been developing a new platform for our data center grade cards

to create new streams of revenue. The Company foresees the creation

of new streams of revenues from GPUs, such as providing HPC

services for rendering, AI, ML, molecular modelling, etc.

New Brunswick Power Costs

HIVE has navigated several months of high energy

prices in New Brunswick (“NB”) at its data center campus, which

have affected all businesses that are customers with interruptible

energy contracts. Mr. Kilic noted “The interruptible energy rates

in New Brunswick have historically been between 3.5 to 4.5 cents

USD per KWHR, based on annual averages over the last decade.” HIVE

also has a portion of the total electrical load in NB as fixed

power at approximately 6 cents per KWHR USD. In the Company’s

fiscal Q4 2022 (January to March 2022), the power rates in NB based

on the Company’s usage (blended fixed and interruptible power) were

approximately 12 cents per KWHR for 46MW of capacity. Mr. Kilic

continued “A benefit of being globally diversified, with 6 data

centers in three countries, HIVE’s other facilities enjoyed power

costs of approximately 3.5 cents per KWHR for approximately 54MW of

operating capacity.” Taking into consideration the average of

HIVE’s global operating costs for electricity, data center staff

and maintenance for all facilities in Q4 2022, the total cost was

approximately 7.5 cents per KWHR USD, based on a global average

operating footprint of 114MW, compared to revenue of $49.8M USD (as

noted in the Company’s audited fiscal 2022 financial statements),

which equates to approximately $0.20 per KWHR. The Company notes

that it was able to profitably mine crypto currencies during these

periods, thus maximizing coin production.

Since then, the Company’s average global

operating costs for electricity, data center staff and maintenance,

in New Brunswick have improved significantly, as the Company has

enacted strategies to avoid high interruptible power prices in NB,

which may include from time to time, reducing consumption during

periods of peak interruptible power. In fiscal Q1 2023 (April to

June 2022), the Company’s average power costs in NB have been 7.4

cents per KWHR USD, utilizing approximately 52MW on average, and

globally operating costs for electricity, data center staff and

maintenance for all facilities is approximately 5.5 cents per KWHR

based on a global average operating footprint of approximately

126MW.

Network Mining Difficulty

The Bitcoin network difficulty decreased 6.5%

during the month of July. The Ethereum network difficulty had a

sudden difficulty decrease of almost 20% at the end of June, which

was followed by a slight and gradual increase of 1.6% during the

month of July. These factors impact our gross profit margins.

About HIVE Blockchain Technologies

Ltd.

HIVE Blockchain Technologies Ltd. went public in

2017 as the first cryptocurrency mining company with a green energy

and ESG strategy.

HIVE is a growth-oriented technology stock in

the emergent blockchain industry. As a company whose shares trade

on a major stock exchange, we are building a bridge between the

digital currency and blockchain sector and traditional capital

markets. HIVE owns state-of-the-art, green energy-powered data

centre facilities in Canada, Sweden, and Iceland, where we source

only green energy to mine on the cloud both Ethereum and Bitcoin.

Since the beginning of 2021, HIVE has held in secure storage the

majority of its ETH and BTC coin mining rewards. Our shares provide

investors with exposure to the operating margins of digital

currency mining, as well as a portfolio of cryptocurrencies such as

ETH and BTC. Because HIVE also owns hard assets such as data

centers and advanced multi-use servers, we believe our shares offer

investors an attractive way to gain exposure to the cryptocurrency

space.

We encourage you to visit HIVE’s YouTube channel

here to learn more about HIVE.

For more information and to register to HIVE’s

mailing list, please visit www.HIVEblockchain.com. Follow

@HIVEblockchain on Twitter and subscribe to HIVE’s YouTube

channel.

On Behalf of HIVE Blockchain Technologies

Ltd.“Frank Holmes”Executive Chairman

For further information please contact:

Frank HolmesTel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this news release

Forward-Looking

Information

Except for the

statements of historical fact, this news release contains

“forward-looking information” within the meaning of the applicable

Canadian securities legislation that is based on expectations,

estimates and projections as at the date of this news release.

“Forward-looking information” in this news release includes, but is

not limited to, business goals and objectives of the Company; and

other forward-looking information concerning the intentions, plans

and future actions of the parties to the transactions described

herein and the terms thereon.

Factors that could cause actual results to

differ materially from those described in such forward-looking

information include, but are not limited to, the volatility of the

digital currency market; the Company’s ability to successfully mine

digital currency; the Company may not be able to profitably

liquidate its current digital currency inventory as required, or at

all; a material decline in digital currency prices may have a

significant negative impact on the Company’s operations; the

volatility of digital currency prices; continued effects of the

COVID-19 pandemic may have a material adverse effect on the

Company’s performance as supply chains are disrupted and prevent

the Company from carrying out its expansion plans or operating its

assets; and other related risks as more fully set out in the

registration statement of Company and other documents disclosed

under the Company’s filings at www.sec.gov/EDGAR and

www.sedar.com.

The forward-looking

information in this news release reflects the current expectations,

assumptions and/or beliefs of the Company based on information

currently available to the Company. In connection with the

forward-looking information contained in this news release, the

Company has made assumptions about the Company’s objectives, goals

or future plans, the timing thereof and related matters. The

Company has also assumed that no significant events occur outside

of the Company's normal course of business. Although the Company

believes that the assumptions inherent in the forward-looking

information are reasonable, forward-looking information is not a

guarantee of future performance and accordingly undue reliance

should not be put on such information due to the inherent

uncertainty therein.

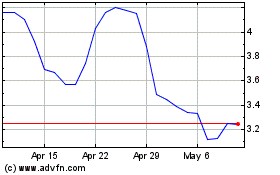

Hive Digital Technologies (TSXV:HIVE)

Historical Stock Chart

From Jan 2025 to Feb 2025

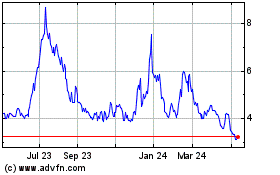

Hive Digital Technologies (TSXV:HIVE)

Historical Stock Chart

From Feb 2024 to Feb 2025